Turn Off Amex Pay Over Time

Over the past few weeks we have been seeing some evidence that Pay Over Time may play a role in American Express applications. As we all know, Amex now has a 5 credit card limit for each individual. It appears cards that normally don’t fall under the credit card umbrella will sometimes be counted if they have Pay Over Time attached to the account. That is because Pay Over Time allows the cardholder to make payments over many months versus having to pay off the balance in full each statement period. This essentially makes it a credit card with a finite credit limit. That seems to be triggering Amex’s system during some applications and auto denying applications. After chatting with an Amex rep I have found a way to turn off Amex pay over time online. This should help you get future offers and better approval odds on your applications.

Update 6/3/22:

A reminder to double check your cards to see if it is turned on since so many people are being targeted for these offers right now. I ended up finding 2 of my cards enrolled when I thought they had already been turned off. And if I found that, as the person that discovered this tidbit, I have to imagine more of you have the same thing. I plan on checking the link for the pay over time offers again in a week or so and see if more cards are targeted.

How To Turn Off Amex Pay Over Time Online

Here is a step by step guide on how to turn Pay Over Time off. I would suggest everyone take the few seconds to do it, assuming that you don’t use the feature.

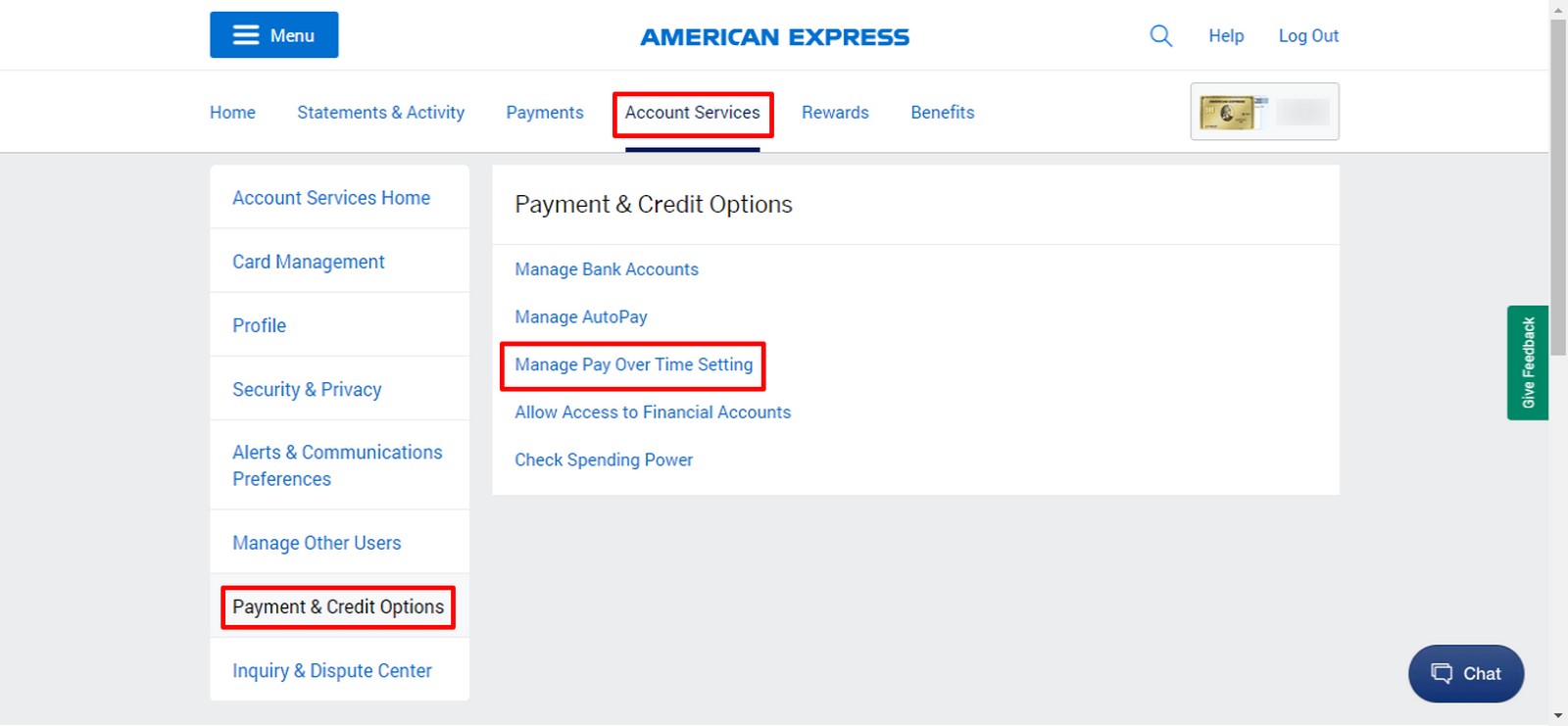

Step 1

Once logged into your American Express account, select Account Services (highlighted at the top of the image).

Step 2

After selecting account services, select Payment & Credit Options that appears from the drop down list (highlighted on the left side of the image).

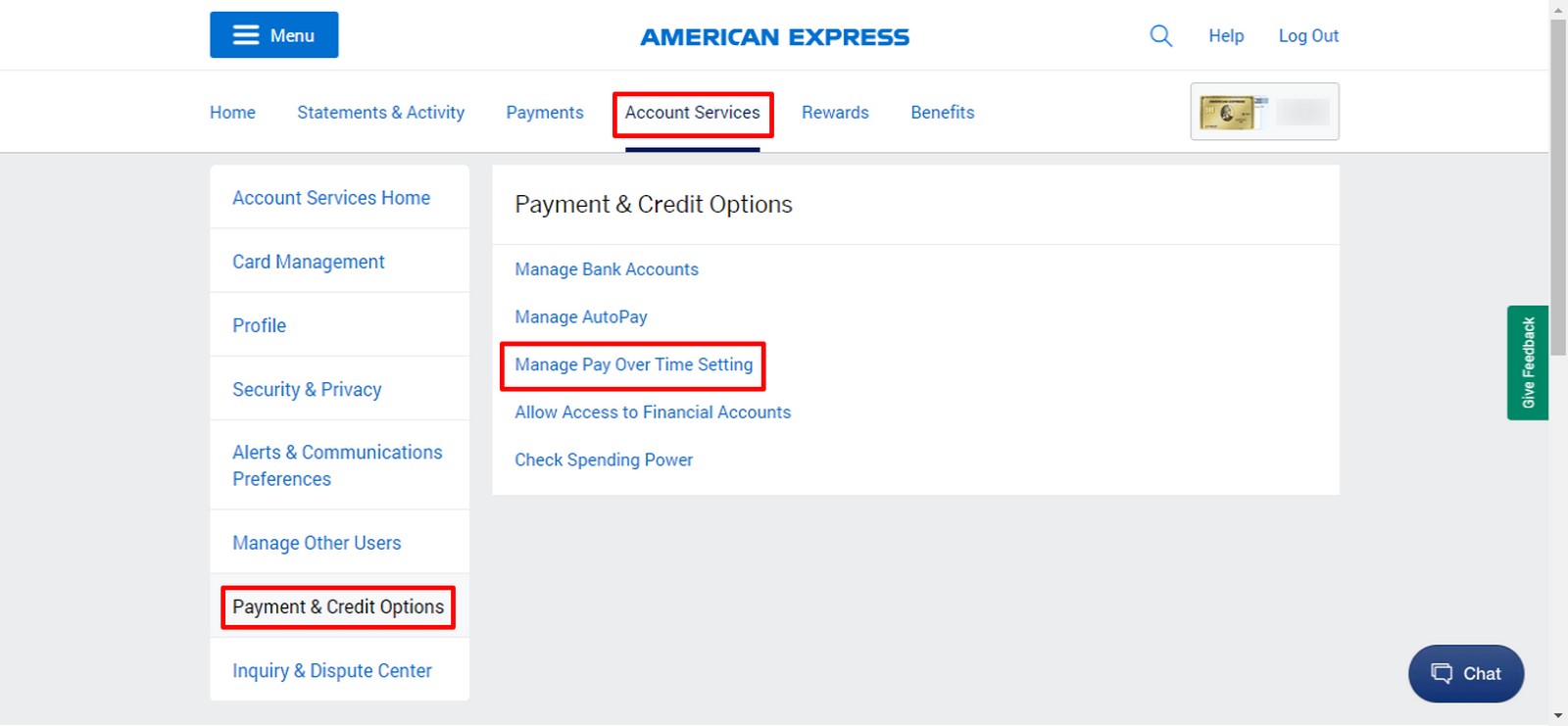

Step 3

After selecting Payment & Credit Services, select Manage Pay Over Time Setting (highlighted in the middle of the image).

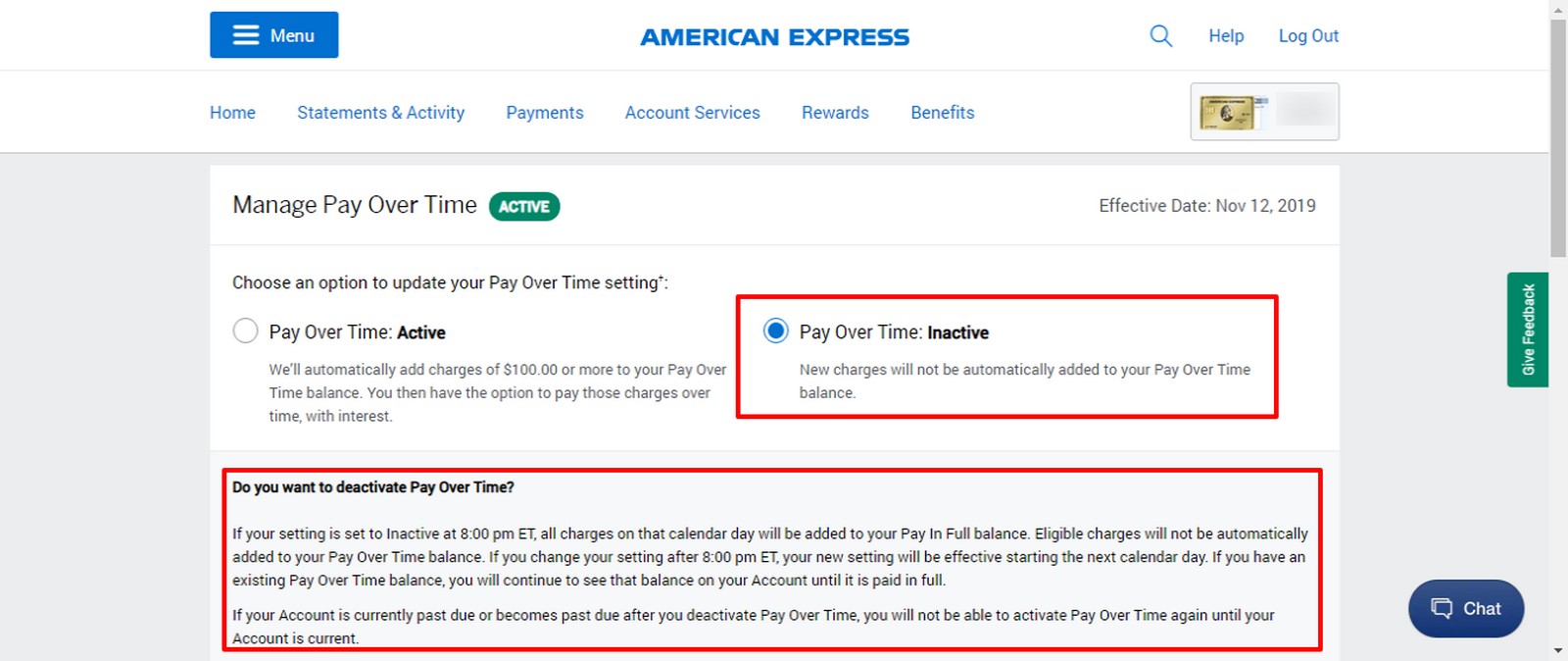

Step 4

Clicking Pay Over Time will take you to a screen that looks like this. Select Pay Over Time: inactive, which is highlighted above. Take note of the information box that comes up. If you select it before 8PM ET you should be be fine by the next day. If it is after 8PM ET then you would probably want to wait an extra day before applying for any new cards.

How To Turn Off Amex Pay Over Time In The App

If you prefer to use the American Express app then the process is different to turn of Pay Over Time on your cards. Here are the steps to do it in the Amex app.

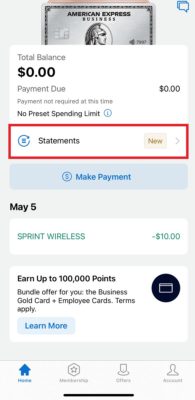

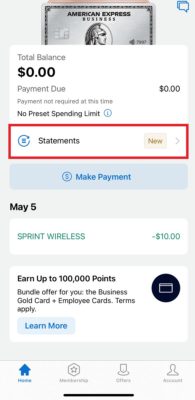

Step 1:

First up you will want to select the card you want to check your Pay Over Time status for. Once you are on that screen select the statements option highlighted in red above.

Step 2

Once on the statements screen scroll down to the bottom. You will see Pay Over Time as an option, highlighted above. If you don’t see it then you are probably looking at a standard credit card which doesn’t have Pay Over Time.

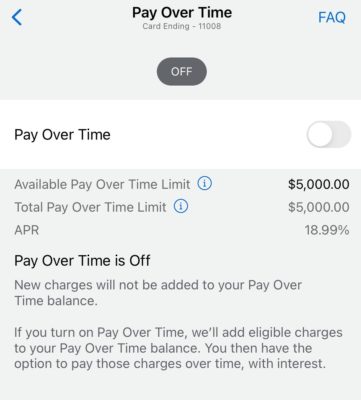

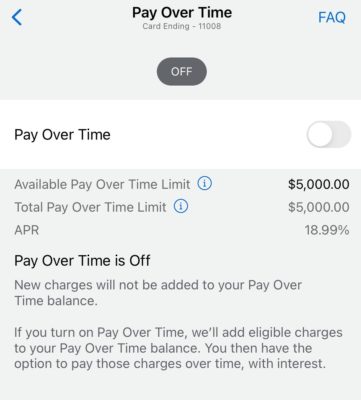

Step 3:

That will bring you to the Pay Over Time screen. Here you can see if it is currently turned on or off for your selected card. If on just slide the toggle over to off. Once you have confirmed it is off you can check your other cards and follow the same steps.

Final Thoughts

It is likely that you won’t have any issues when applying with American Express, even with Pay Over Time attached, but why risk it? You can easily turn it off on your accounts simply by logging and and making a few clicks. This could save you the headache of needing to call in to the reconsideration department. Or even more importantly, it can save you the eye rolls from that unwilling spouse! Do yourself a favor and take the couple minutes to turn off Pay Over Time right now.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How long after receiving POT bonus do you need to wait before deactivating to avoid clawback? Just got bonus last week!

Not sure that there is a real answer there. I usually wait a few months myself.

Good tip, thanks. You first posted this before I was a subscriber – old gold.

Glad you found us DJ!

[…] It may have always been possible to unenroll in Pay Over Time online, but I’ve always thought you had to call in or chat. Thanks to our friend Mark at Milestomemories who realized this and reported on it here. […]

[…] It may have always been possible to unenroll in Pay Over Time online, but I’ve always thought you had to call in or chat. Thanks to our friend Mark at Milestomemories who realized this and reported on it here. […]

Is it still possible to remove POT entirely from charge accounts?

Not that I am aware of

You can do it in the app too under Statements tab and scroll at the bottom.

Awesome – thanks P!

I have the 4 Amex cards I want so no worries for me. May downgrade Delta Platinum or cancel and get something else but that is at least another year out

If I currently have 4 Amex credit cards, will I now be prohibited from applying for the Green Card now?

It seems likely that would be the case. They would probably make you close one although a few people have been able to get 5 cards so it isn’t a for sure denial.

No you can still apply for the green card because it is a charge card. 5 limit on amex only applies to credit cards.

Any concerns about RAT clawbacks if you turn it off ?

I recently got a 10k bonus for activating it. No longer have the T&C, but presumably AMEX will not want me to turn it off again

If it was pretty recent I would keep it for a while. I think they more care if you grab another offer on the same card though.