Why I Don’t Pay Much Attention to Points and Miles Valuations

Points and miles valuations are an attention-getter. Sort of like top ten lists. Or my lame attempt at a catchy title for this article. These valuations spark interest and debate, and questioning their basis isn’t necessarily welcomed. I tend to discard others’ points and miles valuations, as I have a concise method for valuing my points and miles. Here’s my groundbreaking, controversial take: points and miles are worth what I redeem them for. Everything else is just noise. After a few caveats, I’ll share my primary reasons for not paying much attention to others’ points and miles valuations.

Caveats

Of course, I keep up with the valuations on fixed currencies, particularly for cash back rewards. A Membership Rewards point is worth 1.25 cents (via Schwab), a Chase Ultimate Reward point is work 1 cent (and 1.25 or 1.5 cents currently), and a Citi ThankYou point is worth 1 cent (and 1.1 cents with a Rewards+) for cash back, and so on. However, with fixed currencies, there is even a (small) inherent risk, in that a given bank/company could decide to devalue the currency at any time. Also, I pay attention to values (particularly bank points) on the acquisition end. I identify how to most cost-effectively earn points by taking into account point values, bonus points categories, and fees. And prior to amassing and at the point of redemption, I compare currencies to ensure I’m maximizing value.

Now, let’s dive into why I don’t pay much attention to others’ points and miles valuations.

Dynamic Pricing

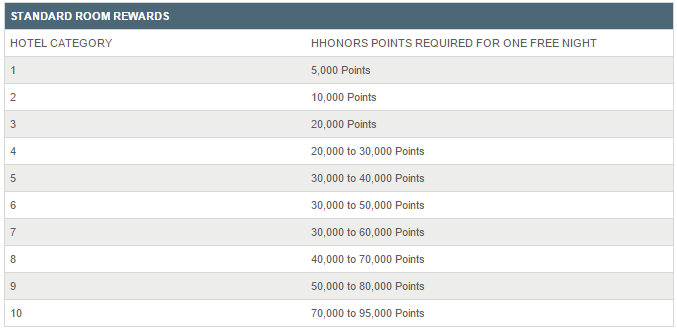

I’m generally happy for anyone who gets what they perceive to be a great cents-per-point (cpp) value on their loyalty points and miles. Without further info, I give people the benefit of the doubt that they are redeeming their currencies for something they actually want. If someone shares their cpp value with me, I don’t get caught up in it, though. Companies increasingly vary the required amount of points or miles for a given hotel or flight. Mostly gone are the days of reliable categories and charts with exact redemption amounts. The major domestic air carriers have done an excellent job of obscuring saver award availability and rates. Hotels have introduced peak and off-peak rates, and others have gone all dynamic, like my favorite program, Hilton.

All of the above makes one’s ability to get the exact same value per point as another person less likely. Even more unlikely is obtaining the same value as what some big-business points and miles website “updates” on a monthly basis. And remember, points and miles are worth nothing until they are actually redeemed, and only then can their value be acquired and accurately calculated. I’ll say it again: points and miles are worth what I redeem them for.

Points and Miles Valuations – An Unnecessary Distraction

For me, I already have enough going on in the points and miles hobby that requires my attention. Earning and booking is time-consuming enough these days (at least for me), and I don’t need the mind clutter that valuations would introduce. Yes, cashing out provides a nice secondary benefit here, in that I know the valuation and do not need to think much about it. But paying attention to valuations of all of the different hotel points and airline mile currencies would quickly overtake the higher priority tasks of booking and traveling.

Varied Travel Styles and Philosophies

No two people have the exact same travel goals. We are all different. You may have been saving up Virgin Atlantic miles to get that ANA first class ticket to Japan. Meanwhile, I’m just trying to get to Hartford without a connection. I definitely don’t care about your Virgin Atlantic valuation, and you probably couldn’t care less about the valuation I got on my domestic Amway-type airline award ticket. In this example, I would choose to eliminate all outside information that doesn’t apply to my situation (noise) and go on with my redemption. I would even do so if we were using the same currency, because the likelihood we are in the same travel situation and share the same travel style is close to zero. As long as my redemption matches up with my travel goals and principles, I don’t care what the valuation is.

Nebulous Origins

Where did these valuations come from, anyway? One prominent site states their valuations are based on what one would pay to buy the points and the overall value one could obtain for redeeming them. Sounds pretty vague and very subjective to me. This same site encourages readers to provide their input if they agree or disagree, which I consider to be crowdsourcing more thoughtful analysis rather than the site actually doing the hard work themselves. This is just one example, but there are others out there.

However, a different site that I think does a solid job is Frequent Miler, where they focus on “Reasonable Redemption Value” (RRV). RRV’s are intended to provide mid-point values that are fairly easy to obtain without much work. Frequent Miler has more meat on the bone with how they determined their RRV’s, also. Kudos to Greg and his team for their thoughtful, well-reasoned analysis.

Points and Miles Valuation – Paralysis by Analysis

Speaking of analysis, if I do too much of it, I may overly question my initial, well-reasoned redemption decision. While I do some analysis, I know that at a certain point I must make a decision and own it. This is very person-dependent, but I don’t think I’m alone here. Valuations can throw a wrench into an otherwise-solid plan and hurt more than help.

Giving Up Control to “The Man”

In this context, I define “The Man” as the big airlines, hotel chains, and banks. From my perspective, any time one takes into account point valuations, they are at risk of being manipulated by The Man. One could be easily seduced into redeeming at a high valuation for something that wasn’t ever a travel goal. Or, based on an inflated valuation, one may wait around indefinitely as he or she searches for that valuation for a given travel goal. This valuation may never come, and The Man could in the meantime devalue their currency further. By paying attention to valuations, one is more susceptible to ceding control to outside forces. Rather, maintain your control – including when, where, why and how you redeem – by resisting valuations.

I’d Rather Be Doing Something Else

While we are talking about valuing rewards currencies, let’s remember our most valuable, unreplenishable currency – time. If I was caught up in valuations and the related extra tasks, I would unnecessarily burn that precious resource. In reality, I don’t waste that resource on valuations since I justify any redemption based on my goals. Instead of bellyaching over valuations, I choose to be with my family, read a book, enjoy my local beach, travel (in normal times), or find new ways to earn points and miles.

Points and Miles Valuations – Conclusion

Those are the primary reasons I don’t pay much attention to others’ points and miles valuations. Again, I’m happy for everyone who gets outsized value out of their points and miles. I, however, highly weight value on my travel goals, and not as much on the monetary side. But everyone is different and has varied priorities. How much do you take into account points and miles valuations in your redemptions?

I totally agree. And one more thing, I hate being “shamed” by the points and miles community when I mention how I used points, etc.

Unless you are regularly paying out-of-pocket the $12,000 for first class flights and $2,000 a night for hotel suites, I don’t want to hear about your breathless “I got a $75,000 vacation for FREE after burning 10 years worth of points and miles” stories. No, you paid $10,000 in opportunity costs. It wasn’t free.

Then again, I fly standby for free or ZED fares and pay $50-100 for 4* Priceline bidding and express hotels wherever I go, so I guess I’m not the expert in getting $75k vacations.

And some program points have negative value to me, like Hilton Honors and credit card funny money bonuses. I’m not paying an extra $50 a night to get $5 worth of points nor am I happy to get 5x funny money at office supply stores when I can buy a gift card at 15% off instead.

I earn points. I redeem points.

Simple.

This article was so spot on! And the “big business“ blog… When they closed down the comments section it was the straw that broke the camel’s back. Hit unsubscribe. Regarding their valuations, I have a suspicion that their valuations are very much in line with the amount of money they’re getting paid by banks. They have lost so much authenticity over the years.

ORDGuy773,

Thanks for reading and chiming in!

I find “that dots dude” site increasingly bogus. They just want to trap the newbies and have pretty much lost their credibility lately.

Benjy: Throughly enjoyed this article, what a refreshing read.

WanderlustingDuo,

Thanks for reading and the kind words.

Benny,

I agree wholeheartedly. I don’t pay much attention to point valuations and I’ll call them out, I think TPG is biased in their calculations and skew things to the way they want their audience to follow. Notice how they hardly ever mention ThankYou points.

But like you said, points and miles are worth nothing until I redeem them. Other sites make the assumption that everyone has a first class seat to the Maldives in mind. That may be true to some but some of us just want to move about the U.S. and are thrilled when we can find saver space on AA via BA for 7.5k or 15k for short hauls.

I accumulate points rather easy these days so I pick where I want to go, use points if it makes sense and be done with it. I don’t want to spend more time trying to justify a value that the time it would take to actually fly the route.

Thanks for this article, very interesting read and I surely enjoyed it.

Randy,

Thanks for reading – I’m glad you enjoyed it! Oh, and I’ll pass along your regards to Benny. 😉

Hahahahaha. Sorry Benjy, auto correct got me!

1) “…at the point of redemption, I compare currencies to ensure I’m maximizing value.”

2) “As long as my redemption matches up with my travel goals and principles, I don’t care what the valuation is.”

??

CR,

If I have two travel currencies that can be used for the same specific travel goal, I pick the currency which I determine gives me the better value at the time of redemption. For the one currency I pick in that situation, if there’s a better value from redeeming it another way (outside of my goals), I don’t care.

How do you determine which of the two travel currencies has greater value?

I agree somewhat with you. Until you redeem points or miles they aren’t worth anything and there are times you “overpay” w points for something you really want.

However I do have a spreadsheet w the values of a leading site for each of my programs. My use of it is deciding whether to use points/miles for a trip or just pay for it. I have the luxury of being able to afford any travel I want (including international business or first class) so don’t use points or miles unless I’m getting at least appropriate value. For example American miles are 1.3 cent in my valuation so if a ticket is priced at $500 I only use points if I can get it for under 38,000 points (using round numbers).

Again I know I am in a unique position where I can always pay or use points/miles but I typically find a way to get value when I use points or miles

AC,

It sounds like you have a method that works well for you! Thanks for chiming in.

I would even argue that the true savings from a Chase business Plus card is half that amount = 625$ a yr – not zero, but potentially not worth min 12 trips to the Staples store and exposure today

The problem is that the manufactured spend gets you gift cards that must be spent somewhere (and that you lose the 2.62c cash back when you use them) so your cost is 1.c a point perhaps

If you could deposit them into your bank account (RIP Bluebird) then it was 0.5c cost for 5x spend but once that is gone – it now is a 1c cost per point to get – so make sue you redeeem for more than 1c to get value

THANK YOU! THANK YOU! THANK YOU!

Benjy,

I agree with your first two assertions: points and miles are worth what you redeem them for, blog valuations are usually overstated and not representative of individual redemptions, be sensitive about time spent on playing the points and miles game. But you missed a critical last observation: folks have to calculate their redemption value to assess whether the points/miles are exceeding the return on a 2% no annual fee cash back credit card which requires no time at all. All three of these observations and actions are required to implement a credit card strategy that maximizes return and benefits for minimal time investment.

JimT,

Often, people are using points/miles from lucrative welcome offers, so the 2% cash back return comparison doesn’t fit that scenario. I would agree using cashback cards’ returns as a comparison for determining whether to spend on other cards is good practice. I generally addressed that in the Caveats section, but perhaps I could have spelled that out further for everyone.

My opportunity cost is 2.62c when I get a point instead of cash back – (BofA Plat Honors)

At 2 points (e.g.) Amex business Plus – it costs me 1.31c to get with guarantee of 1.25 when redeeemed for Amex cash back (Schwab Plat) as a minimum with greater redemptions values possible at times when transferred to airline miles

With category bonuses – e.g., 5x at office stores with Chase I am still paying 0.52c to get it (lost cash back) – now when I have to use it, I can get about 1c minimum value for points for cash or (1.5 with my Chase sapphire) with a max of 25k spend = 125,000 points at 5x = $1250 cash extra saved value minimum each yr (1.5c- 0.5c x 125000 points = 1c saved x 125000 = $1250)

In general for most unbonused spend – get the cash back – you can buy a ticket with cash saved at 2.62c per point

With bonused spend, then it becomes worthwhile, but you are still spending money to travel – if you get cash back you may be happy spending it on a latte at Starbucks, instead of flying across the globe