iPhone & Apple Pay Activation

While I have nothing against Apple or iOS, I have sort of always been an Android guy. My wife and I have had iPads for years, but on the phone side I started with an HTC EVO 4G and stayed with Android from there. At times I have thought of crossing over to the “dark side”, but I have always found a new hot phone (such as my Galaxy S6) to fall in love with.

When Discover announced their Apple Pay promotion, I knew I had to break down and get an iPhone 6 or better. Then last week during one of those amazing 15% off eBay sales, I picked up an iPhone 6 for a crazy low price after the coupon, eBay Bucks and rewards. The only potential issue was that the iPhone is locked to AT&T (unlocked ones were much more expensive) and my family and I are on T-Mobile because of their free international data.

Trying to Unlock the iPhone & Activation

Since I figured this deal would be a good excuse to try out using the iPhone as my daily device, the first thing I did when I got the phone was try to unlock it. I paid someone $2.99 on eBay, but unfortunately AT&T won’t unlock it because the person who owned it previously didn’t pay off the NEXT plan. This means it was most likely a return or repair unit, which is fine, but no one can unlock it but AT&T.

The way iPhones work is they won’t even allow you to get past the first screen without a proper sim card for the carrier that the phone is locked to. While I could purchase a sim directly from AT&T, I wasn’t sure how long it would take to come, so I just bought one for $5 on Amazon. (I probably could have gotten one at an AT&T store as well.) The sim arrived last night.

Activating the Phone & Using Apple Pay

AT&T does have pay as you go plans, so I figured that would be my best option. After inputting the sim, I was able to activate the phone with iCloud and add my Discover cards to Apple Pay using WiFi. Not once did the phone ever ask me to activate the AT&T service. In fact, I put it in Airplane mode and then turned WiFi back on, so it isn’t even pinging the cell network anymore.

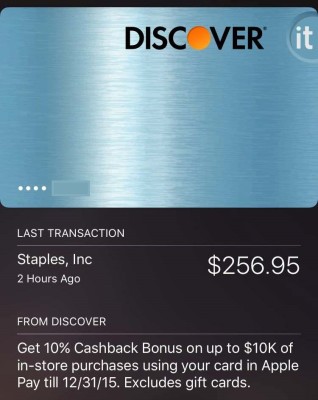

Once the cards were added to Apple Pay I was confident that everything would work and it did. As you can see in the screenshot above, I was able to successfully make a purchase at Staples. For some reason I had been under the assumption that the iPhone needed to be active on a network at some point to activate Apple Pay, but that isn’t the case. (Hence the trick.)

The Gift Card Issue

I do want to make a brief mention that gift cards are excluded from the promotion by Discover. It remains to be seen if they will enforce this or if they are even able to see what is purchased. We will know more in the future, but I am confident that it will work. Even if it doesn’t, 20% back on all of my spending is still well worth it.

Recap

If you simply want to get an iPhone to take advantage of this promotion, you just need to purchase the cheapest iPhone 6 that you can get your hands on along with a nano sim card for the network the phone is locked to. After that hook the phone to WiFi and activate everything. Then put it in Airplane mode and turn the WiFi back on. You basically end up with an iPod Touch that works well and most importantly can do Apple Pay. You never have to get a plan on the network.

While I am a little disappointed that I won’t get to play around with this phone a little more, I should be able to sell it for about $100 more than I paid for it once it has served its purpose. For now, I’ll be carrying around both the iPhone and my Galaxy S6, since 10% back (doubled to 20% in one year) is too good to pass up. Has anyone else out there purchased an iPhone specifically for this deal?

[…] accounts, but eventually it became only available on new accounts. Then of course we have the Discover Apple Pay 10% promotion. On accounts with double cashback, that is like 22% cashback on all […]

so i understand 10% is no valid on gc purchses, but what about the 1.5 doubling to 3x miles end of first year on new card on the gc purchases? I don’t see any legal terms against that part.

[…] My First Discover Apple Pay Experience & A Cool Trick I Learned About Locked iPhones & Act… […]

follow

[…] My First Discover Apple Pay Experience & A Cool Trick I Learned About Locked iPhones & Act… […]

“All they have to do is cite that the cash back given for gift cards was in error. ” They don’t KNOW they’re gift cards. Why does that point elude you? No penetration of visibility allows them to see the detail of what was purchased, only the amount and where. And they can’t MAKE YOU PROVE THAT YOU DIDN’T purchase gift cards. They’re not the IRS where the benefit of doubt goes to the organization and not the consumer. If you continue to proposition that they can make you legitimize the line item detail of your purchases through an invasion of privacy, and you truly believe that, then you are an idiot on so many levels that it defies logic.

Nothing had eluded me. I’ve already made my points as to why a lack of level 3 access isn’t enough protection. If you don’t want to read the comments on this blog post that’s not my problem. If you want to disagree, go right ahead as that’s your prerogative.

An example of issuers requesting receipts already exists as well. The Ritz Carlton cc has requested receipts from people whereby putting the onus on the cc holder to prove the purchases were legitimate.

I find it tragically ironic that those who resort to name calling typically are those who are unwilling to look at all opinions and points on a subject as objectively as possible to help form their own. Especially those they disagree with. When they can’t (refuse to) entertain the full scope they come to the conclusion the other person is (enter derogatory name) and just doesn’t get it.

Hey Bellevuemike, I believe you are missing the point here. Just like anthonyjh21 mentioned, you need to go back and read the comments on this thread. Very active.

While you have not said enough for me to think youre an idiot, I would say that your being too naive. You may have 100 years of experience with Discover already. Good for you. However, anything can happen from now until Discover honors the CB at that unprecedented level. We just dont know enough yet. Nothing is certain. Thats the point anthonyjh21 is trying to make. To be vigilant and cautious. Just like Bloomberg Market journalist love to say “Cautiously Bullish/Optimistic”.

The fact that you believe everything will be OK and theres nothing to worry about because they are not the IRS also defies logic on so many levels.

Let me just give you a recent and REAL example of what happens when shitload people go ape shit on a deal. You know about the TopCashBack 5% match CB on eBay from another portal? Yea, they changed that pretty damn quick and will no longer honor CB matches. They changed the T&C ASAP. I was stupid to think that was gonna be around for a little bit longer and I didnt get in on the action. Similar thing could happen with Discover. I dont know how or when, but it COULD happen. Dont think Discover hasnt noticed this blog and many other blogs talking about $2k CB just from GC.

Well actually, Discover DID in fact change their T&C already. Now its a question of “whats next”?

This may be a nuanced point, but there is a technical difference between ‘prepaid’ cards and ‘gift’ cards. Particular types of OV are/say prepaid. Any thoughts as to whether this argument holds weight with an issuer (Discover or otherwise)?

Another question… If the cash back balance is negative after a clawback, would that impact your ability to close an account? Does it mean anything other than having a negative cash back balance?

Should have been ‘is there,’ not ‘there is,’ and it was a question.

Hmm, Nynja…I was going to remain silent & just do my own thing, but you have made my point exactly!!! One needs to strike while the iron is hot. Yes, the rule will prob change because this is very good and because they are being subsidized by Apple but, I hate to miss a really good deal because I was lazy. One, obviously, needs to make their own decision on this, but I TOO think that you are being too bearish. And BTW, it is Blomberg Analyst’s, not journalist’s, who use the phrase…as I am in the market currently in a leveraged inverse ETF. So I don’t believe you need to be so pessimistic.

What you consider to be laziness is what I’d consider to be prudence.

Not to beat a dead horse but this deal (Apple Pay and double cash back) is no hot iron. There’s a 3 month window to earn the cash back and yet at least a year window whereby you’ll be hoping to avoid a phone call from a manager with Discover and/or any emails. Discover has all the time in the world, and then some on top of that. In a way you could argue that this deal is similar to the Discover Miles card, and how some are going pedal to the metal as far as MS’ing that 1.5% + 1.5% cash back and others opted to avoid it because you’re not paid the full 3% for 13 billing cycles and “a lot can happen” in that amount of time.

In short, we just have to know what we’re getting into here. If you’re comfortable with your own personal risk assessment then more power to you, do your thing and gl to you. Entire point I was making from my first post and on was that people need to know exactly what they’re getting themselves into here, for better or worse.

So Mark, you use leveraged inverse ETFs? Whos pessimistic now? I use Bull Leveraged ETFs and ETFs on Margin so good luck to both of us. Lets make money when VIX is up the ass. Yellen rate hike OCT or DEC for you?

And if youre strictly talking about journalist who only report, then I guess youre right. They dont make calls like being bullish or whatever. Anyway, semantics.

Furthermore, I dont think anthonyjh21 or myself are being pessimistic/optimistic. We are just sayng there is no such thing as a super low risk investment with guaranteed exceptional rewards. In other words, while the potential returns are large, the downside risk MAY be huge. Who knows right? We will see. I think we owe it to the readers to lay out all risks and people can ultimately make their own choices.

Legal basis for recovery you ask? Well, this is their terms of their double cash back promotion, so effectively covers 11% of the deal if clawed back:

“We may make adjustments to your Cashback Bonus based on your Account

activity. For example, we will decrease the balance in your Cashback Bonus

account to correspond with the return of a purchase or the amount of a reward

disbursed by us in error. In certain circumstances, it is possible to have a negative

Cashback Bonus account balance.

You are responsible for reading the Cashback Bonus Program Terms and Conditions

online at Discover.com in order to understand your rights and responsibilities under

the Cashback Bonus Program. We may amend the terms and conditions at anytime

without notice.”

All they have to do is cite that the cash back given for gift cards was in error. They also reserve the right to ammend their terms and conditions at ANY TIME WITHOUT NOTICE. All they have to do is throw in on December 31st “If we suspect abuse of this offer we will, at our discretion, take action and our decision will be final.”

I don’t have time to dig around for any other bits and pieces of what Discover puts in the fine print but rest assured they cover every possible option of going against them if you feel wronged. That is, unless a class action lawsuit is issued by a court. But good luck convincing a judge that you’re entitled to your money all while refusing to show your receipts (which you’d obviously not want to do). Yes, all of this is going down the rabbit hole and looking at the “what if” scenario. Regardless, I have yet to see a defensible argument that would lead one to believe they wouldn’t lose all funds and possible account closure.

Definitely good points anthonyjh21. I would only add that, right now, we dont know enough to decide one way or another. We need more data. But not even sure if we would get any data, since anything could happen at the very last minute. I believe its up to the individual to understand the risks and play the game. If one wants to use older Discover CB experience as their data point, then I guess you could, but 22% CB on all purchases no questions asked is ridiculous. Never before seen. TBD man.

What would even be the legal basis for recovery? How can they prove what you purchased? If the store detail does not provide the visibility, and in the case of the 3 stores I’ve already purchased at, they don’t, it’s not simply a question of suspicion, it’s a question of proof. I purchased $87 of items and Rite Aid that were drugs with large co-pays and $18 of food. Rite Aid confirmed and then Discover confirmed, that they have no access to detail beyond general purchase. My Rite Aid also happens to sell equipment and other large priced ticket items. Who’s to say I didn’t purchase a ton of more expensive things? If they want to rant and rave, hang up. What are they going to do, use their high priced attorneys to implement some likely unproductive PR disaster Apple pissing off strategy to try to recover $2K? Absurd. You’d have to be a ninny and paranoid to believe that.

BAM! Very well said!!!

Please let us know ASAP if this will or will not work with gift cards. Maybe making an every day purchase along with a gift card may work rather than just a straight out gift card purchase.

Well Jim. The truth is, the standoff with Discover will be a long time battle. The reason for this is simple.

After statements close and people begin to report their initial 1%+10%, that doesnt mean jack.

Anything and everything can happen within Discover Banks oversight within the 12 months where you may or may not see the 1%+10% x 2 = 22% CB post. Clawbacks are totally possible in month 13 and anything before that.

Some have speculated that you could potentially redeem the initial 1%+10% asap, but a clawback would send you into the (-). So its a lock down on your future CB.

So will see man.

I was actually going to respond to Jim’s comment as well, but there’s no need. You hit the nail on the head on both points I wanted to make – data points right now don’t mean much and that this is a year long game we’re playing. The only thing that I’d feel more comfortable by is responses from Discover themselves, and I don’t mean random reps on Twitter.

+1 Bro.

Hi Jim. You know what to do. Don’t be intimidated. I have had 4 accounts (Bus., personal, CC & Banks) for a number of years and have participated in many promos/rebates offered by Discover which were very lucrative. I have NEVER had Discover request any money back or disqualify any of my rebates. Lets face it. I am sure that you are not surviving off of these rebates. Therefore, whats the worst that can happen? Well, If it did, which it won’t, you simply return the rebate, just like you would pay your credit card bill at the end of the month and consider it an interest free loan. But, thats not going to happen. The real reason for Discover to make this offer is to get the credit card business and to get individuals to us Discover with ApplePay which they just signed on to and that is exactly what it will accomplish for them. They know people will like it and continue the same pattern of spending. I would, however, make legitimate purchases along with my gift cards for obvious reasons. Additionally, can you imagine the amount of man power and $expense for Discover if they wanted to disqualify a partial rebate to you. No, thats part of the cost of doing business for Discover and engendering future credit card business which is very lucrative to them.

Two points here.

One, what were the promos? What percentage of your spend was it? (how much is Discover eating on a loss here). What I’m getting at here is you’re most likely comparing apples to oranges and hoping that this example will ultimately pan out just because the oranges did. Discover DOES have a precedence for conducing clawbacks and in this context there is no way around the fact that this is an apples to apples comparison.

Two, everyone seems to believe the worst Discover does is slap your hand and confiscate the funds. Worst case you have to assign a certain % chance of account closure due to abusing the terms on a scale of a couple thousand dollars, depending on if you’re utilizing more than one Discover card.

I am not trying to spell out doomsday with this deal. I am in fact only trying to point out that as a whole, the MS community is way, way too bullish on this deal panning out the way they think it will due to a lack of risk assessment imo.

Just playing Devil’s Advocate here (sorry Julian), but why are you so bearish on this deal and not 5X with Chase Ink?

I believe its because Discover is a new rebate player where we have NOT seen signs that they are forgiving at this CB level just yet.

Chase 5x “abuse” in many forms has been around for a long time with many data points/history and no indication that they will retaliate as long as youre “reasonable” about it.

However, with Discover and this unprecedented offer, anthonyjh21 is saying we should be more cautious than normal because they did in fact change their terms ASAP when the blogging community went ape crazy. Not to mention, we have no data points and anything could happen from now to 13 months. Fingers crossed man.

I thought the Ninja didn’t even have any IPhones and “couldn’t STAND their closed Eco-system” and as a result is an “android for life” so how does he plan on partaking in ApplePay?

I am the only Android user in my family. Everyone else is iPhone. Even relatives.

Smart relatives. Please pardon me for stating that your negativity came across as from one who could not participate.

I’m cracking up, but Ninja just pointed out everything I was going to write.

To tack on to it with an example, we all knew Redbird wouldn’t last and we knew the reason. The better a deal is, the more scalable and accessible it is to the masses, the more likely it will end quickly. In this example you can hit it hard and when it’s over, its over. There’s no fallout or retroactive punishment. You cannot say that with Discover and this promotion as it’ll extend, for most, 9+ months after the Apple Pay thing is over.

Chase still continues the UR system and INK, however they’ve essentially blocked churners (abusers in their mind). They’ve made business decisions to make their business model more sustainable. While I personally hate what Chase did over the last few months, I also can’t blame them, and after some careful consideration I came to the conclusion we’re in fact MORE safe than we were previously. Those of us with a premium card that is. The one positive in the Chase scenario is it most likely bought us more time with their UR system and point values going forward.

We can’t say that about Discover, because it’s really an unknown at this point. All we have to go on is a “deal of the year” offer, a quick change to the terms a week or so later, and the fact that there is a precedent for Discover putting your account into the negative with clawbacks. I’ll also add in that the Discover products being used for Apple Pay and double cash back are far more accessible (desirable to the random person) than the premium, annual fee cards that Chase provides which will only compound their losses.

I’ll say it again so that people don’t think I have some personal vendetta against Discover though – we have no idea if they’ll do anything at all. But there has definitely been an infectious feel of invincibility and groupthink surrounding this deal in the MS world with blogs, Reddit etc and it’s been bordering on dangerous in my personal opinion. For people such as yourself who will probably have a good strategy of buying items to resell (different stores, limited per transaction, spaced out etc) I think you’re a much safer bet here than buying gift cards, which is what many are going to do.

@Mark

I get it, you’re having a tongue-in-cheek play with Ninja about iphones. We both know though you’re asking a rhetorical question when you ask why/how he’d participate in this Apple Pay promo. Buy an iPhone 6, use it, sell it. The loss would just be considered an expense of doing business.

I don’t agree that buying gift cards is abusing the deal. The terms state that gift cards are excluded from earning the 10% bonus. There is nowhere (that I know of) that it says that you are not allowed to buy gift cards with Apple Pay. You would only be in the wrong if you lie to Discover and say that those purchases were NOT gift card purchases. Isn’t it Discover’s fault if they can’t enforce their own terms?

Extremely good point Eric!

It’s not hard for Discover to look at your history and ascertain what is and is not reasonable purchasing history. If you have two Discover cards and max out at $20,000 total, from their perspective it’s abuse – it’s in the spirit against the promotion. I’m with you and the other MS’ers. I’d like to take all of these companies for a ride and milk out every promotion possible. It doesn’t mean I won’t look at it from all angles to help gain perspective and sure as heck doesn’t imply I’m a Discover homer or any other issuer for that matter. What you and I call finding loopholes to gain value, Discover and Chase will call abuse. Not sure what else I can say about it without getting into semantics.

And who said they can’t enforce their own terms? Just because the gift card exclusion isn’t hard coded into the promotion doesn’t mean you’re free and clear as soon as you see your bonus funds post to your account. That’s really the entire basis of my counterpoint to the widely accepted optimism on this deal.

The degree of subjectivity and the terms and conditions we accept when entering these promotions gives TOO MUCH power to the issuer to do whatever they want, at their discretion. Have you ever read some of the boring terms and conditions of programs before you accept or participate? They’ve paid gobs of money to lawyers to make sure they plug every possible liability. Sure, we can file a class action lawsuit, but what is our argument? That Discover didn’t take the money back when it was issued and therefore can’t now because too much time passed?

anthonyjh21,

You made some good points. I just want to correct you on one thing. I never said that Discover can’t enforce their own terms. I clearly wrote IF they can’t enforce their own terms it’s their own fault. However, unlike most people if I purchase gift cards and don’t receive the 10% I WILL NOT be upset with Discover. People are hoping for a loophole like you said. I don’t think that they would go back a year later and remove the 10% they already gave. It’s very possible they will choose not to give the extra 10% in a year. If that were to occur I think most people would still be happy earning 10% on Visa gc.

Very good points. I enjoy your logic. Thanks

I apologize, but I’ve re-read your post a few times and I’m still interpreting it the way I initially did.

You asked “if” they can’t enforce the terms isn’t it their fault. Feel free to correct me if I’m misinterpreting your comment, but you’re asking whether it’s Discovers fault if people are able to circumvent the gift card exclusion using Apple Pay.

If Discover does nothing over the course of the next year or so then yeah of course that’s on them. That goes without saying really. If they do nothing then optimistically the added exclusion was nothing more than an empty threat. They have a loooong time to get this one put under the microscope though so as we all know it’s just a waiting game to see if anything happens.

Yes, that’s exactly what I was saying. I saw the Reddit post that either you or someone else linked to. Isn’t it possible that Discover is delaying giving the 10% so they can analyze the data like that person described? If so, it’s more likely they will not award the 10% at all to suspicious purchases instead of doing a clawback like you described.

Two other points I want to add on too.

The scale of this deal will lead to (again, IMO) manual reviews over the next year. Discover shelling out $2m to incentivize business customers is much different than shelling out $50m or whatever number they’re working with here. Yes, there’s no doubt Apple is subsidizing the cost here, but Discover is surely invested in this deal as well. Notice how the terms changed to exclude gift cards after it was publicized without that exclusion? Scale is what caused this. They wouldn’t have a department even care enough to change the terms if it was offered to the 1% of their clientele. It all boils down to money and they’re going to do what’s in their best interest, just like you and I do.

In general, many new players in MS get caught up in not going slow enough or understanding the scope of deals, for better or worse. In the end it’s up to the person to do their own homework, absolutely. But if this deal doesn’t pan out as hoped you’re going to see A TON of newbies going ape crazy, red-eyed and beating down Discover’s door and demanding answers as if they were entitled to the money because not enough people pointed out the dangers of this deal. And lets face it, newbies will undoubtedly go for gift cards (instead of reselling), not blend their purchases and overall be obvious about it.

I’m honestly surprised you’re this bullish on thinking you’ll be able to buy gift cards and worst case walk away unscathed by Discover (beyond getting all cash back retroactively scooped from your balance, most likely putting it into a huge negative balance). Not to mention that manual reviews will be very likely to lead to all Discover purchases through Discover Deals and lets just say I hope you used a Discover card to pay.

Seems I’m in the minority on this one, but I’m bearish on this deal. Especially given the fact I won’t hold a stinkin’ Apple phone longer than is necessary, which means an investment and a loss on the resale (yes I know it’s a cost of doing business). The risk to reward is sketchy at best right now. Maybe more news rolls out in the near future that pushes it one way or the other.

I’ve read it all over the internet. People think because most merchants won’t have Level 3 access they’re safe. Hello, buying $525 of merchandise at Walgreens once a week (masked with purchases of other crap like candy bars) isn’t going to cut it when there’s a manual review. Anyone participating in these programs should already know they can do what they want and how they want it. If they have any suspicions that’s enough for them. Discover aka “Captain Clawback” isn’t going to roll over that easily with such a double wammy of a double cash back promo + this Apple Pay deal. Anyone who thinks otherwise probably is letting greed get the better of them. NOTE: I’D LOVE TO BE PROVEN WRONG AND I’D HAPPILY EAT MY WORDS. I like Discover and I’m really not interested in risking being perma-banned.

I will say this much though. If you’re going to max out the promo I’d highly suggest going the resale route and trying to balance it out at different merchants.

Sup anthonyjh21. You make all good points man. Risk. Level 3. Manual Review. Clawback. and I hate Apple too. Guess that makes me Android fanboy and love it! Although I wish Samsung did certain things.

Anyway, the true answer to your comment is that we dont know yet. Everyone is waiting. And like Shawn said, he doesnt mind getting the discount on actual purchases too. So we will see. Everyone is eyeing this deal! Not to mention Discover knows everything now! So youre probably right man!

The risk of blending actual purchases though is if you’re put under a manual review, they may in fact dip into “real” purchases. There isn’t any precedent for it – other than knowing Discover isn’t afraid to take money back. So yeah it’s a wait and see game like you said. One lasting about a year.

I’ll say this much though. If a former professional poker player (myself) is avoiding this right now, that should cause a few antenna to perk up at whether or not the risk is worth the reward! 🙂 As poker players would say, this feels like implied odds being laid here with the hope that it’s an overall +ev line.

As far as the Apple thing is concerned, my wife was thinking about getting an iphone because her mom and sister have them. I said you do what you want but don’t expect me to fix or help install anything on that thing. She’s a small step ahead of my grandmother in regards to being tech savvy. She quickly quipped back “ok find me a deal on a S6 then.” LOL! Granted, I think they’re over priced and went the Apple way with no removable storage/battery but still, Android all the way.

Haha! Grant her the wish bro! There will be plenty of S6 deals “indirectly” via your GC/Portal/Match/etc etc techniques. Should be easy for you. Your concerns of being family Geek Squad are totally valid. I am the lone Android ranger in my family. Everyone else swears by Apple. Guess who does the iOS troubleshoot though? The most thankless job in your life. Most people dont even know 99% of what the hardware/iOS does except it looks nice, has Star Wars level following and people camp outside for it. Comes down to Power User or Hispster User, but I have seen people have both! Thats a statement itself.

Anyway, youre totally right man. Its a standoff. I havent done anything myself except make valid purchases so no clawbacks there. I am waiting to hear things from other forums.

Thats awesome you were pro man! Online or Casinos? WSOP makes it look so exciting but most dont know the truth. Laws in the US are also messed up. They need to change that!

Yeah, I’m in a bit of a quandary because I need a S6 between now and the end of the year but I also don’t want to fork over the money for an iPhone unless I’m fully committed to the Apple Pay deal. If I do the Discover deal I’m likely to go the re-seller route, which to be honest I’m not that seasoned with and I’m not sure if I want to open that can of worms with possible returns and the logistics of it all. If I do this deal then yeah I’d definitely look for a deal on a S6 at a merchant that accepts Apple Pay.

Was almost all online. Playing live games was extremely boring. I played heads up games, several tables simultaneously and hundreds of hands per hour. Live games also have higher overhead which wasn’t enticing. WSOP is the worm on the hook that lures new blood into wanting to play the game. It’s far from WSOP though. It’s a grind, because you have to stomach variance and also not second guess decisions that are based on imperfect science. They’re in the mix with regulating online poker for the last 4-5 years now. A few states have, but California has been dragging for a few years now. You know how politics goes…. slow as your grandma on a Sunday.

I would buy gift cards at best buy or wegmans as they both sell vgc but I’m going to wait n see if everyone gets the 10% back as I do not have a iPhone.I don’t wanna risk $500 or so for something that may not work

It is still going to work for purchasing deals at Staples and reselling on Amazon.

It looks like I made a big mistake. I was told to order the Straight Talk AT&T Compatible SIM card. I didn’t realize there were different types of SIM cards (Nano and Micro). My SIM is too big for the phone so I must have ordered the Micro. I saw online a video of turning a Micro into a Nano. Is this actually possible or am I screwed?

I cut down a regular sized sim card to a nano. I foud a paper template on line. No intention of making calls with it but it allowed the phone to turn on and proceed with setup and updates for Apple Pay. Good luck.

One interesting thing with Discover, whereas all other cards in Apple Pay support both in person (retail terminal) and in app purchasing, Discover is only supporting in store at this time. No current ETA for support. This is a big miss due to the growing apps supporting Apple Pay and agin other institutions not restricting use.

Take a look in your Apple wallet when you try and purchase using your discover in app through Apple Pay, you’ll see ‘not available for in-app purchases’. Discover confirmed this as well.

I’m android, too, but bought an iPhone 6 tied to Sprint on Ebay to do this deal. I ordered a nano SIM card on Amazon, but it hasn’t arrived yet. My plan is to do exactly what you’ve done.

I picked the cheapest phone I could find that looked like it was in good condition, had the original box, power cord, etc. I intend to sell it when this is all done.

My original comment is proved correct…you are obviously not as smart as you think you are, and sorry Shawn, but I still say “He is a Dick!”

Hm. You know what Sue. I was just gonna keep quiet. So out of full respect for Shawn, I will not turn this thread into a Reddit or FlyerTalk. So let me just agree with you here that I am an idiot and I am not smart. Sorry for giving you and the community wrong info. You are 100% correct Sue. I should have listened to you.

ATTN EVERYONE: Sorry for my incorrect info. My apologies for being an idiot. Please accept and forgive me. Sue has contacted Apple recently more than once and has fully confirmed that Apple Pay will also work on an iPad Mini 3 with Discover CC in-app and in retail stores because its equipped with a Near Field Chip (NFC) and Apple Pay will work similarly on iPad Air2! How KOOL right?! But, if you have an iPad mini 3 or better (like Sue has in her purse) then you can use Apple Pay in-app and in retail stores really easily with your Discover CC and get at least 10% off! Wow! Nice! Happy Shopping Everyone!

I thought you had to have an Iphone 6 to pull this deal off? That or some combination of an Iphone 5 and one of these Apple watches? I’m obviously not up to snuff on this.

Wait, I can’t tell if you’re being sarcastic or not. While the Air 2 and Mini 3 have NFC chips, both have not been enabled for in-store payments…. or so I thought?

ANDROID FOR LIFE BRO!! I cant stand Apple’s closed ecosystem.

Anyway, awesome to hear you now have an expensive discover CC holder.

Look forward to you making profit on the resale.

Also FYI, Apple stores the CC tokenized data in a separate, encrypted area of the phone which is transmitted over short range radio waves via NFC. Thats fine for your resale as that data is secured.

However, its critical to understand that all modern phones use flash memory chips to store their data. No phone has mechanical HDD. Flash memory is PROVEN to be difficult/impossible to erase completely even under circumstances where you “remote wipe” or OEM factory reset.This is due to the way flash memory works. So anything sensitive such as naked photos of yourself can be “hacked”. Its unbelievable the amount of “dirt” that is left over on resold phones.

So if you will resale, I HIGHLY recommend not using the phone for ANY OTHER PURPOSE except for Discover CC payments via Apple Pay.

Can I borrow my friend’s AT&T sim card to just activate the iphone and then return it to him once it’s activated and be able to use Apply Pay?

I haven’t tried it, but read on line that it should work to use your friend’s Sim card just to activate the phone.

You ALL are Brilliant….thank you sooo much! Will forward this wonderful article. Thanks again Shawn!

Has anyone purchased a gift card using apple pay and received the 10% back from discover?

I’d be very surprised if you see 10% back before 2-3 months to allow for any returns some of you all will undoubtedly make.

I’ve done the same thing as you, although I won my iPhone on eBay a day before the 15% deal hit, so was pretty torked about that. But still think it will be worth it in the end. Have my fingers crossed that the gift cards will work.

Apple pay does not require wifi or cell service to process which I thought was pretty darn cool. I used my apple pay extensively while on our recent trip to Scotland & Ireland all while the phone was in airplane mode and not connected to wifi. Both countries were far ahead of us when it came to NFC acceptance availability. I really liked the fact it avoided the dynamic currency conversion “scam” which was pushed hard in Ireland but not even asked about once in Scotland.

Yeah it is great. I knew you didn’t need an internet or cell connection when paying, but for some reason I thought the phone had to be active on a network to set everything up. I’m glad that isn’t the case and it was easy. I hadn’t thought about avoiding the DCC scam, but that is a great use.

This is great timing as I plan to pickup my SIM card this weekend as I also have a locked iPhone to AT&T. You said that you aren’t able to “play around with it”. Aren’t you able to do everything except for make calls?

Definitely. I should have been more clear. I just meant play around with it in terms of using it as my main device. Since I am so heavily tied to the internet, when I am out that mobile connection is important. Not a big deal. I can definitely play with it at home and I have my Galaxy S6 to conduct business when I am out and about.

You can unlock the phone without AT&T approving it. There are plenty of people on amazon that can do it. I am still under contract with AT&T and back in July I bought an unlock through some company on amazon. Whenever I travel i just put in my dutch sim card and it works perfectly.

From what I understand it can be unlocked but the guys who charge $2-$3 to do it won’t unless AT&T agrees. For $60 or so you can have it unlocked, but it doesn’t mean that much to me. I’ll just use it and sell it locked. It isn’t a bad IMEI so it can be activated on AT&T by whoever I sell it to.

What r the chances there is a free WiFi available at the store one might buy smth with apple pay? Cannot imagine this is going to be the case most of the time..

You only need WiFi to activate the phone and add the cards to Apple Pay. (You can do this at home.) After that the phone doesn’t need an internet connection.