Amex Has Been Overcharging Airline Incidental Clawbacks

There has been a lot of digital ink spilled on Amex’s rewards abuse team (RAT). So much so that I created an entire guide about it. For a group (Amex RAT) that just hit the scene a few years ago they sure have made a lot of headlines. Most of the time it is for reasons that people could see coming a mile away, cough cough Hilton 12x grocery earning. And for the most part I have understood where they were coming from, except for a few occasions.

One such instance was their clawback of airline incidental fees, often a year after the fact. I went over the many reasons on why I thought it was wrong so I won’t rehash that here, you can read the article, but there is something that happened during those clawbacks that everyone can agree is wrong. Amex has been overcharging airline incidental clawbacks, well at least for one person. I need some more data points to see if this is an over billing trend though.

Details

A reader reached out to me after doing an audit of their accounts. They were doing some spring cleaning you could say…in the fall. Originally they didn’t think they were caught up in the Amex airline incidental clawbacks but they came across two such instances over the past 2 years. These were for charges that they made and then had to cancel the flight. The charges were later rebilled because the credit was never “used”.

The clawback is one thing but the reader noticed they were rebilled for the entire cost of the charge and not just the $200 airline incidental credit…twice!

- The reader charged $236 in 2018 that was canceled and credited in 2019. The charge was reversed and Amex recharged the airline incidental fee. But, instead of charging for the $200 the reader was credited they rebilled the full $236.

- The same thing happened in 2020 from their 2019 charge. Even though the flight was cancelled for Covid reasons they rebilled the reader for more than the credit once again.

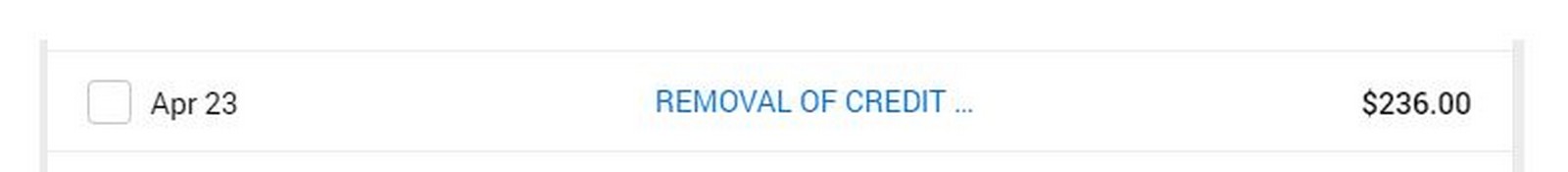

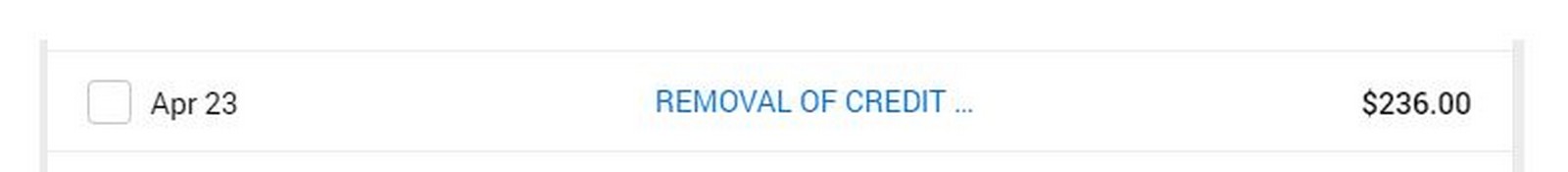

Here are some screen shots:

The first screenshot shows the charges totaling $236 and the credits given for $200. The second screenshot shows American Express rebilling the credits but for the full amount of the charges.

The rebilled amount should be the $200 that the reader was credited, not the entire amount of the flight. Amex overcharged the reader $36 in this instance.

Final Thoughts

I would imagine most people will not see this on their account because if they were purchasing gift cards etc. then they were doing it for $200 exactly, or just under. But if you purchased seat assignments or upgrade fees etc. and the total amount was for over $200 then check your statements. It seems like there is a chance Amex has been overcharging airline incidental credits in that scenario.

If anyone else had the same thing happen please let me know in the comments. Be sure to check your statements for this error.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Very nice. I am going to cancel my other Amex cards. Although this did not happen to me but I’m tired of seeing this is happening to others.

[…] Crazy: American Express Overcharged Cardholder During Recent Clawbacks by MtM. […]

COVID-19 killed the opportunities for banks to game LIBOR rates, illegally foreclose on homes, launder money and illegally create customer accounts leaving the AMEX RAT chewing and scratching to find replacement revenue? An audit of an account gave the RAT away, but the black rice in the chewed up statement envelopes should have been a clue that the vermin were soiling the customer accounts again.

AMEX are wrong, but seriously if right at the end of the year you book 3 flights then cancel the next day, theres a good chance the RAT will come sniffing.

Me, I am busy trying to figure out some utterly bizarre additions and subtractions to my HH account in the past few days. so far I am slightly ahead, but no idea what is going on

Any larger 12X earning purchases they are clawing back. They are just assuming it was gaming purchases without actually knowing.

Nah, the numbers don’t stack up. They took back about 60% of what they gave me…..but they were not due to give me any points, so at a loss as to what is going on. Nothing adds up versus my statements and I do not spend much on the card so I should be able to know whats going on. Anyway, I’m ahead for now…..

Also the flights were not for several months – that credit is the incidental fee being applied so it wasn’t the next day.

Made the mistake of applying a Pay over Time offer for something that got refunded/reimbursed. So many manual adjustments that didn’t directly mimic transaction amounts. I had to make a spreadsheet to make sure it was right.

I downgraded a Gold to Green and they refunded the remainder of the Gold annual and charged the remainder of the Green annual fee, then charged back the remainder of the Gold annual fee then refunded it back, then they did the same for the green annual fee. After all that, it ended up correct but it was sh!t trying to figure it out. When I contacted them by phone, the entire one minute the rep was talking could have been summarized to just one second of “sorry.”

Their IT should be a lot better.