All information about the Marriott Bonvoy Bevy and Brilliant American Express cards has been collected independently by Miles to Memories.

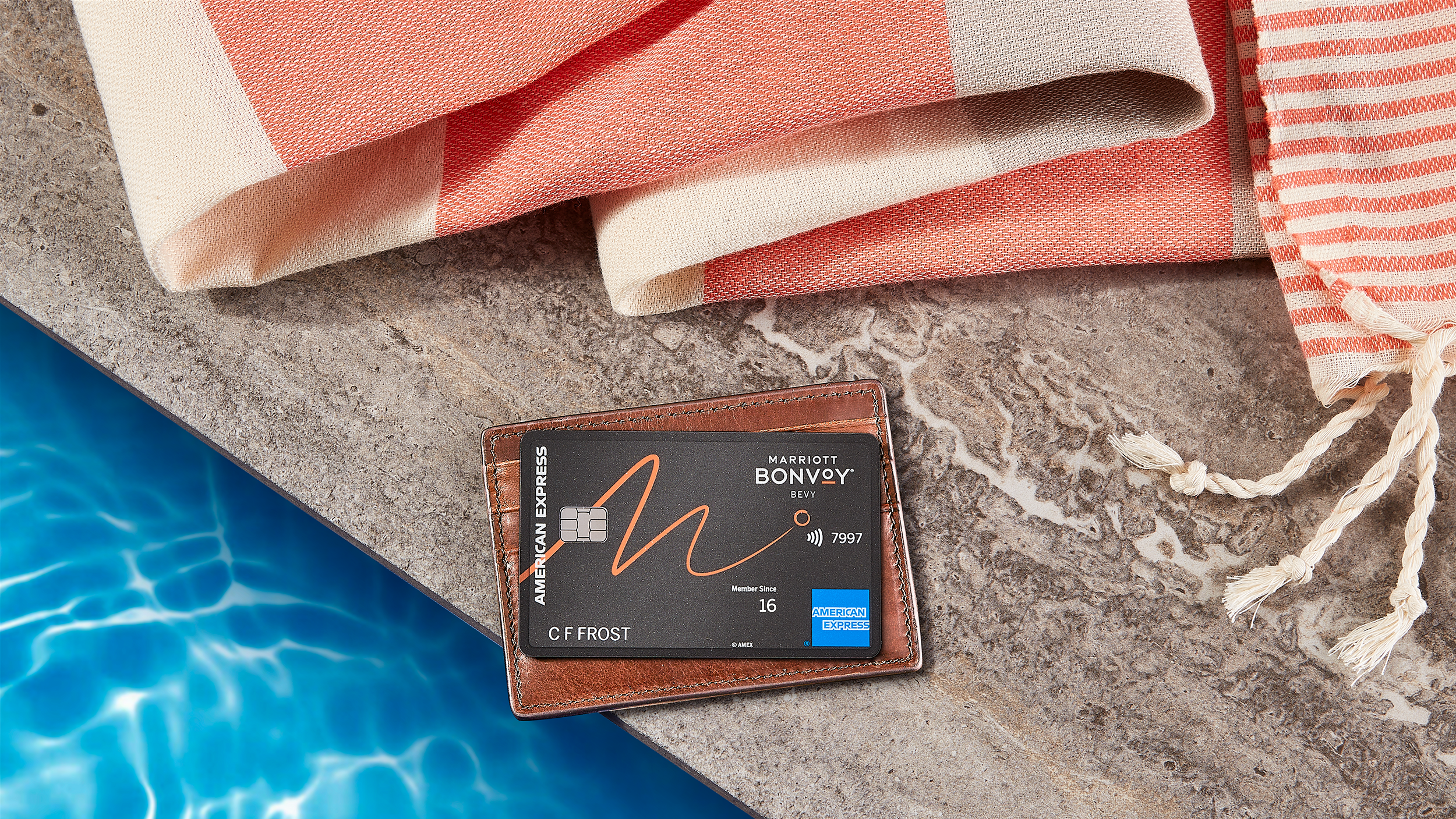

Marriott Bonvoy Bevy Amex

Many have maligned the Marriott Bonvoy Bevy Amex since its inception a few years ago. “A $250 annual fee and no free cert?!” As they shouted, I shrugged and took the card’s easy wins. But all Marriott loyalists should take another look at the Bevy right about now. Let’s get into why.

Marriott Bonvoy Bevy Best-Ever Welcome Offer

Currently, the Marriott Bonvoy Bevy comes with a 155k-point signup bonus when a cardmember spends $5k within the first six months. Not only is that a generous point haul, cardholders have plenty of time to meet the modest spend threshold. The other good news is that individuals can apply for this offer through 2 October. Amex doesn’t always mention expiration dates of their elevated offers, and people have plenty of time to consider their strategies between now and then.

Optimal Timing for a Benefit Double Dip

One of the more noteworthy benefits of the Bonvoy Bevy Amex is a free night award at up to a 50k-point property after spending $15k in a calendar year. That big spend bonus is easier for many to hit with well over four months left in 2024. Even better, cardholders have seven to eight months to hit that same-level big spend bonus for another cert in 2025 before the year two annual fee comes due. That’s two solid free night awards on the Bevy’s $250 annual fee in cardmember year one. And it gets more interesting.

Leverage Bonus Categories

Cardholders can take advantage by spending in the Bevy’s staple 4x bonus categories of worldwide restaurants and US supermarkets. That 4x in earning is capped at $15k per calendar year, but that’s perfect for those who want to optimize this card for spend up to but not over $15k for the free night award. And, of course, cardholders with paid Marriott stays can take advantage of 6x earning on that spend.

More To Love

The Bevy sports a few other noteworthy benefits, such as automatic Gold status, 1k bonus points on qualifying stays, and 15 additional elite nights each calendar year toward higher status. Plenty of Marriott enthusiasts have Gold or higher status, already. But I find the 1k bonus points per stay a sneaky-good benefit for certain travelers who are in and out of Marriotts often.

Putting It All Together

Some may be able to justify pursuit of the Bevy merely for the best-ever signup bonus. That aside, the card makes most sense for big spenders who can hit the $15k threshold for the 50k certs. I made the case for doing so in 2024 and 2025, but hitting it this year is the bigger no-brainer for some. That’s because new cardholders are already one-third of the way to the big spend bonus by hitting $5k minimum spend for the 155k bonus point welcome offer. Another $10k, hopefully in 4x bonus categories, earns that free night award.

But optimally, one can hit that threshold in 2024 and 2025 exclusively in bonus categories. Let’s assume a cardholder does that in the generous 4x version. In return for the year one $250 annual fee and $30k spend, an individual picks up 275k Bonvoy points and two 50k free night awards. Marriott spenders earn even more points for that 6x spend. Regardless, that’s a substantial haul of Bonvoy points, a currency that’s not always easy to efficiently earn in large portions.

Marriott Bonvoy Bevy – Conclusion

Of course, keep in mind your alternatives as they relate to your existing earning strategies. Many will find the Bevy isn’t for them, like other cards. And the Brilliant with its huge welcome offer and unique benefits may work better for some. But plenty of Marriott loyalists can do bigger things with the Bevy now more than ever. I still consider it a one-and-done card for us, but the rewards from that first cardmember year are sweet.

Are you a Bonvoy Bevy Amex fan these days? Why or why not?

Hi Benjy,

I’m going to play Devil’s advocate as I really don’t care for this card beyond the first year sign up bonus. My qualms begin with an “up to” 50k annual certificate. There is a good chance you don’t get the full value and if you don’t have a Marriott stay to use it with, you will often find yourself in a position where you need quickly use it or lose it due to the 1 year expiration. The fact they are tied to the card holder makes them even more restrictive whereas points can be used to book for others. To get the extra certificate, I find charging 15k on card that mostly only returns 1 pt per dollar and the fact the points are generally valued at under one cent, I don’t think that pursuing the cert makes sense, either.

I suggest getting the Amex Marriott Business Card for only $125 per year and combine it with the Bevy for the sign up bonus. I would then cancel the Bevy and get a Chase Marriott Bold and pickup the sign up bonus. Cancel the Bold after one year, wait 60 days and then get the Chase Bonvoy Boundless. The Amex Business card and the Chase Boundless gives you two 35k certs per year, the same Gold status as Bevy and the two combine to give you 30 nights per year towards Platinum status (Bevy by itself only gives you 15) all for $35 less than the Bevy.

On a side note, a word of warning for Marriott points booking. Canceling a Marriott booking after the cancellation period can result in your points being returned and you being held liable for the full rack rate of the room. Not all Marriotts are this hardcore, but it is in the terms and conditions.

Unfortunately that last point is not unique to Marriott. I just booked a Marriott award stay over Hyatts in the same area during a peak season event because of this. All the Hyatts in town have award stays as nonrefundable or worse cancelation within 30 days results in a 2 night rack rate charge (which will probably be over $1K by close in). Comparable Marriotts allowed cancelation until 2 days before.