United Club Membership

I’m not here to polish a turd. Most lounges offered by domestic airlines are generally inferior to those from bank partners like Chase, Capital One, and even Amex. But American, Delta, and United are superior in one area – footprint. Bank lounges aren’t as widely available as their airline counterparts. This matter is why I’ve consistently held an interest in airline lounges. It’s the primary reason I have a Citi AA Executive authorized user card. I also leverage our stack of Amex Platinums for Sky Club visits. I like the peace of mind knowing I can get into American and Delta lounges when flying those carriers, even if it’s not super-often. But currently, I don’t have a reliable option for entering United Clubs, and someday I’d like that. Recently, I discovered the optimal way I should pick up a United Club membership, and maybe some of you should, too. But first, I’m covering why buying a United Club membership makes more sense for some.

Why To Buy a United Club Membership

Why am I considering buying a membership when I could just buy a $59 one-time pass only at the time I need access? That answer’s simple. United Clubs, particularly some of the more desirable ones, do not allow use of one-time passes. Even worse, it’s not exactly easy to confirm a given lounge’s policy on a certain date before a flight. I’d like to think a one-time pass would work, but I can’t rely on it. But with a United Club Membership, that’s not a concern, I’m welcome at any United Club when flying the airline. Also, United Club members can bring two adult guests, or one adult guest and dependent children under the age of 21.

Another reason buying a United Club membership is more attractive is that unlike its competitors’ cards, being a United Club credit card authorized user doesn’t enable access. Citi AA Executive and Reserve authorized user cards come with annual fees, but they receive lounge benefits.

Maybe Buy United Club Membership This Way

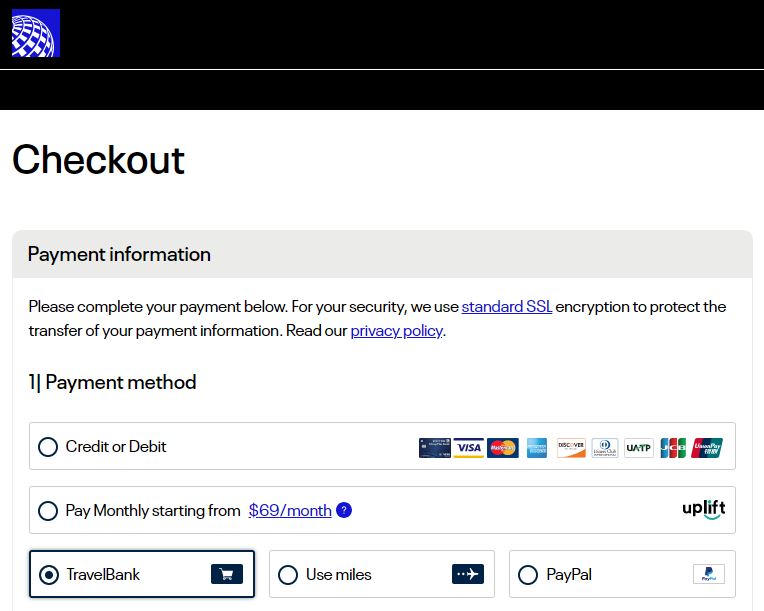

I don’t have an immediate need for a United Club membership, but I got curious the other day. What are the viable payments methods for a membership? It was time to mess around on the United site. I had a big hope of one option, and it soon became a reality. After signing in and a few clicks, I came upon the above. Look at that bottom left corner.

I can pay for a United Club membership with Travel Bank funds! That may mean nothing to many of you, and that’s fine. If you had Travel Bank funds, you would know. And if you don’t, you probably don’t care about this payment option, anyway. Is this payment method for a United Club membership new? I don’t know, but it’s new to me. For what it’s worth, I haven’t found information about it elsewhere.

But many have a stash of Travel Bank funds, and some hold a significant amount. Why pay with another method when I can pay with Travel Bank? Remember Travel Bank’s largest weakness – funds expire five years from the date they’re placed in the account.

My Plan

Am I buying a United Club membership now? No. But when it’s time, I’ll do it with Travel Bank funds. So when is that time? Indeed, deciding that is key, since spending $650 can’t be ignored, even if it’s Travel Bank. I’ll buy it within the next several months when I see my United flight activity increasing, and I’ll buy it just before transiting my first airport with a United Club location. There’s no need to pay $650 and start my membership year until absolutely necessary.

Conclusion

Again, many of you have no need for a United Club membership, don’t have any Travel Bank funds, or both. But for some, pursuing a membership and paying with Travel Bank may be just what the doctor ordered. I plan to buy a membership down the road, but I’m waiting for my travel plans to firm up. How do you access the United Club? For those who have purchased a membership, what brought you to that decision and how did you pay?

Could your screenshot above be a bit old?

As far as I can tell, it’s not possible to buy a one-time pass on the web site, only in the app.

And the app (at least for me) does not offer a way to use travel bank funds for a one-time pass.

Rich,

The above screenshot is from the United site during the membership purchase process, not a one-time pass. I added it days before this article published, and this option still exists (I just checked again). In the past, I’ve chosen to buy one-time passes with cards offering airline fee credits, not with travel bank funds.

Wow. I didn’t know that United Club memberships got that expensive. I’m still getting by with my $95/yr Diners Club (same price since the 1990’s) that gives me the full Priority Pass package.

Yep, it’s definitely gotten more expensive, Tino. But perhaps we’re talking apples and oranges here. Does your $95 Diners Club method provide access to United Clubs?

Chase United business club card. Pay yourself back using 30,000 United miles for annual fee.

I like this better- even if you don’t pay for the annual fee with miles, it’s still $450 and not $650.

That’s definitely the optimal option for some, but not necessarily everyone.

This option had not occurred to me, which is why I follow MtoM! Thanks

Thanks for reading, Jeff!