The Plastic Merchant Bankruptcy Catastrophe Finally Ends

The Plastic Merchant bankruptcy story has finally come to an end. This has been an ongoing saga for numerous people. Here’s what we know about the end of the story.

Recap On The Plastic Merchant

The Plastic Merchant was a gift card reselling group that started bouncing checks and then fell off the face of the earth in the Spring of 2018. They strung out some truly unbelievable excuses until going silent. October 2019 rolled around, and they filed for bankruptcy in the Eastern District of Missouri. The documents showed that they owed huge sums to some people who would probably have difficulty coming out from under the amount TPM owed them. Remember to never float what you really can’t afford to lose when reselling.

The Final Chapter

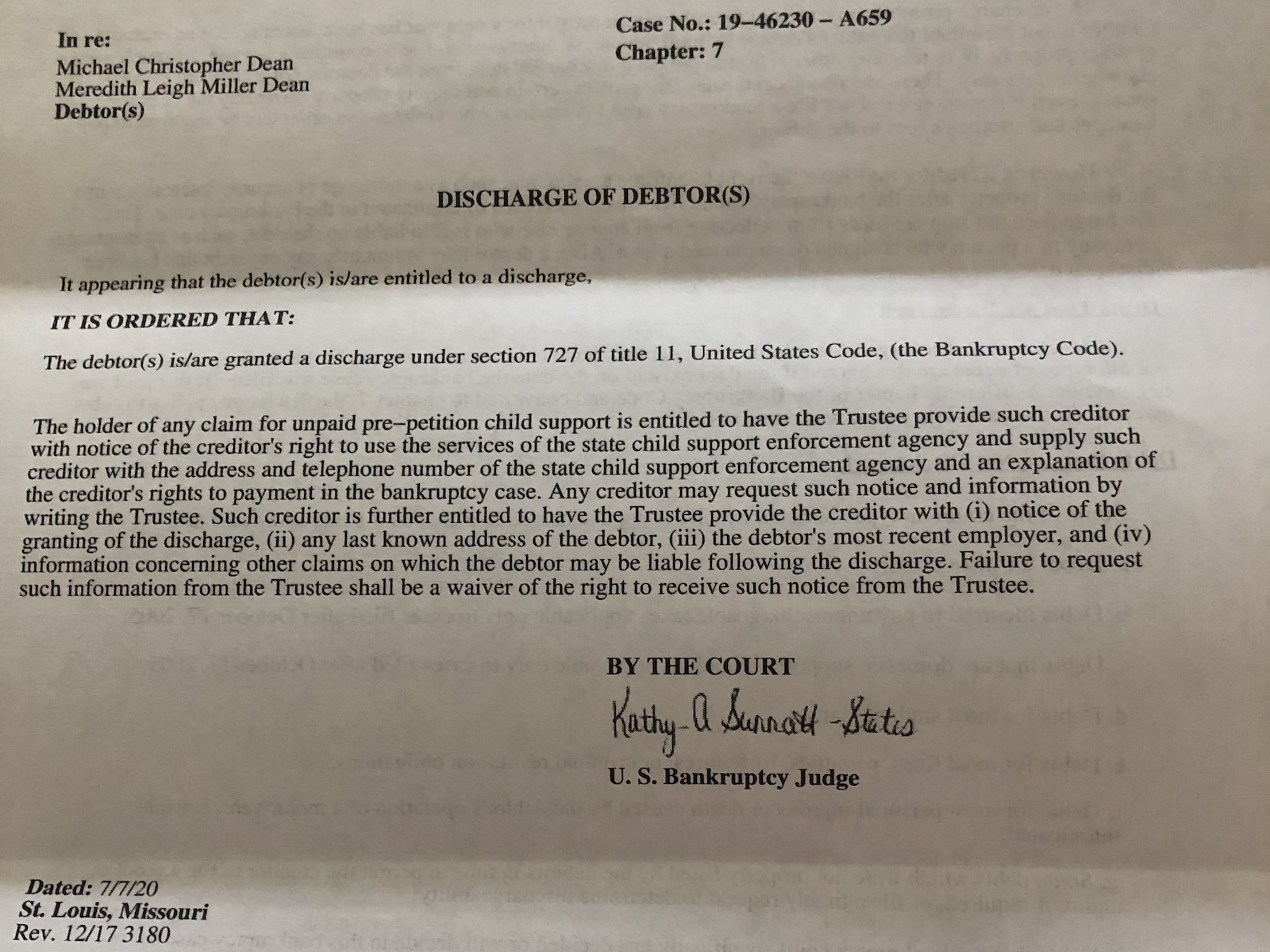

As of July 7, The Plastic Merchant bankruptcy under Chapter 7 is closed. The debts were discharged, meaning creditors named in the documents can’t come after TPM for money owed. If you didn’t opt out of the proceedings, legally speaking TPM doesn’t owe you money now. This is what I expected to happen in the bankruptcy proceedings, and the case is closed.

Final Thoughts

The Plastic Merchant bankruptcy story dragged out much longer than it should have. Once they bounced a bunch of checks, I think everyone knew this day was coming. It just took longer to get here than expected. Gift card reselling is a favorite in this hobby, since it’s an easy way to increase spending and earn more points and miles.Remember to be wary of reselling groups where you do not personally know the people you’re working with. Don’t float money that you can’t afford to lose, especially not for long periods of time.

[…] And you could be working with a bad actor who steals your money. The story of what happened to The Plastic Merchant is […]

[…] inachevées et ont perdu leur argent définitivement lorsque l’entreprise a officiellement déclaré faillite en 2019. Beaucoup de mystère a entouré l’épreuve, mais pas grand-chose ne pouvait être fait sans […]

[…] left with uncompleted transactions and lost their money permanently when the company officially declared bankruptcy in 2019. Much mystery surrounded the ordeal, but not much could be done without consumer protections in […]

[…] left with uncompleted transactions and misplaced their cash completely when the corporate formally declared chapter in 2019. A lot thriller surrounded the ordeal, however not a lot could possibly be achieved with out […]

[…] left with uncompleted transactions and misplaced their cash completely when the corporate formally declared chapter in 2019. A lot thriller surrounded the ordeal, however now not a lot might be achieved with out shopper […]

[…] 2019年に破産を宣言。 […]

[…] left with uncompleted transactions and lost their money permanently when the company officially declared bankruptcy in 2019. Much mystery surrounded the ordeal, but not much could be done without consumer protections in […]

[…] left with uncompleted transactions and lost their money permanently when the company officially declared bankruptcy in 2019. Much mystery surrounded the ordeal, but not much could be done without consumer protections in […]

[…] sad saga is over. Have bloggers who were pumping this shit ever apologized? The Plastic Merchant Bankruptcy Catastrophe Finally Ends. Be careful out […]

@Ryan S: Part of your message was to know who you’re selling to. I actually met Mike at a Frequent Traveler University weekend. He seemed ordinary to me. Nothing gave me alarm. Very fortunately, I didn’t get heavy into MS as he was the only person I worked with and I fully dodged the bullet. My question: how could I have better assessed a bulk buyer like him? I mean this genuinely!! I don’t know what I don’t know.

Leigh – you’re right. That is tough. People who have met him tell me it seems like he came out of nowhere. I got into TPM from a friend who’d been doing it for almost a year, and he’d never met Mike. It seems like Mike charmed a lot of people, so I don’t have a good answer for you.

If you met him at Chicago Seminars when he first started, you would have observed that he likes to spend a lot of money. Expensive bar tabs, party bus rentals, etc. Probably wasn’t setting himself up for a long carer in a low margin business

https://i.ibb.co/rw78Xvp/Mike-Photo.png

Wow. My $40.10 might be the smallest # on that list. I definitely got “lucky” timing wise as some of my TPM checks were in the thousands.

Couldn’t they have blacked out people’s addresses?

Legally, it’s required to be published like this.

This is a very valuable lesson that everyone should be very happy that they got, even those that lost a lot of money. Our capitalist system works on personal responsibility. You stick your neck out you are responsible for it.

Just like the students that betsy devos is screwing who paid fees to for profit colleges which then folded. Our system of “caveat emptor” means you take full responsibility and if you are a supporter of the party of personal responsibility you should sing “hallelujah” as you get screwed because the system works just as you wanted it to work.

So sucks to be you but hallelujah.

You and AC should get together.

The fact that they amassed $335,000 in credit card debts is amazing too.

For supposedly having medical problems that sidelined the whole business, surprising they only had $10k in medical debts.

Somehow they get to walk away from this free and clear.

I hadn’t done much with them in 18 months; feel terrible for the folks on this list with significant losses.

What scum. Karma is a bitch. I have no doubt they’ll get theirs.

I believe the medical thing was only right at the end, and I have doubts about how much that actually related to the business. They were already bouncing checks by the time that statement came out.

Well, if you call having anything of value taken away by the court, no ability to get credit, and not being able to rent an apartment, buy a house or car or get anything but a prepaid cell phone for the next 7-10 years “walking away free and clear” then I guess they did.

From all the reports I’ve read earlier, they sold or gifted the house to her mother just before the deadline to have it included in this. They get to have $4000 a month in expenses excluded from anyone touching. That sounds like they got out of this better than anyone else. I would imagine that $350,000+ in cc spend didn’t just create $500 in furniture and household assets. There is something elsewhere.

Yeah, it’s super fishy.

Yup, hire a bankruptcy lawyer and wait well over a year to file. No one with only a couple of hundred bucks lost is going to do a thing about it

@Leo,

If you look at the dates of the sales (flips) and it is the same as the address of the business. See Zillow 3464 Charlestowne Crossing Dr .

Which MIL leases to them for $400 a month untill April 2020 (When Property sold) .

They left their previous address 3749 Arpent St 10/2016 ~ 7/2018.

The MIL purchased 8/16/2018 for $19k less than sale on 5/10/2018, Original sale was 5/15/17 for $250K

It looks $52K was cashed out of a retirement account sometime in 2018.

Its also unusual to see what I assume based on kids ages – is almost $100k in retirement funds (unless he maxed out contributions, or had some great timing on funds. I’m painting with a broad brush . ( Also basing on the PEERS – Secretary for the school system at about $38k/yr.

I don’t have and never had any skin in this game with TPM or know mike. But the just looking over all the numbers and it looks like conservatively $350K+ is missing from just the numbers listed in the filing.

I can think of four or five ways of how this would be an easy con that was hard to prove and harder to track the money.

the plot thickens

Where do I sign up to get half a million and just have to endure bankruptcy?

The CC debt was probably initially probably 30- 40% of that looking at the number accts, and the number of collection agencies related to said cards.

Figure it snowballed up quick at 29% penalty intrest, plus tack on late fees, over the limit fees, fine print fees for each card it could ballon up fast over 12 months (Considering the lawsuit dates breach of contract).

Mike was an arrogant man. Got himself in too deep and had too much pride. Kept fighting the quicksand. There are hospitals and doctors listed as creditors, I think he was really was sick at the end, but the business was already insolvent by that time

the “but” is the most important part, in my eyes.

It does look they had a daughter in 2017 and wife had no income for 2017. (lists 2 y.o. daughter as dependent).

Unless they ran up credit cards limits on medical bills. I think unlikely – if income was as listed many Doctors and Hospitals will work with you and lower bills and do payment plans.

So sad for the woman who lost 89k to him. Horrible timing to go big on a sale and “sell” it all to him. Shame on Michael for taking a huge amount of cards from her knowing he was in serious financial trouble at that point. Having a lot of people losing a few hundred dollars each would have been less scummy.

Without knowing all of the people, I do wonder if she was able to recoup some of that by exchanging the gift cards to get new ones (which he didn’t have access to the codes for) and then selling elsewhere. The “money owed” and how much someone actually lost are hard to know, but it’s still a lot.

Anyone could have a business failure but for Mike to continue to operate as a bulk buyer when it was clear he was in way over his head is clearly wrong. That our legal system allows him to walk away without consequences is much worse. I grew concerned with his aggressive behavior and lame excuses for delayed payments several years before this happened and took my small volume elsewhere, but I feel bad for the people that were harmed by Mike.

I lost about $200 with TPM, which is nothing to compared to other people I saw on the list. I sold To TPM for about a year and half and slowed things a lot once one of my cards got switched from mastercard to Visa. I could have been greatly impacted if that didn’t happen.

I just wonder what happened to the guy. Was that story of him Being ill fake and used as an excuse to cover his debt? Anyone know?

The illness didn’t cause his business to fail. When he realized he was underwater, that causes him to be hospitalized briefly. It’s just an excuse for his extravagant lifestyle paid for by other people’s money.

It’s all fun and games till someone catches up with the owners… and I would bet that someone will.

Anyone that buys and resells gift cards simply to get credit card points is living in a very questionable grey area. Clearly not intent of programs to allow this. Frankly I’m glad when people are caught and lose points or have accounts closed. Even better if they actually lose money!!

Opening credit cards simply for the points and then repeating it over and over is also not the intent of the programs, so I’m not sure why people would partake in this hobby while making that argument.

I hope some day you will find happiness in your life.

That guys trolls blogs all the time. He pretends to be a high dollar former executive that loves paying large AF’s and making sure the banks come out ahead. It would be funnier if he was better at it.

He’s a douche. Sad world that you can swindle people and with a simple stroke of a pen, not be responsible.