Statement Credit Amex Offer

I have been trying to line up the end of the year the last month or so. This is the time of the year when many of us are digging deep to find something of value to work on. Most of our yearly spending caps are maxed on our cards and our free night certs have been earned etc. I ended up signing up for a few cards, which I’ll detail in an upcoming post, and thought I had a game plan in place. That was until I saw one of those statement credit Amex offers on my wife’s account. It had me switch everything up in an instant. Let’s take a look at the offer, why I think it was perfect for me and what value I expect to get from it.

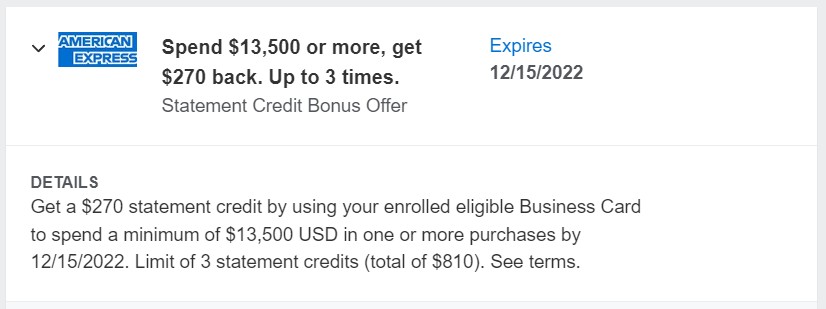

Amex Offer Details

I have gotten a few of these Amex Offers that offered Membership Rewards, or cash back, after spending obscene amounts of money. Something like 10,000 MR points after spending $40,000. Totally not worthwhile. I have never been targeted for one of those crazy spend $500 get $500 type offers that looked like an error but Amex paid out on.

This latest offer, on my wife’s Hilton Business Amex card, was something in between those two extremes.

- Spend $13,500 or more, get a $270 statement credit

- Can do it up to 3 times

Breaking Down The Value Of This Offer

On the surface this offer is just okay. The $270 statement credit is a return of 2% on that $13,500 in spend. That isn’t bad, especially when considering I would get another 1.35% – 2.7% back on the spend via 3X or 6X in Hilton Honors points. That would bring me well above 3% on average, pretty hard to beat for everyday spend without a welcome offer.

The thing that pushed me over the top though was that we hadn’t done any spend on the card yet this year. This was the card Amex paid us money to keep with a retention offer worth more than the annual fee. It gave me a little profit towards my now $25K+ in earnings.

The Hilton Business Amex earns a free night certificate after $15,000 in spend, just like the Amex Surpass personal card. Since I had not completed that spend yet completing this Amex Offer would essentially earn me a free night certificate as well, only $1,500 short of the requirement. If you add them all together the value looks something like this after $15,000 in spend.

- Free night certificate worth at least 70,000 points to me – (70K x $0.0045) = $315

- Points from spend (estimated $10K 6X earning, $5K 3X earning) = $337.50

- Statement credit = $270

- Total value = $922.50

That is a return of 6.15% on my $15,000 in spend. The numbers could vary a bit depending on where I use the free night certificate and how much of the spend I do in the bonus area but I am confident I will get at least the value listed. I’ll take a 6%+ return every day and twice on Sunday!

Statement Credit Amex Offer: Final Thoughts

You know how the saying goes about making plans, don’t you? Well, I can have my well laid plans ruined all the time if it brings me outstanding value like this surprise deal did. If I had already complete the $15K in spend on the Hilton Business Amex card and earned the free night certificate then I probably wouldn’t follow through on the offer. It would have been decent still, but not great. But, by adding in the value of the free night certificate I would be stupid not to chase it down!

Just curious for big spend offers like this, do you ever compare to the many 5-6% opportunities you would have all the time even at scale with cards like Chase Ink and Wyndham Earner card – I guess the second one makes less since if you don’t ever stay at Wyndham Grands and you were already considering the spend for the free night.

Something you need to consider for sure if you need to decide between one thing or the other. Most of my 5%+ earning is capped spending and has all been handled already and that is why this makes sense.