How I Plan To Eat For Free The Next Few Months

Who doesn’t love free food? This article won’t be about how I scrounge together free fries from this restaurant + a free sandwich from that restaurant (though that is always fun too). This is much more straight-forward approach on how I plan to eat for free the next few months.

How I Am Planning To Eat For Free

Chase’s ‘Pay Yourself Back‘ policy was launched in 2020 to help cardholders use their Ultimate Rewards points while being stuck at home. I charge all of my grocery and dining purchases (including restaurants, takeout, and eligible delivery services) to my Chase Sapphire Reserve card, and then use my Ultimate Rewards points to redeem the purchases at 1.5 cents per point. I then get a statement credit for the grocery or dining purchase. This is even better than a normal refund because I am still earning 3x points on dining and groceries (with their limited time increased earning on groceries).

With the Sapphire Reserve, you also get $60 in DoorDash credit each year.

I also use my Amex Platinum for an extra $45 a month of “free food”; $15 per month ($35 in December) credit for Uber/Uber Eats + $30 per month on PayPal, which I use to pay for the remainder of my Uber Eats order.

Why I Am Choosing Money Over Points Right Now

I could use my Amex Platinum for 10x on U.S. Supermarkets, which would be the smarter move points-wise. However, I have several reasons why using my Chase Sapphire Reserve card is my preferred option for me right now:

- I am very COVID-cautious, and haven’t traveled during the pandemic, and don’t plan on traveling anytime soon, so my points are just currently sitting there unused (I have a stockpile of points in Amex and Chase).

- Like I mentioned, I have points to spare, and plenty of time to build my points bank back up for when I am ready to travel again (and eagerly looking forward to that day!)

- My husband and I are taking this time of not traveling to really focus on paying down student loans. The money we are saving from food is going toward those student loans. The savings on interest outweigh the savings on future potential travel.

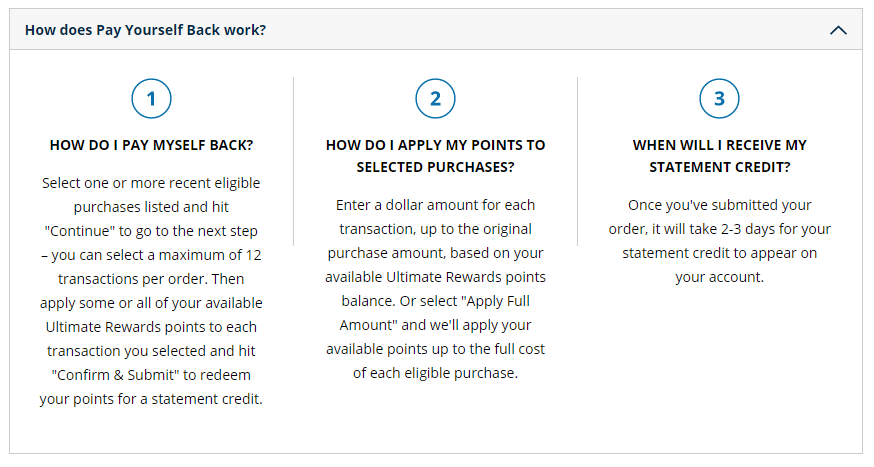

How To Use Chase Pay Yourself Back

You will need a Chase card that is eligible for Pay Yourself Back, such as the Chase Sapphire Reserve card or Sapphire Preferred. Points are worth 50% more for the Reserve and 25% more for the Preferred.

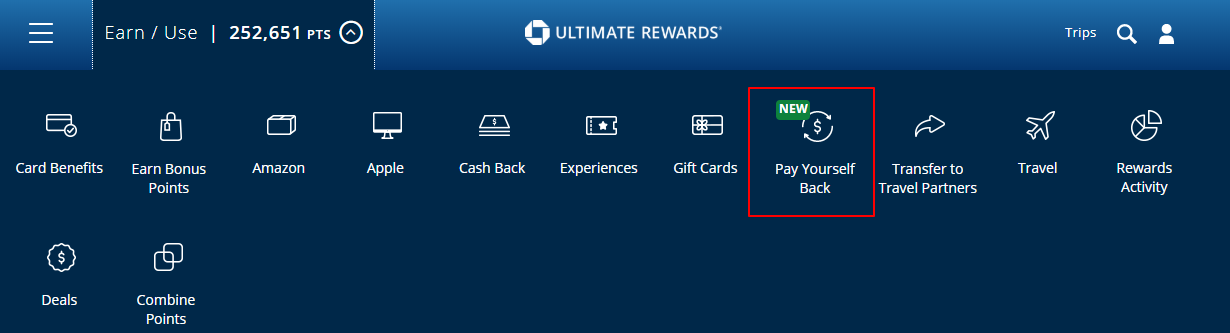

To redeem Chase points through Pay Yourself Back, login into your Chase Sapphire Reserve or Preferred account and click your points balance to go to the Ultimate Rewards site or simply login via UltimateRewards.com. Once logged in locate “Pay Yourself Back” on the menu as shown.

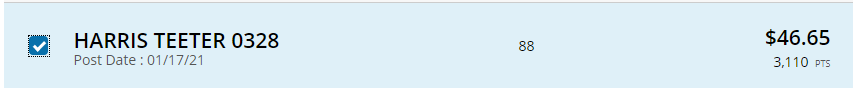

Clicking “Pay Yourself Back” on the Chase Sapphire Reserve menu will bring you to a page that shows all of your eligible grocery, restaurant, and home improvement purchases from the past 90 days. Anything in those categories purchased within the past 90 days should qualify.

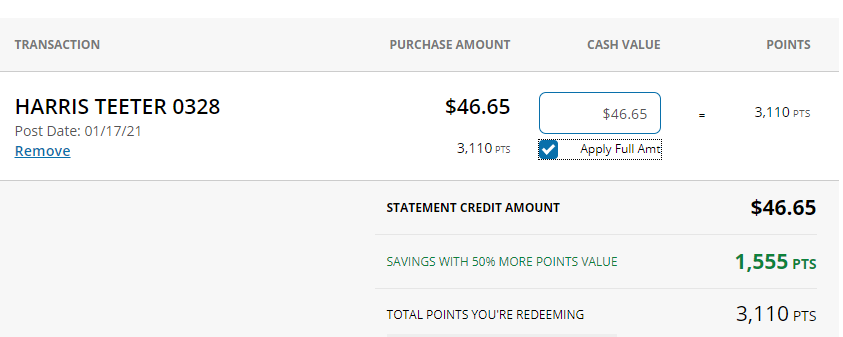

To choose this transaction for cashback, simply select the check box to the left as shown above. The site informed me that I could cash in 3,110 points to receive a $46.65 credit for this purchase. This would normally be 4,665 points; a 50% greater value.

Once the transaction is selected you can choose to apply points towards the full value of the purchase or a partial value. In this case I chose “Apply Max Value” and cashed in 3,110 points for a $46.65 statement credit just as expected!

How I Plan To Eat For Free – Final Thoughts

Using points to pay for food may not be everyone’s priority, but it works for me right now. Taking advantage of all of the promos and limited time credits helps out a lot too. My strategy will likely change again in the future, but I love being able to take advantage of this to save money on a necessary expense: food. I will in turn use that money saved to pay down student loans, which has additional interest savings as well, making my redemptions worth that much more.

@Robert the annual fee was $450 for most CSR cardholders. The fee was raised for new cardholders last year but many existing cardholders received a $100 reduction due to COVID-19. After the $300 travel credit and other cash back benefits the net is less than $100.

I don’t know if I am misunderstanding you but… If you’re able to use Pay Yourself Back and earn points on the same transaction, does that mean you’re effectively not losing any points?

That is correct

To each their own but I will NEVER use any of my points for basically cash back. Maybe it helps I’m retired and financially set (as well as for the next generation to follow) so money is never an issue for me. I get points to use them for travel experiences and will continue to do so. On the other hand if people feel they need to convert points to $ to cover their expenses then go for it – I just will never need to do that and certainly wouldn’t

If you’re the kind of person to use pay yourself back, you shouldn’t be using a $550 card, just get cashback cards.

I am gonna have to disagree here because this unlocks ALL Ultimate Rewards points and not just the CSR’s points. Any that you have earned in the past or continue to earn. That gives you 7.5% back with the Ink and Freedom cards, 4.5% back on restaurants, 3% on gas, 2.25% on everyday spend, 4.5% on drug stores, 4.5%-7.5% on travel.

It does a whole lot better than cash back cards when you look at it that way. Not to mention the $550 is offset by a $300 travel credit, $60 in doordash and lounge access.

Excellent post. Thanks for the advice!

Yes…is a great feeling (& program)!

I get more than 1.5 cents value transferring to Southwest, that is my go to for all UR points. Saved me thousands over the years on flights, and I prefer Southwest over the big three so I don’t feel like it’s a compromise.

For most Southwest flights you earn about 1.5 cents per point on the redemption. If you instead paid yourself back and then booked that same flight with the cash you would get 1.5 cents per point on the redemption and then will earn miles on the Southwest flight and on the credit card you use to pay it with. You will almost always come out ahead going this route.

The only thing different is you can easily cancel award flights. So I would book travel that is up in the air with points but anything you are for sure taking this route would be better for you.

Been trying to convince myself to use the pay yourself back but having only the CSP is not as worth it to me if I had CSR… But good plan in using that cash to pay down other expenses.

Something to consider is doing an upgrade to the CSR from the CSP. The way their system works you should be able to get 2 x $300 travel credits out of it and all the other perks (DoorDash, lounge access, better travel insurance etc.) and then could cash out at the higher rate. Then you could downgrade at the end of the year if you wanted.