Getting to $20k By Many Means

As I wrote about before, I was able to take advantage of a recent offer on the American Express Business Platinum card that gives 150,000 Membership Rewards points after $20,000 in spending during the first three months. That is a lot of spending, but I took it on and sort of consider it a challenge.

Several other bloggers also got the same offer and have set up a competition to see who can make the most profit while meeting the spending requirement. While I am NOT participating in that, I still thought it would be useful to share some of what I am doing to meet the minimum spend.

My Spending Breakdown Thus Far

At first I was planning on using some more common techniques, but then I decided this was a great opportunity to dabble more seriously with reselling and gift card churning.

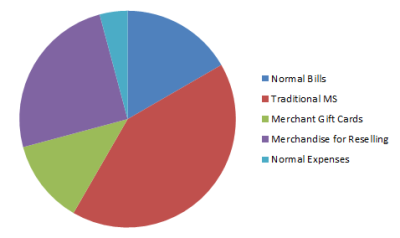

So far I have spent $12,000 of the $20,000 required. Here is how the spending breaks down:

- $2k – Large bills that I needed to pay.

- $5k – Traditional MS. The kind that costs about $4 per $500.

- $1.5k – Merchant gift cards.

- $3k – Merchandise for reselling.

- $500 – Normal expenses.

A Few Notes

When I first got this card, I thought that I would participate in more normal methods of MS, hence the $5k in spending. Since then I have decided it would be much better to earn a profit, so I shifted my spending to gift cards and merchandise. I plan to spend most of the other $8k remaining in the same manner.

Reselling & Expected Profit

Hopefully in the future I will be able to break things down more, but most of my buying has been on eBay where I earn eBay Bucks plus portal cashback. I have also been able to stack eBay gift card discounts to some extent.

Since my local grocery store is running a 4X fuel points promotion on all gift cards, I may stock up on those to earn the fuel discounts and then use the cards for future eBay purchases. In the end I expect a 5-10% profit on my reselling and I am making a similar margin when reselling gift cards.

If you factor in the $40 in fees I paid for the first $5k in spending, I am expecting an overall profit of about $200-$300 for the $9,500 in spend that isn’t part of my normal expenses. In the end, I expect an overall profit of about $600 for the entire $20k in spending plus of course 170,000 Membership Rewards points.

Conclusion

As more low hanging fruit methods of MS start to go away, I think it is a great idea to have a backup plan. In my case, this is sort of the beginning of a new business, albeit on a small scale. Either way, I’ll follow up when the spending is complete and the merchandise is sold to see how close or far I am from my totals. I am also doing my best to track my time, so we will see if my return justifies the effort!

[…] of weeks ago, I am in the process of selling about $5,000 worth of merchandise in order to work towards my minimum spend on the American Express Business Platinum card. Based on current prices, I should do a little better than breaking even, but to be honest, I […]

Shorter answer- 18000 through Serve, 2000 through other random bills.

Not really related, but I recently applied for the Business Gold and it’s been stuck in the “in progress” stage for the past 6 days. I was told the technology dept needs to confirm some information, but each time I check, I’m told the same thing. Any thoughts on how I can expedite this so I can get a decision?

[…] How I’m Meeting the $20k Spending Requirement for My Amex Business Platinum – A Full Breakdown […]

Reselling is risky but once you have an established practice with a high near perfect rating, you’ll be fine. Like I said in my other comments, I’ve used reselling as my last resort for MS though I rarely make a profit from it (my goal is to at least break even or make a very small profit.) I’ve noticed the smaller the profit = the faster you can sell the merchandise.