Question: Do Amex Employee Cards Earn the Same As Normal Cards?

Our question this week looks at whether Amex employee cards (added to a business account) earn in the same way as the main account. Do the employees earn bonus categories, or do cheaper cards earn at a lower rate? Let’s look.

The Question

Our question of the week comes from Guarav in our Facebook group:

I’m going to take advantage of the AmEx add employee offer for 20k points. If I add a gold or green card to minimize fees, but spend more than $5k in a transaction on that card, would that transaction still earn 1.5x?

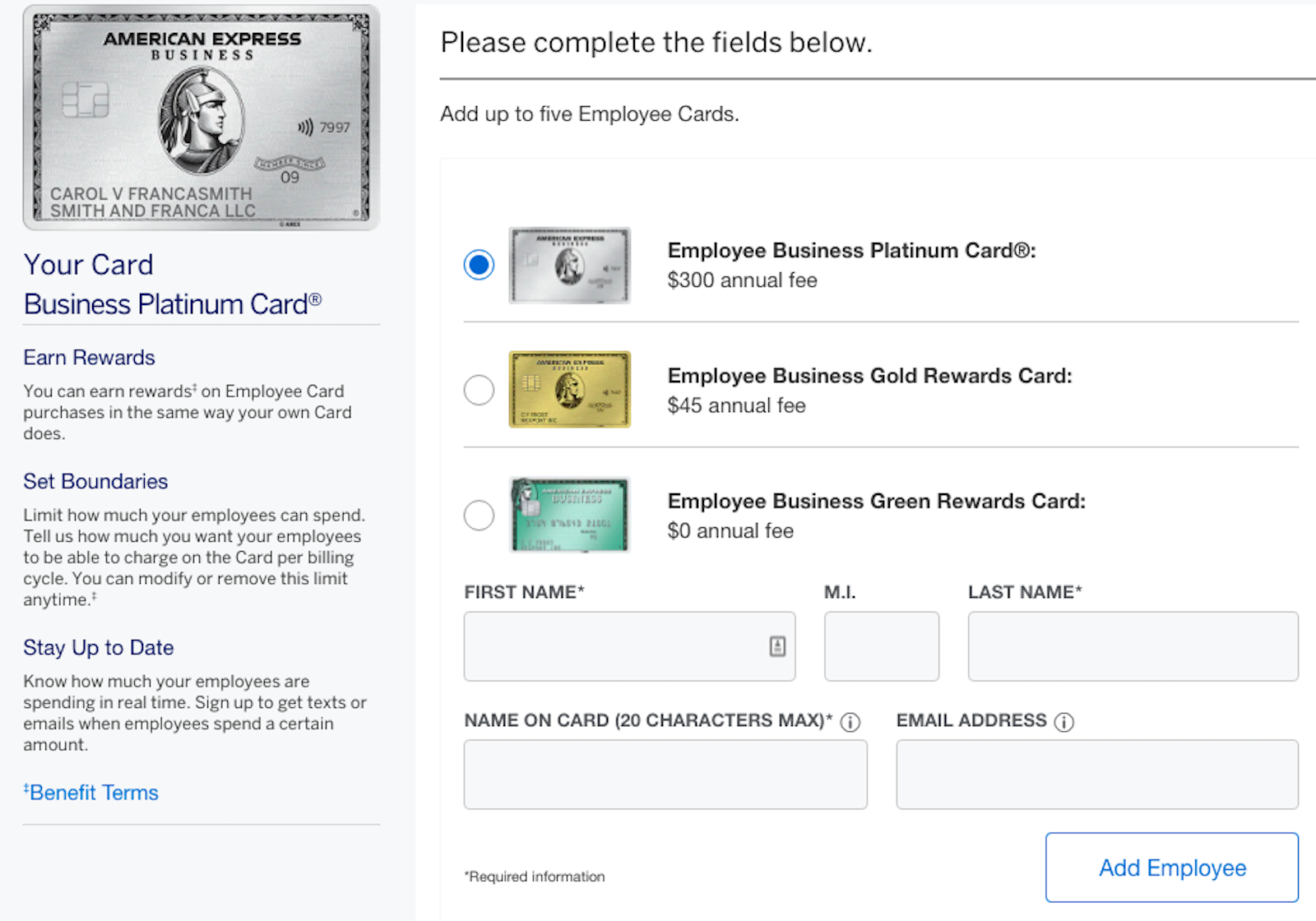

Guarav brings up a good point. If you have a business account, you can add employee cards that cost different amounts of money. For example, if you have The Business Platinum Card from American Express, you can add three different types of employee cards to your Amex account:

- Platinum

- Gold

- Green

What’s the Difference?

How are the 3 types of employee cards different with Amex? The annual fee is obviously different. If you add an employee Platinum card, you’ll pay $300 per year for that card. However, the card will still come with perks like lounge access, a separate TSA PreCheck/Global Entry credit for that employee, Marriott and Hilton status–all of the perks you read about in our Business Platinum Benefits Guide.

The employee Gold card is significantly cheaper–just $45 per year–while the Green card costs nothing. How are these different? The secret answer is that they aren’t. Neither comes with any additional perks. I can’t figure out why you’d pay for one that offers nothing better than the other. Food for thought.

But What About Points Earning?

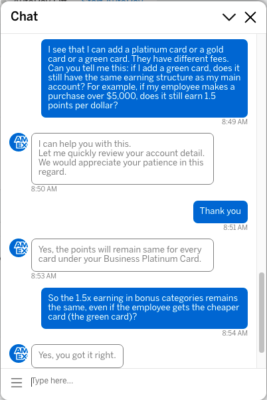

To get to the heart of Guarav’s question, what about points earning? All of the cards will earn American Express Membership Rewards. And all of those points earned will go into the pocket of the account holder; the employees don’t keep the points from their purchases on these cards.

And the earning rate on Amex employee cards? It’s the same as the main account. Whether you add the $300, $45, or $0 option, your employee’s card will earn points at the same rate for purchases as the main account does. This includes bonus categories or things like the “1.5x earning on purchases over $5,000” on the Business Platinum Card. Thus, you can essentially have your cake and eat it, too. You can get the best points earning rate while paying the lowest fee on the employee card.

And, if you’re like Guarav and have a targeted offer to get points by adding an employee card to your Amex account, you can get those points on the cheapest version of the card! (That assumes the terms don’t specify which type of card you need to add–be sure to check your offer)

Final Thoughts

Great question here, Guarav. Amex allows you to add different types of employee cards to a small business card, and these come with different fees. Only the most expensive option comes with any perks for the employee. Luckily, all of the cards earn points for the master account at the same rate as the main card. Plus, all of the employee cards help you meet spending requirements for welcome offers. Lately, we’ve seen a lot of bonus points offers for adding authorized users and employees to accounts with American Express. It’s a great thing that even the free cards earn points in bonus categories.

Have a question? Ask in our Facebook group or email me at ryan[at]milestomemories.com

thx Ryan, u covered / answered all Qs that i too have…

mine got an offer to add EEs that could earn 20k pts with a min $4k spend within 6 mos; although a 6-mo allowance for EEs, my main biz card, however, has 3 months to meet $15k spend to get 150k pts