Marriott Bonvoy Brilliant Amex Changes

Amex and Marriott grabbed a lot of attention recently with their new Chase and Amex cards. Not to be forgotten, the Marriott Bonvoy Brilliant Amex has received a new coat of paint. But which cardholders will like the color? That’s what I highlight today. The annual fee has skyrocketed to $650, but some of you may be able to stomach that for what you receive in return. I’ll first reset the Marriott Bonvoy Brilliant Amex changes then dive into who will come out ahead with this card.

Marriott Bonvoy Brilliant Amex Highlights

As always, DDG did yeoman’s work summarizing the recent changes. Here’s a brief rundown (new stuff in bold):

- New Welcome Offer: A new Marriott Bonvoy Brilliant Amex account holder can earn 150k Bonvoy points after they spend $5k on the card within three months

- Cardholders earn 6x at Marriott properties, 3x on dining worldwide and flights booked directly with airlines, and 2x everywhere else

- Complimentary Marriott Bonvoy Platinum Elite Status

- One Free Night Award annually after the card’s renewal month redeemable (redemption level at or under 85,000 Marriott Bonvoy points) at Marriott properties 85k points per night and under

- Up to $300 in statement credits per calendar year (up to $25 monthly) for dining purchases worldwide. Annual Marriott credit of $300 has been removed.

- 25 Elite Night Credits each calendar year (increased from 15)

- Up to a $100 property credit at The Ritz-Carlton, Ritz-Carlton Reserve, or St. Regis when you book direct using a special rate for a 2+ night stay

- New Annual Earned Choice Award: Each calendar year (starting January 2023), after making $60K in purchases, Card Members can select an Earned Choice Award benefit

- Priority Pass Select Membership

- Application fee credit for TSA PreCheck or Global Entry (which comes with access to TSA PreCheck)

- $650 Annual Fee (up from $450). For cardholders who opened accounts prior to 22 Sep 2022, the new annual fee will take effect on annual renewal dates on or after 1 Jan 2023.

Who’s This Card For, Anyway?

Did you get all that? For existing and potential Marriott Bonvoy Brilliant Amex cardholders, there’s much to process. Why bother applying for or holding onto this $650 annual fee card? Let’s go.

One and Dones

Obtaining the 150k point welcome offer and closing after the first year will be enough for many to justify the $650 annual fee, regardless of how they value all other benefits. While I don’t overly rely on point valuations, MtM assesses the average Bonvoy point value at 0.67 cents per point. That’s $1,005 in points value, just over $350 ahead of the annual fee. But many (myself included) will groan at that welcome offer net return on $5k spend.

But there’s a bit of good news. Those of you in two player mode with a spouse, domestic partner, or trusted friend can leverage referral offers to defray the annual fee cost. Unlike certain prior instances, individuals can currently refer others to the new Marriott card welcome offers and receive bonuses. Referral bonuses can shave a few hundred bucks (or more) off that year one annual fee.

Status Buyers

To say I don’t heavily lean on elite status is an understatement. But in the past, I’ve appreciated buying into elite status (as part of additional card benefits) with the Hilton Aspire. While not as lucrative as the Aspire in my view, Marriott loyalists who won’t organically meet status but highly value the respective benefits may enjoy simply purchasing Platinum status via the Marriott Bonvoy Brilliant Amex.

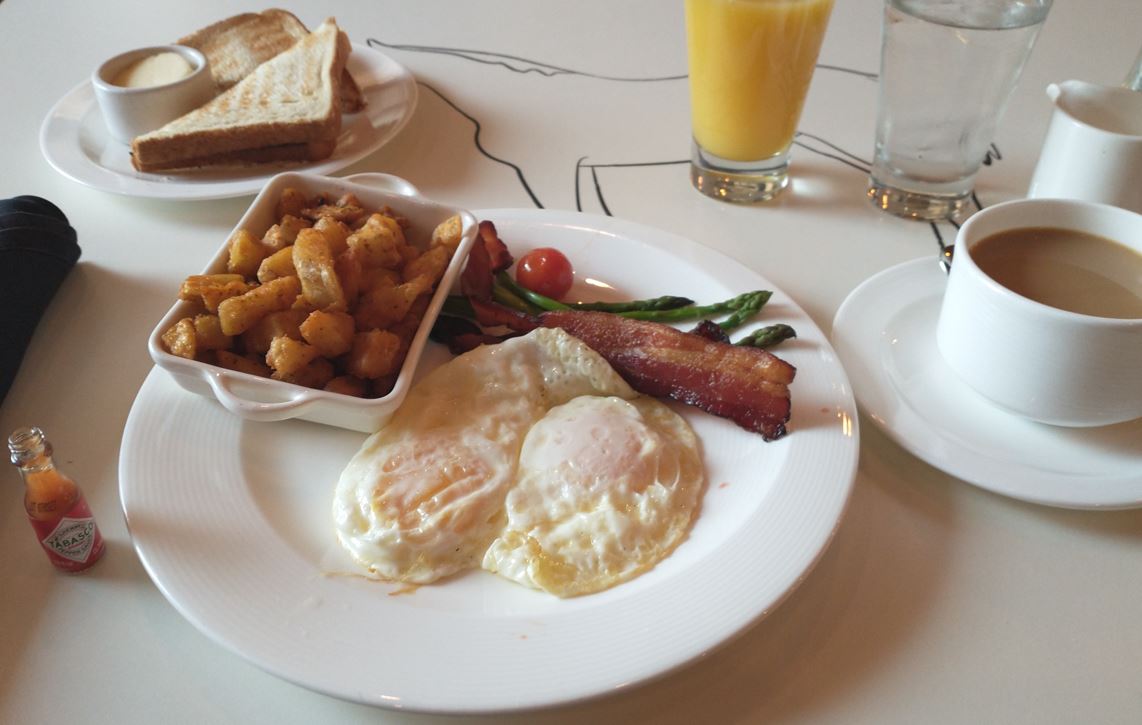

Breakfast Fans*

I love a full breakfast, especially when it’s free. But it takes a special kind of hobby masochist to reconcile Marriott elite breakfast benefits. And not all brands provide a free breakfast, hence the asterisk. Long story short, Platinum status unlocks complimentary breakfast at a variety of Marriott brands, but nowhere near all of them. For instance, Design, Edition, Ritz-Carlton, Gaylord, and Marriott Vacation Club and Executive Apartments do not offer free breakfast for elites.

Others have written tomes on the subject, but I encourage taking additional steps to manage your expectations. I recommend reviewing Marriott’s policy directly and contacting the hotel in advance to understand that property’s specific offering.

Foodies

Many bemoaned the loss of the $300 Marriott credit in exchange for the $25 monthly dining credit that the Brilliant now offers. But I value this benefit at 100%. Sure, it takes a bit of recordkeeping to use it monthly versus a general $300 annual credit. But beyond that, I’ve enjoyed the ease of this credit so far. I’ve found it akin to the temporary Amex dining credits from earlier in the pandemic. No registration is needed, and it’s good anywhere which codes as dining.

Luxury Travelers

Those who already spend at luxury properties and can maximize the annual 85k Free Night Award should easily counterbalance the annual fee. Properties approaching and over $1k per night can be booked with an 85k FNA, especially when you top off with up to 15k points.

Those Pushing For Even Higher Status

The Brilliant now provides 25 elite night credits for simply holding the card. At first glance, this benefit cannibalizes itself, since the card comes with Platinum status, normally requiring 50 elite night credits. But for attentive cardholders who travel just a bit, going beyond Platinum is possible. For instance, the Bonvoy Business and Bevy cards each come with 15 elite night credits. If an individual holds the Brilliant and either the Business or Bevy, they’re only 35 nights away from Titanium. And remember, even nights booked with points count toward that total.

Marriott Bonvoy Brilliant Amex Changes – Conclusion

As I had hoped, our decision for the wife and I to each apply for the Marriott Bonvoy Brilliant Amex a few months ago worked out great. But many can benefit from the new welcome offer and the areas I covered above. And many current cardholders meet multiple of these categories and can more easily justify holding onto the card. On top of that, aggressively pursuing Amex retention offers can make retaining the Brilliant a no-brainer. My hunch is that Amex will be very aggressive with Brilliant retention offers during the first go-round of $650 annual fee renewals. My wife and I will be there in mid-2023, and our keep/close decision will highly revolve around retention offers (or lack thereof).

I find the big spend offer on the Brilliant disappointing. The vast majority of us will do better putting $60k of spend on other cards. Like much else in our hobby, the long term value of the Brilliant is a more nuanced, personal decision. I recommend reflecting on your own goals and crunching the numbers prior to your next decision with this card, whether that’s applying, closing, or keeping. That way, you’ll enjoy a brilliant outcome, regardless.

So my annual fee just posted at $450. Is that going to be good for the full 12 months, or will they give me a pro-rated increase on Jan 1, 2023 ? If anyone knows thanks in advance !!

Tom,

Based on other Amex card fee increases, I’m confident you’re only subject to the $450 annual fee for the next 12 months. Regardless, still try to go after a retention offer.

Will do – thanks Benjy !!!

Goes to show you how little value there is in Marriott’s program. If Chase and Hyatt offered a card exactly like this for Hyatt – $650 for a Category 1-7, $25 monthly dining, Explorist and ~20 EQN, it’d be the most popular card in the points and miles game. The consistency offered at Hyatt properties, particularly as it relates to elite recognition is a major brand asset and runs in stark contrast to the lack thereof at Marriott brands.

My wife and I both have the Brilliant (and will be cancelling at next renewal) because we did find value with the $300 Marriott credit and the 50k free night cert even before the ability to top off.

Now that Amex has introduced another monthly credit that we’ll have to capture that we have no interest in doing, an 85k cert that will accomplish nothing more than the 50k cert as Marriott has already started pricing places at 102k which pushes hotels outside of the 15k top off even with an 85k cert, makes ditching this card easy. This is a card I won’t even bother seeing a retention offer on because there’s nothing they can offer that would make me keep it shy of just waiving the AF for another year…and they ain’t gonna do that.

Everyone talks about the top off feature but that means that I would have to actually want to generate Bonvoy points to have something to top off with…and again, no desire to earn Bonvoy points because that means I’d have to give up a much better currency on purchases to do so. With the old structure I needed to do nothing besides hold the card…combine the 50k cert with the $300 Marriott credit and I had a decent weekend without the need for additional points or to touch the card throughout the year…that is no longer an option. This card will now require work…and a Bonvoy card ain’t worth working for…at least not to me.

You said the 50k free cert your able to “top it off” with up to 15k? I had no idea about this but that’s great news. I have a 50k cert I have been trying to use for something nicer then fairfield inn at 50k and was unaware it was a 50k flex. This will make it much easier to use the 50k now. Thank you!

2808 Heavy,

Thanks for sharing your perspective. I’m probably a bit more optimistic for referral offers waving AF’s, at least for the first cycle of renewals. Amex has waived $695 AF’s on personal and business Platinums, and I’m thinking they’ll want to give certain Brilliant cardholders a substantial incentive to stick around one more year. But we’ll see soon!

How can you get 55 nights by holding Credit Cards? I thought it was one business and one personal card so the max would be 40 nights with the Brillant personal with 25 nights and a business card with 15 nights. Thanks!

Sam,

Corrected. Thanks for the heads-up!

Thank you!

I’ve had the Amex Marriott card from the days when it was a Starwood (SPG) card. The annual fee increase and the switch to the 12x$25 restaurant credit are downgraded benefits for me. However, I did get a retention offer of 60k points for $2k spend and the AF doesn’t increase until 2023 so I have another year to make the final decision.

The ideal customer is the traveler that likes luxury or “upper upscale” properties and stays at Marriotts 15-50 nights a year organically, for work or leisure. They get guaranteed Platinum, a worthwhile free night cert, 25 nights (which helps them earn SNAs or maybe Titanium or above status) and a useful dining credit. For lifetime Platinums/Titaniums, the card isn’t for you – Platinum status and 25 nights are a key benefit.

Correct. With generally low probability of receiving free upgrades, the SNAs are necessary. With 25 nights from the Brilliant card and another 15 from the Business card, plus 1 from the Free Night you’re already within striking distance of earning the first set of SNAs. Another 25 nights earns the second set of SNAs.

The problem with SNAs is that they rarely clear. Making it more frustrating to have picked them as an award and they never clear than to have never picked them at all.

Suite night awards are far from sweet. I have 5 that will likely expire end of year. No luck getting them to clear.

Does anyone feel there is a difference in treatment with earned Vs. given status beyond the free breakfast? It just extremely rare if im ever offered an upgrade. I happened to see the check-in screen at a property and in big letters at the top of the screen showed my status level, points, #of earned nights and nights until reaching next level so they can clearly see if your status it’s earned or given and I wonder if that flags the staff to make difference upgrade decisions.

I haven’t noticed any difference in the level of service even for earned Platinum or, in my case, Titanium. At every check-in it’s only by proactively asking what benefits they offer will I ever get a discussion of free breakfast or F&B credit. Complimentary upgrades are as rare as the major airlines. I only seem to get an upgrade when using the Suite Night Awards. This was not the case with Starwood prior to the big merger. Nostalgia is a bi**h isn’t it?

Good timing I have not noticed the changes yet. Dinning credit is a big plus. Happy to see they bumped up the free night to 85k, I wish they would apply to my current free night (Mar 2023 exp) but it’s still showing 50k on the app. I was just trying to plan last night where I can actually maximize it which is a difficult task having only 50k to work with. Many of the better properties tend to fall in the 52-70k range and you have to hit those on off-peek. Trying to plan for the 50k cert is very stressful unlike Hilton unlimited certs are worry free.

Nets out – not bets out in 2nd paragraph above. Sorry for the type

Good summary and it isn’t for me anymore. First of all I’m lifetime Titanium so the Platinum status and associated benefits (like breakfast) have no value since I already have them and more. I do value the $300 credit and will have no problem using it but the 25 status nights (I also have the Chase $95 AF card which gives 15) isn’t a big deal when you have lifetime status (I may hit 50 nights total but that gets me suite night upgrades I may never be able to use)

All that bets out to $350 for an 85K certificate. Sure that is nice but if I’m staying more than 1 night I have to pay or use a lot of points. The old pricing where the net cost to me was $150 for a 50K certificate was fine but this will lead me to cancel by renewal next March (after I as many of the $25/month credits as possible(