Barclays AAdvantage Aviator Business Application Process

Barclays is known for having some of the most difficult approvals, changing rules, and denials that don’t make sense. When applying for their cards, the rules never seem etched in stone. For their business cards, that can become even more complicated. I wanted to share my Barclays AAdvantage Aviator Business application process and how I made it through all of their hoops to get it approved.

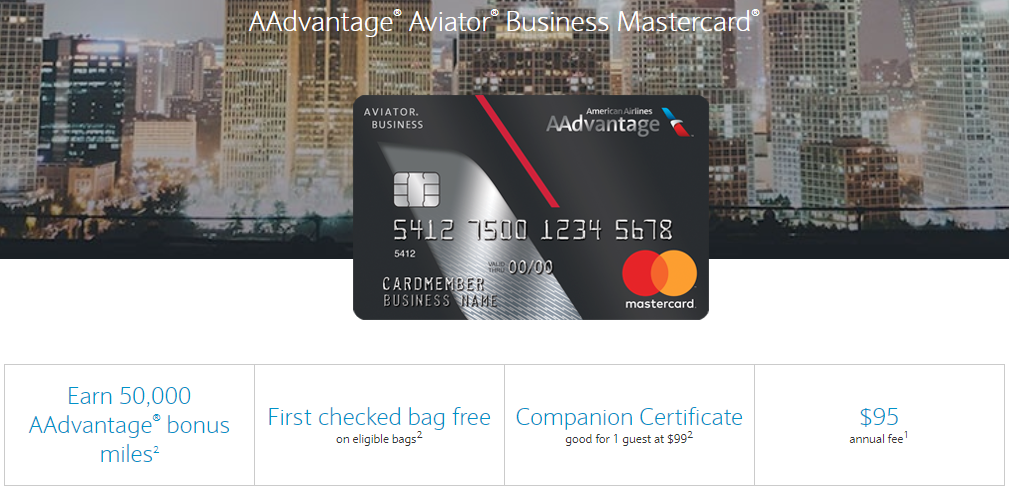

The Barclays AAdvantage Aviator Business Card Details

The Barclays AAdvantage business card recently offered its highest welcome offer of all time, so I applied. Spend $1,000 in 3 months and get 65,000 American Airlines AAdvantage miles. Also, if you add an authorized user within the first 30 days and then have that user make any purchase within those first 3 months, you get another 10,000 AA miles. Essentially, 75,000 AA miles for $1,001 in spending + $95 fee. That’s almost 70 points per dollar earning.

It has an annual fee of $95 that is not waived in the first year. Additional perks of the card include:

- First checked bag free for the primary cardmember and up to 4 companions

- $99 companion certificate after spending $30,000 or more

- Earn $3,000 Elite Qualifying Dollars (“EQDs”) after spending $25,000 in Net Purchases

- 25% discount on in flight purchases

- No foreign transaction fees

The Barclays AAdvantage Aviator Business Application Process

I applied using the business information from the LLC that my wife and I own 50/50. I listed the business and home address as the same, since that’s where most of the action happens. The application showed “pending”, which didn’t surprise me. A day later, it showed “denied” online, so I waited for my letter to come in the mail.

Within a week, I received a letter saying that Barclays couldn’t verify my business information. I called in and gave them our EIN (Federal Tax ID), because they seemingly couldn’t find any record of it. They told me they had everything they needed, and I’d get a decision in a few days.

4 days later, I received another letter asking for more information, asking me to call again. I called, and they said they couldn’t find any registration documents for our business. Our LLC is registered in another state using the address of an expat tax specialist. Once I provided this registration number, they found it in the database and confirmed the existence of our business. Both representatives I’d talked to at this point used the phrase “we are very thorough” several times.

My Barclays AAdvantage Aviator Business Approval

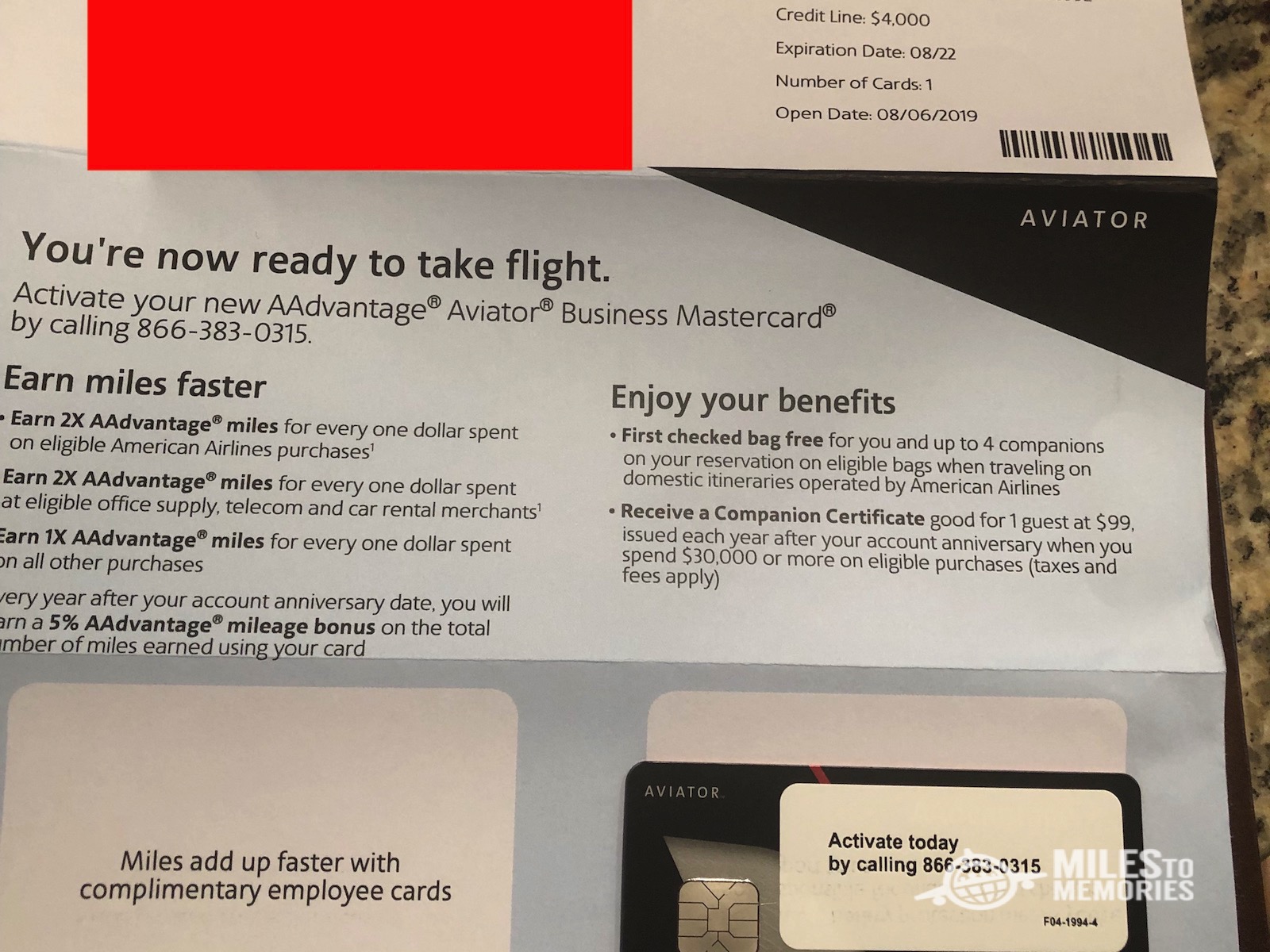

After providing everything they’d asked for, I still couldn’t get approved on the phone. I waited another 4 days to receive an approval notification on the website. 3 days after that, I got the card in the mail. Our LLC had over $50,000 of revenue listed on our last tax return. Credit limit for my card: $4,000.

My Wife’s Application

My wife is still going through this same routine, applying for the same card and jumping through the same hoops. We are glad that we applied when we did, since the welcome offer has decreased now. At least we know what to expect and what they’re asking for, so my wife’s application should be less annoying.

Final Thoughts on the Barclays AAdvantage Aviator Business Application Process

My last Barclays card was the Arrival Plus, back in January. I purposefully waited 6 months from that date to this one. I tried applying for the AAdantage Aviator Red (personal card) in February and was denied, because I forgot this was Barclays. I’ll make sure to wait another 6 months before trying to get anything else from them. I also put some spend on my Arrival Plus before this application, hoping ‘signs of life’ would help.

It took me nearly a month to get this card from first applying online. It probably would’ve been simpler if the home address and business registration address were in the same state. They never searched nationwide, just checked the ‘home address’ state, saw nothing, and denied the application. It’s frustrating the first representative told me they had everything they needed, since they clearly didn’t. In the end, I got the card and will earn the AA miles that come with it.

It is possible to get Barclays cards, despite how much they seem to make up the rules as they go. The process for the AAdvantage Aviator Business Card took much longer than any other application I’ve done, but the end result was the one I wanted.

[…] knew I was taking a risk as getting approved for a business card from Barclays is notoriously difficult. However, I took a chance because we have a decent relationship with the bank by keeping the […]

nice work, keep up the good work.

very nice post

I have the same experience.. I had to call them on numerous occasions for a month and a half. And I’m still not approved! They have the worst customer service ever!! I provided them with everything under the sun, and they keep asking for more. I asked to speak to a manager today after being told what I gave them wasn’t enough. I’m still waiting for the call…I could understand if my business wasn’t legit but they can google it and find all the information they need. I’ll take my hard earned $ to chase or amex.

My husband had to jump through even more hoops than you did. He called once a week for updates. His application went through several departments. They wanted several documents ( Drivers license, SS card & bank statement) mailed in for one department.

Then they told they approved his credit, but needed to review his website.

Barclay said the website didn’t prove ownership of the company, so he had to fax a K1 or articles of incorporation.

Each phone call triggered a letter that said they were reviewing and please call. In all, it took a month.

Glad they didn’t ask for our website. That’s incredible. Making up the rules as they go along, clearly.

I wanted the card as it had a low spend to get the pile of AA miles. Did it all on line and received a letter saying they needed more info. So I called them and chit chatted with the representative and answered a few of her questions. She approved it right then. No need for LLC or other info. No EIN as I used my SS number.

Maybe the lack of paperwork made it easy, but it’s all just guessing with Barclays roulette of rules.

I also had no problem at all getting instant approvals. Actually just applied last night for both my husband and myself, with the code from a mailer he got with the 75k offer. My heart was in my throat when I hit submit on his, but the instant approval popped up in 60 seconds. I decided to push my luck and apply for another one for myself, and after I’d read about other people having problems, I was very surprised to get the instant approval for that one too! Both of us have sole proprietorships with very low business income, but we both also have separate day jobs, credit scores over 800, and no Barclays inquiries for several years (many other open business & personal cards though). Maybe that helped?

The lack of ‘this is how it goes’ is why I said the rules seem to be made up as they go along. See below about checking your company’s website hahaha.

Crazy – both my husband & I got instant online approvals for this card with no addtl requirements several months ago. I have 2 other personal cards with Barclays, my husband 0 before this.

We do have quite a few other biz cards, however, with Chase & AMEX. Chase did the most thorough checks of all.

I have biz cards with Chase, Citi, Amex & Bank of America, so lack of paper trail isn’t an issue.

You’re the first person I’ve heard not say Barclays was frustrating 🙂 This was also the first bank who couldn’t figure out how to just check my EIN for the registration address and then verify that state’s info, instead telling me the business doesn’t exist. Chase, Citi & BofA all figured out how to do it themselves.

I had a very different experience applying for 2 Barclay business cards for my new LLC. Started my own professional LLC. I was able to get big CLs from Barclay even with $0 income at the time of application, it did take a phone call for both. In both they verified my LLC online with my state’s sectary of state office.

Wow, when was that?

I applied about two weeks ago and got my card this past Friday. Wasn’t great, but didn’t have quite as big of an issue. Do you know if the $1k is for all employees, or does it have to be the owner card?

I’m sure the 2 states thing made it more complicated, but telling me “we’ve got everything we need” was the real kicker on the first call.

As for the $1k: yes, it’s across the account. Remember that the parent account always earns the points and the spending credit from the account. The only time this would be different would be if it’s spelled out somewhere (ex: “Have an employee charge at least $500…” means your AU needs to do that, not the master account). I can’t think of any example of the AU spend not counting towards the threshold for the sign-up bonus.

My husband and I had similar experiences. Interestingly, he had more trouble with his LLC than I did using our rental income from 3 properties as my business. He had to deal with several phone calls while I just had to wait a few weeks. We both ended up with tiny credit lines (around $2,500) but this isn’t really an issue since you just need 1k in spend. He was denied outright for a Citi AA business so go figure.

Surprising about the Citi AA business, since my wife and I have both had it as sole proprietor and with the LLC (so 2 cards each of the same card).