Taking Stock of My 2022 Credit Cards: Wins and Losses

I haven’t had much of a credit card strategy over the past couple years. With travel on the fritz during the pandemic, to sky-high award prices this summer, it’s been difficult to plan ahead. I’ve been mostly opportunistic with the new cards I pick up, either taking lucrative offers to bank the miles for later, or pick up cards I will get ongoing value from, even if the welcome offer is low. The summer 2022 credit cards I applied for are no exception.

Prior to my round of new card applications earlier this month, my three most recent new cards were with American Express and Citibank. All were approved. In order, I’ve gotten an American Express® Business Gold Card, the Delta SkyMiles® Reserve American Express Card, and finally a Citi®/ AAdvantage® Platinum Select® World Elite Mastercard®. With all these miles and points banked, here are the next few I targeted.

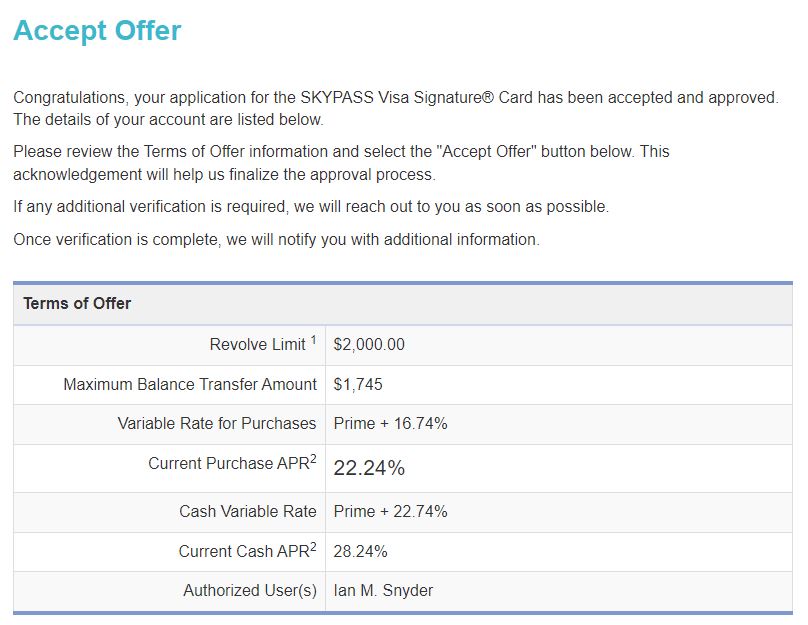

Korean Air SKYPASS® Visa Signature: Approved

Korean SKYPASS Miles are a currency I’ve never used. I never took advantage of their sweet spots when they were still a Chase Ultimate Rewards transfer partner. Their card offers usually aren’t great. But the elevated welcome bonus of 50,000 SKYPASS miles, even with a higher required spend, was something I decided to jump on.

Basics on the Korean Air SKYPASS® Visa Signature offer:

- Earn 50,000 Bonus Miles by first spending $3,000 in the first 90 days to earn 30,000 Bonus Miles, and then an additional $7,000 in six months to earn 20,000 Bonus Miles.

- 2X miles on Korean Air purchases.

- Annual discount on Korean Air tickets

- Two KAL Lounge coupons each year

- No foreign transaction fees

- $95 annual fee

This offer is only good for a couple more days!

Even though I have two other U.S. Bank cards, I was approved after a few days. The approval process was the only thing that was confusing. I thought that I’d been instantly approved, based on the “Accept Offer” page post-application. But the subsequent page said they’d get back to me.

Alaska Airlines Visa® Business Credit Card: Approved

If there is one new card deal to jump on right now, it is this one. Alaska Airlines Mileage Plan is one of my favorite programs, and I can never have enough Alaska miles. With multiple trip cancellations keeping my balance high, this offer will push me to over 200,000 miles with this hard-to-acquire currency. With no bank transfer partners, there aren’t easy ways to accrue a lot of miles.

Basics on the Alaska Airlines Visa® Business offer:

- Get 70,000 bonus miles and Alaska’s Famous Companion Fare™ from $121 ($99 fare plus taxes and fees from $22) after you make $4,000 or more in purchases within the first 90 days of opening your account.

- Receive another Alaska’s Famous Companion Fare™ every year.

- Free checked bag on Alaska flights for you and up to six other guests on the same reservation.

- Earn 3 miles for every $1 spent on eligible Alaska Airlines purchases.

- $50 annual fee

- More Info

Citi Custom CashSM Card: Rejected

I guess I should have seen this coming from Citi, but I really didn’t. With multiple new accounts in the past few months, and a high balance (temporarily) on two of my cards at time of application, I got the denial stamp. I may give the reconsideration line a call after paying off my two high-balance cards before the end of August. We’ll see if this changes the metrics. Remember Citi’s tricky 3 hard pulls in the last 6 months rule too.

The Custom Cash card appeals to me due to its flexible 5% categories that you can tailor your monthly spend around.

Here’s a quick card rundown:

- Earn $200 cash back after you spend $750 on purchases in the first 3 months of account opening.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter.

- No category choice or enrollment required.

- No annual fee

It’s a simple, flexible, high return card.

Looking Ahead

I continue to get American Express new card offers through either their website or by email on a near-weekly basis. If Amex keeps this up, I’ll likely apply for either a Business Gold or Business Platinum card later this year, before we hit Q4. I’m also cleaning house with my current set of Barclays cards and might consider either the Lufthansa Miles & More card or Hawaiian Airlines card if the offers remain at 75,000 and 70,000 miles, respectively.

I’d love to get the Capital One Venture X, but I know that’s simply not happening, given the number of new accounts I have opened in the past 24 months.

How about you…how are things faring in terms of new 2022 credit cards?

Yes I’m going to do the same and just pray for the day they close the venture on me for lack of use.

Still not allowed the savor which is why Anything capital one in my possession is permanently locked up.

Thought I would be turned down for citizens since I just collected their checking and savings bonus but nope they gave it with a large limit.

Capital One is pretty much impossible with even a few recent inquiries on your report. At least that has been my experience. I’ve given up.