Travel Freedom with US Bank’s Real-Time Rewards

I have previously mentioned that I value travel freedom over brand loyalty. Given how much in this hobby is out of my control, it is important to control the aspects which I can. US Bank and their Real-Time Rewards program tend to line up with my travel philosophy. In my experience, US Bank’s currency provides a wide array of redemption options. Let’s dive in.

What Is US Bank’s Real-Time Rewards?

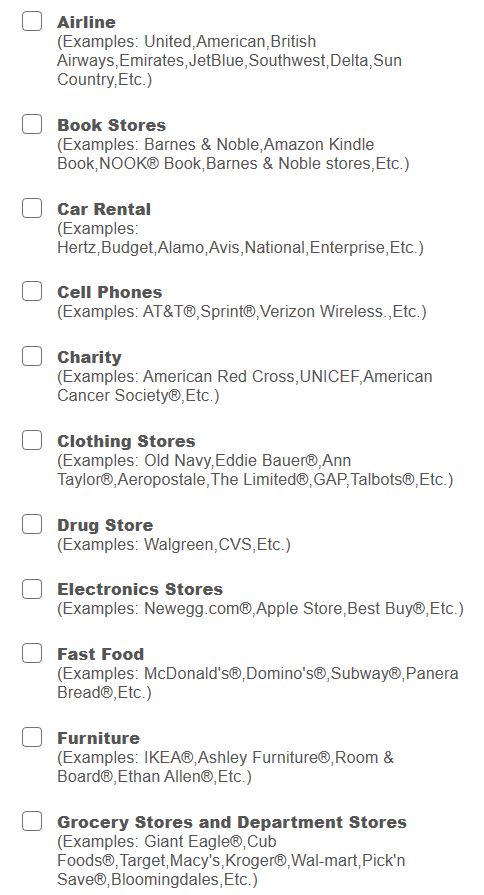

US Bank’s Real-Time Rewards program allows US Bank point-earning credit cardholders to instantly redeem their points via text for a variety of travel and non-travel purchases. I have enjoyed booking with my US Bank credit card to obtain all discounts available to cash-paying customers, then redeeming points on the back end. The list of travel-related redemption possibilities is quite impressive:

- Airlines: United, American, British Airways, Emirates, JetBlue, Southwest, Delta, Sun Country, etc.

- Car Rentals: Hertz, Budget, Alamo, Avis, National, Enterprise, etc.

- Lodging: Four Seasons, Hyatt, Marriott, Hilton, Disney Resorts, Best Western, Wyndham, etc.

My personal favorites are Disney Resorts and Four Seasons. The above are just a few examples of how points can be redeemed; US Bank allows redemptions for many other travel-related companies. All travel-related redemptions can be redeemed with 50% more value (1.5 cents per point). All non-travel redemptions are valued at 1 cent per point.

The full list of redemption examples can be accessed by logging into your US Bank account. Here they are:

How Does Real-Time Rewards Work?

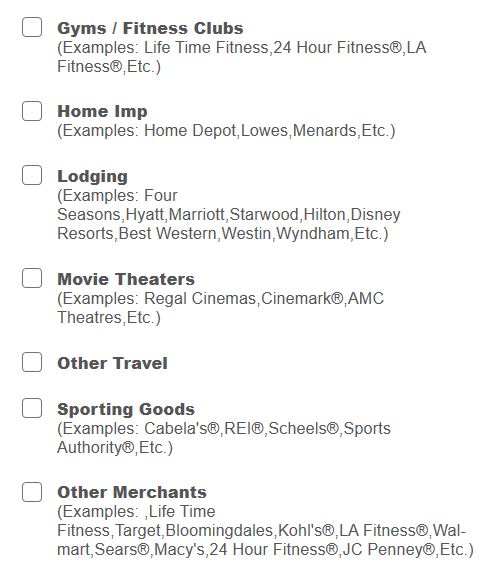

First, enroll in Real-Time Rewards here. Then, opt in to all participating redemption categories (why not?) or pick the categories you are interested in. Next, you will receive a text confirming your enrollment in the program. From that point on, you can make purchases with your US Bank-participating credit card, and you will receive a text asking if you would like to redeem points for the given purchase. There are two key limitations: car rental redemptions must be at least $250, and lodging redemptions must be at least $500. All other redemptions have a minimum purchase amount of $10.

What Does Real-Time Rewards Look Like?

I’ve routinely obtained great value for my US Bank points by redeeming for Disney Resort stay deposits via Real-Time Rewards. First, I booked my preferred rate on the Disney World website. Within a minute or two, I received a text from US Bank asking if I would like to redeem points. In order to redeem, I simply responded “REDEEM” and wait for the confirmation message. The whole text sequence looks like this:

The refund of the purchase shows up in your online account within a few days of your text response. For all purchases you wish not to redeem US Bank points, simply ignore the text. All texts come from the same number, so my preference was to not delete this text conversation so that I could preserve a history of all redemptions.

After enrolling, I would first suggest redeeming on a refundable purchase. That way, if there is any confusion, such as the purchase not triggering a text, you can always cancel the purchase. On a whole, though, redemptions are fairly straightforward, and you shouldn’t run into any surprises if you redeem carefully.

Where Are The Sweet Spots?

As I mentioned earlier, Four Seasons and Disney Resorts have been my two favorite redemption options. These entities do not have their own traditional loyalty programs, so using US Bank points via Real-Time Rewards is a great option for redemptions at these properties.

Once again, an overall sweet spot across all travel bookings is the ability to stack sales, discounts, and deals obtained through regular, cash-like bookings. You can simply look for the best deal regardless of airline, hotel, or car rental company and leverage the Real-Time Rewards program. Also, since you are making normal bookings with airlines, hotels, and car rental companies, you will receive the miles or points in their respective programs.

Non-Travel Redemptions: Why Not?

In general, I haven’t focused on non-travel redemptions, given the lower 1 cent per point redemption rate. Due to my recent US Bank shutdown, the redemption of some of my US Bank points for Amazon gift cards via Real-Time Rewards (grocery store) came in handy. The wider, non-travel options may have more utility to some who don’t have immediate travel needs for their points, even at the lower redemption value. More options are always good, in my opinion.

Point Earning Options

What are the welcome offers and earning rates for US Bank point-earning credit cards? Let’s take a look at some card highlights:

- US Bank Altitude Reserve Visa: 50,000 point welcome offer with $4,500 spend within 90 days. Earns 3x on travel purchases and mobile wallet spending and 1 point per dollar everywhere else. Annual statement credit of $325 on travel purchases. Usually requires an existing relationship with US Bank.

- US Bank FlexPerks Travel Rewards Visa: 25,000 point welcome offer with $2,000 spend within four months. Earns 2x points at grocery stores, gas stations, or airlines (whichever category has most spend each statement cycle), 2x points at cell phone service providers, 2x points for charitable donations, and 1 point per dollar everywhere else.

- US Bank FlexPerks Gold American Express: 30,000 point welcome offer with $2,000 spend within four months. Earns 3x points at restaurants, 2x points at gas stations and airlines, and 1 point per dollar everywhere else.

- US Bank FlexPerks Select+ American Express: 10,000 point welcome offer with $1,000 spend within four months. Earns 1 point per dollar spend everywhere.

- US Bank FlexPerks Business Travel Rewards Visa: 25,000 point welcome offer with $2,000 spend within four months. Earn 2x points at airlines, gas stations, or office supply stores (whichever category has most spend each statement cycle), 2x points with cellular providers, 2x points for charitable donations, and 1 point per dollar everywhere else.

Point Earning Analysis

Welcome offers are not particularly lucrative, with the exception of maybe the Altitude Reserve Visa. Bonus categories for ongoing spend are solid, depending on your habits. My personal favorite is the Travel Rewards Visa with the grocery stores category earning 2x points, effectively making this a 3% rewards credit card for travel redemptions. However, those who have high out-of-pocket travel costs could do better with the Altitude Reserve Visa, increasing rewards to 4.5% for travel redemptions. While the Altitude’s 3x earning on mobile wallet spending is attractive, I found that more difficult to scale compared to the Travel Rewards Visa’s grocery store 2x earning.

US Bank’s Real-Time Rewards – Final Thoughts

You may have read that I was recently shut down by US Bank, but I remain a big fan of their rewards options. I loved routinely redeeming via the Real-Time Rewards program, which lines up with my travel style and philosophy. What have been your favorite redemptions via the Real-Time Rewards program? Have you had similar types of redemptions with other programs?

I’m not seeing the 1.5x bonus anywhere in the literature for the Altitude Connect. Is this bonus only available on the Altitude Reserve?

That’s my understanding.

Has anyone had an issue with the RTR texts stopping? I used to reliably get redemption texts but recently they have stopped coming which means there is no way to redeem. Alternately is there some way for customer service to manually apply credit? I’d like to maximize ~9500 points but the response I get is they can only do increments of $50 credits.

Unfortunately, it was not a separate charge for each route. I booked 2 seats on a one way flight for $300 ea (total of $600) with Hawaiian Airlines.

Benjy,

Actually, I am impressed that after your experience with US Bank, you choose to be positive about their Real Time Rewards program.

I have only 2 US Bank cards, both Business… Korean Air Lines and Club Carlson. Zero activity for 4 years.

In my interactions with their employees on the phone, I have found their rules and structure difficult to sort out.

Tried to apply for the Altitude card about a year ago, and was turned down, have a good credit score, but too many inquiries and accounts opened was what I could glean, Not unreasonable.

Thank you again.

doctnx, Thanks for the comments! As silly as it may sound, I’ve had a positive relationship with US Bank primarily via the Real-Time Rewards texts! The text robot and I seem to understand each other perfectly: Buy, Text, Respond, Repeat. However, when I previously made a call to US Bank with a general question about the Real-Time Rewards program, the CSR had zero knowledge of the program. I ended up explaining the program to the CSR. That’s when I gave up.

The problem I always have is that the hotels split up the charges on the card and it often ends up that both are below $500 so I never get the text to redeem.

For airfare it was split up on the statement and the redeem text only covered the first amount. I was on the hook for the second.

Any idea on how to avoid this? I’ve been thinking about switching to WF or BOA for fixed points.

Nathan, I can understand how the hotel stuff can get sticky. For the hotel redemptions, I primarily focused on Disney deposits or prepaid rates I knew would be immediately charged to the card and were definitely over $500 in one transaction. The texts reliably came through in those situations. Regarding airfare, if I understand you correctly, you are describing for example a round-trip that ends up being two separate charges (one for outgoing, the second for the return). And only one text? Bummer. With airfare, I think a way to ensure you get a text for each charge is to book two separate one-way tickets. For instance, book the outgoing ticket, wait for the text, respond to redeem. Then book the second ticket and follow the same text sequence. While this is much more tedious and I’ve never done it, it may be worth trying. Regardless, I can definitely empathize with your situation. If I was unable to reliably redeem with Real-Time Rewards, I don’t know how I would’ve gotten solid value out of US Bank’s redemption options.

I like using for Uber/Lyft rides.

Matt B, thanks for the comment! I, too, have redeemed via Uber and also Uber Eats. However, I noticed Uber Eats stopped triggering RTR (for me) a few months ago….

Does Disney theme park tickets count as travel (1.5 cpp) when redeeming?

Toreby, great question! I have never redeemed US Bank points for Disney tickets, so I can’t say for sure. But when I’ve booked resorts directly on Disney World’s site, that has worked with Real-Time Rewards. And there is an option during the resort reservation process to add tickets. It seems like it should work. If you have to buy ticket(s) anyway, it may be worth a shot!