Discover Cash At Checkout: A Useful Option, But Did I Earn Rewards?

While Discover isn’t widely considered a heavyweight in the credit card rewards hobby, they’ve provided simple, useful card options for years. I’m especially a fan of their Discover it Miles card, a no-fee card that essentially provides 3% cash back for the first cardmember year. Discover is definitely a quirky bank, for better or worse. One unique, positive feature of their cards is Discover Cash at Checkout. I’ll describe this feature, how it works, why it’s useful, and if I earned credit card rewards.

What Is Discover Cash at Checkout?

This feature allows a Discover cardholder to withdraw cash during a purchase transaction at select stores. Most stores are in the grocery category, but you can use the capability at others like Dollar General and Sam’s Club.

How Does It Work?

It’s pretty simple, but here are the steps:

- In conjunction with your purchase, use your Discover card at checkout. All Discover card flavors appear to be eligible for the feature.

- Choose how much cash you want to receive when prompted by the merchant terminal. You are allowed up to $120 in cash every 24 hours, but stores may have their own separate, specific cash limits.

- Take your cash when dispensed as part of the purchase transaction. This feature works at self-checkout in additional to traditional checkout with a cashier.

Why Is Discover Cash at Checkout Useful?

First, cardholders can tackle two tasks at once by buying their item(s) and ostensibly visiting the ATM in a single transaction. There are no ATM fees, transaction fees, or bank fees. Second, Discover Cash at Checkout essentially enables cardholders short term, no-interest cash loans. There are no special interest rates; the same purchase APR applies as with any other Discover card purchase. Therefore, as long as you pay off your future billing statement in full by the due date, you will not pay any interest! By timing this right, you can have access to interest-free cash for close to two months.

Did I Earn Rewards on my Transaction?

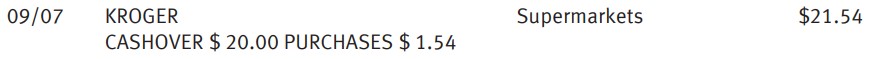

While I earned rewards for the merchandise portion of the transaction, I did not earn rewards for the cash at checkout part. Frankly, I didn’t think I would, but I was curious enough to try. Fortunately, Discover made this clear on my billing statement by breaking down the transaction:

My Bumbling Experiments

Cardholders’ mileage may vary with the list of participating merchants. For instance, Discover lists Walmart as an eligible store to use the feature. I attempted at different Walmart Neighborhood Market locations, and I was never prompted to enter the amount of cash I wanted at the terminal. This happened at both self-checkout and cashier checkout. Obviously, these locations didn’t participate. Later, I easily used the feature at self-checkout at my local Kroger.

Conclusion

I didn’t think I would earn rewards on the cash portion of the transaction, but it was worth a try! Nonetheless, I was curious about the rewards angle and the experience overall. In my opinion, Discover Cash at Checkout is a handy feature that I will probably use when I infrequently need cash and happen to be at a participating store, anyway. Discover is obviously looking to give cardholders reasons to keep their cards in wallets (or moneyclip, in my case), and it’s definitely worked on me. What’s been your experience with Discover Cash at Checkout?

How will cash at checkout

appear on my receipt and on my credit card statement?

Discover used to give rewards even on the cash part but that changed a couple of years ago. There was an update to the cardholder agreement.

Interesting to learn that there are no fees or interest if you pay it back on the bill due date. I always assumed there would be a transaction fee and interest.

Karen,

I hear you! Since we don’t get rewards, at least that part is useful.