| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

|---|

Discover Cash Over / Cash at Checkout Feature

One of the things I love about my job is letting people know about features of their credit card that sometimes fly under the radar. Today I’m going to talk about a feature of Discover It (my review) that isn’t even really advertised anymore.

The feature in question used to be called “Cash Over” and now it is called “Cash at Checkout”. Basically, Discover will allow you to get money back from a cashier when checking out at select stores up to $120 per 24 hour period. The cashback is subject to your normal APR (don’t carry a balance), does not trigger a cash advance fee and the process works the same as with your ATM Debit card, just without the need for a pin.

Frequently Asked Questions

Here is the FAQ list about the feature from their website:

How do I get cash at checkout?

Easy. Just use your Discover Card at checkout and choose how much cash you’d like.

Will I be charged a transaction fee for getting cash at checkout?

No. There is no fee for the transaction.

Is there a special interest rate applied?

Not at all. The same purchase APR apply, just like your other Discover Card purchases.

Is there a limit to how much cash I can get at one time?

Cash Over transactions are limited to $120 every 24 hours with no monthly limit. Most stores have a cash over limit. Please check with your local store.

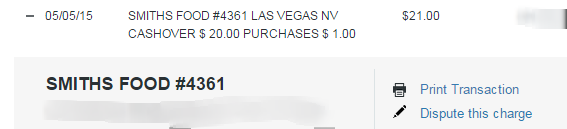

Real World Experience

To test this feature out I recently made a $1 purchase at my local Smith’s store. (Kroger) After swiping my card, the system asked if I wanted cashback as shown above. Initially I asked for $40 back, but the transaction was declined. When I asked for only $20, everything went through.

Despite the $120 limit mentioned in their FAQ, Discover says every store has a different limit. I’m guessing Smith’s will only allow $20 per transaction. One other thing to note is that not all stores participate either. Discover used to publish a list of stores on their website, however that has been removed. Most major grocery and big box stores support this feature.

Do You Earn Rewards

A “Cash at Checkout” transaction is only supposed to earn rewards for the purchase amount. I have read varying reports that transactions at Walmart and Sam’s Club specifically do earn rewards on the cashback too, but I have not been able to confirm that. You will not earn cashback rewards on the “Cash at Checkout” amount in most cases.

Conclusion

Many people are weery to use a debit card attached to their bank account when shopping at grocery and other stores. Using your Discover card to get cash out in a pinch can be a great no-fee way to get money, especially while traveling when you may not be able to easily find your bank’s ATM.

Have you ever used this feature? Let me know in the comments!

Is there any way to turn off or disable this Cash at Checkout feature? I don’t need it, want it or use it!

Absolutely a lifesaver in unusual situations, of course I hadn’t any clue that Cash at Checkout ✔️ was even an option because everyone knows that you simply can’t ever get cash back from anything other than a debit card. Beats the heck out of the ATM approach with it’s deadly fees.

I just freaked out because I pushed cashback without thinking and got $60 back. So excited I won’t be getting a fee. I almost called customer service to freak out but instead I read this article

I routinely take out as much as I can to put into my savings account and then pay it at the end of the month. Free money!

[…] 7. Carry several types of currency: local cash, traveller’s cheques, some U.S. dollars to convert if you spot a deal, credit cards that have no foreign transaction fees abroad, debit cards to withdraw money from an ATM without fees or have the fees reimbursed such as Charles Schwab. Also, you can get cash advance from your Discover Card while traveling. […]

[…] This new offer goes along with some other great perks that Discover cards offer! […]

[…] 超市结帐时的 cash back 选项;图:Miles to Memories […]

so no where in manhattan?

https://www.discover.com/credit-cards/member-benefits/cash-over-purchases.html?icmpgn=HelpCenter

Above is the link of stores who offer cashback with Discover Card purchase.

Though not on the list, I’ve been getting cash at checkout at Trader Joe’s ($50 limit) in the Boston area for the past month or so.

Where can one use discover cash over in Manhattan, NYC?

[…] A Useful But Little Known Discover Card Trick to Use While … – Discover Cash Over / Cash at Checkout Feature. One of the things I love about my job is letting people know about features of their credit card that sometimes fly … […]

I’ve noticed that message come up almost every time I buy food, asking me if I want cash back or not. I really didn’t know that it was a cash advance thing. Do you think it would be a good idea to do that more often if you are running low on cash and you use a credit card?

Discover does have a list on their site: https://www.discover.com/credit-cards/member-benefits/cash-over-purchases.html

michael – the cash over portion of the purchase doesn’t earn points so it won’t affect the category bonuses.

Does anyone have more data points about the Discover ‘Cash Over’ with regards to counting towards category/promotional bonuses (ala Apple Pay in Q4 2015)?. I don’t see much discussion as to if the cash over would also earn points as regular spend would. Mileswhip mentions it won’t, but haven’t seen others share their experience with this portion of ‘Cash Over’

[…] 7. Carry several types of currency: local cash, traveller’s cheques, some U.S. dollars to convert if you spot a deal, credit cards that have no foreign transaction fees abroad, debit cards to withdraw money from an ATM without fees or have the fees reimbursed such as Charles Schwab. Also, you can get cash advance from your Discover Card while traveling. […]

I have been doing this for….. hell…. 5 years? maybe longer.

I dont remember if the service existed when I first received my discover card immediately after graduating from high school back in 2005….

I first discovered the service accidentally. I simply noticed the “cashback” option on a POS terminal and tried it out.

That was 4-5 years ago and I use this service routinely, many many times per month.;

I basically *always* get out the maximum ($60 for Albertons, Vons/safe, and Home Depot) whenever I go to a store that I already know will support the cashback opion and I use my credit card./

Hell, I will fully admit: I am struggling starving student and I have been forced to engage in personal financial practices that I would not recommend unless your alternative options get down to the point where you are considering sleeping in your car

Great post Shawn. I had originally called Discover to ask about a spending offer (https://milestomemories.boardingarea.com/discover-spending-offers/ – thank you) and got $10 bonus after spending $200 on any purchase. I asked her about this Disocver Cash Over feature and I can confirm everything you said in this post. She said Walmart has a transaction limit of $60, so you can do 2 transactions to get the full $120. Looking forward to trying this out soon.

Thanks, @Shawn and @Grant.

I worked as a cashier at a large grocery store years ago when I was in high school and was able to get cash back on Discover cards back then. No fee was ever charged.

I think we would even ask the customers if they wanted cash back. It was pretty well known to the customers of that store but I guess not as known overall.

I can confirm you will NOT be charged any fees. It codes as a purchase but without rewards points, sadly. I have used it a few times and believe it is an awesome feature that Discover created for its cardholders that I feel is very unknown to the masses, but can be extremely useful when you need some cash and don’t want to make a purchase with a debit card, so you can still earn rewards on the purchase and not go to an ATM just to get cash.

They clearly are not charging you a transaction fee as you described. But please report back as to whether or not you see finance charges on your next statement. A minimum finance charge of 50 cents or a dollar may hit you on the next statement as well as the following one (if you don’t repay your entire statement balance before the next statement is generated), And if you pay $2 to get $20, your theoretical annual interest rate (if you do one $20 cash over every month) will be astronomical. It’s not cost effective at all. And that’s probably why DISCOVER allows it. Banks don’t knowingly give out interest free loans.

Ed as I mentioned, you are charged your normal purchase APR on this type of transaction. My statement for the test purchase hasn’t posted, but I did a lot of research and no one has ever been charged a fee for doing this type of transaction.

I also mentioned that no one should every carry a balance. This feature is helpful to get money when you don’t have or want to use your debit card. It should not be used to take money out and carry a balance.