Free FICO Scores & Comparing Offerings from the Major Banks

Credit is central to modern American life and to our economic system. Banks use it to determine the safety of loaning money to you, employer’s use it to determine what kind of employee you may be and insurance companies use it to determine your rates. In other words, if you aren’t paying attention to your credit score then you absolutely should be.

How Your FICO Is Calculated

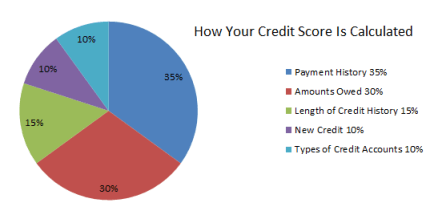

FICO scores are calculated by weighing a number of factors to determine your overall credit worthiness. Specifically the score is calculated as follows:

FICO also has different “scoring models” which can effect your overall score in the end. Depending on which model is used, your score can fluctuate. The current model most widely used is Model 8, however a new version called Model 9 is being rolled out. No matter the model used, the basic factors are the same. You can find the differences between the models here.

Since so many factors go into determining your score, it is likely to change often. I highly recommend visiting our FICO resource to find out what data is calculated into each of the above categories and how credit card churning affects each one.

Getting Your Free FICO Score

In 2014 major banks started giving select customers their free FICO score. While services like Credit Karma & Credit Sesame give you an estimated score, it isn’t the same as your true FICO. Thankfully five of the largest banks now give their credit card customers their actual FICO for free. These banks are: Citibank, American Express, Discover, Barclaycard & Bank of America. Below I’ll show you how to access your free FICO score from each bank.

Citibank Free FICO Score

Citibank offers a free FICO score to most of their credit card customers.

- Bureau Used: Equifax

- Scoring Model: Score 8

How to Find Your FICO from Citi

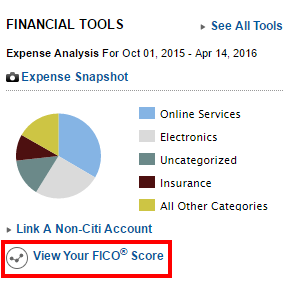

To access your FICO, find the link on the bottom right side of the page after you log-in to your Citi card account. The link is under the “Financial Tools” section.

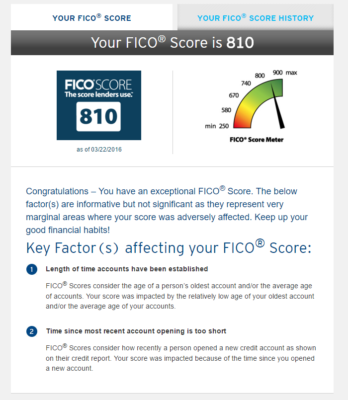

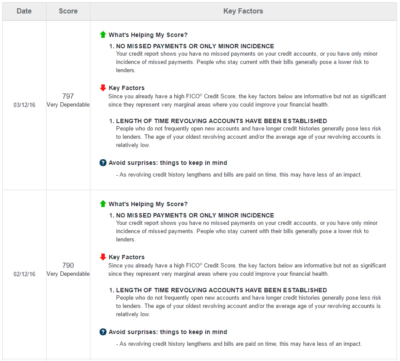

Once you reach the FICO score page, you will see your score along with an explanation of some factors that are affecting your score. Even if you have very good credit, there will always be factors listed.

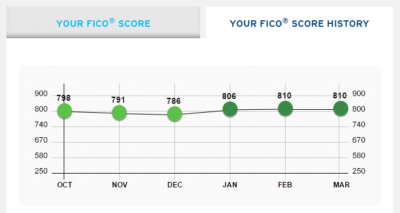

If you click the “Your FICO Score History” tab, Citi will also show you a chart of your credit score as it has changed month to month.

American Express Free FICO Score

American Express now offers a free FICO score to all of their customers. (You may need to opt-in first.)

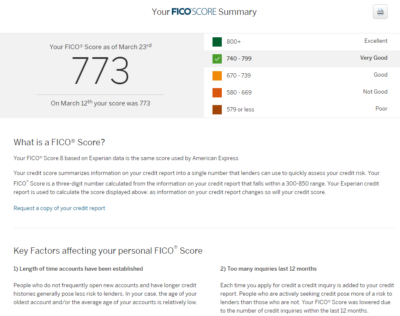

- Bureau Used: Experian

- Scoring Model: Score 8

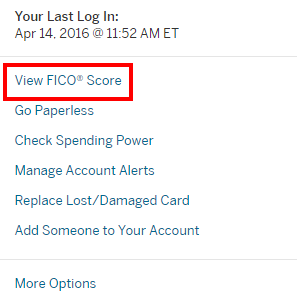

How to Find Your FICO from Amex

Find the link on the middle right side of the page to access your free FICO score.

Unlike Citi, American Express puts all of your information on one page, but they do not provide a historical graph of your score. They do however include the major factors affecting your score.

Discover Free FICO Score

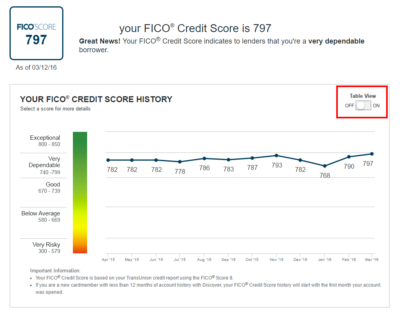

Discover has perhaps the overall best display of your FICO score since they provide a lot of useful data. They also offer a new program, Discover Alerts, which alerts you if your social security number is found on the dark web.

- Bureau Used: Transunion

- Scoring Model: Score 8

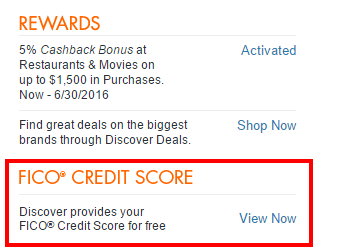

How to Find Your FICO from Discover

To access your free FICO score from Discover, log-into your account and find the link on the right hand side of the page.

In the first view you will see your current score along with a graphed historical view of your scores every month.

If you click the “Table View” toggle on the top right (highlighted in red above) then you get a wealth of additional information. Not only do they provide the key factors affecting your current score, but they also provide these factors for your historical scores as well.

Barclaycard Free FICO Score

Before any of the other major banks, Barclaycard began providing free FICO scores to their customers.

- Bureau Used: Transunion

- Scoring Model: Score 8

How to Find Your FICO from Barclaycard

Log-in to your account and located the free FICO score link on the menu under “Just for you”.

Barclaycard’s free FICO score tool is pretty barebones. On the first view it shows your score and the key contributing factors. You can click to expand the explanation of each of the factors.

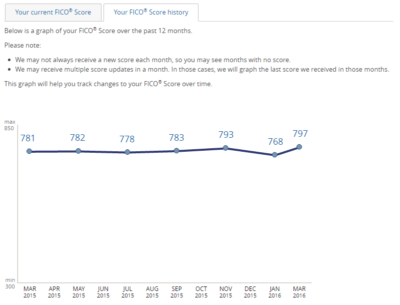

After viewing your score, you can also click the “Your FICO Score History” tab and see a rather basic chart of your credit score by the month.

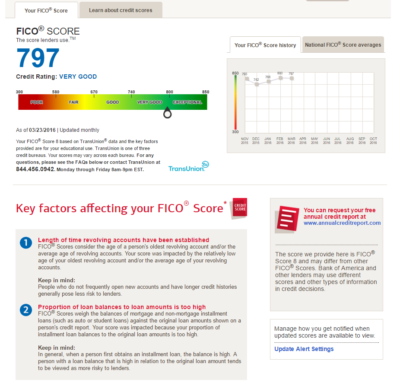

Bank of America Free FICO Score

Bank of America is the most recent big bank to offer a free FICO score to customers. This feature is still rolling out to all customers, but you can opt-in here.

- Bureau Used: Transunion

- Scoring Model: Score 8

How to Find Your FICO from Bank of America

Once you have opted-in, you can find the link to access your free FICO score on the right hand side after logging into your account.

Bank of America’s free FICO score tool is very pretty and displays your score, a historical chart and the contributing factors all on one page.

Bank of America also provides more resources such as national averages and answers to commonly asked questions about FICO scores.

Other Banks

Chase doesn’t provide free FICO scores to most credit customers, however if you have a Chase Slate card you can access your score. Some other local/regional banks also give customers a free FICO score. It never hurts to ask.

Conclusion

Getting access to your free FICO score is now easier than ever. With Barclaycard, Discover and Bank of America using Transunion, Citi using Equifax and American Express using Experian, you can also see what your score looks like based on data from each of the three bureaus. Thanks to the wealth of information now available, there is no excuse for not knowing your FICO score.

[…] I covered how to check your free FICO score at each of the major banks. I think knowing your score is important, since credit is truly one of the most powerful and […]

[…] How to get FICO Scores from the major banks. Excellent comprehensive post if you care about the subject. I don’t, been in the 800’s for ever […]

CRAs scores and FICO scores are not the same thing. http://youtu.be/_h2yKafF8zI

The best place to get your free and timely scores from both TransUnion and Equifax is CreditKarma.com. It’s not some subscription service, they don’t even ask for your credit card. Besides two scores (that are updated every Monday!) it includes access to your credit history, credit advice and tons of other neat things.

What I don’t like about scores from my credit cards is that they seem to be behind by a couple of months.

Credit Karma does not provide a FICO score which is what banks use. This article is about getting your actual FICO score. With that said, I do believe Credit Karma can definitely be a useful tool. Thanks Sergei!

You described all the FICO scoring models above as Model 8. Can you expand on the difference between them, since Citi’s FAQs say the range on their model is 250-900 and most other banks say the range is 350-850. Thx.

They are all Score 8 but, Citi is using the a different version of the FICO with a different range for some reason. It is explained well in this article. http://www.magnifymoney.com/blog/building-credit/citi-free-fico-scores-live-something-different367796063

Citi used the bankcard enhances Equifax FICO 8 score.

There are also several credit unions that offer free FICO scores.

I find my Citi FICO is generally 20-45 points higher than my AMEX. Any idea why the big difference?

This often happens since each bureau has slightly different information. Citi is pulling from Equifax and Amex from Experian.

Possibly different dates and different FICO versions.

Why the big difference between all of them? 773 797 810

The scores are coming from different bureaus and they each have different information.

CapitalOne has something called a credit tracker powered by Transunion, but they describe it as “TransUnion New Account Model”, not a true FICO score I imagine?

As a datapoint – i was tracking my fico number through various cards. When I came to refinance our place the loan company used a considersbly lower fico score than the cards had provided citing having open multiple lines of unused credit. This did not in the end make any difference to the loan in this case but interesting that the cards and the loan company differed in their evaluation.

Mortgages don’t use FICO 8 scores, and the previous generations of scores do not go up to 850. Equifax, for example, only goes up to 818. You can get a free version of this score monthly from DCU (a credit union).

I don’t believe I said Score 8 was used for mortgages, but just in case here is a resource I wrote today covering credit & mortgages. https://milestomemories.boardingarea.com/mortgage-credit-card-churner/