The Best Rewards Apps for Easy Savings: Stack For Bigger Discounts!

Apps. I prefer the term when it refers to something I’m eating prior to the main course. The phone versions end up cluttering my home screen and hogging memory. With a bit of weeding through the nonsense, though, plenty exist which can save us money. Let’s take a look at five rewards apps for simple savings.

#1. Rakuten

Regardless if you’ve seen the recent onslaught of TV commercials, you already may be a Rakuten loyalist. For what it’s worth, I am. I would be more skeptical of the biggest, most mainstream of all rewards apps if it didn’t deliver so consistently at excellent rates across a wide variety of merchants. But Rakuten rarely disappoints me. I have had the infrequent category bonus not paying out situation which Shawn has previously described. However, once I’ve contacted Rakuten for a resolution, they have quickly jumped on it.

In general, I have found their merchant rates to be competitive with other cash back portals like Topcashback. Rakuten runs higher promotional rates so often, they seem neverending. Purchases track quickly and reliably in my experience, something I can’t say for some other cash back portals. Rakuten has in-store portal rewards available, albeit usually at a lower rate and with fewer merchants than online. But why not get rewards for places you shop anyway? Simply link the credit card within the app that you plan to use, and you are on your way to more rewards.

Where Rakuten truly shines for me is with their Membership Rewards-earning portal. As an American Express Platinum for Schwab cardholder, I’m effectively earning 25% more than normal Rakuten cash back portal payouts. And depending on your Membership Rewards redemption for travel, you may get even more value out of these points.

From my perspective, the biggest Rakuten negative is their infrequent payout schedule. Members receive payouts on a set date every three months. On the flip side, those four days a year can feel very lucrative after accruing points for the previous three months.

#2. Dosh

I’ve had an on-again, off-again relationship with Dosh. Valuable deals have been infrequent but lucrative when they finally show up. Sam’s Club and Kroger in-store offers (5%) have been particularly rewarding in the past – and gift card purchases tracked. I’ve predominantly used the Dosh app for the in-store deals, but more recently the app has featured online portal offers, as well. For what it’s worth, I’ve been able to get better online portal rates elsewhere.

Like Rakuten, prior to shopping, simply link the credit card in app which you plan to pay with. Most of the time, cash back has reliably tracked for me, but I’ve had repetitive issues with a couple locations not tracking. In these instances, despite the participating store’s address being listed in the app, my repeated purchases did not track. I had to submit help requests for each instance, and Dosh was unwilling to accept a help request until seven days after purchase. A bit laborious, but cash back eventually showed up.

In my experience, the biggest negative for Dosh is the discount desert I discover most of the time. Outside of the infrequent big offer from a major store, I’m mostly greeted with offers from struggling restaurants in my area. Also, the minimum payout amount is $25, which is tough to reach when useful offers are so infrequent. When you do reach $25, request a payout as soon as possible, as I’ve heard reports of Dosh shutdowns for very frequent users holding high balances.

#3. Payce

I’ve had a bit of experience with Payce, but what I’ve seen is promising. The app has a fairly low-end feel, but the variety of merchants in my area is strong. CVS Pharmacy, Home Depot, Kohl’s, Office Depot/Max, and several other department stores/restaurants are currently included. As with Rakuten and Dosh, link your credit card within the app prior to purchase. Payout happens automatically once your balance reaches $10 – fairly easy to obtain with the available merchants. Offers refresh monthly. Similar to Dosh, Payce has an online portal which is easily outbeaten by some of the others.

#4. Shopkick

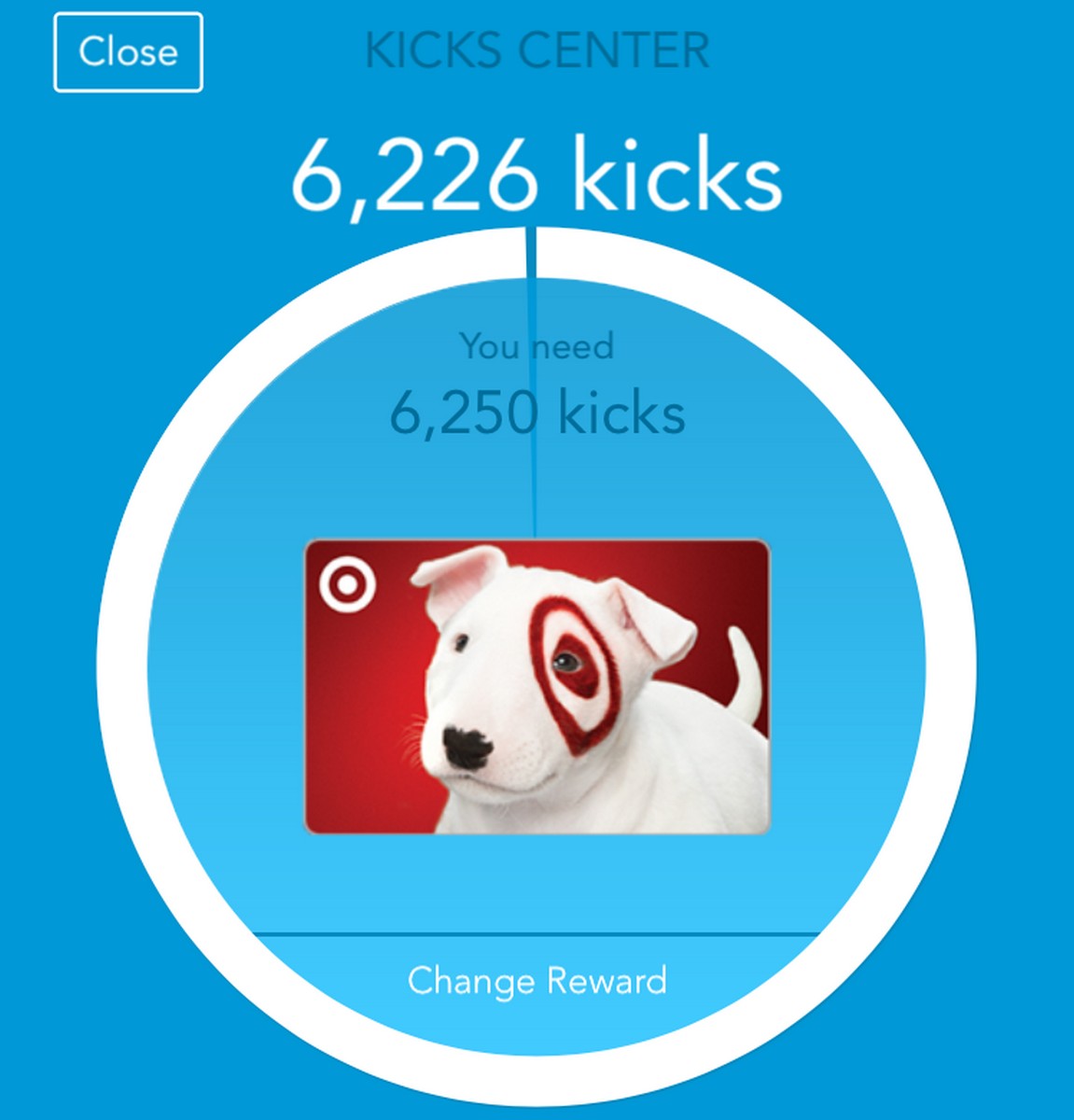

I’ve recently used Shopkick particularly for the tasks I’m already doing. You may have read Mark’s take on Shopkick previously. Points, or “kicks”, are earned by store walk-ins, scans, and purchases (with a linked card or by submitting a receipt photo). Payouts are provided in the form of gift cards to retailers such as Wal-Mart, Target, and Amazon. Payouts start as low as a $2 gift card. Points are easy to earn, but it can take some time to reach even a $2 payout. That said, many of us are already going to some of these stores, and walk-in points are a no-brainer there. I like this app for the fun diversion away from the card-linked programs. I give a big recommendation for those of you who get just as much a kick from saving $2 as $200.

#5. Amex Offers

While not a unique rewards “app”, I’m including Amex Offers for the substantial, consistent rewards I’m able to obtain. I, and many of you, have the Amex app installed already! When logged into your Amex account via the app or desktop/laptop, simply locate the Offers tab, peruse at your leisure, and add offers you like. Be sure to look at the offers on each of your Amex card accounts, as offers can differ between cards. Rewards are provided as statement credits and/or additional points in your respective Membership Rewards or loyalty accounts (Delta, Hilton, etc).

I’m a big fan of Amex offers for the significance and ease of savings. You are paying for a lot of this stuff already, and the discounts can be substantial. For instance, I recently redeemed the insurance offer. I received $60 for activating the offer and paying my auto insurance bill with my Amex card.

Stacking These Five Rewards Apps

Putting a few of the above apps together is where the real fun begins. I’ve reliably stacked Dosh with Amex offers repeatedly. In my opinion, the deal of 2019 was combining Dosh’s 5% off Sam’s Club promo with the Amex Offer which gave four bonus Membership Rewards points per dollar at Sam’s Club. I added the Amex Offer to my Blue Business Plus card in order to earn 6x Membership Rewards, and I got another 5% off via Dosh. Most importantly, this was repeatable, allowing substantial scale to the deal.

I’ve had solid success stacking Rakuten with Amex Offers, as well. My most recent win was saving big on contact lenses. In addition to bonus 15x Membership Rewards via the Rakuten portal, I stacked a Contacts Direct 15% off promo code with a $20 off $100 Amex Offer. This is the closest I’ve come to enjoying paying for contact lenses.

Think slightly outside of the box for other stacks. For instance, Amazon periodically offers at least 20% off any purchase by using at least one Membership Reward point for payment. I also had a 4 additional Membership Rewards points offer with Amazon via Amex Offers. So those Amazon purchases netted 6x Membership Rewards plus 20% off with Amazon. Unfortunately, Amazon wasn’t offering any portal rewards for my purchases at the time!

Amex Offers can stack on each other, as well. I was recently targeted for one additional Membership Reward point and 10% off offers at Lowe’s simultaneously. I activated both offers on my Blue Business Plus card, ensuring 3x Membership Rewards plus 10% off. Not bad!

I haven’t stacked with Payce or Shopkick yet, but I look forward to exploring!

Five Rewards Apps – Conclusion

With just a few apps, you can substantially save. And stacking can save you even more! Of course, plenty of other apps exist and can provide solid rewards. What experiences have you had with the above apps? What other rewards apps for easy savings would you recommend or not recommend?

Agreed about Rakuten being way easier then Topcashback. The amount of time, I spent addressing orders not tracking was ridiculous. I rarely have issues with Rakuten, and when I do, they are quickly and painlessly resolved. The people at Topcashback are nasty.

ssss,

Thanks for reading! To your point, that’s exactly why I’m okay accepting lower rates from Rakuten some of the time.