The Card That Earns up to 7.5x For Loading REDbird

Note: As of October 13, 2015 the Target REDcard (REDbird) can only be loaded with cash in-store at Target. This means that neither debit cards nor gift cards can be used to load REDcard any longer. For more info about the changes and where to go from here, see: REDbird Postmortem: An MS Path Forward

Yesterday I wrote in detail about why I love the new portal payouts for Visa gift cards purchased from GiftCardMall. In that article I mentioned that I want to purchase those cards, because I don’t want to shift my spending away from REDbird.

You see, my wife and I have a magical card that earns 5x at grocery stores. It just so happens that my local Target is coded as a grocery store by Visa. Each point earned by this card is worth $.01 for cash or $.015 for the purchase of airfare. This means I effectively get up to a 7.5% return on loads.

After seeing my statement about 5x (7.5x) earning at Target with REDbird, several people asked me about it. Since it seems to be a popular question, I thought I would provide a few more details.

Which Card Is It?

Wells Fargo has a number of credit cards that earn 5x or 5% on purchases at gas, grocery and drug stores for the first six months. In my opinion the best one is the Wells Fargo Visa Signature because it is the only one that has that 1.5x bonus for airfare. (Frequent Miler reports it may be up to 1.75x.)

This Is Going to Be Easy Right?

Wells Fargo is notoriously difficult to get approved with. If you don’t have a banking relationship with them, then it is most likely that you will be denied when trying to get this card. The best practices based on the experiences of others are:

- Open a checking account at least 30 days before applying for the card.

- Show some deposit activity in that account during this time.

Some people who have had other rewards credit cards in the past with Wells Fargo have been told they are not eligible for the 5x promotion. If you have had previous cards with them, I would make sure to clarify this before applying.

My Experience

My wife and I followed the exact plan as detailed above. She opened a checking account a month before applying for the card and we used it to pay some bills as well. This past December during our latest application spree, we applied for the card. It was just over a month since opening the checking account and the card was instantly approved with a $5,000 credit line.

Only $5,000?

Wells Fargo is also notoriously stingy with credit lines. Some people have reported being approved for less than $5,000 which drops them from being a Visa Signature and means they lose the 1.5x benefit. Thankfully this didn’t happen to us.

Having a low credit line with Wells Fargo is tricky for one main reason. When you pay off the bill, the credit line doesn’t return for up to two weeks. So say you load your REDbird and then pay the balance of the card off from your REDbird account. The payment will reach Wells Fargo within a couple of days, your balance will be $0, but your available credit won’t return for up to 2 weeks.

Luckily there is a way around this, but it involves a little trickery. The only way to get your credit limit returned immediately is to pay off your card from your Wells Fargo checking account by transferring money over. If you want to cycle your limit more than once each month, this is how you have to do it.

Shut Downs?

Some people have reported being shutdown for using their credit limit multiple times in each month. Based on what I have heard, cycling the limit 2-3x per month seems to be ok, but you always risk being shutdown when doing something like this.

Finding a Target Codes as Grocery

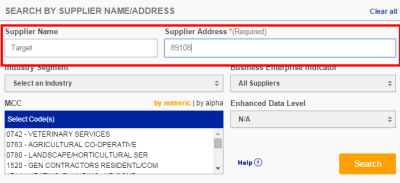

Luckily it is very easy to find a Target that is coded as a grocery store. Since this is a Visa card, all you need to do is search via the Visa Supplier Locator tool.

On this tool simply enter the zip code you are looking in and type Target. You will probably see a few other businesses with Target in their name, but you will also see all of your local Target stores. Find one that is coded as “grocery”.

As you can see, not all Targets will be coded as grocery stores and some Targets even show up as both a grocery and a warehouse store depending on the register. I only go to stores that have a grocery code just to be safe.

Conclusion

So now you know how I earn 5x (7.5x) on my REDbird loads and why I don’t want to use my precious REDbirds to meet minimum spend requirements on other cards.

Is this a permanent solution? Of course not. It only lasts 6 months and REDbird may not be around, but we are four months in and it has been nice. When my wife’s time is up, I may just have to get one of these for myself!

| Miles to Memories operates under the Value for Value model. If you receive value from this site, find out how you can provide value back. |

|---|

[…] While I am still sad about losing credit card loads to REDbird, it just became my preferred Vanilla liquidation method. Right now since I can purchase Vanilla Visas at Office Depot for a discount and earn 5X, I am still doing really well. In fact, I am doing better than before. […]

Shawn,

Transferring from RB/BB to bank account create any issue?

thanks

It shouldn’t. I generally pay bills, but transfer to banks when I need to.

Hi Shawn – given that you need to use the CC itself at Target, and maybe for$5K+, what has been your experience with multiple loads per day, load amounts, fraud alerts, etc?

I have had success using it twice in one visit. Three times and it triggers a fraud alert. I haven’t tried going back later in the same day.

I’ve been looking all over for this online without luck, so i’ll come back to you again as my trusted advisor: first, thanks to your great tip here I applied for the Wells Fargo Visa card, and got it a week after the RB credit loads ended. =( Some blogs are reporting that the WF CCs don’t provide the 5x bonus on VGCs – apparently the gift cards are excluded per the T&C. Have you tried buying VGCs with your WF CC? Do you what is the truth here? Thanks again Shawn!

Yes buying Visa gift cards works and I have done it. Most of the time the credit card company doesn’t have any way of knowing what you purchased. I haven’t had any issues purchasing Visa gift cards.

The thing that was not clear to me is how long the 5% at grocery coded Target stores lasts. Only 6 months. To bad this is not ongoing the way “old blue” was. I don’t think it is worth it for me to mess around. Thanks for the info though….I got all excited.

Do you know if Amex Blu considers RB load as supermarket for 5% back? I’ve heard of shut downs, but I think they’re mostly for those going over the 50k, right?

Q. Are the points redeemable for money spent on a(ny) flight, or are they points that can be used to book a flight. If money, then I assume it applies to any airline. Also, are the points transferable to another program. I want to use Asia Miles for some inter-Asia travel next year I’m working on building points with them.

You have to book a flight through their website and a $24 fee applies. I have tested their website on a variety of routes and it always has the same prices as I can find on ITA or Google Flights. The points are not transferable.

I received the offer (as a “valued customer”) of .0175 for depositing more than $50,000.

Thanks for sharing that!

So on a $500 ticket you could redeem 50,000 Wells Fargo points for cash and then earn 1,000 points on a 2x card or 1,500 on a 3x card.

If redeeming Wells Fargo for airfare you would spend 33,333 points plus $24. So the argument then is are the 1,000 or 1,500 points earned plus $24 saved worth 16,667 points.

The 16,667 points are worth $166.67 in cash or $250 in future airfare. If we generously value the points earned on the airfare purchase with another card at $.02, then 1,000 points is worth $20 or 1,500 points is worth $30.

So in the end by redeeming for cash at $.01 instead of $.015 and buying the ticket, you are paying $167 more in Wells Fargo points (cash value) and earning/saving $54 which isn’t worth it.

Of course on smaller purchase prices then the difference is quite a bit less. For example on a $300 ticket you are redeeming 10,000 more points with the cash option and earning/saving $42. Still not worth it, but closer.

Thank you for putting me in my place. 🙂 Makes perfect sense using your example.

Definitely not putting you in your place. Thanks for making me do the math. It makes the post more complete!

I was just kidding. (In case the smiley face didn’t do that justice.) Despite being a numbers guy myself, running an example is always helpful. Thanks again.

I currently have Wells Fargo Propel World card and already took advantage of its 40,000 points after min spent. I called Wells Fargo to confirm that if I already have another rewards card with them I won’t qualify for 5x promotion for their Visa Signature card. Does anyone know if I will qualify for that 5x promo if I cancel my Propel World card before applying for Visa signature card? And how long I should wait before applying for a new card? Thanks

As far as I have heard it won’t make a difference. Since you earned a bonus on the Propel card they won’t give one on the other card. I’m sure at some point if you haven’t had a card for awhile they would give you a bonus, but unfortunately I can’t confirm that or give you a time frame.

I’m looking to load my redcard for the 1st time this week. I am looking to use my CSP and my Citi Prestige card. Waht are the limits for reloads?

Thanks, Gaspare

The limits are $1,000 per load, $2,500 per day and $5,000 per month.

1st.. Thank you so much for getting back to me!! On that 1 load it can be one credit card for $1k.. or is there a max amount on that card?

Yes you can do it on one card.

Perfect, thanks again!

Anyone hearing any issues w/ CSP or Citi Premier as cash advances?

I haven’t heard of any cards coding as cash advances when loading REDbird.

Perfect, thank you so much for all your help!

Nice write-up and nice looking website update.

Can you shed any light on the 1.75x redemption? I assume no personal experience (yet), or you probably would have mentioned. I see some speculation in the FM comments on needing $30k in annual spend to get the 1.75x. Regardless of 1.5x or 1.75x, I’m assuming the travel needs to be booked via a WF travel portal?

While even 1.5x (for 7.5%) is great, is it fair to think that maybe the 5% cash-back is the best route (and still a great deal)? I’m just thinking that to take advantage of the 1.5x, you have to bypass getting something like 2x UR on CSP or 3x MR on Amex Gold. Is that a fair point and way to think about it?

No experience personally with 1.75x, but with 1.5x the travel is booked through their website and there is a $24 fee, which cuts down on the value. I think it is a good value to go either way. I will probably eventually redeem some points for both cash and airfare in the future. Even at 5x with REDbird, it is $250 free every month for minimal effort.

Agreed that 5x is great on its own. Just thinking out loud if the 1.5x (with $24 fee) is “worth it” (compared to the option of taking simply the 5% cash and using another card for booking airfare). At 1.75x (if that exists), it would be more compelling. But, again, either way the 5x & Target combo is nice!

Is there a similar tool for Mastercard and AMEX?

Thanks!

Not that I know of. There is a Mastercard service that requires you to register, but I can never get it to work.

https://cps.mastercardbusiness.com/sdportal/home.view

@Shawn –

“and REDbird may not be around” SHAME on you for even suggesting ! LOL 😉

Thanks Shawn,, good one..