American Express Upgrade Card Automated

American Express is one of the more generous banks with letting people upgrade and downgrade between varying levels of their credit cards. I know many MtM readers have received offers in the past to upgrade and in general adopting an upgrade/downgrade strategy can be useful when it makes sense.

For example, downgrading a card can help you keep the credit limit in tact and as well as the account history. It also opens you up to being able to upgrade the product back to a premium version if circumstances change or you receive an offer to do so. Recently I downgraded my Hilton Aspire card simply because I am not traveling and didn’t think I would get enough benefit out of it.

Why I Downgraded then Upgraded Again

With an uncertain future I opted to downgrade my Aspire card to the no annual fee Hilton card a couple of months ago. While I lost some benefits of the Aspire card, I also was no longer paying a $450 annual fee so it all made sense. Well it did until shortly after when Amex announced temporary bonus payouts for some of their cards.

Through the end of this month the Hilton Aspire ($450 annual fee) and Hilton Surpass ($95 annual fee) cards are earning 12X Hilton Honors points at grocery stores. Additionally the Surpass card gives a free weekend night after $15K in spend per year. Since I have some purchases coming up that would both earn bonus points and get me a long ways towards a free night, I decided to upgrade to the Surpass card. (Hopefully they won’t hold my points like they are doing to others.)

Through the end of this month the Hilton Aspire ($450 annual fee) and Hilton Surpass ($95 annual fee) cards are earning 12X Hilton Honors points at grocery stores. Additionally the Surpass card gives a free weekend night after $15K in spend per year. Since I have some purchases coming up that would both earn bonus points and get me a long ways towards a free night, I decided to upgrade to the Surpass card. (Hopefully they won’t hold my points like they are doing to others.)

How to Upgrade an Amex Card with the Automated Sysytem

One thing that surprised me is that the American Express website now does card upgrades (and maybe downgrades) automatically without any human interaction. Here is how the American Express automated card upgrade works.

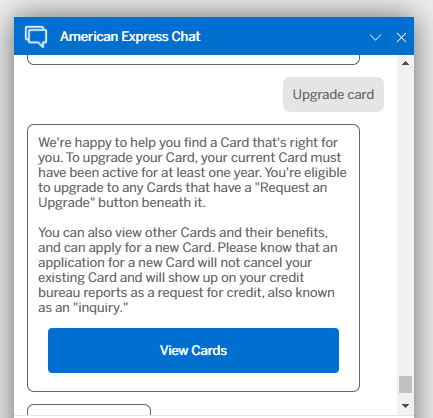

- To start, I simply clicked the Amex chat button on the bottom right when I was logged in. I then typed “Upgrade card” into the chat as shown below.

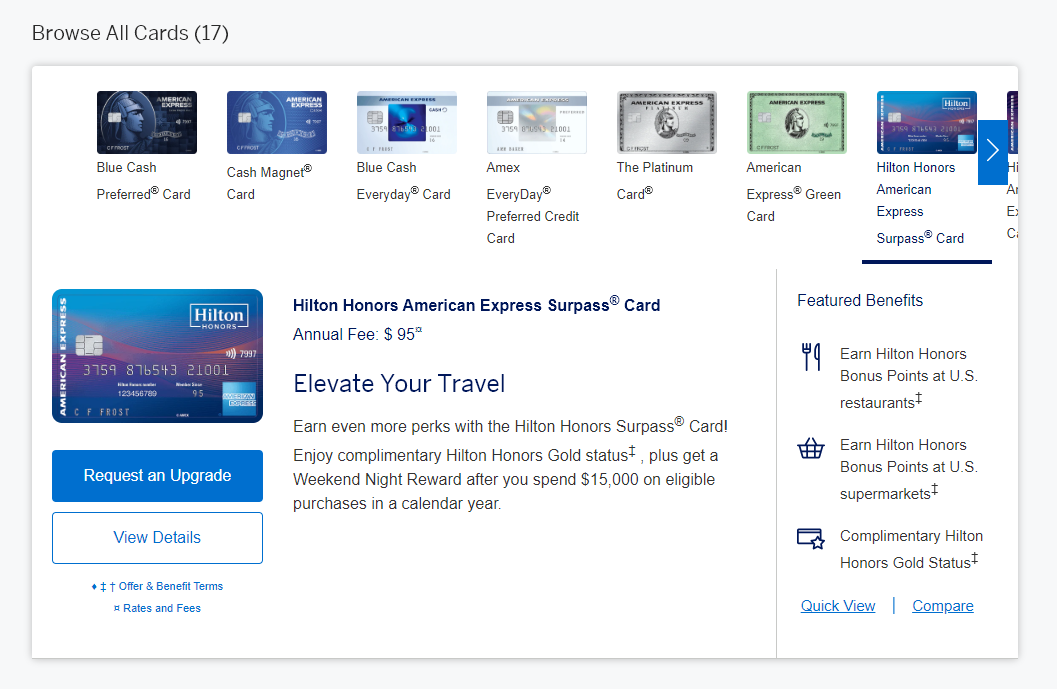

- The system is a little confusing in that you have to click the “View Cards” button and then you are brought to a screen with a lot of different Amex products (shown below). You have to find the product you want to upgrade to and then click “Request an Upgrade”.

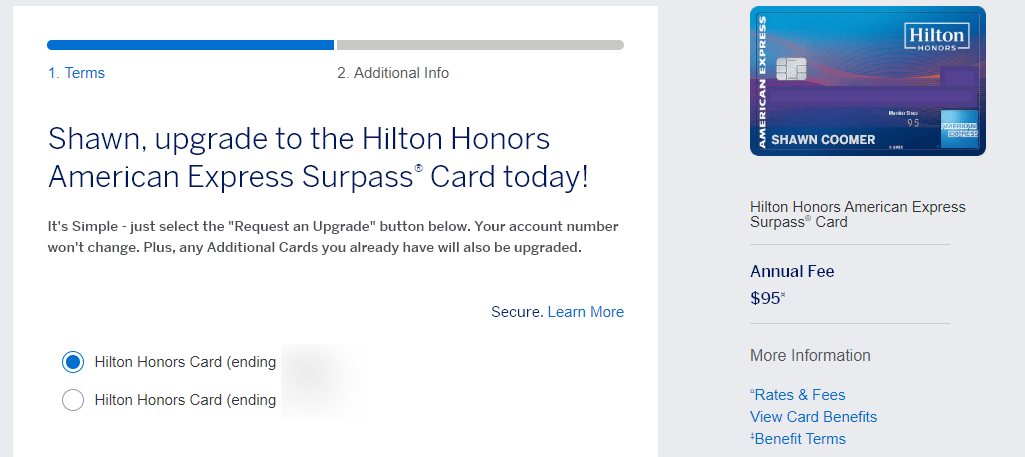

- Next, the website will confirm which card you want to upgrade. I actually have two no annual fee Hilton cards. One will probably get cancelled whenever I apply for a new Amex card (thanks to the 4 card limit) and the other is being upgraded here.

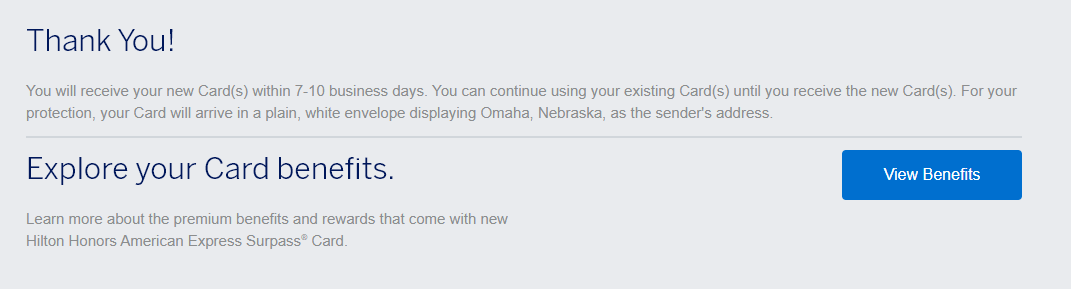

- Once you do that you’re pretty much done. Note, the website won’t show your upgraded product type for about 24 hours. On the day I upgraded it still showed the no fee card, however the next morning it was showing as a Surpass!

American Express Upgrade Card Automated – Bottom Line

If you are looking to upgrade your American Express card there is now an automated way to do it. By utilizing this automated system I was able to get my no annual fee Hilton card upgraded to a Surpass so I can earn 12X points and enjoy the other benefits as well. The system automatically handled the switchover and a new card is in the mail as well.

Overall the American Express upgrade card automated system works as it should and that’s a good thing. Have you used this new automated card upgrade system? Let us know in the comments!

My main reason for the Aspire is free breakfast/lounge, upgrades and late checkouts. I downgraded to the free card due to covid travel restrictions just prior to them announcing incentives such resort credit can be used at restaurants etc. Hilton kind of screwed Amex by extending Diamond for all members by one year. Now I have zero incentive to upgrade to Aspire again for a long time. Hopefully at some point they offer points to upgrade.

I started upgraded to the Amex Aspire card in late November and paid a partial AF of about $100 or so. The first full $450 AF then hit in March. I had read a lot on closing cards within a year of opening was frowned upon, and went ahead and paid the AF.

Of course after my anniversary date the unused prior Resort Credit was lost. I recently called and explained I was keeping the card, but largely due to COVID-19 I had been unable to use the Resort Credit (and I’m over 65 and had extra concern). They told me they would issue a $250 statement credit, and sure enough TODAY I GOT IT!

The customer service rep told me people with membership anniversary from January to May were eligible. Note I do NOT think I would have gotten it without calling, IT MAY BE WORTH A CALL FOR PEOPLE IN THE SAME SITUATION.

So I’ve paid about $550 or so in AF. For these I have two weekend (now anytime) nights (with expirations extended due to COVID-19), $250 statement credit, $250 use of new Resort Credit for restaurants (which I’ll use), and the 150,000 welcome bonus. I’m going to conservatively (I think) say this is worth $1,500 plus other benefits (Diamond, etc.), and could be worth be worth much more depending on use of the two “weekend” nights.