How To Transfer Credit Limit Between Your Cards, Rules For Each Bank

This guide will show you how to transfer your credit limit from one card to another. There are limitations to how and when you can do this, so we’ll examine these. We’ll also look at which banks don’t allow this, plus creative ways to get what you want. First, we’ll understand what shifting a credit line is and why you would want to transfer a credit limit.

Understanding Credit Lines / Limits

Commonly called a “credit limit” or “credit line”, this term refers to how much you can charge on your credit card.

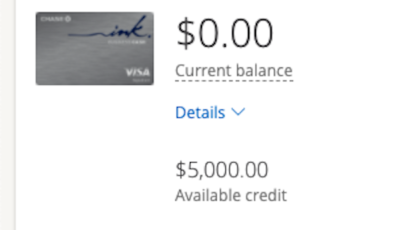

In this image from my Chase Ink Business Cash Credit Card, you can see my credit limit is $5,000. I cannot charge more than $5,000 to this card at one time. After reaching $5,000, the card will be declined. I need to pay my bill before I can charge again.

That’s my credit limit.

Why Transfer A Credit Limit?

Now that we know what a credit line / credit limit is, why would you want to transfer a credit limit? Transferring a credit limit means moving part of the credit line from card A to card B. An example would be card A has a limit of $20,000 but card B has a limit of $5,000. You could take part of the limit for card A and move it to card B. This is NOT a balance transfer, where you move around the money you’ve already spent. This is moving your ABILITY or maximum amount you can charge.

There are several good reasons to move a credit limit:

- The card you use most has a low credit limit, and you want to be able to charge more on it.

- A credit card with a low limit is nearly maxed out, which is bad for your credit score.

- The bank will not give you more credit to open a new card, so you take some credit from an existing card.

- You are closing a card but don’t want your available credit / maximum credit line to decrease.

In all examples, you will move credit from an existing card you already have with the bank to another card or a theoretical new card with that same bank.

Any times you shouldn’t do this?

Yes, there are times when you shouldn’t do this. Here’s a great example:

Your credit card has a credit limit of $10,000 and you currently owe $5,500 from your last statement. If you move $4,000 off that card to another card, this first card is close to maxed out. This is generally a bad idea and will hurt your credit score. Don’t do it unless there’s a pressing or urgent reason to do so.

How To Transfer Credit Limit – Bank Policies

What are the banks’ policies on this? We’ll look at several rules and how each bank answers them. This will be whether you can transfer from business accounts to business accounts, personal to personal, personal to business, and business to personal. We’ll also look at how to transfer credit limits (phone, chat, online, etc.).

American Express

- Business to business: yes

- Personal to personal: yes

- Personal to business: yes

- Business to personal: yes

- Method: online, chat, phone

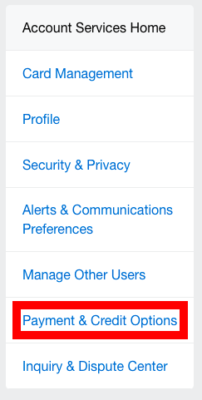

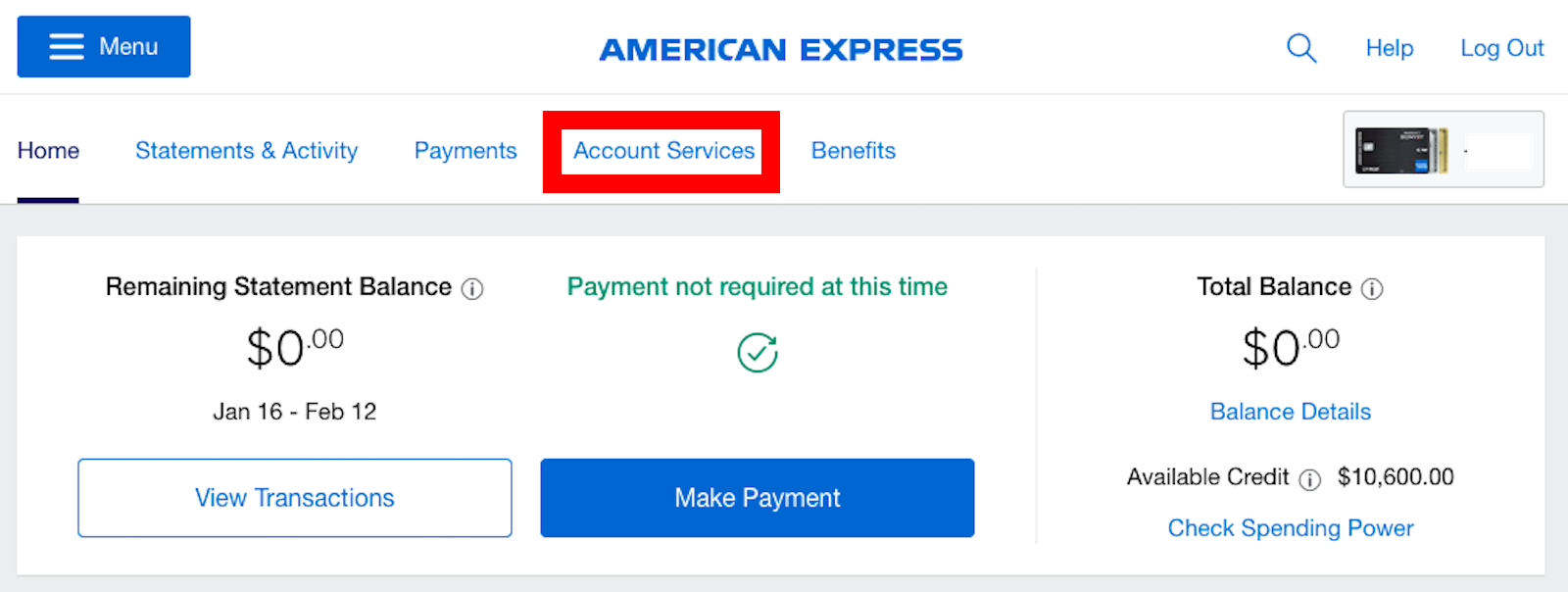

With Amex, you can do this online. It’s quite simple. Start here after logging in. In the screenshot above, you see step 1. Click on the card that you want (top right) and then choose “Account Services”.

Step 2: click on “Payment & Credit Options” on the left.

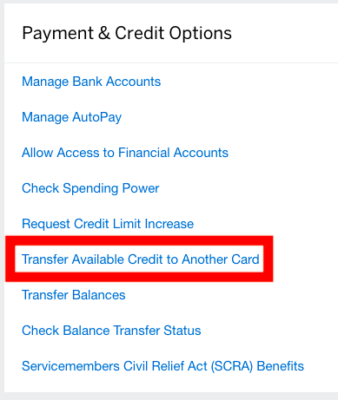

Step 3: click on “Transfer Available Credit to Another Card” in the center console.

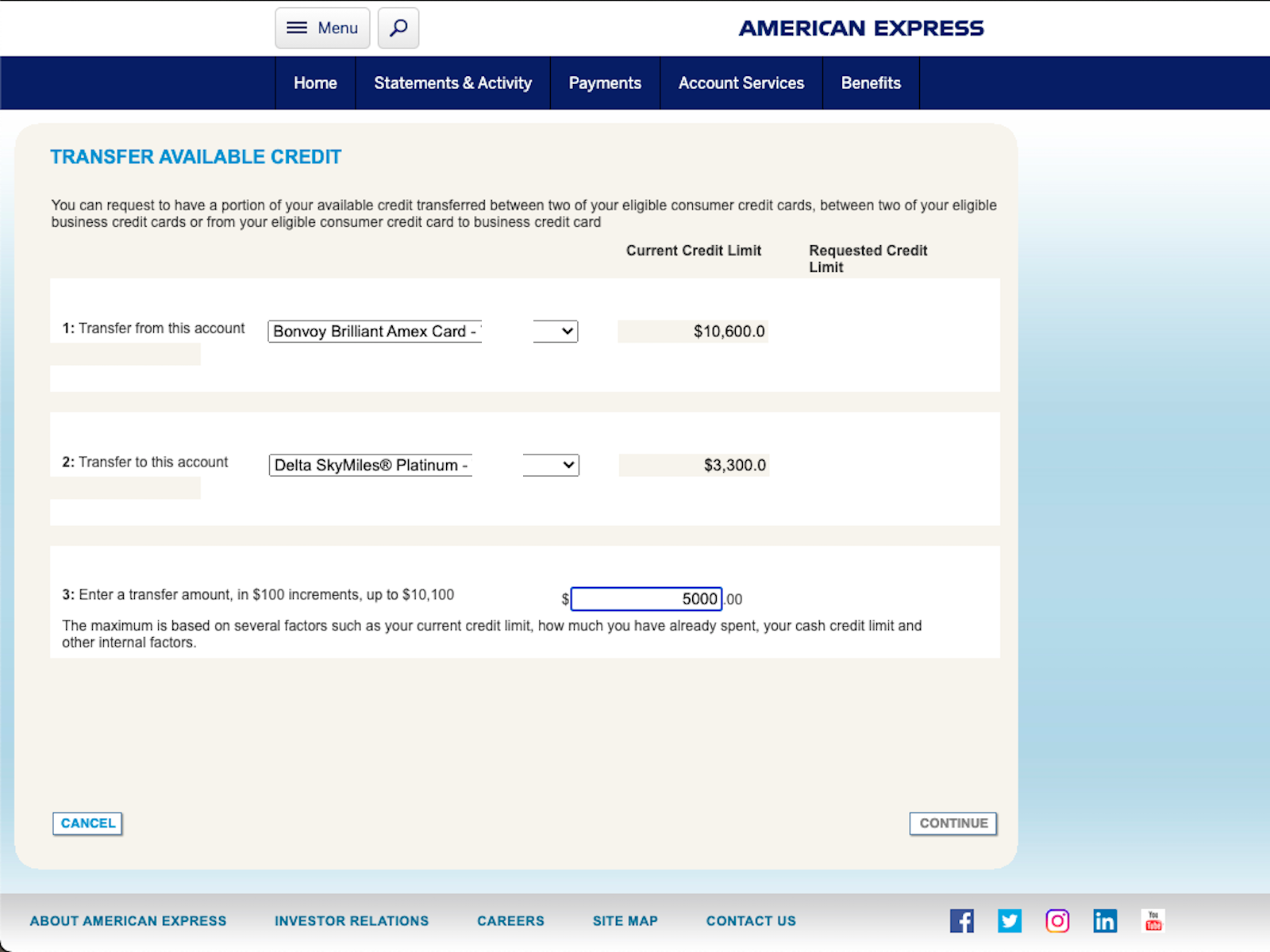

Finally, choose the cards for the from / to, and you will see the existing credit limits for each of them. At the bottom, type in how much you want to move, then click “continue” at the bottom. That’s it! It will process and should give you a confirmation.

If you don’t have your credit cards all in one log-in with Amex, then you will need to call the number on the back of your card.

Bank of America

- Business to business: yes

- Personal to personal: yes

- Personal to business: yes

- Business to personal: yes

- Method: call the number on the back of your card (the “from” card)

With Bank of America, in order to transfer credit limit you must call. They should let you move from any card to any card. Most cards cannot have a credit line below $100, FYI.

Barclays

- Business to business: yes

- Personal to personal: yes

- Personal to business: maybe

- Business to personal: maybe

- Method: call the number on the “from” card

Barclays is best described as “depends on who you talk to”. Some reps may say this can’t be done. Others will let you do it. Your best odds seem to be when the card is brand new. You just got the card, you see the credit limit is low, and you call. Ask to speak to the credit analyst department. Explain to them that you want to shift from another card, and confirm that they aren’t going to do a hard inquiry on your credit during this process.

Capital One

Simple answer: Capital One will not allow you to transfer credit limits from one card to another.

Chase

- Business to business: yes

- Personal to personal: yes

- Personal to business: no

- Business to personal: no

- Method: call the number on the “from” card or send a secure message in your account center

Chase will allow you to transfer from personal to personal or business to business. You cannot shift between the 2 types, though. You can send a secure message with clear instructions (“I want to move $5,000 of the credit line from my Hyatt card ending in 1234 to my United card ending with 8888”). You can also call the number on the back of the “from” card. It can take up to 24 hours for the new credit line to reflect in your account.

Note that most Chase business cards have a minimum credit line of $5,000, so you cannot go below that. The Chase Sapphire Reserve has a minimum limit of $10,000.

Citi

Cit also does not allow shifting credit limits from one card to another.

However, you can get around this on personal cards. I mentioned here that you can easily change from one type of personal card to another with Citi. People also have good look doing this via chat.

I used this to my advantage just last week. I changed my Citi Double Cash with a $3,500 limit to a ThankYou Preferred Card. I changed my ThankYou Preferred Card with a $10,000 credit line into a Double Cash card. In the end, it’s the same result, just with some “Citi logic”.

Discover

- Business to business: yes

- Personal to personal: yes

- Personal to business: no

- Business to personal: no

- Method: call the number on the “from” card

Discover has a funny approach to this. In most cases, you first need to call the number on your credit card and request a credit limit increase. Then, ask to speak to Credit Operations and request to shift your credit limits. It’s likely they will do a hard inquiry on your credit report during this process. Decide whether you’re OK with that and confirm with them whether they will pull your credit report.

HSBC

Simple answer: you can’t shift credit limits with HSBC.

Synchrony

Think you haven’t heard of them? If you have a store credit card, you probably have a card from Synchrony. They do not allow shifting credit limits between cards.

U.S. Bank

Despite allowing it in the past, U.S. Bank no longer allows people to transfer credit limit from one card to another.

Wells Fargo

- Business to business: yes

- Personal to personal: yes

- Personal to business: maybe

- Business to personal: maybe

- Method: call the number on the “from” card

It’s rare for Wells Fargo to allow shifting between personal and business cards, but it does sometimes happen, so I won’t put it as “no”. However, it’s not a guarantee. Call the number on the back of the “from” card and explain to the employee that you want to move credit to another card. Confirm whether they will do a hard pull on your credit or not.

Things To Consider Beforehand

Now that we know how to do this, here are some things to think about before you jump in:

- Will I hurt my credit? If you shift credit in a way that you now have a card that’s maxed out, this can hurt your credit.

- Will I get a “hard” inquiry? Some banks will insist on pulling your credit, just like they do during a new application. Decide whether you’re OK with that before proceeding.

- What if they say “no”? If the bank surprisingly won’t let you do this, what then? Is there another way to get what you want (i.e. the Citi approach)?

Final Thoughts

There are several good reasons for wanting to shift credit across cards. We looked at what those are and also reasons when you shouldn’t. Bank by bank, we looked at how to transfer credit limit from one card to another, specific rules per bank, and the way to do it.

Being able to have the credit where you want it to maximize your credit score & points earning capabilities is great. Some banks make it easier than others. Lastly, remember that you will close credit cards in this hobby. Before closing the card, move as much of the credit as possible to another card with that bank. “Save” your credit to prevent a massive dip in your “available credit” next month, affecting your utilization & credit ratio. This could bring down your score. Now you know how to save your credit with that bank.

[…] Good reference post in case you need to do some shifting around: Rules For Each Bank: How To Move, Shift, Or Transfer Credit Limit Between Cards. […]

Same with BofA; they start a credit pull to increase limit and then reduce limit on the business card

Amex does NOT allow business to personal even if on same login

The available choices will not list a personal card to transfer to when using a business as the card to transfer from

Through the automated site, that’s correct. I’ve heard enough people say they were able to do it over the phone that I marked ‘yes’. With BOA, it’s not the ideal way we’d like to do it, but it is a transfer. As stated in the article, always ask if there’s a hard pull and decide whether you want that or not before going forward.