Possible Cash Advance Fees on Serve Loads

Earlier today, Greg the Frequent Miler reported that some of his readers have been getting charged cash advance fees for Serve online loads made with their U.S. Bank credit cards. As of now it appears that only U.S. Bank is charging these fees, however I did a little digging and found something interesting.

My Personal Experience

This month I have personally done Serve loads with both a Barclay’s Arrival Plus & Citi AA Executive Mastercard. I thought I would dig into the transactions to see if I could notice anything different.

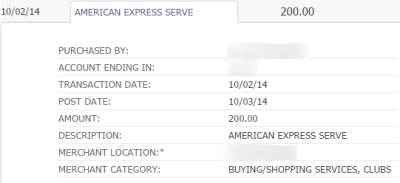

Barclay’s Arrival Plus

As you can see, everything still looks exactly the same as it has in the past. The merchant category remains the same between the transactions and the only difference between them is the date. This appears to be business as usual. Now let’s look at what caught my eye at Citi!

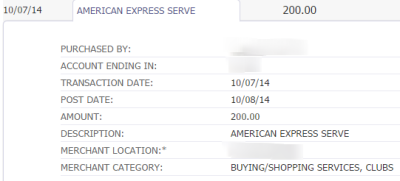

Citi AA Executive

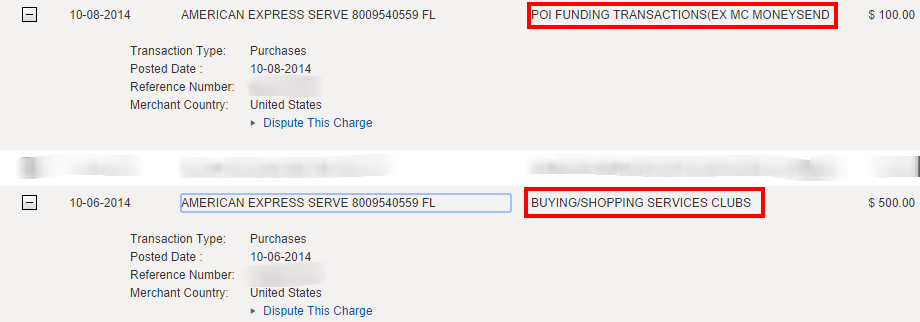

While both of the Citi transactions were still treated as purchases, you can see that the merchant category changed from “BUYING/SHOPPING SERVICES CLUBS” to “POI FUNDING TRANSACTION/EX MC MONEYSEND” between the 10/6 transaction and the one on 10/8. To me, that second merchant category sure sounds like something that would be classified as a cash advance.

The Dates Matter

My last Barclay’s transaction was done on the 7th and the last Citi transaction was done on the 8th. It is possible that American Express changed their merchant category between those dates. The good news at least for now is that Citi didn’t consider it a cash advance even with the new category.

Cash Advance Limits

My recommendation is to lower your cash advance limit to $0 for any card you plan to use to load Serve. This way if the bank does classify it as a cash advance, the charge won’t go through and you won’t be hit with a hefty fee. Hopefully this is just a small hiccup, however it doesn’t seem to be. It looks to me like American Express changed the way they report Serve credit card loads. Only time will tell.

Conclusion

At this point we know that Barclay’s and Citi are not charging cash advance fees (yet) for Serve loads while it appears that U.S. Bank is. I am sure this story will develop over the weekend as data points come in from others in the community. Please post your experiences and data points in the comments. Greg is also asking for people to report their experiences over on his site.

US bank wouldnt allow me to lower my cash advance limit 🙁

Wow I haven’t heard of that before. Best to be cautious before using that card I guess. U.S. Bank does things quite a bit differently than other banks in a number of ways.

I funded $1,500 (signed up with ISIS Wallet) my Serve account with my Chase Business Ink Plus card in early October and just had to *pay* $151.84 in cash advance fees. Interest starts accruing on these right away it seems. It’s no longer a pending/maybe problem, but it is really happening. Was coded as Sale->Finance & Other, but cash advance fee charged nonetheless. Switching to Barclay Arrival card next month.

Apologies, early *November* — the 7th, 9th, and 10th.

So sorry to hear that Rich. Thanks for sharing your experience. It seems our options are dwindling.

For what it is worth –

No cash advance fee charged from Amex Serve transaction on recent Chase CC paper statement.

Card: Chase ink Business Plus

Server Transaction Details:

Date of Transaction

11/11

Merchant Name or Transaction Description

AMERICAN EXPRESS SERVE ST 8…9 FL

$ Amount

200.00

My Citi Thankyou Premier: Transaction Type: Cash Advance; Category: MORTGAGE CO/NONFINANCIAL INST/TRAVEL CHK (on 10/10 and 10/12).

I did not see the associated CA fee though. However, I need them in the right category for the sign-up bonus ($1000 short now), right?

What could I do?

If it did code as a cash advance then it will not count towards the purchases needed for a bonus. Is the transaction still pending or did it post? Some people have reported it showing as a cash advance while pending but it still posts as a purchase.

I see. These are posted already. Am I supposed to dispute with CIti even there is no fee posted? If I need to quickly MS $1000 for signup bonus now, could I just use PAyPal or Google wallet?

So the ADVANCES*TRANSACTION FEE finally shows up in the statement. $10 for each $200. I chatted with Citi but they refused to waive the fee.

[…] It appears that American Express has changed the merchant category they use when reporting online Serve credit card loads. Several people have reported being charged cash advance fees for Serve loads this month. You can find the latest info and what banks are known to be charging the fee along with my advice on how to safely avoid extra charges here. […]

As reported on my Barclay Arrival account, the merchant category for Serve changed between Oct 7 and Oct 9 from “Buying/Shopping Services, Clubs.” to “POI Funding TXN.” However, both transactions were processed as purchases (not cash advance) and earned points as usual.

Emigrant Direct Visa charged a $20 cash advance fee for “taking $200.00 cash out” of Serve on 10/8/14.

The merchant category for Chase Marriott Rewards on Serve loads is Online, Mail, or Telephone transaction up to 10/6/2014.