American Airlines Loyalty Points

In my view, the American Airlines Loyalty Points program is the most ingenious invention from a travel entity in recent memory. With this program’s rollout, American grabbed, and more importantly, has continued to hold, the attention of a variety of travelers. Even I’ve gotten in on the fun. For years, I hadn’t cared much about elite status, but American and my own changing circumstances gave me subsequent reasons to reconsider. I reached AAdvantage Executive Platinum status about three months ago through the Loyalty Points program. (It’s a long story, one I’ll probably describe in a future article.) So, naturally, I was intrigued by American (already) tweaking the program for its second qualification year. In weeding through the substantial changes, these are a few interesting developments I’ve noticed.

A Shrewd Move on Gold Status

Perhaps the biggest move to some is that AA has made it tougher to reach Gold elite status. To qualify in the next period, AAdvantage members will need to earn 40k Loyalty Points, 10k more than the previous year. Gold is the first level up from base AAdvantage member status but delivers some solid benefits, including a free checked bag, earlier boarding, and access to Main Cabin Extra seating close-in to the flight.

I think American has been quite clever here. American’s betting many will make the extra effort to earn “just” 10k more Loyalty Points to reach Gold, and American will profit even more, directly or via partners, along the way. The move to 40k will weed out some of the lower-value customers who scratched and clawed just to get to 30k. And it will probably bring more co-branded credit card signups in the process.

Feeding the Beasts

A big catch in the initial version of the Loyalty Points program is individuals have been required to meet a minimum number of flight segments to qualify for valuable Loyalty Choice selections. With the next qualification year, that requirement’s gone. Members just need to focus on earning certain Loyalty Points levels to unlock Loyalty Choice Rewards. And, oh, there are a TON more levels.

I applaud this change but also figure American benefits more than consumers do. Many who have focused on the Loyalty Points program’s first incarnation will probably become even more obsessed. Streamlining Loyalty Choice Rewards qualification, combined with the myriad options for earning Loyalty Points, will be all-consuming for some. If that isn’t alarming enough, here’s another reason for consumers to be careful….

Status Levels Mean Even Less Now

Sure, AAdvantage members who reach the traditional status levels – Gold, Platinum, Platinum Pro, and Executive Platinum – obtain a few concrete, incrementally better benefits along the way. In my view, though, those levels are less meaningful now. Many will have even more single-minded focus on sheer collection of as many Loyalty Points as possible (see above). There will be even more competition for certain perks, like upgrades. Status levels will play less of a role, and Loyalty Points balances will play an even larger one. And there is no limit to how high the competition can reach. The race for the biggest Loyalty Points balance will never end.

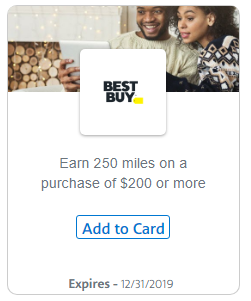

Yummy Loyalty Point Bonuses

At the 60k and 100k Loyalty Point levels, members will unlock 20% and 30% bonuses for certain spending, respectively. These bonuses apply for spending with American Airlines Vacations, SimplyMiles, AAdvantage eShopping, AAdvantage Dining, and AAdvantage Hotels. I’m particularly intrigued by the eShopping and SimplyMiles angles, as those played a prominent role in how I reached Executive Platinum status this past year. We don’t know all the specifics quite yet, but American has definitely piqued my interest.

A More Complex Decision

While American has made certain aspects of the Loyalty Points program simpler, assessing the utility of the program for a given individual is now even more convoluted. With these changes will come learning curves, half-hearted attempts, and unused benefits – all at a larger scale. Throughout it all, American wins. Meanwhile, individual members must be even more careful in their spending and loyalty decisions. Like any program, investing in Loyalty Points without thoughtful analysis can lead to disappointing results. The opportunity costs at these levels mean that individuals can possibly make big mistakes in focusing too much on American.

Conclusion

Will I play the Loyalty Points game again in 2023? I don’t know yet. There will come a time to think about requalification more seriously – this March, at the earliest. What I do know is that I’ve already benefitted from Executive Platinum status, and I look forward to doing so more in 2023. I encourage all of you who achieve status to stop and enjoy it along the way. Focusing on requalification, while fun for many, can distract us from enjoying what we’ve already accomplished. Regardless, the American Airlines Loyalty Points program has brought more intrigue to the hobby, and I’m all for that. How are your Loyalty Point efforts going?

As someone who flies regional to regional for work every week the new programs have been a huge hurdle for me. Where as the segments I accrued would always give me leg up ( my first year traveling for work I incurred 200+ segments) they now seem to matter none at all in achieving status. I will now have to be creative with credit cards and booking hotels through their portals, which my work will not prefer. I have to ask myself after being EP for five years is it worth sticking with American?

Agreed. The actual act of flying is one of AA’s least preferred interactions with clients. Since it is the moat costly one for them.

The miles on 200 + segments a year should still easily get you EP. Especially if you are EP now.

My regional to regional cone out to about 2,500 LP per segment. So that’s 80 segments = 20 round trips.

C_Adams,

Ouch, that’s a tough one. It’s definitely worth considering your options more!

With that many segments, you should consider BA, if you can squeeze in Europe once a year. You might even qualify for Gold Guest List, which is like CK. Doors would open.

I fly regional to regional going through DFW. being EP has been amazing as upgrades almost always happen and when not upgraded, the treatment I get in main canin from the cabin crew is soo much better than anything I ever had on AA before. Should it be, I’m conflicted there, but it is. Oh and the 75# bag limit has made packing and choosing a good suitcase no longer a worry. Gone are the days of fretting over that last pair of jeans in the ‘ultralight’ 28″ case…

I too did most of my EP run via juggling the shopping, hotel, etc.. and a big one was giftcards.com as essentially it was paying like $1 for 150 loyalty points (which added up quick) and the “spend” just went into visa cards I used for everyday stuff. I’ll miss that one if they don’t come back.

Mike,

Thanks for chiming in with your experiences!

do the points we earn in jan and feb 2023 count toward this years status or next year?

Margaret,

Great question. This and next month count toward the qualification period ending February 2023, so “this” year.

AA made a smart decision to eliminate the segment requirement. The next move should be to allow rollover Loyalty Points (a la Delta’s rollover MQMs) to the extent that a member has residual Loyalty Points above a milestone point.

Lee,

I’m liking what you’re throwing down there. Rollover would be another win/win. Consumers get the extra points rolled over, and AA gets people hooked even more.

I love it, but I wish I had played it better sooner. I waited until the last months of the last year and the first two months of this year to requalify for Platinum Pro — and now I’m 10,911 points away. But now I’m thinking maybe I’ll go for Executive Platinum in the remaining months. That’s a lot of spending to do but if there are some solid deals from SimplyMiles or Aadvantage Shopping/Dining, I might make a mad run for Executive Platinum. We’ll see

Andre,

No harm, no foul. I bet many feel they should’ve started sooner. But the Loyalty Points angle was and is a lot to take in. It sounds like you have a good plan to hopefully hit Platinum Pro, at least.