How Long Does A Bank of America Blacklist Last? Ask Me, I’m Off The List!

How long does a Bank of America blacklist last? I’d been wondering that myself, since I was on their naughty list for a while. Through sheer dumb luck and then some targeted emails, I got off the naughty list. In this article, I’ll look at how long a Bank of America blacklist lasts through my own data points and things I’ve read from others.

Data Points – My Situation

In this previous article, I shared my experience finding out my name was on a Bank of America blacklist. Here’s a synopsis for data:

Long time ago

- I had a credit card with BoA 15+ years ago that went to collections and was paid off for less than the balance in February 2010.

- After that date, I had several business credit cards and a personal checking account with Bank of America at various points.

2019

- May 2019, Bank of America told me they were unwilling to consider me for any type of personal credit, even with low limits or secured, due to writing off a loss with me in the past.

- Their loss was over $1,000 when I settled with collections.

Since then, I mostly moved on & forgot about this situation, assuming there are other miles & points to pursue.

2020

Late last year, I re-established a relationship for the sake of a checking account bonus:

- August 2020, I applied for the Bank of America new checking account welcome offer and earned the $100 bonus from completing 2 direct deposits.

- September 2020, I applied for the Alaska Airlines Visa Business Credit Card from Bank of America. I had to open a CD and get this as a secured card, but I got the card in the end.

- That same day, I applied for a personal card after receiving a targeted offer in the mail. This was for the personal Alaska Airlines Visa Credit Card. I figured “eh, why not?” and filled out the application. I shared here the info and how surprised I was with an instant approval.

Not wanting to read too much into it or burn a newly-restored bridge, I laid low with Bank of America for a while.

2021

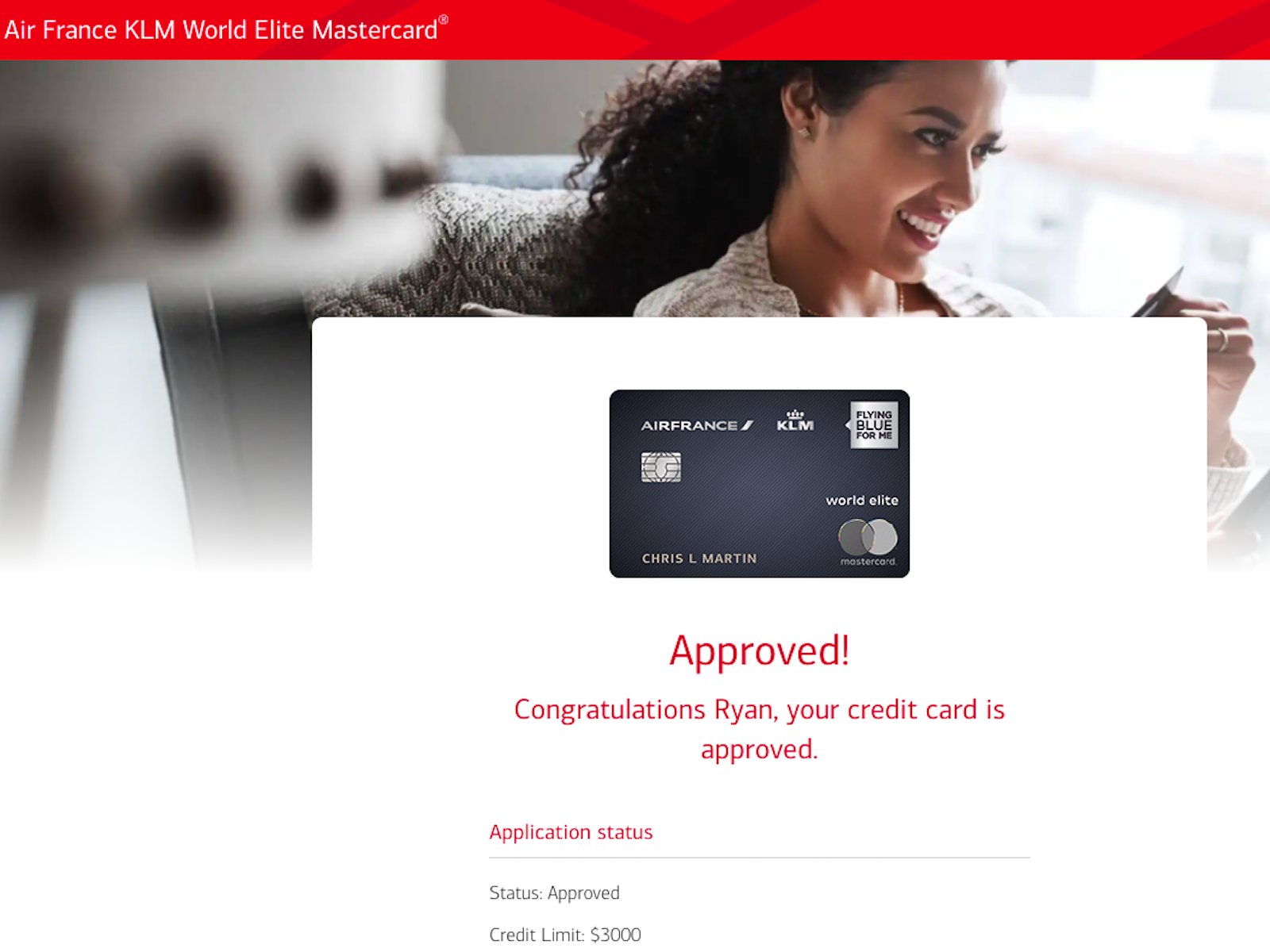

In the past 3 weeks, I received 5 – YES FIVE – emails from Bank of America about a welcome off for the Air France / KLM World Elite Mastercard. I figured that many emails meant I should give it a shot. I waited until today, when an inquiry dropped off my credit report, and then applied. Instant approval!

With the $3,000 credit line from this card and the $7,500 from my Alaska Airlines Visa, I have $10,500 in personal credit from Bank of America.

Data on my applications

When I applied for the Alaska Airlines Visa, I put over $3,000 into my personal checking account at BOA to help my chances. Today, I forgot about that and had only $11 in my checking account. However, I also have another credit card, made a payment to it an hour before this application, and the business credit card + business CD.

Crunching The Numbers

How long does a Bank of America blacklist last? My experience is that it took 10 years. Various factors can shorten that, according to this thread. What type of account did they write off? How much money did they lose? And what type of account are you trying to get now (Checking? Low risk for them. Credit card? Much more risk for them.)? Some people report that a Bank of America blacklist lasts for 6-7 years after problems with checking & savings accounts. People blacklisted because of credit card-related issues report blacklist timeframes of 7+ years. Mine was 10 years.

Final Thoughts

Again, we come to the importance of good credit behaviors. Aside from understanding credit card application rules for each bank, your past also can haunt you. In our beginners’ series, we even talked about what makes up your credit score. A full 35% is your history of (non-)payments. Participating in this hobby really exposes how much your credit score can enable or disable things you want to accomplish. It took a full 10 years for me to get off the Bank of America blacklist. I learned my lesson from this, and I hope the info helps others avoid my mistakes.

With Bank of America giving you choices of categories on the cash back card, is it okay to buy gift cards if you chose fuel for your 3x category.

Haven’t heard of any problems with this. Start slow and go from there.

Appreciate you responding.

Kudos Ryan for helping other people learn from your error. No one is perfect.

Glad you got something out of it 🙂

…right but now you’re stuck with that AF/KLM card /s

I’ve had a checking account with them for 15+ years & they haven’t approved me for anything in at least 10. I’ve never defaulted anything with them, though I think I had a couple of cards closed for lack of use in like ’09. There isn’t much in their portfolio that makes me want to bother trying again. (VS got deval’ed, dont care about AS or premium rewards, Amtrak to Choice would be nice but the transfer cap is low, maybe Sonesta someday…?)

I don’t understand why you said “you’re stuck with that AF/KLM card”. No I’m not. Let me know if there’s something I missed from your comment.

Yes, you missed the “/s” tag 😉

I had to google that just now to know what it was

Got a Bank of America offer for 25,000 points after$1,000 spend with no annual fee. Is that a good offer or typical?

Brett – for which card? New account or retention offer? Let me know what the offer is that you’re talking about.

It says for the Travel Reward cc. 25,000 online bonus points good for travel and dining.

And new account. Not retention. But I do have their cash back card also.

Brett – I believe that’s a standard offer.

Thanks for sharing this. Anyone have experience with citi? I have on their blacklist for about five years for unknown reasons (I think Walmart billpay to their credit card was a likely culprit). Applied for a personal card with them last week and was declined. I have been doing one application per year to try my luck. It’s never an instant denial and they pull my credit but ultimately decline based on the last account closures.

John – I don’t personally, but there are multiple forums where people are sharing their experiences https://www.google.com/search?q=citi+black+list+blacklist+how+long&rlz=1C5CHFA_enSG704SG704&oq=citi+black+list+blacklist+how+long&aqs=chrome..69i57.4713j0j7&sourceid=chrome&ie=UTF-8

Not to be judgmental but if I were a credit card issuer I would never authorize an account for someone that defaults on their payment obligations. Very surprised and disappointed to know you did this. IMHO takes away a lot of creditably of your posts!!

You’re surprised and disappointed to find out I made bad financial decisions 15 years ago and now being honest about it takes away my credibility? This makes no sense at all. Hiding it would take away my credibility. At least I’m trying to share info and help others.

People start their post by “not to be judgmental” then they go ahead and do just that. Lol

Takes credibility away from his posts? Have you never made a mistake and been given some way to redeem yourself? Not only that but he is sharing this info to help others. I guess you should read sites where the author pretends to be perfect, because those exist. Here on MtM we aim to be real and share our diverse thoughts, experiences and backgrounds.

Thanks for sharing your experiences Ryan!