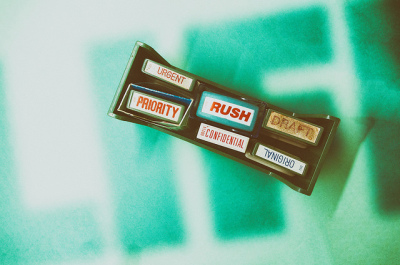

Urgency Is Everywhere

From time to time I go on a rant about credit cards and deals. I talk about how debt is evil and how the latest deal isn’t always the best deal.

As Americans we are bombarded by marketing messages all of the time. I stand firmly on the ground that marketing is inevitable and thus the consumer must be educated.

The average person who reads this site is well educated and makes a fair amount of money. My average reader also has great to excellent credit and prides themselves on how they handle their finances.

Why is it then that credit card companies offer such lucrative bonuses? Some will say it is the swipe fees they collect, however we all know that interest is the real reason.

If you are reading this site then you are either a miles/points veteran or a person newer to the arena who is trying to find out more information. Both are great!

Those who have been around awhile recognize marketing messages for what they are. Just as McDonald’s tells me that “I’m Lovin It”, Chase tells me how great the Ink card is. It is all the same.

Just like McDonald’s commercials convey the feeling of happiness when our bellies are full with a hamburger, bank marketing messages show us all of the wonderful places we can travel with “points”.

But we must always come back to the realization that people are paying the interest. If they weren’t then the banks wouldn’t offer such high bonuses to attract us. They wouldn’t be so agressive in their marketing.

The average rewards credit card carries a much higher interest rate than a standard card. Is it worth using a card with a higher interest rate if you carry debt? No, and that is the secret.

These days we are bombarded with even more and more marketing. I even write about exciting deals and sometimes forget to mention the downsides. Even though I am not being compensated, I still feel some responsibility to inform.

The great deal of the moment is for the Chase Ink card, however there will be a new one when that passes. Some of the deals will work for you and some will not. It is ok.

In the end I earn and burn over a million miles/points a year and do it all without ever taking on any debt. It takes discipline and often is a lot of work. While writing this blog is my job, some of the miles/points stuff falls firmly in the hobby category.

If you think that you will travel everywhere for free with a minimal amount of work or effort, then you are wrong. After all, if it was that easy then everyone would be doing it.

On the other hand, if you realize that your discipline, knowledge and good credit can open doors to amazing experiences that you would otherwise never have, then you are in the right place!

While my rant is over, I just want to remind everyone to study this hobby. Take the time to read and learn. Ask questions when you are not sure. Slow and steady doesn’t make you a loser.

Sometimes it can feel like you need EVERYTHING NOW, but in reality you don’t. Now don’t forget to go to Staples for the gift card deal, send your last Amazon Payment before it ends tonight, oh and my giveaway ends in a few hours. SO MUCH URGENCY! 😉

[…] applying I highly suggest reading the following post about taking it slow. Also please feel free to read our credit card reviews and credit card related […]

[…] applying I highly suggest reading the following post about taking it slow. You can find all of ourcredit card reviews here. Thank you for the […]

[…] applying I highly suggest reading the following post about taking it slow. You can find all of ourcredit card reviews here. Thank you for the […]

[…] applying I highly suggest reading the following post about taking it slow. You can find all of ourcredit card reviews here. Thank you for the […]

[…] applying I highly suggest reading the following post about taking it slow. You can find all of our credit card reviews here. Thank you for the […]

[…] for everyone, it is a decent way to manufacture spend at a negative cost. As always I suggest starting slow to make sure this deal works for […]

[…] Slow & Steady Doesn’t Make You A Loser from Miles to Memories […]

Great post, thank you for taking your time to raise this issue. Try to keep it up, even when you have some CC links to link and receive commission for them.

Cheers,

PedroNY

[…] Slow & Steady Doesn’t Make You A Loser – Miles to Memories Great down to earth advice here. Awesome comment by J. […]

Congrats, this post made the next TBB edition (the good one, not the Blog Buzz angry one!). Excellent advice!

I commend you for this posting. Its a shame the message is going to be drowned out by the other 99 blogs on BoardingArea that simply push credit cards deal after credit card deal after credit card deal.

There is one statement you make that I do not agree with: “Those who have been around awhile recognize marketing messages for what they are.” Even those who are newbies can recognize that marketing statements are biased. We are so bombarded by advertising these days that most everyone is cynical about ads. Thats why credit card companies have created affiliate links. Rather than advertise themselves, credit card companies have gotten many bloggers to do the dirty work for them by offering them money to shill for the credit card companies.

Sure, bloggers are required to reveal they get paid by the credit card companies, but then they go on to say that all the opinions in the article are their own. Quite frankly that is a load of BS. Readers, especially naive newbies, see a “respected” blogger talking about luxury travel for nothing and do not recognize that most blogs are basically just one big billboard for the credit card companies.

Once again I commend you for encouraging readers to think for themselves rather than just jumping into the credit card game. Unfortunately, it is likely this message will be drowned out and ignored. BoardingArea has expanded so quickly and all the bloggers are so eager to get a piece of the pie that on days with a new credit card deal or days when a deal is expiring, more than 50% of the postings on the BA front page are about the same exact deal. The only people that can really stop this are the bloggers themselves and Randy Petersen. I think we all know how likely anyone is to turn down easy money though.

I wish you success in blogging. We need more bloggers like you. I won’t be holding my breath though.