What is the Ideal 3 Card Wallet?

Most people in the world don’t want to have 30 credit cards like some of us have. Some people value simplicity or are just scared to ramp up to those levels. Others want to un-George Costanza their wallet. I decided to run some trial and error spreadsheets to find out what the ideal 3 card wallet would be. And I have found a few options that brought the most value back. I hope you are willing to give it a try or two and see if you can come up with something even better.

Ground Rules

How did I do this you ask? I checked out a few different sites to get the average spending over the course of a year for a family of 4. I then created a spreadsheet with those spending figures and plugged in different card combinations until I figured out what worked best. These figures do not include increased spending or purchasing gift cards in a bonus area for bonus points etc. I tried to keep it simple for the people who want their life to be simple. I may do an enhanced version of this in the future for those of us who like to go to the extreme.

The Data

When deciding which cards to try I went with the staples, the cards we know or think to be the best. I focused on keeping the annual fee costs down and maximizing the bonus spending categories where I could. Here are the spending figures that were used for an average family for a year:

- Groceries – $4100

- Restaurants – $3000

- Travel – $4000

- Gas – $2500

- Cable/Netflix etc. – $1400

- Cell Phone – $1000

- Everyday Spend – $14000

Remember that these are only general averages and be sure to plug in your own calculations using your own spending patterns.

I also used the following valuations for the points involved:

- Membership Rewards – $0.015

- Ultimate Rewards – $0.02

- Hilton Honors – $0.005

- Hyatt – $0.018

Remember to plug in your own point valuations as well.

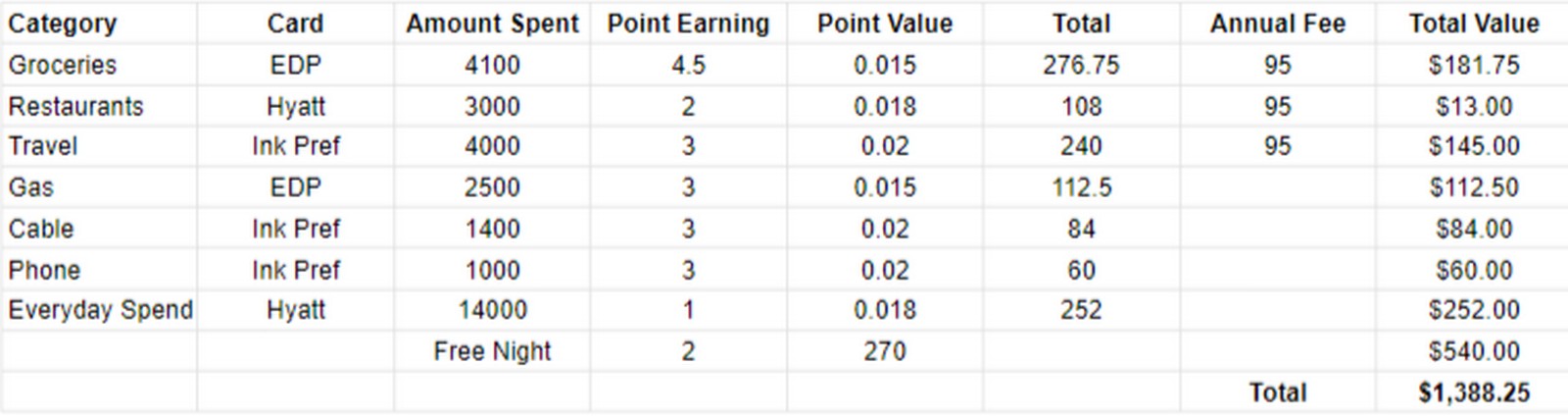

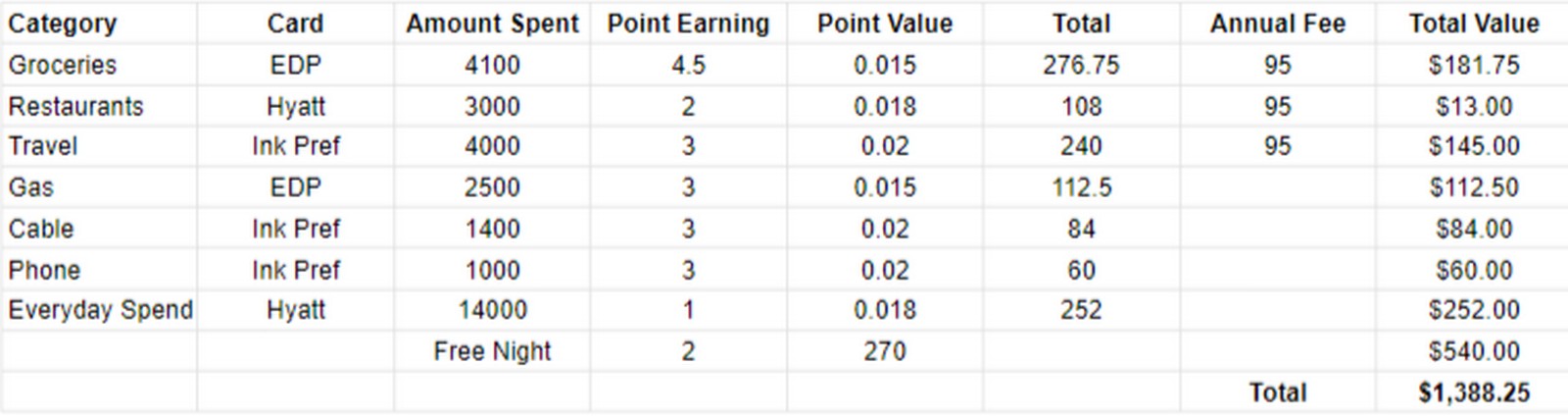

The Results

I calculated the results by plugging in the best cards for each category when testing out my groupings of 3. I also subtracted any annual fees and added in any bonuses, like free nights, back into the calculations. The free night values were based on point valuations for the maximum redemption valuation. So for the World of Hyatt card I took 15,000 points and multiplied it by $0.018 to get a value for each free night.

The best combination was as follows:

- Chase World of Hyatt

- Chase Ink Preferred

- American Express Everyday Preferred

The two free nights from the Hyatt card (one upon the anniversary and one for spending $15,000 during the cardmember year) put this combination over the top. If you value the free nights differently then that could change things for you. Some other combinations that came close:

- World of Hyatt, Ink Cash, Everyday Preferred – $1363.25

- This one was knocked down a little since the Ink Cash points were worth only 1 cent each without a Chase UR premium card attached.

- Chase Sapphire Reserve, Ink Cash, World of Hyatt – $1365.00

- I tried plugging in a Chase premium card to add more value to the Ink Cash but it still came up short. I had to give $1,000 in travel expenses to Hyatt to hit the $15K free night which dropped it just below the winning combo. However if that $1,000 was at Hyatt hotels instead of just regular travel expenses then this would be the winner.

- Everyday Preferred, Ink Preferred, Blue Business Plus – $1093.25

- This was the best pure points combination I could come up with. It just shows how much value those annual spending and anniversary nights add.

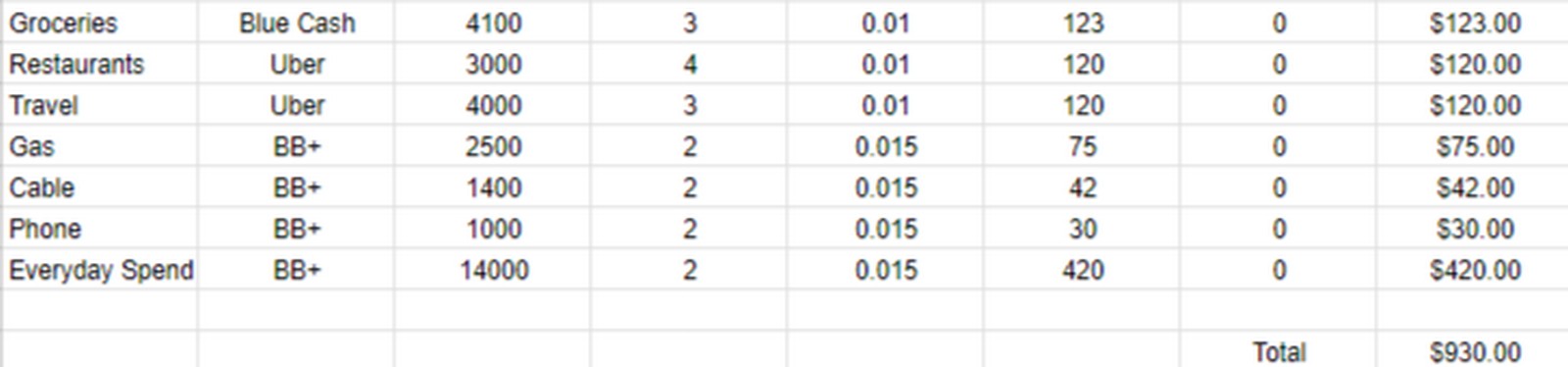

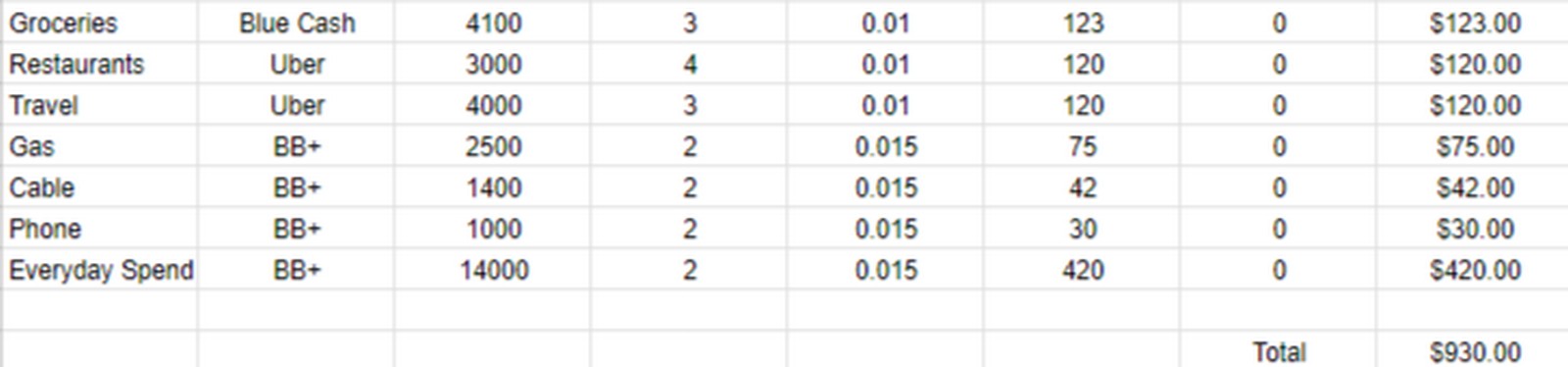

No Annual Fee Option

Just for fun since so many people out there think paying an annual fee is foolish I did a no annual fee option. I was curious to see how it stacked up when compared to paying $200-$300 in annual fees. The combination I used was:

- American Express Blue Cash

- Uber Card

- American Express Blue Business Plus

As you can see, people who think paying annual fees are crazy are actually crazy themselves. They are stepping over $740 (difference before annual fees are taken out) to pick up $285 in annual fees.

Compared to a 2% Back Card

If you also compare these figures to someone who simply uses a 2% card for everything it really gets interesting. They are only earning $600 per year on the same amount of spend. The simplicity of using one card for everything is nice but giving up almost $800 a year to do it seems crazy to me.

Conclusion

Be sure to plug in your own valuations for the points and free nights into the spreadsheet to find out what is best for you. As long as you value Hyatt and know you can max out the category 1-4 certificates then the Chase World of Hyatt, Chase Ink Preferred and American Express Everyday Preferred combo offers the best value. If you want points instead of free nights then the Everyday Preferred, Ink Preferred and Blue Business Plus offer the best option.

If you find a better 3 card combo let me know and I will add it in. I tried to stay away from things like the Bank of America travel rewards card with banking status etc. I was trying to focus on cards that pretty much everyone can get and take advantage of. But if you simply want to share your favorite 3 cards in the comments section I look forward to reading them.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

AMEX Blue Cash (5% on grocery, gas & drugstore), Chase Sapphire Reserve, and Chase Ink Plus

Very solid lineup!

I think a lot of the value proposition concerns your overall strategic goal. We have collected miles and points for years for the primary purpose of international premium cabin airline travel awards. We have flown all over the world using this strategy. On these premium cabin awards, we receive per award multiples of the 2 cents per point value assumed in this analysis.

Also, cash back is not a viable strategy if that is your objective. How many points does it take to buy a $10,000 business class ticket? I believe that, even at 2% back, that ticket would require $500,000 in spend, i.e., 2% X $500,000 = $10,000.

The three cards we have relied on are the Chase Sapphire Reserve, Freedom Unlimited and the Ink Cash. We recently added the AMEX Gold for the 4X grocery and 4X domestic restaurants. (We spend about $12,000/year on groceries. That includes our booze!):-)

I do wish Chase would add a meaningful grocery bonus to one of their cards. Amex is the only true option in the area but it is good to diversify away from all UR points too.

Yes, that is one of the reasons we are getting the Gold (and have the Blue Business). We are putting all of our spend on this card and the Blue Business now (except for Ink Cash 5X categories) to diversify away from Chase. With the advent of dynamic pricing with United and Delta, and American probably not so far behind, having the greatest flexibility possible to move points directly to various airline frequent flyer programs for better redemption options seems to me much, much more important. Chase does not have all the partner airlines AMEX has and visa versa.

Exactly – I think that is a great move!

IHG grocery spend isn’t sweet enough for you? XD

Haha you know my love for IHG and their amazing points runs deep!

How amazing would it have been if they added 2X to Hyatt. I am surprised they didn’t add it to the CSP and let people carry both the CSP and CSR – get rid of the overlap. I think people would pay both fees and keep both if they did 2X on Gas and Grocery for the CSP and dropped restaurant and travel. Would be an awesome 1, 2 combo. Damn I should work for Chase!

I still don’t understand why anyone is paying for any gas, groceries, Netflix/Uber and some restaurants, travel and general spending with a credit card at all. A simple strategy of buying discounted gift cards with a 2% cash back card puts all of these strategies to shame.

In fact, most of the gas stations in my area tack on a 3-4% surcharge for paying with a credit card, so the gift card strategy is the only rational one.

In the past year, my cash yield on this strategy is about 12% of all my CC spend, but it does take a bit of extra work.

That last sentence is why – people don’t want to do the extra steps. I do it probably half the time but there are times you have a BP gas card but no BP in the area you are in etc. There is the added risk of losing the gift cards or forgetting to use them fully. More tracking etc. A lot of people don’t think the effort is worth the extra savings.

You & I have previously discussed Sharon’s point about actually using the Hyatt free night with their limited footprint. I get you have favorite properties (with lounges even!) you are using your Hyatt certs & status, but I agree with Sharon that Hilton is the better play for most people. Your numbers are predicated on the value of the Hyatt free night, so I don’t agree with your conclusions, either.

You are the only person I have ever heard say they struggle to use a Hyatt cat 1-4 free night Pam 🙂

And you are getting 2 night certificates with Hyatt versus 1 with Hilton…that is a lot of value being left behind.

Didn’t I just say that in my comment? If not, I’ll say it again. I struggle to use a Hyatt cat 1-4 free night.

I guess there are two then 😉

Do “most people” really stay at Hyatt hotels that often? I did get a Hyatt card for the intro offer and then ended up having to build an entire vacation around the need to use those Hyatt points. I let the card renew for the free night, but now I’m really struggling to find somewhere to use it. If I were going to use a hotel card for default spend, it would be the Hilton Ascend. 6x back on groceries/gas/dining, 3x on non-cat expenses, and a free night for $15K spend. Yes, Hilton points are worth only half a cent each, but that’s still 3% back on the core categories of everyday spend and 1.5% on non-cat spend. I find it pretty easy to use up Hilton points. But I wouldn’t recommend a hotel card to any “average” family unless they stay at hotels a lot and specifically at that brand of hotel. Calculations on how many points you can earn never seem to take into account the problem of orphaned points. It does you no good at all to earn 100,000 Honors points if you never stay in a Hilton Hotel. And even if you do, you will inevitably end up with a bunch of points left over that don’t add up to enough for another night.

Similarly, the EDP card seems like a very odd choice for the “average” family. Unless you use it as your default card it can be nerve-wracking trying to make the minimum transactions per month, and even when you do, the payoff is not that great. Membership Rewards points are worth a lot to YOU because you earn a lot of them and know how to use them. Most people don’t want to take the time to figure that all out. Again, I see a lot of unused MR points in this average family’s account.

For the typical consumer that doesn’t want to spend a lot of time and effort dealing with travel rewards, I really think cash back is best. Or Amazon points, which are the next best thing to cash. If I had to pick just 3 cards for the “average American” I think I’d go with the strangely underrated Chase Amazon Prime Visa (5x back at Amazon and Whole foods, 2x on dining/gas/drugs), the Amex BCE or BCP (depending on how much they spend on groceries), and the Citi Double Cash card for a default.

Fair points Sharon – this is more of an exercise to show what people could get versus what they normally do. And your assumptions are based on a shorter period of time. If you use this combination year after year after year then I don’t think points will be orphaned. Maybe it takes you two years to amass the points needed for a particular trip but if you play the long game you will be able to make it work.

I tried plugging in the Hilton Ascend card and it didn’t offer as much value as the Hyatt card because it does not give you the anniversary free night like the Hyatt card does. That is 1 less night every year. Hilton points are also less valuable and more volatile than Hyatt points. I think that Hyatt has good coverage in the areas families would travel most. Places like Orlando, New York, Las Vegas etc. But it would depend on the family. I was simply trying to show what could be possible and this offers the most value. Adjustments would for sure need to be made to accommodate a specific individual family but this is not what that was about.

You started off talking about “Most people in the world”. Well, most people in the world don’t travel more than once or twice a year, and therefore are not going to get a value of 1.5 cents on membership rewards or 2 cents on ultimate rewards. Most of my coworkers who are average people all carry the Citi DoubleCash card as their number one card.

Now if you are talking about people who like doing a lot of traveling and people in the MS community (again, that is not most people in the world) then I agree with your cards you mention above.

You have to also realize this is based on 30K in spend and no sign up bonuses so the spend would equate to only 1-2 trips per year. Now this is assuming that they would be educated in the space enough to use the points properly and that could be considered a jump. I did it more to see how it would play out but also to show people who think using only a 2% cash back card is good enough. This is a way to show them that they could be doing twice as good with a little work is all. Something you can share with people that say using a card with an annual fee is stupid etc.

How do you intend to meet the 30 swipe minimum for the EDP without any everyday spend?

Amazon reloads, $1 at a time?

Agreed it is not too hard to game that even if you do it at the pump or a self checkout grocery line. I think people can make it work or throw a few 50 cent Amazon loads on there if they have to. You could even steal some of the everyday spend with it since there is a little overage and it would be best to stop at 15K with the Hyatt card but I was trying to keep it simple versus breaking that out even further.

Careful though, I’ve seen multiple cases of <$1 spend doesn't count towards EDP's grocery's 3x, and if I recall correctly I don't think it counts towards the 30 times either.

Really I have not seen that before – so go over $1 to be safe then – good tip. Do you happen to remember where you saw that? I may wanna do a quick write up on it so others know.

Your numbers are probably average across the country but I’m excited to plug in our own regular charges and see how it looks. We spend twice what others do on cable based on these numbers and don’t even have Netflix or premium channels like HBO. Our household of two is also double the grocery average.

It definitely will be different depending on who you are talking to, sometimes widely so. It will be interesting to see what people come up with using their own numbers. Let us know what you come up with if you end up plugging it in.

Still recovering from a Chapter 13 on medical/cc bills. AMEX hates me for only giving 50% on the dollar, and I am not interested in giving them a four digit sum post discharge.

Right now it’s Discover secured with cash back bonus (4% on restaurants the first year), Cap One Platinum (no international fees) and Fidelity Rewards (2% cashback). I think this is OK for someone who will have a bankruptcy on record until early 2021 (at which point I will be under 5/24 for Chase). All cards are no fee.

You are definitely working with a different set of parameters and I think being able to get something for your spend while working on a bankruptcy is a good thing for sure.

The average family spends a mere $4,100 on groceries, but a massive $1,400 on cable and Netflix!?

Priorities I guess 🙂

I do think the restaurants number was high for a lot of families so I think those two numbers will be closer to average for most families when combined but the amount of each will vary more widely.

Our grocery to media spend ratio (*including* the internet service itself) is 12:1. Never gonna have cable or other TV service.

I think more and more people are going that way.