MTM101: Points And Miles For Beginners – Part 1: Getting Started

MTM101 is a new series on points and miles for beginners who dream of doing what we do: travel the world for free or for just pennies on the dollar. You’re intrigued with this concept of flying for free and staying at hotels for free. You’re in the right place.

Over the next few weeks, we’ll look at how to start in this hobby and address common questions. All of us had questions when we were new at this, so we hope to cover those questions here. MTM 101 will look at important things for starting out, like what “travel hacking” / “points & miles” is, how to make a plan for starting out, some important things to know, and even things we wish we’d known when starting out.

In MTM101 Part 1, the topic is “Know where you stand”. We will introduce the major topics that are part of this hobby. Maybe you Googled “how to travel hack” or “points and miles” and still feel like you don’t understand how this works. Welcome to the world of points & miles for beginners!

Here is what we will cover today:

- Is this hobby for me?

- Is this legal?

- How much does it cost?

- Does this hurt my credit?

- What about interest and fees on credit cards?

- Do the banks know you are doing this?

- How do I get started?

Is This Hobby For Me?

I will be honest that “points and miles” or “travel hacking” is NOT for everyone. We previously talked about this in an article here and also in a podcast regarding who this is and isn’t good for. There are several basic requirements:

Organized

There is information you need to keep track of. When you start opening multiple credit cards, you need to track the opening dates, bill due dates, etc. Keep track of the requirements for earning the bonus from the welcome offer, plus your progress towards it. If you aren’t organized, it’s easy to miss a credit card payment or fail to complete the requirements for a welcome offer, missing out on all the points and miles you were trying to earn. You can really mess up your credit if you aren’t organized / don’t pay your bills on time.

Some people like online tools like TravelFreely.net, while others prefer to use a Word document or Excel spreadsheet. The best tool? It’s the one you use and use regularly. This system will probably change over time, and that’s OK.

Decent or better credit history

If you have terrible credit, this hobby will be difficult (if not impossible) for you to participate in. That’s not a judgment against your past, but banks will not approve credit card applications for people with a history of missed payments, bankruptcies, foreclosures, etc. If you have a history of bad credit, you may need credit repair services before participating in this hobby. Once you have a better credit score (around 700 or above) with some history of on-time payments / managing credit responsibly, banks will be more willing to approve you for the credit cards recommended in this hobby.

U.S. citizen or legal resident

Yes, there are people who do this hobby in other countries. However, our advice is based on the points & miles hobby in the U.S. Most credit cards we review are issued by banks in the U.S. Their terms stipulate that they are open to U.S. residents only. If you are not a U.S. citizen but are living/working in the U.S., you should check your visa situation to understand what you are/aren’t allowed to do. For example, some people are not allowed to operate an independent business on their visa. Those people should not apply for any business-related credit cards.

If you are not a U.S. citizen and/or not living in the U.S., maybe try searching for “points & miles (insert country)” on Google. Our credit card recommendations might not mean much for you. However, using your points, as well as our reviews of hotels/flights/destinations, are still great–no matter who you are or where you live. If you are a U.S. citizen but living in another country (like me), it is possible to do this.

Willing to put in effort

This hobby takes some work. None of the things in this hobby are automatic. This is often the part that turns people off. You need to be organized, read information, and learn before making decisions. This hobby takes some effort, so know that before you start. If you want to do it right and really enjoy the free trips, know that it’s not automatic or ‘set it and forget it’. You can put in more or less effort; everyone has different limits.

Is This Legal?

Yes, it is! This is a common question. This hobby seems too good to be true, right? Surprise: it’s not. This is 100% legal. I’m not a lawyer, but I do read the credit card terms before applying. I will tell you that I’ve never seen anything saying we can’t do this. The banks aren’t big fans of us, but it’s definitely not illegal to open multiple credit cards with the goal of earning as many points & miles as possible.

How Much Does It Cost?

The answer isn’t technically “nothing”, but this course is totally free. As you learn about points and miles, you’ll see that what you put in is a small amount compared to what you get out of it. Credit cards often have an annual fee for keeping the account, so it’s not “totally free”, but $85 for a credit card that gives me 3-4 nights at a hotel is pretty awesome. Also, as we learn about opening credit cards for their welcome offers and bonuses they will give us, the goal is to NOT increase the amount of money you’re spending every month. The goal is just to take everything you are spending and put it on your new credit card. That doesn’t cost you anything, but you can earn free vacations around the world because of it.

Does This Hurt My Credit?

Surprisingly, it helps your credit. In the U.S., there is a stream of anti-credit card advice. For people who cannot use credit cards responsibly, avoiding them is a good idea. However, if you can manage credit cards responsibly, this can really boost your credit score. That’s why we talked about being organized and paying your bills on time.

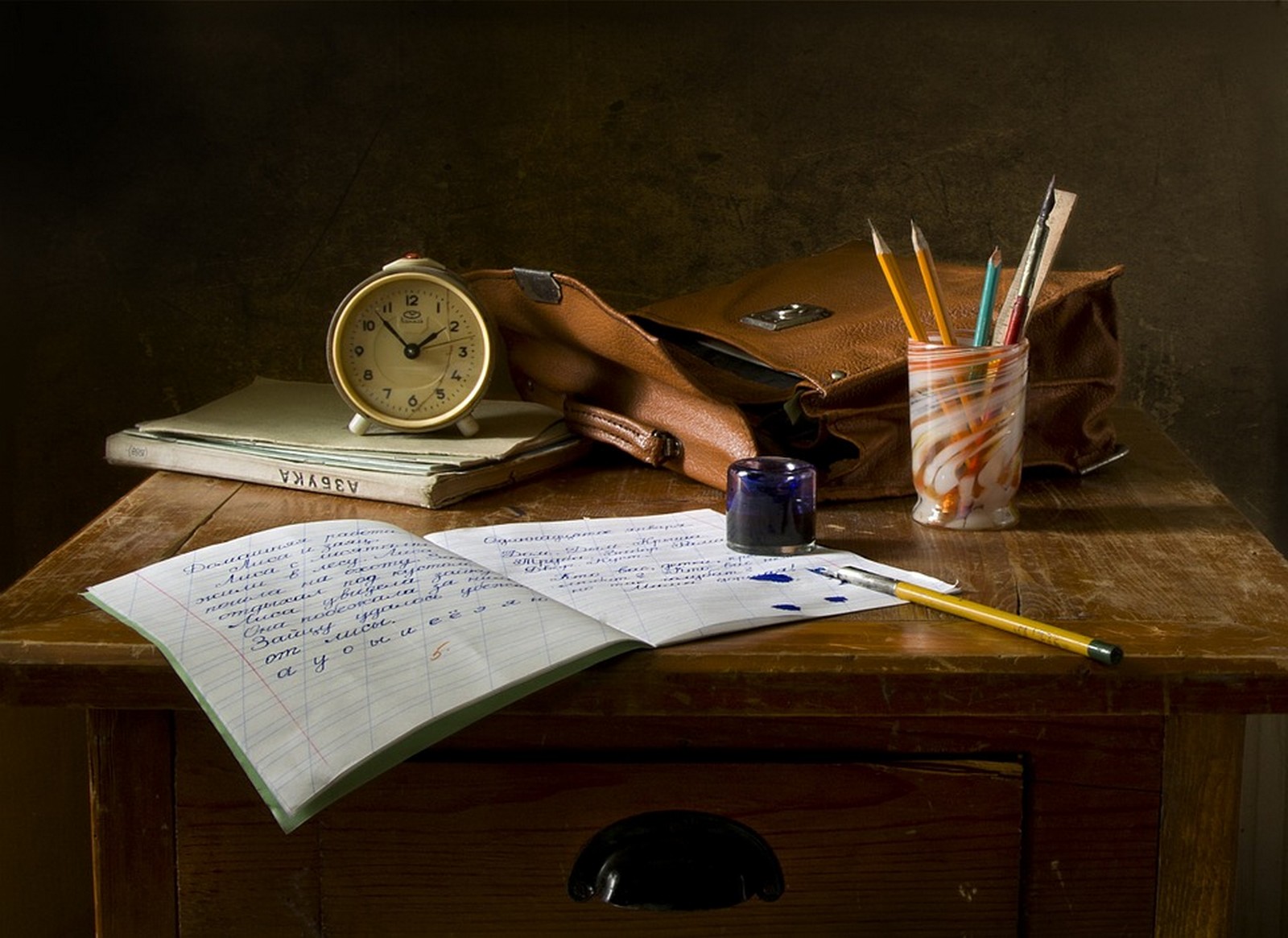

Your credit score is built like the image above. 10% is credit mix, meaning you should have a mix of credit cards, mortgages, car loans, etc. to show you can be responsible with different types of payments. 35% of your score is simply paying your bills on time. 15% of your score is having a long credit history, so a credit card you’ve had open for 10 years and always paid on time really helps your score. 30% is “amounts owed”, also known as “credit utilization”. This is where this hobby can boost your score.

Here’s an example:

Imagine you have one credit card, and the limit on it is $10,000. You charge $1,000 on it this month. The bill comes, and you pay it. That month, you used 10% of your available credit.

You open another credit card, which also has a limit of $10,000. This month, you charge $1,000 on the new card but you don’t use the old card. You’ve still spent $1,000 and paid your bill as normal. However, you’re using only 5% of your available credit ($1,000 out of $20,000). You look MORE responsible now, because you are managing a bigger credit limit in a responsible way.

Now imagine that you have 10 credit cards, all with limits of $10,000. If you still have $1,000 due at the end of the month, you’re using just 1% of your credit limit. This looks super responsible. Your score is going up and up the more credit you are managing.

Having more credit cards increases the amount of money you are managing. Doing that responsibly makes you look more trustworthy, raising your credit score.

What About Interest And Fees On Credit Cards?

Yes, the best credit cards in this hobby typically have annual fees. Those can range anywhere from $89 to $595. I know that last number sounds ridiculous, but different cards have different perks. We’ll get into this more in the future, but don’t immediately like or dislike a card just based on the fee. There’s more to it than that.

Interest: we aren’t going to pay it. Most people think that using a credit card means you’re paying more in the long run. The interest rates on the best travel rewards credit cards are high. However, if you pay your bill on time, you actually don’t pay interest. This surprises many people, because we are inundated with anti-credit card information. If your bill is $1,000 and is due on the 10th, pay it by the 10th. If you do, you only paid $1,000. You won’t pay a penny of interest if you pay your entire bill on time every month. This comes back to using the cards responsibly, which helps your credit score, and it costs nothing extra. No interest.

Do The Banks Know You Are Doing This?

Yes, they do. The banks often refer to us as “gamers” or “churners”. They account for us in their planning and budgeting meetings. The banks know that every single promotion, product, and credit card they offer will have people who intend to extract maximum value with minimum input. They know that, and they plan for it. So why do they allow it?

Despite their efforts to make this hobby more difficult (after all, it reduces their profits), the banks still make money. They make insane amounts of money from credit cards, to be honest. They make money from people who don’t pay their bill on time. When those people charge $1,000 and only pay $200, the banks make money on the interest paid. By paying your bill on time / in full every month, you earn rewards while boosting your credit score and not paying anything extra for the points & miles you earned.

The banks know we are doing this. They know that for every 1 person who opens a credit card and does what we are doing, there are 10 who will not pay the bill in full. There are at least 10 people who are giving the banks profits for every 1 of us.

How Do I Get Started?

Everyone starts somewhere. This hobby is awesome. It’s fun & exciting. We are pumped that you’re here to learn more. Points and miles, for beginners at least, can sometimes feel overwhelming. Here are some actions you can take to prepare. Before the next article, there are some ‘next steps’ you need to take. Here’s how you should start.

1. Get a copy of your credit reports.

Go to AnnualCreditReport.com and get free copies of your credit scores from all 3 bureaus (Experian, Equifax & TransUnion). Make sure everything on there is correct and up to date. Addresses, credit history, personal information — all of that should be correct. If there’s anything wrong (ex: it says you didn’t pay a bill but you did), fix it. This is in your best interest.

2. Sign up for an account on CreditKarma.com.

While this is not an official credit report, CreditKarma.com is free and easy to monitor. You can keep track of your estimated credit score. Also, you can find dates for when you opened and closed accounts. Plus, you can see factors like your credit age, history of accounts, and how much your bill was (watch how your score can fluctuate up and own when a big credit card statement reports / when you pay off an account). The plus is that you can check this as often as you want, while your official credit reports have limited free access.

3. Make a list of all credit cards you have opened in the last 2 years.

It could be 1 or 100, but write down the dates of any credit cards you opened in the last 2 years. We want to know the account opening date and who issued the credit card (Citibank? Bank of America? Etc.). Also note any accounts where you are an authorized user, not the primary account holder. If it shows up on the report, write it down, even if it’s a Macy’s card.

4. Join our Facebook group.

If you haven’t already, join our Facebook group. This is a great place to ask questions about points and miles for beginners. If you’re unsure or unclear, you can ask others. You can also read what others are talking about and learn from them.

Consider these your homework before Part 2.

Final Thoughts On Points And Miles For Beginners – Part 1

That’s a wrap on Part 1 – Getting Started. We looked at some common questions about points and miles for beginners. Next, we talked about understanding your credit and how your credit score is built. We saw that this hobby can improve your creditworthiness and credit score. Also, we talked about the fact that this hobby does NOT cost a lot of money, and you don’t need to be rich. Lastly, we talked about key characteristics required for doing well in this hobby, and we talked about some “homework” and next steps to prepare for getting your feet wet.

There is a lot of information in this hobby, once you really get into it. Sometimes, it can feel like drinking from a fire hose. Remember that we all started somewhere, and everyone was a beginner at some point. Don’t be afraid to ask questions. And don’t forget the homework for next time! It really is important to know your credit situation and credit history as you get started.

See you next week!

looking forward to learn more and make my first travel for free.

Great! Glad you’re here.