These Third-Party American Express Cards Are Not Subject To New Limits

Here is a look at which Third-Party American Express credit cards are not subject to the new limits. Now that Amex has further restricted the number of cards you can hold at one time, it’s helpful to know which cards are NOT subject to this limit. The cards in this article are third-party Amex cards. This means that they are branded as American Express cards but are issued by other banks. This means the rules are different.

Recap On New American Express Rules

Last month, we reported on new limits from American Express regarding the number of cards you can have at one time. This applies to new limits on credit cards (4) and cards without a preset spending limit (10). This further restricts the American Express application rules we covered here in our application rules for each bank. Their constant changes in application rules and card limits make them quite unpredictable these days.

Third-Party American Express Cards Have Different Rules

These rules relate to cards issued and managed by American Express. Cards issued by other banks have their own rules. Thus, third-party American Express cards offer unique opportunities to have additional American Express cards beyond the limit. Why does this matter? Let’s look.

Access To Unique Perks

Different banks have their own rewards program. Yes, the American Express Membership Rewards program is fantastic in its own right. However, programs from other banks may be of interest to you, depending on how you can use them for travel, cash back, erasing purchases, etc. Bank of America Preferred Rewards and U.S. Bank FlexPerks / Real-Time Rewards are good examples here. Other perks from these credit cards include waiving fees on your checking account by having a credit card from that bank.

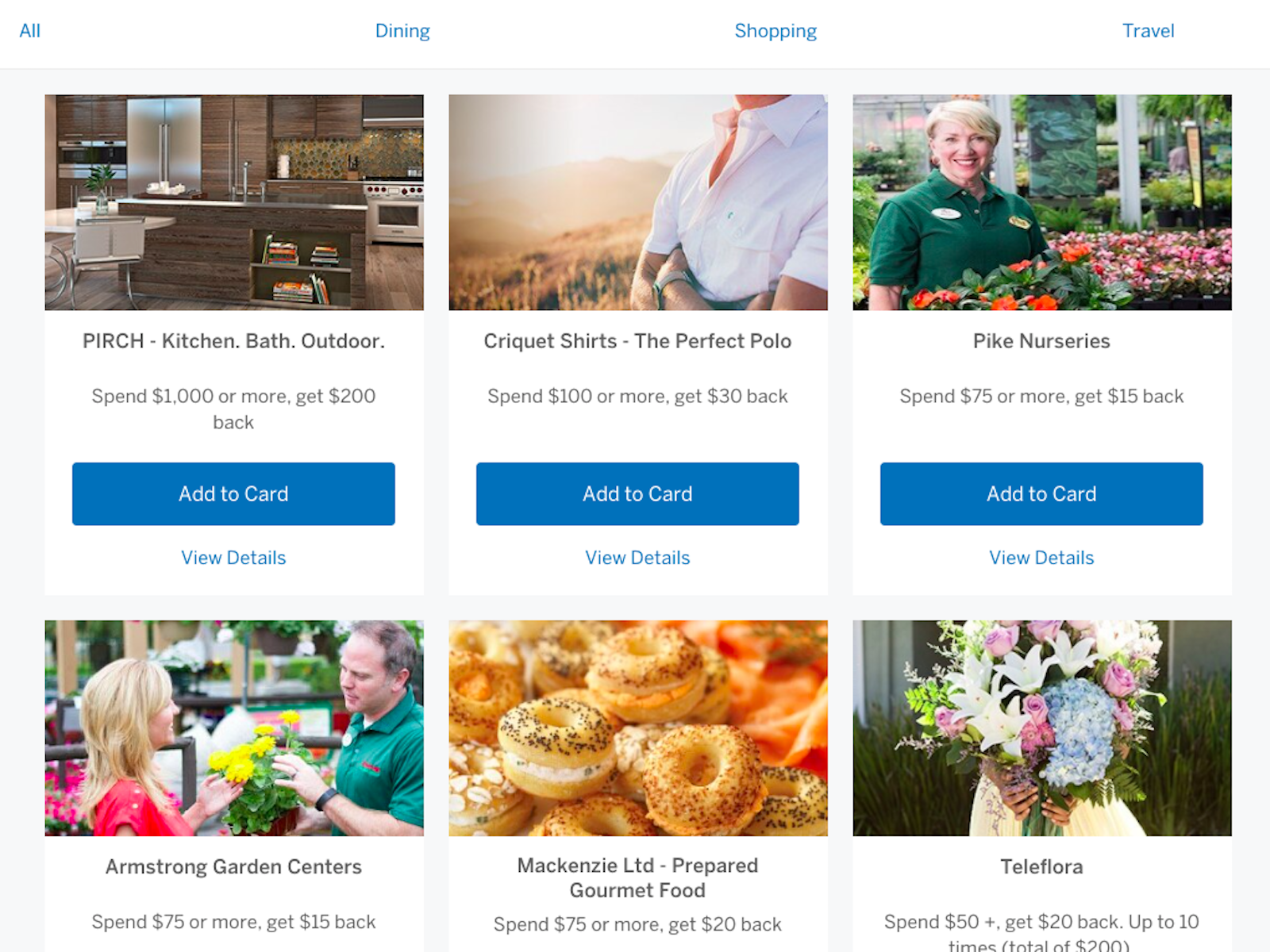

Access To Amex Offers

Did you know that third-party American Express cards have access to Amex Offers? I love Amex Offers, as these can lead to big savings or even profit, depending on the deal. Though there are fewer options, you can still have access to some of these Amex Offers via the American Express Connect website. Simply add these to your third-party Amex card and use that card for the purchase.

Build Relationships

Many of these cards are issued by banks that provide other services, as well. If you’re looking for things like car insurance or a mortgage, having a pre-existing relationship with the bank can help you earn better rates or a higher chance of application approval.

Build Credit History / Account Length

The best thing about cards with no or low annual fees is that you can keep them open for a long time. In this hobby, we often suffer from short ‘average account age’ issues on our credit reports. Having a no annual fee card that’s been open for 7 years helps bring up the average age of your accounts. Plus, you won’t have to close it to make room for other cards, because…

Avoid Closing Amex Cards

The biggest item here is that you won’t have to close an Amex card to get a third-party American Express card. If you’re past the Amex limit of 4 credit cards, you’ll need to close a card to get a new one. Maybe you don’t want to close any of those cards right now. If you still want to open a new credit card for the welcome offer, this provides another route. You can avoid closing your Amex card while also opening a new card. Remember that you will be subject to the other bank’s application rules, not those with Amex itself.

Third-Party American Express Cards

So, what cards are there? This list is not exhaustive. It’s not uncommon to find a local credit union offering American Express cards. Additionally, numerous banks moved away from American Express in 2017, eliminating cards they previously offered and product changing customers to the same card but now backed by Visa or Mastercard.

You can know if a card is issued by American Express or is a third-party card by the application terms. These are the terms from the Wells Fargo Propel American Express:

American Express is a federally registered service mark of American Express. This credit card program is issued and administered by Wells Fargo Bank, N.A. pursuant to a license from American Express®.

Here are common third-party American Express Cards available to applicants:

FNBO American Express Card(no longer available to new customers)- U.S. Bank FlexPerks Gold Credit Card ($85 annual fee)

- USAA Military Affiliate American Express Card

- USAA Rewards American Express Card

- USAA Cashback Rewards Plus American Express Card

- Wells Fargo Propel American Express Card

- Wells Fargo Propel World American Express Card ($0 first year, $175 annual fee after that)

Because these cards are not issued directly by American Express, you pay your bill or talk to customer service at the issuing bank. Basically, you do not interact with American Express but with the bank who issued the card via license from Amex. Also, aside from the U.S. Bank FlexPerks Gold, all of the other cards have no annual fee.

Final Thoughts

As banks continue to update their application rules and/or become more stringent during the economic down turn, it can be difficult to keep up with the changing rules and limits. Many of us are at or above the new limit of 4 cards with American Express. Knowing that there are third-party American Express cards on the market opens more possibilities for credit card welcome offers and exploring different types of perks.

If you have a favorite third-party Amex card that we didn’t mention, what is it? What’s good about it?

Will I be able to add & get credit for an amex offer to a 3rd party card AND an amex issued card for the same offer?

Dawn – yes you can. You can use the same offer on those 2 cards, as long as it shows up on the portal I linked above and in your ‘Amex offers’ the normal way.

The Wells Fargo Propel card (a different product – without the ‘World’) has a $0 annual fee. Has some decent perks too.

Great point that there are 2 products. I added it to the list. Thanks!

Wells Fargo Propel World American Express Card ($0 first year, $175 annual fee after that? I have this card thought it was no AF? When did this change?

I don’t know how long this has been the fee, but it’s been over a year at least.

https://www.wellsfargo.com/credit-cards/propelworld/terms/

The propel works has an AF buy it is waived the first year

Good point. I forgot there’s a fee after the first year. Thanks.