Kasheesh Debit Card

Points and travel hobbyists love new financial tools which enable novel capabilities, often ones we never thought would be possible. A promising newcomer is Kasheesh, and based on my experiences, many will benefit from Kasheesh’s unique features. Today, I’ll describe Kasheesh and why you should care. I’ll also highlight how Kasheesh works and it’s practical applicability for most every thoughtful consumer. Here’s why I’m loving the Kasheesh debit card and why I’m certain many of you will, also.

Note: Neither Miles to Memories nor I receive compensation from Kasheesh.

What Is Kasheesh?

Kasheesh allows users to combine and split payments across their various credit and debit cards. Specifically, Kasheesh generates a one time use virtual debit card for a member to use anywhere Mastercard is accepted. Notably, the credit cards joined with the Kasheesh debit card earn their respective rewards currencies. But why would someone want to use Kasheesh? Here are just a few examples where Kasheesh will come in handy:

- Efficiently Meeting Welcome Offer Requirements: Kasheesh users involved in meeting one or more new credit card welcome offers can customize, down to the penny, exactly how much they want to charge to each credit card. It’s possible for a Kasheesh user to meet multiple welcome offer requirements on one transaction without any “wasted” spend at low-earning levels of certain cards.

- Enabling A Large Purchase: The impossible becomes possible! A Kasheesh user can effectively combine credit limits of multiple cards to make a large purchase beyond any one credit card limit a reality.

- Playing It Safe: An individual may want to use a Kasheesh debit card, which is one time use only, to maximize security when dealing with an unfamiliar business while still earning points.

- Trial Period Plays: Many of us like to take advantage of trial periods on a variety of products and services. Using a one time use Kasheesh debit card will prevent a member from being charged a larger amount after the trial period ends.

These are just a few options where many will benefit from using a Kasheesh debit card. The sky’s the limit with Kasheesh!

How Kasheesh Works

After a few months on the waitlist, I was able to obtain early access to Kasheesh through a friend before writing this article. Here’s how Kasheesh works. (I’m hitting the highlights today and will save the specific how-to steps for a future article.)

After providing basic info to set up my account, I attached a few credit cards where I currently want to maximize spend. I subsequently downloaded the Kasheesh Chrome extension. When I was ready to check out at a given retailer – remember, Kasheesh works anywhere Mastercard is accepted online – I accessed the Kasheesh Chrome extension.

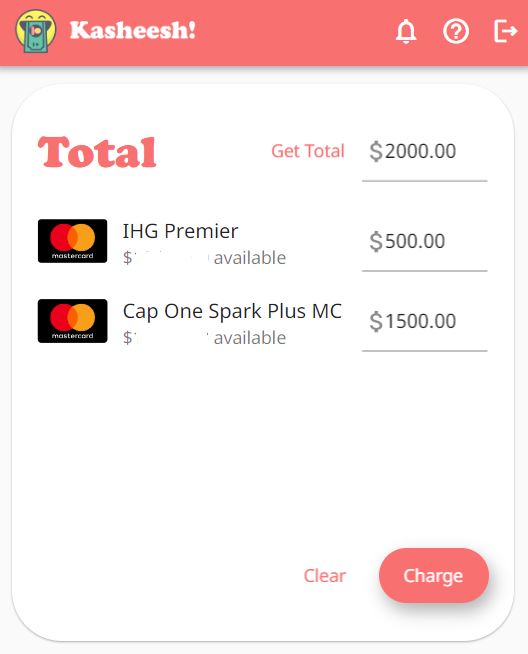

After logging in, I can customize the various amounts – purchase total, and the specific cards and amounts I want to charge to each. Conveniently, Kasheesh displays the amount of available credit I have on each of my connected accounts. A member can use a maximum of five cards in conjunction with the Kasheesh debit card for any one transaction.

Once I click Charge, Kasheesh provides the full debit card number, expiration date, and CVV. If you’re already on the appropriate merchant page requesting payment info, the Kasheesh debit card info will autopopulate. After that, keep checking out as you normally would. All done!

Kasheesh Debit Card – Useful Info

- You only need to provide basic personal info to start – your name, date of birth, social security number, and address.

- There’s no credit pull involved.

- Again, Kasheesh works anywhere Mastercard is accepted online.

- Kasheesh is absolutely free for any US consumer.

Get On The Kasheesh Waitlist

Kasheesh has advised that Miles to Memories readers can join the waitlist as follows:

- Navigate to Kasheesh.

- Click the “Join for FREE” button on the upper right.

- Enter email in the email field.

- Enter “MTM” in the “(Optional) How did you hear about Kasheesh?” field.

- Click the “Join Kasheesh!” button.

Conclusion

I’ve found Kasheesh very useful in the relatively short time I’ve used the tool. I’m a fan of efficiency in our hobby (and otherwise); Kasheesh is one of the rare tools recently that has provided me immediate benefits with minimal effort. Whether it’s their evolving debit card capability or other initiatives they pursue, I’m excited to see where Kasheesh goes next. Have you used Kasheesh? How has your experience been so far?

Ssn and dob to an unknown player? Don’t think I’ll be a dp on this one. Or at least now

Would this let you charge an Amex card on Costco.com? hmm…I’m working on a big spend SUB

Does it work with prepaid cards?

Do we get any bonus category spend on the respective cards or all purchases earn the base/lowest rate?

+1

if you pay with Kasheesh, but use Amex platinum as the card, do you get purchase protection as if it was purchased directly on Amex?

I don’t believe so. That’s probably going to get a claim denied on that technicality. AMEX wants to see you charging directly to the merchant when reviewing the claim.

How does the charge show up on the credit card statement? Does the charge come directly from the vendor? Asking in regard to charges on bonus catagories…