American Express Chat

I pontificate plenty about American Express. Most of that is justifiably positive. Like other banks, though, something unexpected, weird, or bad happens with Amex every so often. It would be irresponsible to ignore those matters. Mark today’s topic under the “unexpected” column, with a dash of weird. While we changed plans, we aren’t seeing a long-term impact. A recent American Express chat session brought a reality check we probably needed.

Our Situation

The annual fee on one of my wife’s Platinum cards is due soon. We love the Platinum and its benefits, but we decided downgrading to another Gold would work out best given the elevated referral offers currently available. She has other Platinums, anyway, including a Schwab keeper. Our plan was to jump on Amex chat to downgrade while also keeping our ears open for retention offers. That said, we weren’t expecting much since she received a retention offer on this card last year.

The Chat

My wife’s online chat started normally. After having initial contact with an agent, it took a few minutes to be passed to a retention specialist. Perhaps it’s just our recent experiences, but retention specialists don’t seem to listen as well anymore. My wife stated she was fully aware of all Platinum benefits and not interested in paying the $695 annual fee. The rep then launched into a description of several card benefits. My wife diplomatically moved on, simply asking if there were any offers available to encourage her to keep her Platinum open.

At this point, the rep engaged Terse Mode. There were not any retention offers available. My wife segued into a request to product change her Platinum to a Gold. Here’s how that went:

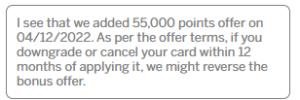

Whoa, easy, Turbo! Nice job throwing out that threat and immediately sending us the disclosure to downgrade. We weren’t falling for that and asked for some clarification. Here’s how the rep responded:

This was the most useful statement in the entire chat. I partly say this because the chat ended quite abruptly after. Long story short, while my wife and I talked it over, the Amex rep left the chat! My lame joke now is that after all the waiting we’ve done for Amex chat agents, it’s a source of pride that one got tired of us and hung up.

Our Next Move

The retention specialist didn’t have the best bedside manner. But he possibly did us a favor. Here’s how.

The past several years, I’ve seen similar language in retention offers upon accepting them on the front end. On the back end, our style has been to attempt to close or product change the cards after the next year’s annual fee hits. We didn’t keep up with the exact 12 month timeframe the rep mentioned, and we’ve never had issues.

But the rep reminding us of this wrinkle may have saved us from losing the prior retention bonus. Of course, we’ll never know if the rep’s threat that Amex “might reverse the bonus offer” is empty or not. Regardless, our plan isn’t affected. We’ll just chat back on 13 April to downgrade to the Gold.

Conclusion

We keep better records on some matters more than others. We’ll start tracking the exact date we obtain retention offers from now on. We have our very rigid retention rep to thank for that. Everyone be careful out there, American Express chat included! Have you had any weird chats recently? What did you learn along the way?

@Abby

To be safe, it’s 366 days after being approved (if it’s your first year of the card) or 366 days after accepting a retention offer (that’s my understanding. If I’m wrong, someone let me know)

Yes I did that once and my balance went to -50,000 MR. Lesson learned. Funny thing after a few months of spending furiously I then I got an offer to upgrade back to Platinum so at least I was able to pay back my negative balance with the upgrade offer! Yes would have been nice if the agent had known about that when I was downgrading.

…Do you think you were dealing with a bot and not a human?

I was not told this when I downgraded my Amex Every Day Preferred card and they definitely clawed 40k upgrade bonus. I called to see if I could reverse the change, but no luck. Glad other are getting a heads up.

Is it 365 days from when the bonus posts, the year 2 annual fee posts, or the date the application is approved?

Just had the exact same thing happen. Retention reps just click on boiler plate responses now. I told my rep I wanted to cancel Gold card because we buy groceries at Walmart and Sam’s Club. Response was to make sure I know the Gold card gets 4x at groceries stores. Then got the 12 month warning and immediate disclosure. Asked if I had received a bonus in last 12 months. Turns out got 30k retention bonus 364 days ago. Obviously I said I would come back in 2 days.