Never Pay With PayPal Balance

I have had my issues with PayPal in the past, no doubt. I caught them over billing me on fees when making a payment with a partial PayPal balance and the rest with credit card. Recently, I ran into another issue that could also come up when paying a merchant. It is just another reason why you should never pay with PayPal balance when buying goods. By doing so you leave yourself open to the shysters out there and PayPal’s lackluster dispute center. My wife ran into such an issue last week. Luckily, she had a fall back option because she used a credit card when making her PayPal payment.

Background On The Purchase

My wife made a purchase from a company for a product she saw in a Facebook ad (don’t do this!). She clicked through to their website and everything looked legit to her. She purchased the item on January 3rd and tried to cancel it shortly after seeing comparable products on Amazon for triple the cost ($100 vs $300). There was no response from the seller and at one point the email kicked back as invalid.

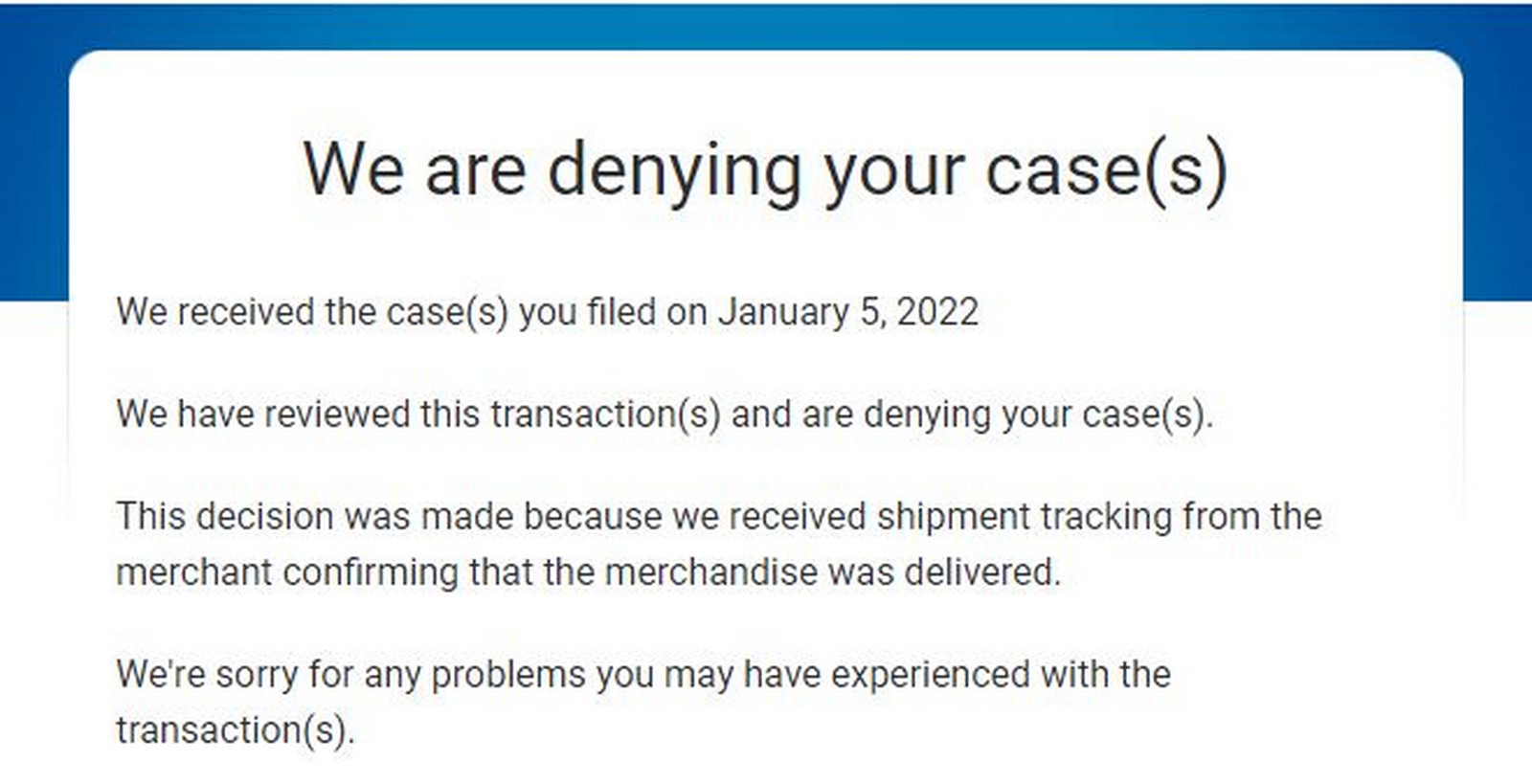

After a week and a half, and no response from the seller, no tracking info, or a delivery I told her to file a dispute with PayPal. She got a response a few days later that PayPal had sided with the seller and the 27 pound package was delivered on January 6th.

PayPal’s Dispute Program Is Easy To Fool

I know from reading other sites of resellers that deal with fraudulent charge backs that simply providing a tracking number that shows delivery will often win you a case. This was particularly handy when people used to sell digital codes on eBay. If they suspected the account may be a fraudulent account and suspected a claim coming they would mail out something with tracking to “prove” they sent it out.

This is where the story gets a bit weird though. The seller provided PayPal with a tracking number for UPS. This is the first time we had seen any type of tracking info on the item. It said delivered on 1/6 to our city. But, it didn’t give any tracking info etc. or the address it was delivered too. UPS said only the sender could see that info for security purposes. I have never had that happen before. My best guess is that it was all that PayPal saw too, a shipment marked delivered and to our city.

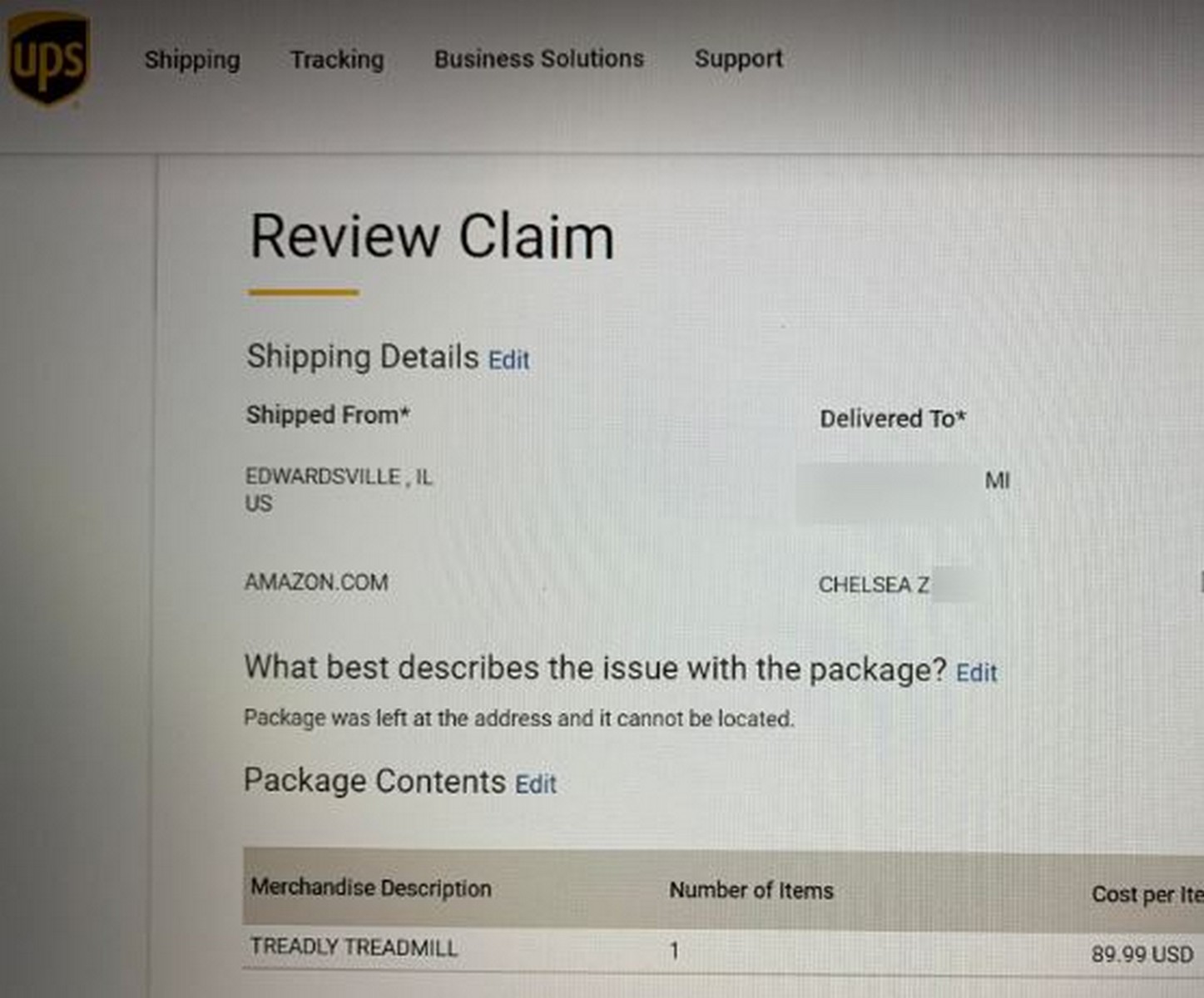

UPS Delivery Claim

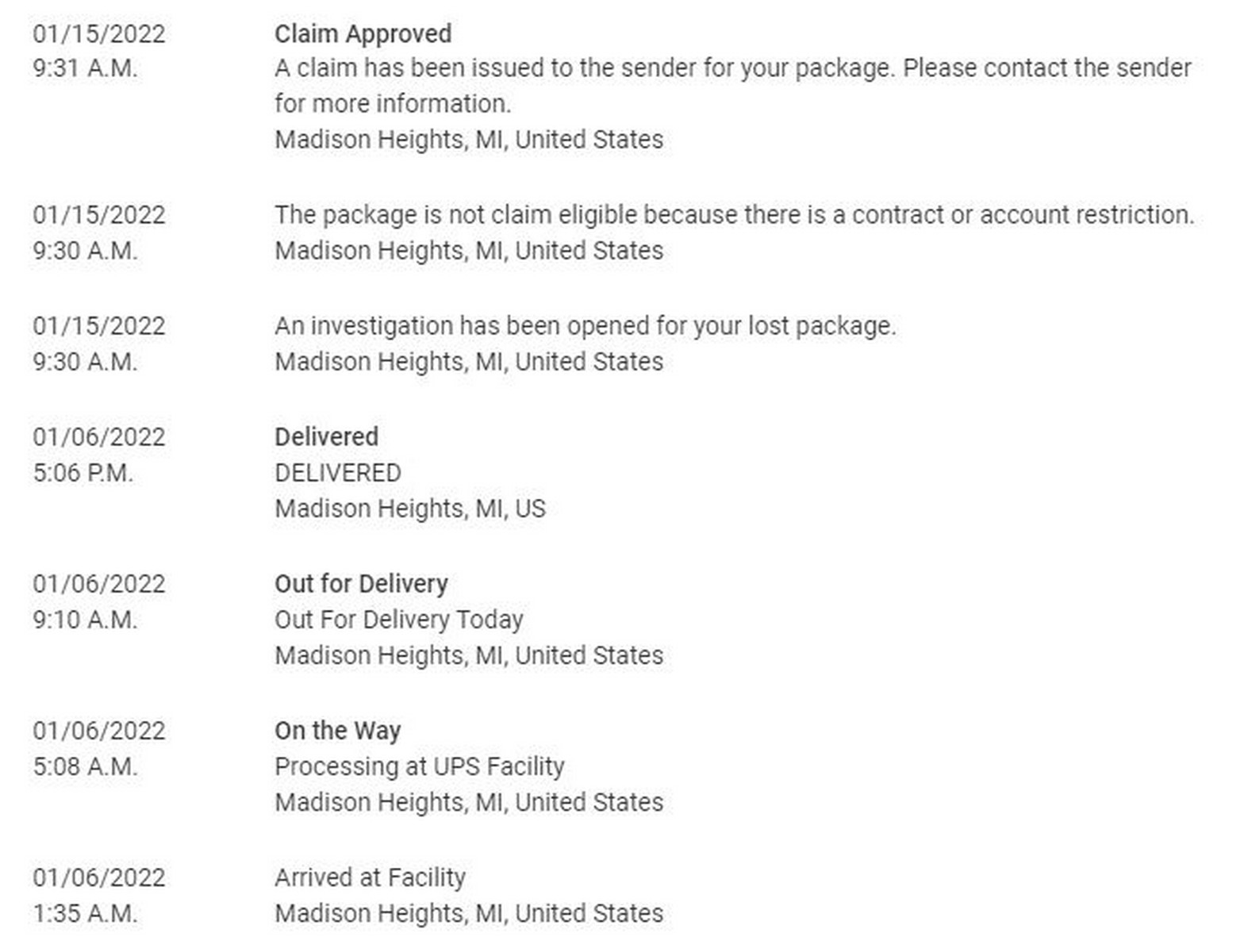

We filed a dispute with UPS and that unlocked more info. Once doing this it showed the package was signed for by a name we are not aware of (Chelsea Z). It still did not show the tracking info or the address it was delivered to though. We did a Google search of the person’s name and our city and they in fact do live a few blocks away. It shows that it was delivered from Amazon, was this a drop ship purchase?

The rabbit hole goes deeper though. Once the dispute with UPS settled, and they approved the claim we had access to the full tracking info. This showed that the package was “delivered” to the same city the UPS depot is located in, about 20 minutes away from our house. This doesn’t match what we initially saw during the dispute process. The delivery still shows it was marked for our town but nothing matches up at all.

American Express To The Rescue

While this was going on I decided to go straight to the source, American Express. My wife had used her newly upgraded Amex Platinum card to make the payment through PayPal so we could file a charge back with them too. I should have just started here but I am glad I didn’t for a few reasons.

- This goes to show that you should NEVER pay with PayPal balance because you are left to their flawed dispute process if an issue arises.

- I probably would have never gone down the rabbit hole with UPS which I may need if the seller tries to fight back with Amex too.

American Express “approved” the claim right away and we should see a credit on the account in the next few days. The seller still has an opportunity to fight it until the middle of February so we shall see what happens there. By filing the dispute with UPS it has unlocked the full tracking info for anyone with the tracking code. So unless they provide them with a new fraudulent tracking number at least Amex will be able to see that detail now.

Never Pay With PayPal Balance – Final Thoughts

I still don’t know who entirely is at fault here. Did the company really ship it to us? Did UPS screw the pooch delivering it? Was the shipment called back by the seller halfway through? Or maybe it should just fall on my wife’s shoulders from ordering it in the first place…hey I know you were thinking it 🤣. The all over the place tracking info leaves me confused on the situation for sure.

Regardless of who was at fault remember to never pay with PayPal balance when making a purchase from a merchant. It eliminates some protections you have, and will probably need to use, if when the PayPal dispute resolutions department fails you. Having more options is always a good thing!

Don’t forget that PP via their TOS give them permission to SIEZE, RETURN, or get REIMBURSED from your BANK account, if hooked to that PP account. Of course, first they would only do it, and you’d first notice it on a statement, and then you would have the opportunity to prove that PayPal had no right to take the funds, or it was a mistake, or it was a fraud. When can they do this?? “Whenever there is a ‘fraud’ or other alleged offense.” Want to PROVE to them that PayPal should never have disputed something?? Nope, I sure don’t. If you receive money and transfer it to your bank, you really are at risk for being forced to prove they made the mistake, or someone else created a fraud with your account. This is likely only risky if you are receiving funds, so unless there’s a fraud on your account, or at least PayPal thinks it is, you might be OK.

RULE == ANY account you have that you’ve allowed ANY type of auto-pay, HAS ACCESS to that bank account. So, if there’s any risk at all, (like any account that you receive money from or through PayPal FOR ANY REASON), either don’t hook your account to that service or site, or only hook it up to a “burner bank account” that you never keep more than ~$100 balance in, that you also use to transfer to your real account.

I bought a sporting event ticket on PayPal from Vivid Seats with an Amex card. The seller cancelled the order. My claim with PayPal was denied and VS is dragging it out. I filed one with Amex and they charged it back. Hoping it stays off.

Why did PayPal say they declined it? Was the seller saying they still sent the tickets etc?

Ive disputed quite a few things with amex on PayPal. But it still lets me use it. Not really all that useful unless chase freedom is doing 5X points and with a seller that is trustworthy.

This is actually a new scam that PayPal is aware of. Same thing happened to me where the Seller produced a tracking number after I filed a case with PayPal. Similar to your situation PayPal cited with the Seller based on the tracking info they produced but I called PayPal and told them nothing was delivered to my house and the seller is only providing the tracking number now. Long story short, the PayPal agent did some research, came back and refunded my money. She informed me this fake tracking number is a new scam they’ve been seeing. My case was settled with one call to PayPal. Now how these Sellers are able to obtain a tracking number to the same city for around the same time as the buyer’s purchase is beyond me.

Thanks for sharing SJ. Pretty crazy for sure.

I totally agree to stay away from PayPal. They have a history of terrible customer service, which has not improved over the years, and what happened to you Mark is a way-too-common occurrence. I have had them add fees for currency translations that weren’t necessary and a myriad of other things. I only keep my PayPal account around for those rare occurrences when I need it — almost never.

Which brings up another point: It’s a service that is completely unnecessary. If PayPal shut its doors tomorrow, what services would we lose? Not a damn thing that I can think of. You can pay merchants in lots of other ways (credit cards!). You can park your money in plenty of banks. You can give money to friends in other ways (Venmo, Zelle). I can’t think of any service that PayPal provides that does anyone any good or is unique or helpful in any way.

I think when it started it was unique but it is true that they no longer offer anything you can’t get somewhere else.

Doesn’t PayPal own Venmo now?

As a former shareholder of PayPal (I moved to leveraged index etfs) and user since 2005, I am a big believer in PayPal. However, they have a really bad history of arbitrarily and capriciously suspending/closing accounts and blocking access to money. It’s been that way since around the time PayPal told a buyer to break a $2500 violin in a return dispute (no returns accepted) so it could be marked as damaged and the buyer could force a refund from the seller through PayPal. Conservatives are also targeted for blacklist due to PayPal’s anti freedom bias and hate.

The lesson is to not keep high balances in PayPal (more than a few hundred). Business users who have a hold period on their funds have no choice unfortunately.

I like PayPal because it has a solid user base compared to Square and is expanding into crypto and these BNPL loans. It’s not insanely valued like Square based on earnings. Given the above problem with holding money, this discourages people from holding crypto in their PayPal accounts which PayPal wants to be pushing. PayPal can work on fraud without suspending and banning accounts based on some antiquated algorithm.

be careful with the leveraged index funds. I held TQQQ during late 2018 bump and it was quite painful.

I had a similar situation but it was resolved in my favor quickly. It was a fradulant website and I kick myself for not catching it. The package was from China (but the site I ordered from said CA). They did send a tracking number and it tracked to the USA but ended there. On China Post I read that the type of tracking number it was didn’t show me info after that point. On a Sunday night it showed delivered to me. At that point I did some research and ran across a thread on China Post that said scammers use that particular kind of tracking so that they can send something (like a package of seeds) to some address near you and then say your package was delivered. I copied that. I also have USPS informed delivery, showing they didn’t deliver any package to me that day or the days before. I submitted all of that and two days later paypal ruled in my favor.

Such a tricky scam to send it to someone in your area but block the details.

And why would China Post have that type of tracking? It said the type of tracking they normally use starts with A (then a bunch of numbers or letters) and ends in CN. But of course, no one has a clue about that. I highly recommend having USPS informed delivery and UPS My Choice. I also ordered from an ad on Facebook and will never do so again.

I have USPS informed delivery already – will have to look into UPS My Choice

Next question: will the PayPal account be banned for issuing a chargeback via the credit card???

I have never heard of that being an issue but I’ll let you know if I run into anything

Just seems like that’s a common issue I hear from folks when they start a dispute outside of PayPal; maybe it’s not as widespread as I hear…

Protection against a bad or scammy seller is just reason #1 not to pay with a balance.

Reason #2 is that Paypal itself can be problematic, and it’s far too easy for them to freeze your funds. So you should never have a Paypal balance to begin with. Always transfer funds out of Paypal as soon as they come in.

But even if Paypal themselves were not an issue, and even if the seller was completely trustworthy and reliable, there’s reason #3: when you use a Paypal balance, you’re not earning anything for the spend. If your wife had used a credit card for that $100 purchase, she’d earn 100 mile or 100 points or $2 for it. For a miles blogger, that should be top of the list!

She did use a credit card for the purchase – via PayPal 🙂

I think the protections outweigh the 2 or 3% you get back on the purchase for sure though in this instance.

“She purchased the item on January 3rd and tried to cancel it shortly after seeing comparable products on Amazon for TRIPLE THE COST ($100 vs $300).”

Did you mean a third of the cost? Seems odd that she would’ve wanted to cancel the purchase if it was significantly cheaper than comparable items on Amazon.

Nope realizing it was likely a scam.

The story and a few others including the ten thousand dollar PayPal taxicab ripoff story has perhaps almost convinced me not to use any other card except American Express, regardless of rewards. The purchase protection and chargeback protection could outweigh any increase rewards. What do you think?

I have had good experiences with Chase etc. when doing chargebacks as well. I think many of the credit card issuers do a good job with it.