Sapphire Reserve Annual Fee After Upgrade, How Long Does It Take?

I had written about our Chase Freedom to Chase Sapphire Reserve upgrade over the summer. We decided to pull the trigger to take advantage of Pay Yourself Back and because all of the spending offers they have had on the card. I broke down my decision in more detail back then. One thing I forgot to inform you on is how long it took for the Chase Sapphire Reserve annual fee to post after upgrade. Spoiler alert, it takes a while! Also, does it post as a prorated annual fee or for the full amount with a new anniversary date?

Updated 7/16/21: I have added an updated section below after the first year was up.

Details

I had my wife call in to upgrade her Chase Freedom card to the Chase Sapphire Reserve on June 13th. If you remember, she tried to upgrade her Sapphire Preferred first with little success…which was expected. She had to haggle with the rep some, who seemed somewhat clueless, and move some credit around to get approved. Then I waited, and waited and waited for the annual fee to post. I heard it could take a while but it took even longer than expected.

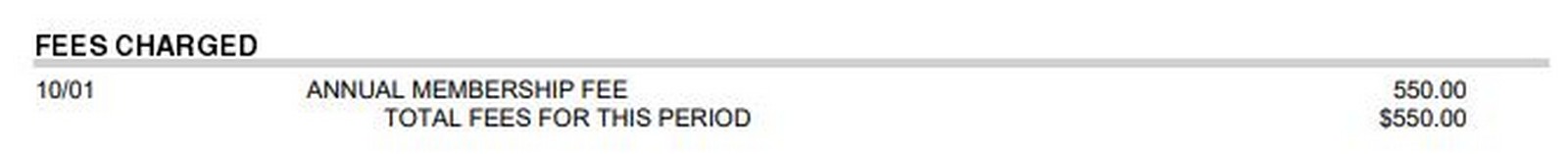

The $550 annual fee finally billed to my account on 10/1. That is almost a full 4 months later, crazy!

The really tricky part is I had no idea when the Freedom’s card original anniversary date is since my wife got the card in college. I reached out to Chase to see if they could inform me if her anniversary date and when the annual fee would bill each year etc. They said her anniversary is now in June and the annual fee will be billed in October. That is what I expected. It also means there is a few month window where you can double dip the travel credit since it should reset in June. But the next fee will not post until October.

This hasn’t been an opportunity for new cardholders since Chase changed the credit from calendar year to cardmember year a while back. But it appears to be a nice little side perk for the upgrade crowd.

Potential Trap?

I should say that there are some people out there that have played around with this grace period. If you had a booking you wanted to use the Chase portal for, or wanted to burn some Ultimate Rewards via Pay Yourself Back, you could upgrade and downgrade before anything changed. I decided against such games because I took advantage of the travel credit, via grocery spend, and felt the spending offers were more than worth it. Throw in the increased rate from Pay Yourself back and I am coming out way ahead.

I also want to avoid getting on Chase’s bad side, so for that reason I am holding the card for a while. I know others that have done it without issues, seeing as Chase doesn’t have an Amex RAT as of yet. But I would implore you to consider how much you value the Chase relationship before diving in the deep end here. I just don’t think the juice is worth the squeeze.

Update One Year Later

It has been a little over a year since I upgraded to the Sapphire Reserve. As expected my new yearly anniversary came and went in June without an annual fee. The date was reset when I upgraded. My annual fee shouldn’t post until October like it did last year. But since my anniversary came and went my travel credit reset. I was able to spend $300 at the grocery store to deplete it. Remember that you can use your travel credit on gas or groceries until the end of the year. I think I may downgrade it to a Freedom Flex before the 3rd quarter is up to get 5X on groceries with it.

Final Thoughts

The reports are true, the Chase Sapphire Reserve annual fee after upgrade takes forever to post. Forever, as in practically a quarter of the year…that just blows my mind. The nice thing is you can take advantage of the perks and offset that cost before you even need to pay it. Others may take that window of opportunity even further, although I would not recommend it.

It is also tricky in respects to when the card’s anniversary date is now. Is it based on the upgrade date or when the annual fee posts etc? The annual fee legally can not be billed before 12 months again but will our travel credit clock reset in June, when it first became available? Or will it reset on the card’s original anniversary date, which I have no idea when that is? From Chase’s secure message it appears the upgrade date becomes the new anniversary date and the annual fee will be billed on the same time every year. These dates will not be the same going forward, which makes it confusing for sure.

Yeah. Same thing happened with me. I upgraded my Freedom to CSR in August 2019. My $300 travel credit was immediately available, which I used in October 3019 for a trip. My $450 annual fee posted on 12/01/19. When my statement closed in August 2020 I received another $300 travel credit, which I used for groceries. My $450 annual fee just posted on 12/01/20. If I downgrade my CSR now I will have received $600 in travel credits plus a $60 DoorDash credit for one $450 annual fee. A net gain of $210. However, I am going to keep the card for one more year at $450 because for that annual fee I will receive another $300 travel credit, another $60 DoorDash credit and a $85 TSA credit. With this year’s credits my CSR out of packet cost will be $5.