Did My Gold Card App Land Me in Amex Pop-Up Jail?

I’ve never had the Amex Gold Card. That might be a shock to some, but I just didn’t see a lot of appeal in the card. Sure, it has an excellent 4x earning at grocery stores, but the Citi Premier at 3x and rotating 5x on my Discover and Freedom cards is plenty for me. Plus, the $250 fee is a turn-off. But it was time to pull the trigger. And now I may have landed myself in Amex pop-Up jail.

Amex…Why the Pop-Up?

Let’s get things straight. I’ve never held the Gold Card. American Express has their restrictive “once per lifetime” rules for card welcome bonus offers, and I have held off applying for this particular product for years. The regular card offer is unappealing, especially with the $250 annual fee. But the elevated 60,000+ point offers started to turn my head. But I’d dropped under Chase 5/24, and I took about 18 months to make some changes to my Chase card portfolio, avoiding new personal offers during that time. Now I’m picking up non-Chase personal cards again. Time to finally get the Amex Gold Card.

A friend has been pestering me to apply through his referral for a while. Like MtM contributor Benjy, he uses his Gold Card, Blue Business Plus Card, and Schwab Platinum to generate Membership Rewards that he cashes out monthly. It’s a great strategy, just not for me.

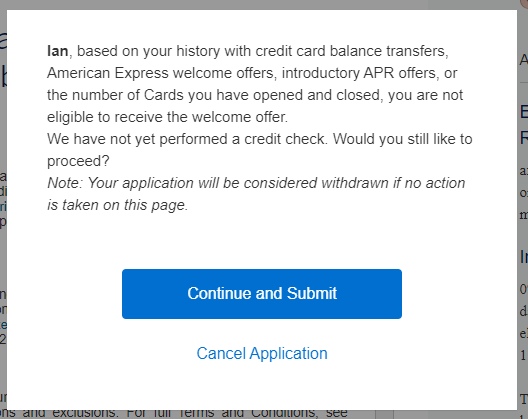

Using his link, I filled out the card application. American Express has never denied me for a card, mind you. So getting the pop-up was the last thing I expected.

I Thought We Were Friends, Amex

I know that previously having a card product is one primary factor that makes you ineligible for a welcome bonus. But American Express also uses other factors to determine eligibility for new card welcome offers.

I have made some Amex portfolio changes in the past year. I dropped a Delta card and my Hilton Aspire card. I picked up the Delta Reserve for Business Card about 18 months ago, and The Platinum Card about 9 months ago, along with the Hilton Business Credit Card. Within the past 8 months, I’ve picked up two Business Gold cards.

It’s these latter three that have probably influenced things the most. I pulled the trigger on a Business Gold card at the beginning of the year. Amex kept dangling “Expand Your Membership” offers in front of me, and I bit on a second. There was no Amex pop-up that time, which shouldn’t be surprising.

My portfolio is now 3 charge cards and 4 credit cards. Now that I’ve thought through everything, I’m less surprised by this outcome.

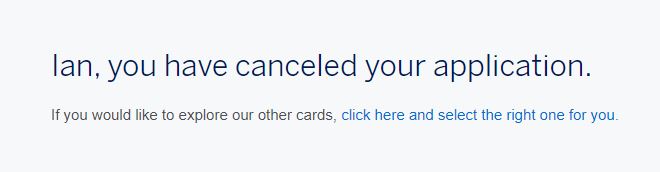

Ultimately, I chose to cancel the application. My worry is…am I now in Amex pop-up jail?

Anyone Else Have Amex Pop-Up Jail Experience?

I’ve read various methods for getting out of Amex pop-up jail. Mark has his own experience of slaying the Amex pop-up. Putting a good amount of spend on your American Express cards seems to be a big factor. Admittedly, I’ve put a good amount on mine, but primarily because of the large minimum spend requirements for the cards I’ve obtained. Aside from some routine spending on my Blue Business Plus card, I’ve moved much of my ongoing business to Citi and Chase products. This is probably the main issue.

Another factor I’ve heard is that if you keep trying frequently, you’ll just prolong the length of time you’re in Amex pop-up jail. I’ve not closed any accounts before the 1-year mark, so that’s not a mark against me.

I’m going to wait a while and try again. Assuming I kick out the minimum spend requirements for my newest cards, I’m hopeful I can put a bunch of Q4 reselling spend on my Blue Business Plus card. I’ll try again for the Amex Gold Card early in 2022.

Anyone else have experience with being in Amex pop-up jail? What did you do to get out?

I just landed in Amex pop-up jain last night when applying for the Amex Marriot Bonvoy Business. The thing the confused me the most is I only had to Amex Credit cards prior to this. One is the Amex everyday card (almost 3 years old), and the other one is the Amex Platinum (3 months old). I have never canceled an Amex card and never really abused the reward earning program in any ways. so that does not make sense to me that they would not let me have the sign up bonus. There are a couple theories that I can think of that may have landed me in this situation. First is my Amex everyday card, I applied mainly to take advantage of the zero APR while i was in college. I still use the card here and there to keep it active, but it’s not in my wallet all the time. IF this is the reason, Amex is CRAZY. :)). The other theory that I could think of is my Amex Platinum. I have legitimately earned more than 200,000 points since the card opened (this including the 125,000 points sign up bonus). I am taking advantage of the 15% small business category and put a lot of my natural spending on it (my dentist, orthodontist, restaurant, local grocery stores). Maybe Amex thinks that I have earned enough LMAO. Any thought on why they are doing this guys? any sugesstion to get of this situation because I really believe Amex targets the wrong person here.

I used my referral link to have my husband apply for the no-fee Hilton card since it offered 100,000 points. Several years ago he was an authorized user on my no fee Hilton but no longer. He got the Surpass card in May 2017 and still has it, plus Amex Marriott and downgraded Delta Amex. Doesn’t use any of them much. FICO over 800, high income (retirement). Got the pop up. Put some spend on his Amex cards, tried again just before offer ended on 8/25. Same popup. This is the no-fee Hilton for heaven’s sake, not the Platinum. WTH.

This could be from trying twice within a fairly short window? I really want to know the “secret sauce” to get out of jail.

I have been in pop up jail for 4 months, have put a lot more spend on the cards, but still no change as recent as a couple of weeks ago. I have kept all accounts for 24 months that are not newer than that. Only opened a green card in the last two years and still have it. I guess I still need more spend, there have been some competing offers from player 2 (including Amex) that have shifted household spend to those offers so maybe that’s it.

They seem to want a lot of spend, at least from what I can tell. Those that have no issues seem to consistently put a good amount on their cards.

Ian – you mention the $250 AF but assume you know that just between the Uber credit and dining credit (which total $240 a year) you basically cover that fee then get all the other benefits and offers. Also it is 4% on dining as well as groceries which is better than the previous card I used for dining (Chase Sapphire Reserve).

Personally I have 4 Amex cards w higher AFs (Platinum, Gold, Delta Platinum and Marriott) which each is worth more than the fee (at least to me)

Also I never close an Amex card in less than 3 years. Frankly based on your card holdings, recent additions and also cancellations I can easily see why Amex sent you the pop up

Two issues with this: Uber barely operates here, and I need them locally maybe once per year. The complete unreliability (2-3 times when I need them, there are no cars operating) means this is breakage for me about half the time.

Ditto for dining. We have two options in the entire county, although a $2 burrito would be better than a $7 burrito. I’d just need to remember to use it.

Thus, for me, I assume I need to recoup the AF in other ways. And $250 is steep. I’m happier with 3x TYP from Premier and access to the Citi ecosystem and rotating 5x at grocery.

I have never been in pop-up jail, as you term it, but I *always* keep an Amex card for at least 24 months. I’ve developed a pretty good relationship with them and treat them as if they would bruise easily, were they a fruit or something.

Me, in your situation and with as many cards as recently gotten, would stay away from them except for putting steady, not necessarily high, spend and otherwise, let them all set. Be ready to suck up a few Annual fees as well. Might just be the repair you need for your relationship with AMEX

Good insight. I hadn’t considered the annual fee aspect but you’re probably right about that being a factor.

Interesting. I have some Amex “keepers”, but I have dropped many cards at the 12-month mark.

Yes i just was recently bailed out of Amex pop up jail. I did not do anything special other then to call and say whats up? the person really could not tell me. In any event i waited them out, i only used their cards lightly and then eventually, prob a result of COVID, they reached out to me with a deal to do spend for a bonus and we have been tight since.

Nice. Glad you got out!