A New Manufactured Spending Opportunity?

A lot is made about us “bloggers” ruining everything for everyone. If I had a dollar for every time someone wrote “you bloggers” followed by an insult or an angry statement, I would be rich. (For example, I just love Ron’s comment on this post.) While I don’t think these people are very credible with their criticisms, they do get one thing right. We don’t tend to teach enough.

In that vein, I thought I would walk you through my thought process of finding a new avenue of manufacturing spend. Today I will talk about the new “Disney Vacation Account” in detail including why it looks like a MS gold mine.

Disney Vacation Account

I learned about the Disney Vacation Account from my friends at Park Journey. (Great amusement park site!) The way the program works is that you deposit money from a debit or credit card into a no-interest savings account that Disney holds on your behalf. The minute I saw the word credit card my mind started spinning.

Most people who read Miles to Memories have good credit and no debt so in most cases this product wouldn’t work for them. While it is unfortunately true that many people are unable to save on their own, I don’t see that as being an issue for my readers. On the flip side, my readers love to deposit money into accounts funded with a credit card. (I wonder why?)

The Truth is in the Terms

So once I saw that an opportunity existed, I began to dig into the terms & conditions.

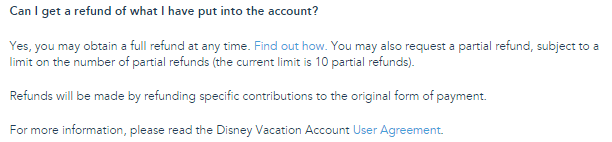

First I had to see if there is any way to liquidate the funds from this account without spending them at Disney:

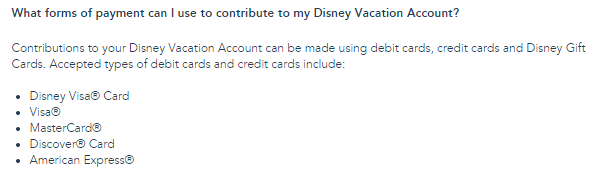

Then I had to find exactly what payment methods are accepted:

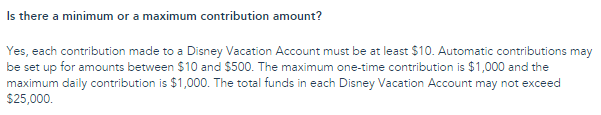

Next I needed to know what the contribution limits are:

Looking Good So Far

So at this point I know that I can load up to $1,000 per day to a Disney Vacation Account from my credit card. Disney also allows up to 10 partial refunds per account and the maximum balance at any given time is $25,000. This could be fun.

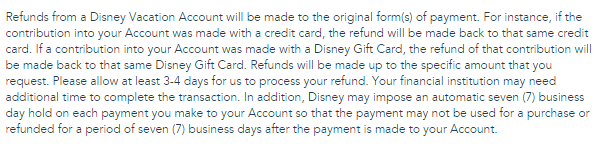

Of course the next step in my research process is to read in detail the refund process. How does Disney handle the refunds and what type of paperwork is required:

BOOM! There goes the whole scheme. Disney is too smart for us. If you decide to ask for a refund, they will send the money back to the original form of payment. Manufactured spending plan foiled!

The Next Step

Of course true manufactured spenders don’t just stop there. They try to figure out if there is a manual process by which Disney will refund to a different card or send a check? What if the account is closed?

Many good manufactured spenders would open a Disney Vacation Account and try a test funding to see how exactly Disney refunds the money. There are many times when what is written in the terms and conditions isn’t the reality of how things work.

Conclusion

I just found out about the Disney Vacation Account today, although it has apparently been in a limited beta for quite awhile. If you are reading this and think I am hinting at something, please know that I have no knowledge other than what I shared in this post.

The true purpose of this post was to share a little insight about what to look for while at the same time not killing an existing deal. Hopefully this will help grow the community without the need to kill fragile deals.

If you like posts like this one, then please let me know. Also, if you ever run across something and have a question, I can always be reached at shawn@milestomemories.com. If you share something with me in confidence, then I will not share it on the blog without your permission. Thanks and have a great evening!

| Miles to Memories operates under the Value for Value model. If you receive value from this site, find out how you can provide value back. |

|---|

I’m fairly new at this so these kinds of posts are really helpful. It helps me to be able to see the big picture. Please keep them coming.

I concur!

While the Disney Savings Account may not be the best for manufactured spend, you can use it to get significant savings on a trip to Disney World. Anyone who has tried to buy park tickets and merchandise or food in the parks knows how expensive they can be.

What savings? Does having an account come with discounts?

Unlike most of you, I’m not trying to meet any minimum spend requirements, because I haven’t had any offers just yet. I’ve been busy rebuilding my credit score. I have a Chase Freedom card with only a $2200 credit limit, and I’m trying to show lots of activity by spending and paying in full, hoping that Chase will boost my limit and/or send me some good offers. I’m thinking about making monthly deposits of, say, $500 into a Disney account, using my Chase card. Then, in about seven or eight months, ask for a refund from Disney. Can anybody point out any pitfalls in doing this? I dont mind floating around 3K to do this.

[…] Case Study: How to Find Manufactured Spending Opportunities By Yourself – A step by step guide for what to look for when discovering new avenues of manufacturing spend. […]

Really interesting post! Would like to see more like this! Of course, it will be better if you or any of your readers has tested it out and share with us the first hand experience. 🙂

Thanks for the post!

What if you get it refunded after your min spend bonus posts?

Well not only after it posts, but also after you’ve used/xferred the points??

here is the answer Jake. I often close cards as I churn them. Once in a while I will return something to the store with a receipt long after I have closed a card. The store does not give a darn that I closed the account. They run it through on the old closed number or give me a store credit. Usually I let them run it through on the old number and it will show up as a credit on a dead/closed account. Then I call the bank that issued the closed card and explain that I have a credit on a dead and closed account and they arrange to have a check sent to me to clear the account. I have never done this as a manufactured spend and all have been legit, but that is the way it has been handled.

Thanks Jeff, that’s good to know. That just made me realize that even though I have been churning for almost 3 years I haven’t been in that situation. Yet.

I’m glad there is a reasonable process though.

Any data points on which banks were easiest to deal with or who you had to jump through extra hoops for those checks?

I don’t think I’d do it as a MS strategy. But it definitely is a totally different way to do things.

I wonder how they handle refunds if the card you funded from is no longer active (say you closed the account or even if the number was changed because of a lost or stolen card..)

Interesting post–thank you.

What if you cancelled your credit card (or it was stolen) you used to make the payment, would they put the refund on another card ? or give the refund by other means?

Yes, liked the post. Would like more!