| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

|---|

My Easy Path to a Free Companion

The Southwest Companion Pass is pretty well known among travel hackers. Despite their recent devaluations, Southwest remains a fantastic value if you can get your hand on one of these passes. Thankfully getting one is now easier than ever.

The Companion Pass

For those who are new to miles/points, the Southwest Companion Pass is gained when you earn 110,000 Rapid Rewards points in your account during a calendar year. When that happens, you get a pass which allows your companion to travel for free with you on both cash and points bookings. (You just pay their taxes.)

The pass is good for the rest of the calendar in which you qualify and the entire next year. So passes earned this year, are good through the end of 2016! Does this sound a little too good to be true? Well it sort of does, but it really is one of the best deals around and it is far from a secret.

Ways to Earn the Companion Pass

There are a few ways to earn the points that count towards the companion pass:

- Paid flights (yawn)

- Credit card earnings

- Shopping portal earnings

- Transferring points from some other programs (Note: Ultimate Rewards transfers don’t count.)

As you can probably tell from the list, the easiest way to get a pass is via credit card bonuses. (Although some advanced hobbyists easily get Companion Passes via the Southwest portal.) Since the Southwest credit cards often have 50,000 point sign-up bonuses, it has been pretty easy in the past to get 100,000 points.

For example, you could get the personal Premier and business Premier cards at the same time. Each of these cards has a $2k spending requirement for the bonus, so you would only be 6,000 points shy of the pass after getting the bonuses. This is how my wife got her pass last year.

Of course to fill in those extra 6,000 points you could simply MS or use the cards for purchases. You could also shop through the Southwest shopping portal or transfer Marriott points over. Well thankfully you don’t have to do those things anymore.

The 110K Credit Card Combo

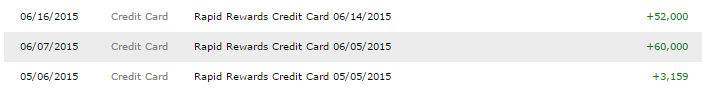

Historically the highest bonus on the Southwest cards has been 50,000 Rapid Rewards points. Thankfully now, the Business Premier card has a 60K link. I wrote about it a few months ago and you can find the direct link in my original article.

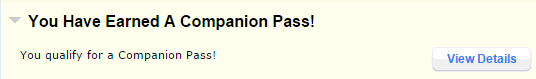

By combining the 60K Business Premier card with a 50K personal card, you already have the 110K needed for the Companion Pass as soon as you get the bonus! (You actually end up with 115K after meeting the spending requirements.) That is exactly what I did. I got both of the cards recently, met the spending requirements and obtained my companion pass.

Personal Plus or Premier

You might notice that there are two versions of the Southwest personal credit card. (Although the Plus card isn’t advertised on the Chase site.) The main difference between these cards is the annual fee (which is not waived the first year) and anniversary points.

The Plus (direct link) has a lower $69 annual fee and gives 3,000 anniversary points while the Premier (direct link) has a $99 annual fee and 6,000 anniversary points. I personally went for the Plus since I have a ton of Southwest points now and prefer to save on the annual fee. (Note: The Premier also has no foreign transaction fee and earns 1,500 qualifying points for each $10k in spend.)

Chase Churning Rules

I feel it is important to note the recent developments regarding Chase and credit card churners. Recently they have been denying applications for some cards to people who have had 5 or more applications in the last two years. The Southwest cards are not part of that, but it is something to keep in mind. You can find out more information here.

Conclusion

For me, getting the Southwest Companion Pass was as easy as applying for two credit cards and meeting minimum spending requirements. Now my wife and I both have a pass so we can book four seats for the price of two, which is an incredible value in my opinion!

In regards to applying for the business card, do you actually have to be a business owner with a Tax ID number to qualify? Can anyone apply and use the card simply for “business” means?

Enjoy your blog. Appreciate any insight….

Here’s a complicated question:

I churned enough to get the companion pass. I registered my wife as my “companion”. We have two kids – one is 18months and the other is 3 months. We just flew to chicago and back (all four of us) for the price of one ticket because both children are lap seats

Here’s my dilemma: My wife wants to go see her family in Colorado. I can’t go because of work. Can I still buy a ticket for myself, add my wife as a companion and just have my wife board with her and my ticket and have the 18month old baby sit in my seat? This way the three of them can still travel for the price of ONE ticket.

Otherwise we would have to buy two tickets (one for my wife and one for the 18month old and the 3month old would sit on my wives lap)

Any experience on this scenario would be greatly appreciated!!!

Thanks

The primary has to fly for the companion ticket to be valid and they won’t let her check-in and get boarding passes for two lap children either. I don’t see any way to avoid that second ticket.

Hey,

I just attempted to apply for both Southwest cards(business and personal) and was only approved for one. When I called they told me you can only have one card within the reward program. Has anyone else come across this scenario?

The “offer details” say Tier Qualifying points are capped at 15,000 per year. Doesn’t that mean spending and bonus points won’t get you there anymore?

Hi, thanks for the great info. You mentioned that “Ultimate Rewards” don’t count when transferring the points into the Southwest program for purposes of the companion pass. Are you referring to the points one would earn by using the Chase Sapphire Card? I did see on their website that Ultimate Rewards will transfer to Southwest on a 1:1 basis. I was considering getting this card because it seems like a good way to earn and redeem. Do you mean that it can transfer, but not count? Could you please comment on this to provide some clarity? Thank you again for providing great detail in travel hacking!

You need to earn 110,000 Southwest points in a year to earn the companion pass. If you transfer Ultimate Rewards to Southwest, those points transferred in don’t count towards the 110,000 required to get the pass.

My future husband and I want to pay for a portion of the wedding expenses with rewards cards. I’m considering applying for the plus southwest credit card. I’m new to this, though. If he gets a personal card, and gets the 50,000 points and I do the same in my name, can I transfer my points to his account to make an accumulated amount of 100,000 points?

Thanks, Shawn, I had read somewhere that the SW Plus personal card had been discontinued – good to hear it’s still around.

@: I was also recently denied (06/13) for SW personal card citing more than 8 inquiries in last one year. My score is 780+. Seems chase is also cracking down on partner cards churning

Hi Shawn,

I tied to apply for a business and personal sw card but the sw system would not let me apply for 2 cards like, one right after the other. How much time must pass between applications?

As for the first card i got a message that they would review my application and get back to me in 7 to 10 days. I contacted them in 15 days to find out whats. Up. Next day got a call from chase wanting to know why i needed more than 2 cards (sapphire and freedom) and so much credit (15 +15)

I told the reviewer I was doing alot of travel within usa that i hadnt done before and the new internatioal routes interested me. Alot of blah blah well she must have bought it as she said she would reccomend i be approved to her manager.

Not sure about that, since I have done two applications before in a short period of time. The problem may be with having so many recent Chase applications. The bank seems to be much more strict now on approvals, so they could be what is causing the issue. I have never heard of the system blocking you like that. You could always use incognito mode or another browser in the future.

I have greater than 800 credit score and was denied the SW card for too many new cards

“Although some advanced hobbyists easily get Companion Passes via the Southwest portal”…could you explain this a bit? I got companion pass earlier this year by getting a personal and business credit card, so I am good till end of 2016. But wondering if besides CC and Marriott, there were other ways to get the companion pass.

Hi jediwho – I think this is in reference to the Southwest Rapid Rewards shopping portal. Sometimes the portal has short-time special offers like “10x rewards” (10 SWA miles per dollar spent) at merchants such as Sears. So if you spend $11k on merchandise, you’d get your 110k SWA miles for the CP. Unless people have big personal expenditures, most people are likely reselling the items they purchase. Another route would be the half-way route, with one SWA Visa and the other half via the shopping portal.

There are quite a few people who wait for limited time portal deals and then buy and resell items. I know of a couple who have earned the 110,000 points completely through this method.

The Companion Pass is fantastic. It has saved me a lot of money over the past couple years.

What have people’s experiences been with getting the personal Plus & Premier at the same time (or maybe separated by a few months)? I just had a friend ask me about this, and they are not comfortable applying for a business card (even though they probably could). I think I’ve read conflicting posts about getting both personal versions in the past.

I didn’t want to apply for a business card either. I applied for one in November 2014 and the other in February 2015. Both instant approvals and received companion pass.

Hi Shawn. Great article.

Quick question…you said, “So passes earned this year, are good through the end of 2017!”

Since it is 2015, wouldn’t the pass expire at the end of 2016?

Thanks.

Good catch. I did indeed mean 2016. The post has been corrected. Thanks Peter!