Undervalued 75,000 Mile Credit Card Offer Returns for Virgin Atlantic

The increased offer for the Virgin Atlantic card has returned. This card’s bonus can be worth up to 90,000 miles after the first year of card membership but the true welcome bonus is for 75,000 miles. This is one of the more undervalued cards out there and one that I got last year.

RELATED: How to use Virgin Atlantic miles to fly Delta Airlines & Save Huge!!!

Offer Details

- 20,000 Flying Club bonus miles after your first retail purchase

- 50,000 additional Flying Club bonus miles after you spend at least $12,000 in purchases within 6 months of your account open date

- Earn up to 15,000 additional bonus miles each anniversary after qualifying purchases

- 7,500 Miles after $15,000 Annual Spend

- 7,500 Miles after $25,000 Annual Spend

- Earn up to 5,000 Flying Club bonus miles when you add additional authorized users to your card

The $90 Annual Fee is not waived the first year.

Note: Bank of America has a 4 personal card limit

Card Benefits

- Earn 3 miles per $1 spent directly on Virgin Atlantic purchases

- Earn 1.5 miles per $1 on all other purchases

- 25 tier points per $2,500 in purchases (max 50 per month) toward Flying Club status

- No foreign transaction fees

Direct Application Link

Why This Card Is Undervalued

I signed up for this card last year and I think it is one of the more undervalued cards out there. The bonus requires a lot of spend but they also give you ample time to complete it. Plus the 1.5 miles per dollar earning structure is better than almost every other airline credit card.

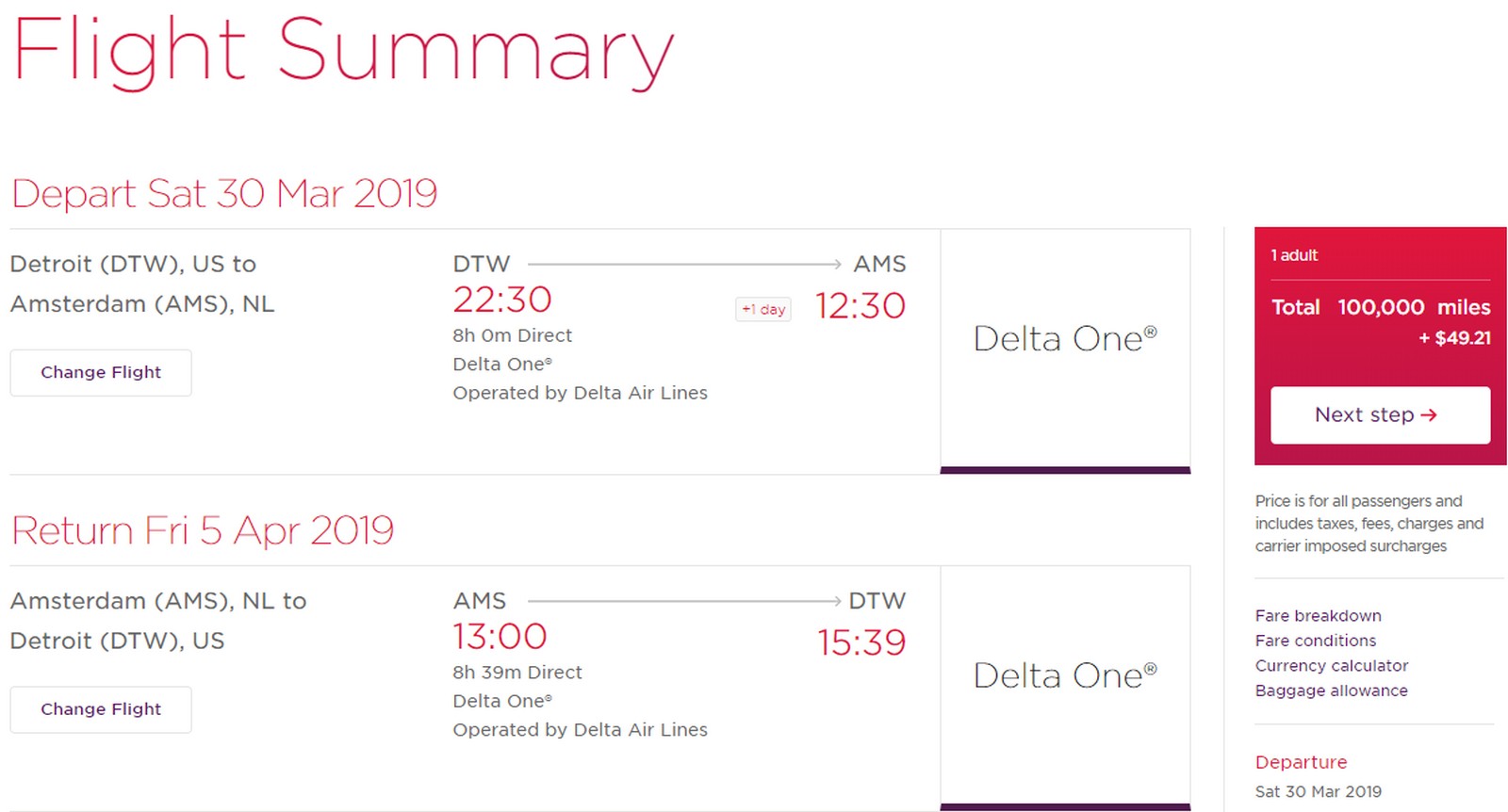

Living in a Delta hub I like using Virgin Atlantic miles to fly Delta for a fraction of the cost. In my guide I showed that you can book first class flights to Europe for 100K round trip plus $50 in taxes and fees. The availability can be tough to find at times but with proper planning there is value to be had. And if you need hotel points in a pinch the Virgin Atlantic program offers somewhat reasonable transfer rates.

RELTATED: Virgin Makes An Interesting Announcement – What Does It Mean?

Conclusion

This is a compelling offer worth consideration but make sure that you have a use for the miles before applying. Bank of America is also the toughest approval in the business these days. This was the last personal card I was able to get approved for from them so maybe this approval is a little easier than their other cards.

Hat Tip Frequent Miler

[…] trying to hold out for–they have offered a higher annual bonus about once a year, offering 75k miles rather than 25k as the signup bonus. That offer closed a few months ago so I’m not expecting it to return […]

there is no 75,000 bonus for Virgin Atlantic MastrCard from BoA .. your post was joke …

This post is a few months old and it was a limited time offer – Sorry that you missed out. I will update the post. You should follow us on twitter so you don’t miss it next time around. Thanks Laszlo!