Our Full Personal Capital Review – Updated for 2020!

If you are like me and have money spread across multiple brokerages (admittedly I love free stock offers) then you need a simple and easy way to see everything in one place. Personal Capital is an online finance service/app that aims to do that for you. In this Personal Capital Review we’ll take a look at the service, how it works and I’ll cover the $20 promo sign-up bonus they are offering!

Signing Up & Personal Capital Promo Bonus

Personal Capital is completely free and without commitment, however they do have premium investment services that they will hope you try. Signing up doesn’t obligate you to anything. If you sign-up with our referral link then you will get a $20 Amazon gift card.

Here is how signing up for Personal Capital works:

1. Sign-up here

2. Answer any required questions. They do ask about your goals, etc. but most of the questions can be skipped.

3. Link an investment account to your profile. Note that simply linking a bank account won’t work to trigger the $20 credit. Only an investment account will work, but linking an account is made very easy. Note: You do not have to link all of your accounts, so you can just link one and try out the Personal Capital service while also collecting the bonus.

Getting the $20 Personal Capital Sign-Up Bonus

Within about 24 hours or so after linking an investment account to Personal Capital, you should receive a $20 Amazon code via email. When I signed up it took about 12 hours to receive the code and I linked my investment account right away.

Free Stock Bonanza! Our Roundup Of Every Free Stock Sign Up Offer

Is It Good – Our Personal Capital Review 2020

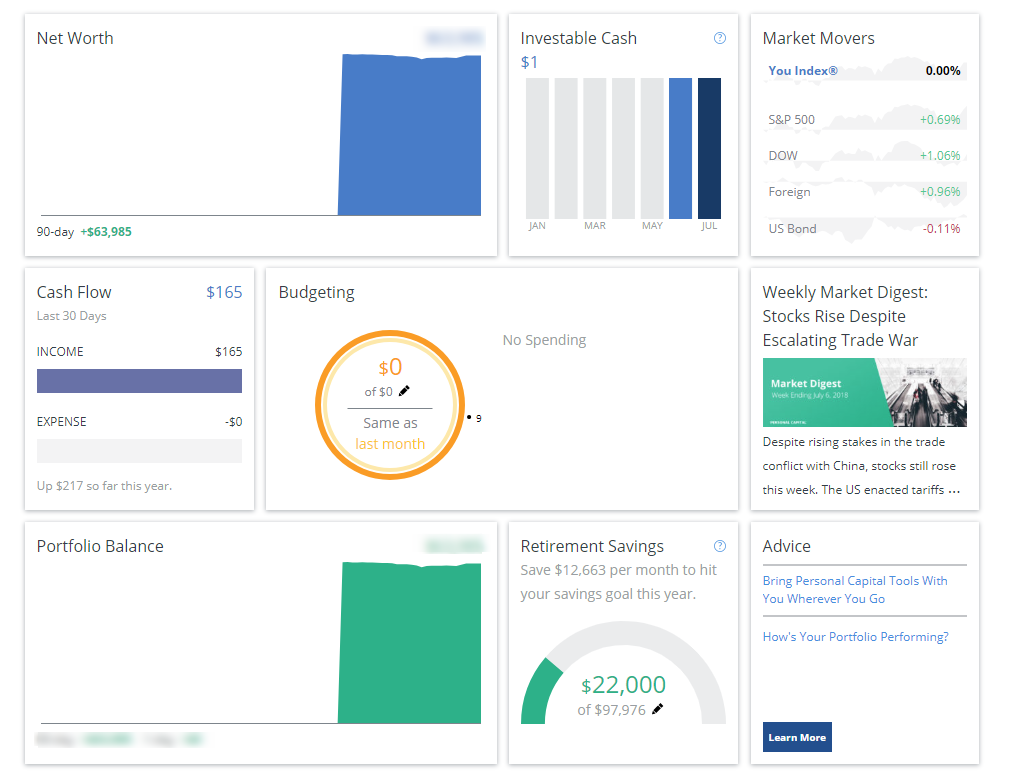

Personal Capital doesn’t require you to link a ton of accounts in order to use the service. When I got started I simply linked one of my Vanguard accounts and was instantly able to see just how Personal Capital works with only that one account. The dashboard (shown below) is pretty nifty and has most of the information you would want in a quick glance.

For example the Personal Capital dashboard allows you to quickly see your cashflow, how much you need to save and what your “net worth” is. Right now since I don’t have all of my accounts linked, it only shows a partial picture, but if I had all of my bank accounts, etc. this would be a very accurate number.

As you can see above, Personal Capital also has a Budgeting screen where it tracks spending on credit cards. Once again, I haven’t used this but I can see it being a very useful tool to see when you are spending more in certain categories.

The You Index

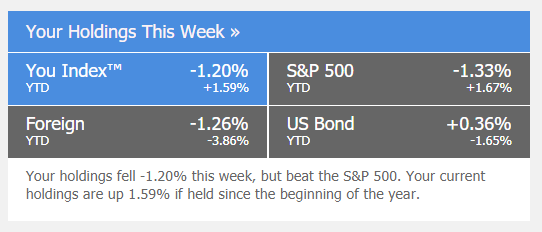

One of my favorite features of Personal Capital has to be The You Index. Basically they track how much my portfolio goes up and down. It obviously shows this information when you login, but they also fill you in occasionally via email.

I don’t love receiving an email showing a losing week, but it’s nice to see how my holdings are comparing to other markets.

Personal Capital $20 Bonus Sign-Up

Why Is Personal Capital Free?

So why is Personal Capital doing this all for free? They want you sign-up for their investment services. This is something I won’t do and it doesn’t bother me, but be aware of that. Occasionally I receive an email asking if I want to schedule a call. To date they haven’t called me. (Although others have reported being called often.) I suppose you could give a fake phone number just in case, but an occasional email is fine with me.

So Which Too Is Better for Tracking Your Finances? Mint vs. Personal Capital

This is probably more personal preference than anything, but I like Personal Capital better than Mint. I think the interface is nicer, although both admittedly accomplish the same thing. In my experience Personal Capital makes it quicker to link accounts, seems to just work better and I really like their mobile app.

Personal Capital Review – Conclusion

Overall my Personal Capital Review has to be a positive one. Not only do they give you a $20 Amazon code just for signing up and linking an account to try them out, but the service is actually quite good. While they will try to expand the relationship by offering investment services, it isn’t required. In my opinion Personal Capital is definitely worth a try!

Fine print: The Referred Friend must link at least one valid investment account (e.g. brokerage, 401k, IRA) containing a balance of more than $1,000 USD within 30 days of registering for the Dashboard

I signed up 3 days ago linked bank and investment account but have not received any $20 credit or any calls. Looks like they do not have a customer service email.

To date they haven’t added a feature to print reports like Quicken. I know it’s a free service, but…

Aren’t you afraid of getting hacked? I worry about that with all of my investment accounts and bank accounts, so I try to check them all at least monthly. Never had financial accounts hacked, but having just one password for all accounts certainly would increase the risk.

i have sign up for 2 weeks and link my bank 2 account never see my amazon $20 giftcard.sent a complaint to personal capital.never get answer.too bad

Did you link an investment account? Bank accounts don’t work to trigger the bonus.

they pay you $20 to get access to your account info?s Hmmm?

I have been using this for about 3+ years. Its a financial gold mind of information… And if you use this with PRISM…. You just found your dynamic DUO to monitoring bills and investments.

What is PRISM?

I got mine, as did my wife 🙂 I have received a call and a text, but they have not been too persistent at all.

Warning: These guys will call after you start an account, and they will keep calling even if you close it.

Also, never got my 20 dollar credit

Interesting. Did you link an investment account and not just a regular bank account? I know at least a dozen people who only did a bank account but then later added an investment account and got the credit. I’ll add more of a warning to the post, since for some reason I haven’t been called, but I want people to be aware of it.