Tracking Awards & Credit Cards

One of the biggest difficulties of credit card churning is keeping track of everything. There are application dates, anniversary dates, bonus & spend amounts and so much more. For someone new to the hobby this can all be a little overwhelming. (Ok, a lot overwhelming!)

Over the years I have developed a sloppy system that seems to work for me, but that I cannot recommend to anyone else. In fact, my system is so ill-advised that I have been looking for ideas on how to finally properly organize my data.

How People Track Their Info

My best guess is that many people use spreadsheets to track their credit card applications. I also use a spreadsheet, although mine is pretty rudimentary. In the past I have been tasked with creating very complex spreadsheets for work, but for my own personal stuff, I guess I am just too lazy.

Another way some people track credit cards is with services like Card Watchdog and others. I’m not a huge fan of giving third parties all of my information, plus I have found inputting and updating the information isn’t as easy as I would like it to be. In other words, a spreadsheet is easier and probably a bit safer.

A Better Spreadsheet

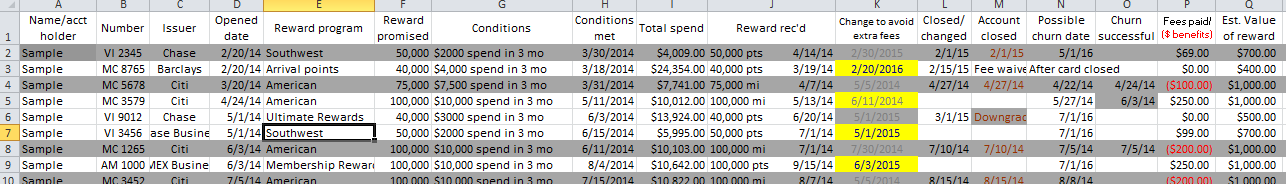

A couple of days ago I came across a very good spreadsheet that I wanted to share with you. It was designed by Kenny from Miles4More and it contains fields for every bit of data you could ever want to track.

The spreadsheet allows you to track both active credit cards and applications. It has a place to put in all of the spending bonus information as well. Heck, it even has a tab where you can paste application screenshots. I honestly have not been able to find one thing missing from it.

I had the opportunity to meet & record a podcast with Kenny just a couple of weeks ago and he is a very nice and knowledgeable person. Thankfully for us, he has decided to unleash his spreadsheet onto the world. I for one am very grateful, since I can take his template and make some small tweeks to fit my needs instead of having to reinvent the wheel. You can find the spreadsheet and more information here.

Conclusion

So now that I have shown you where to find an amazing spreadsheet, let me know what little tips and tricks work for you in tracking this information. Do you use a spreadsheet, a service or some other method? What key pieces of information do you feel are necessary to track. Which pieces of information do you leave out? Let me know in the comments!

[…] in place it is so much better than not being organized. New to organizing credit cards? Here is a sample spreadsheet to use and this is the book I physically keep all of my cards […]

[…] and some people less. While I cannot post my own spreadsheet here, Kenny from Miles4More posted a spreadsheet awhile back that I covered here on Miles to Memories. I believe it is still available for […]

WOW, this guy is even more detail oriented than I am! I’m switching over to this….thanks Shawn!!

I’m glad you like it!

A link to the spreadsheet?

The link is at the end of the second to last paragraph. https://saverocity.com/miles4more/points-tracking-spreadsheet/