What I’d Do With 80k AA Miles: Using The Citi American Airlines Transfer

There’s a temporary Citi American Airlines transfer option for points right now. With that in mind, how would I use those miles in my account? In this article, we’ll cover the transfer rules for sending miles from Citi ThankYou Points to American Airlines and also the expected value. We’ll also look at how to earn those miles before jumping into the fun part: what I’d do with those miles.

Temporary Citi American Airlines Transfer

Starting back on July 18, Citi added a temporary points transfer option to American Airlines. The limited-time transfer possibility runs through November 13, 2021. We originally wrote about this news here. A weekly later, Benjy analyzed the value of this transfer to show that you could use many of Citi’s ThankYouPoints earning cards to effectively earn American Airlines miles at much higher rates than with any AA-branded cards, then transferring over.

With an elevated welcome offer (all-time high) on the Citi Premier Card, this further sweetens the pot. Because of this elevated welcome offer and the temporary Citi American Airlines transfer option, we could have 80,000 American Airlines miles at our disposal.

Citi Premier Card Benefits

The Citi Premier Card has some lovers and some haters. Before we get into the long-term aspects of the card, here are the important details of the all-time best welcome offer:

- Type of card: personal

- Card issuer: Citi

- Application rules to follow: cannot open this card if you have received a welcome offer/upgraded/downgraded a card in the ThankYou Points family within the last 24 months, 8 days between personal cards with no more than 2 cards in 65 days, and sensitive to recent inquiries (6 in 6 months typically, but lately it’s more like 3 or less in the last 6 months). You can get this welcome offer even if you have received one on this card in the past. See the bank rules here.

- Spending requirements: $4,000 in 3 months

- Welcome offer: 80,000 Citi ThankYou Points

- Annual fee: $95

- Learn More

Citi Premier Card Benefits

- 3X ThankYou Points on grocery stores, gas stations, restaurants, hotels & airfare

- 1X ThankYou Points on All Other Purchases

Other Benefits

- Enjoy $100 off a single hotel stay of $500 or more, excluding taxes and fees, when booked through thankyou.com or 1-800-THANKYOU. This benefit will be available to you once per calendar year.

- The Premier comes with the ability to transfer ThankYou points to partner airlines and hotels.

- You gain access to Citi Private Pass.

- You can now cash out points at 1 cent a piece to your bank account or as a statement credit.

- They will sometimes run promos where you can get more than 1 cent per point on gift cards.

- No foreign transaction fees

- Learn More

Remember that Citi removed many of its travel insurance & protection plans from cards back in 2019. That means you won’t have trip delay/cancellation or car insurance, etc. when using this card.

What I Would Do With 80,000 American Airlines Miles

So…what would I do with 80,000 American Airlines miles? Technically, you’re going to have more than that. After earning the welcome offer on the Citi Premier Card, you’ll have a minimum of 84,000 miles (80,000 points from the welcome offer + minimum of 1 point per $1 on the $4,000 you spend to get it). I’ll use that number for our trip planning.

American Airlines uses a zone-based award chart. Consult the chart here. Find where you are flying from and flying to, and you’ll find the number of miles needed.

Economy – Couple’s Trip To South America

From the Continental U.S. you can fly to South America 1 (Colombia, Ecuador, Guyana, Manaus [Brazil], or Peru) for 20,000 miles each way, per person.

If you manage to fly in the off-peak dates (January 16 – June 14, September 7 – November 14), each person pays only 17,500 miles for a one-way flight.

Either way, we’ve got enough miles to take a couple’s trip to South America. Visit the Galapagos (read my tips here) or go to Machu Picchu in Peru. For our example, let’s look at

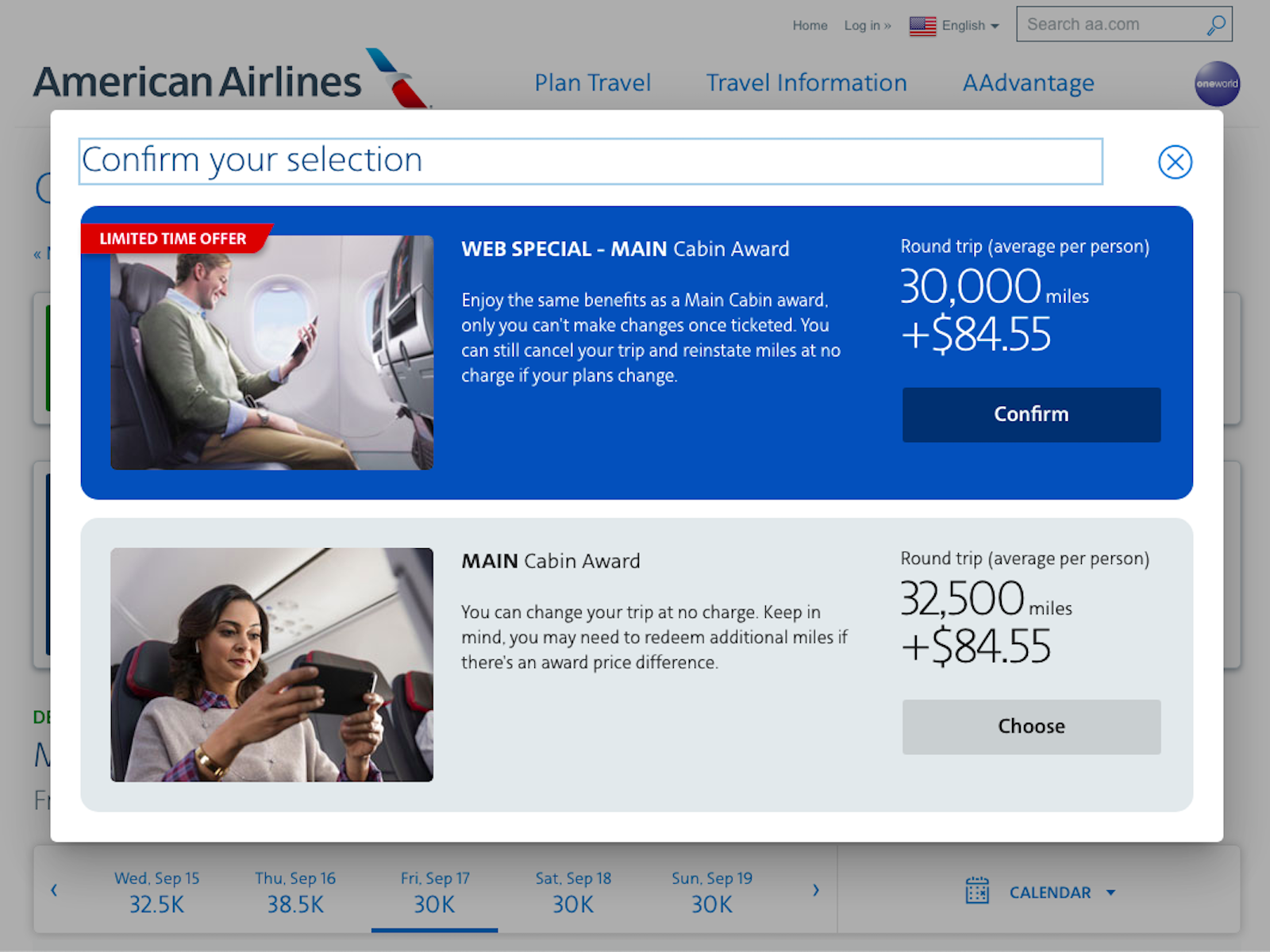

From using their 30-day calendar, I found a deal in September 2021 for 30,000 miles per person round trip. That will use only 60,000 miles of our 84k.

This gets you a week together in Cartagena (my search) or other destinations in South America 1. AA has non-stop flights from Miami to Cartagena, which is a beautiful walled city on the northern coast of Colombia. If you go there, I highly recommend the Hyatt Regency and its rooftop pool.

Business Class – Northern Lights In Alaska

Did you get intrigued by Mark’s recent posts about going to Alaska? I love Alaska. If you time it right, you can get there at the end of the busy summer season and before the start of the busy winter season.

I went to Alaska the first week of October and saw the first dustings of snow, the Norther Lights, and did some solo hiking near Denali National Park. It was beautiful.

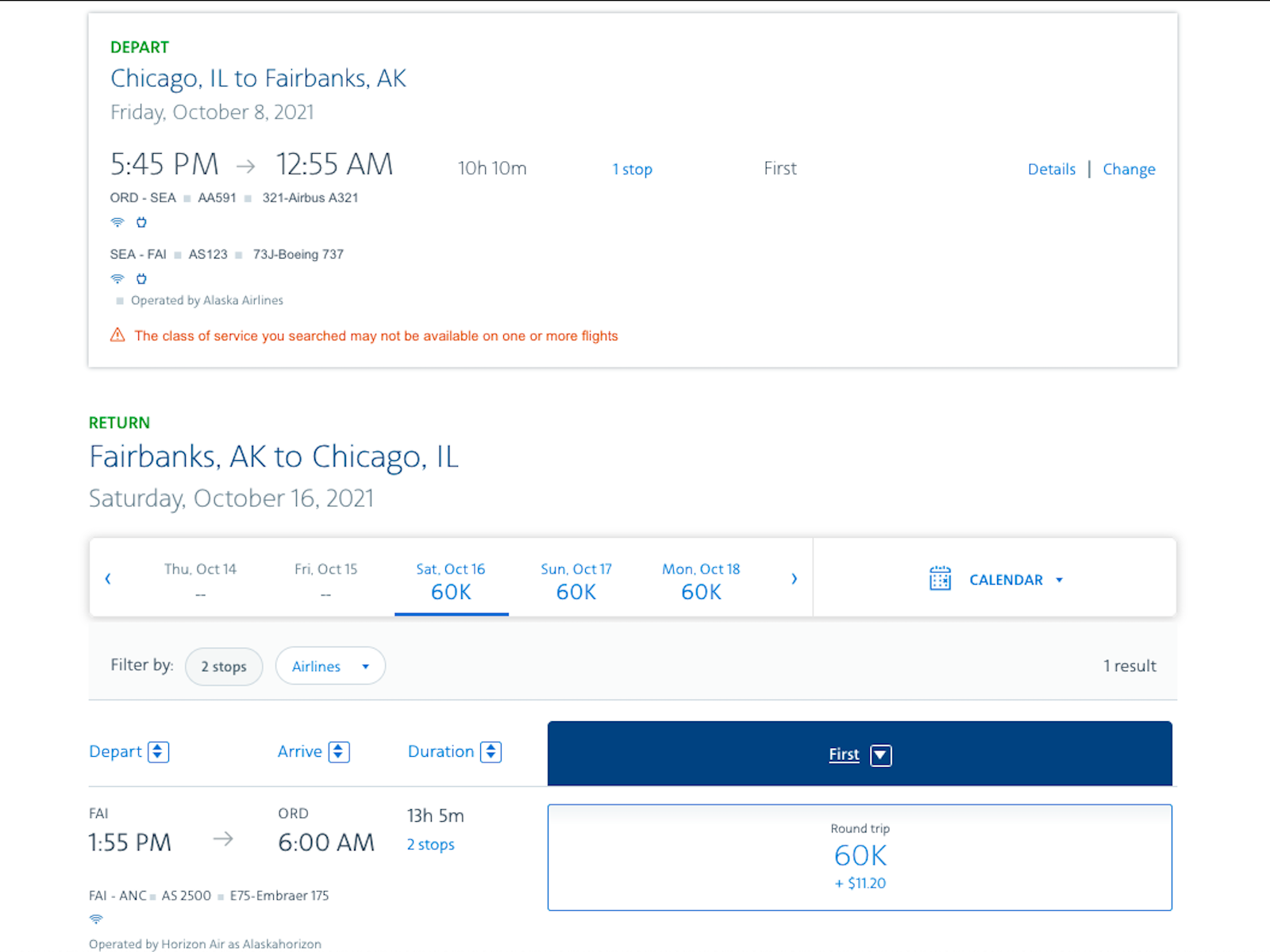

But the flights to get there and back…suck. It’s basically a guarantee that you will either arrive or depart (or both!) around 1am or 2am. So let’s fly there in business class (domestic first class) to get some comfort & sleep on the flights.

Fly round-trip in American Airlines domestic first class from Chicago to Fairbanks for 60k miles per person.

For some great views of the Northern Lights, head up to Chena Hot Springs outside Fairbanks and sit in the warm waters while staring up at the sky.

First Class With Etihad

I’ve previously mentioned some great first class routes in my American Airlines sweet spots article. The sweetest of the sweet spots.

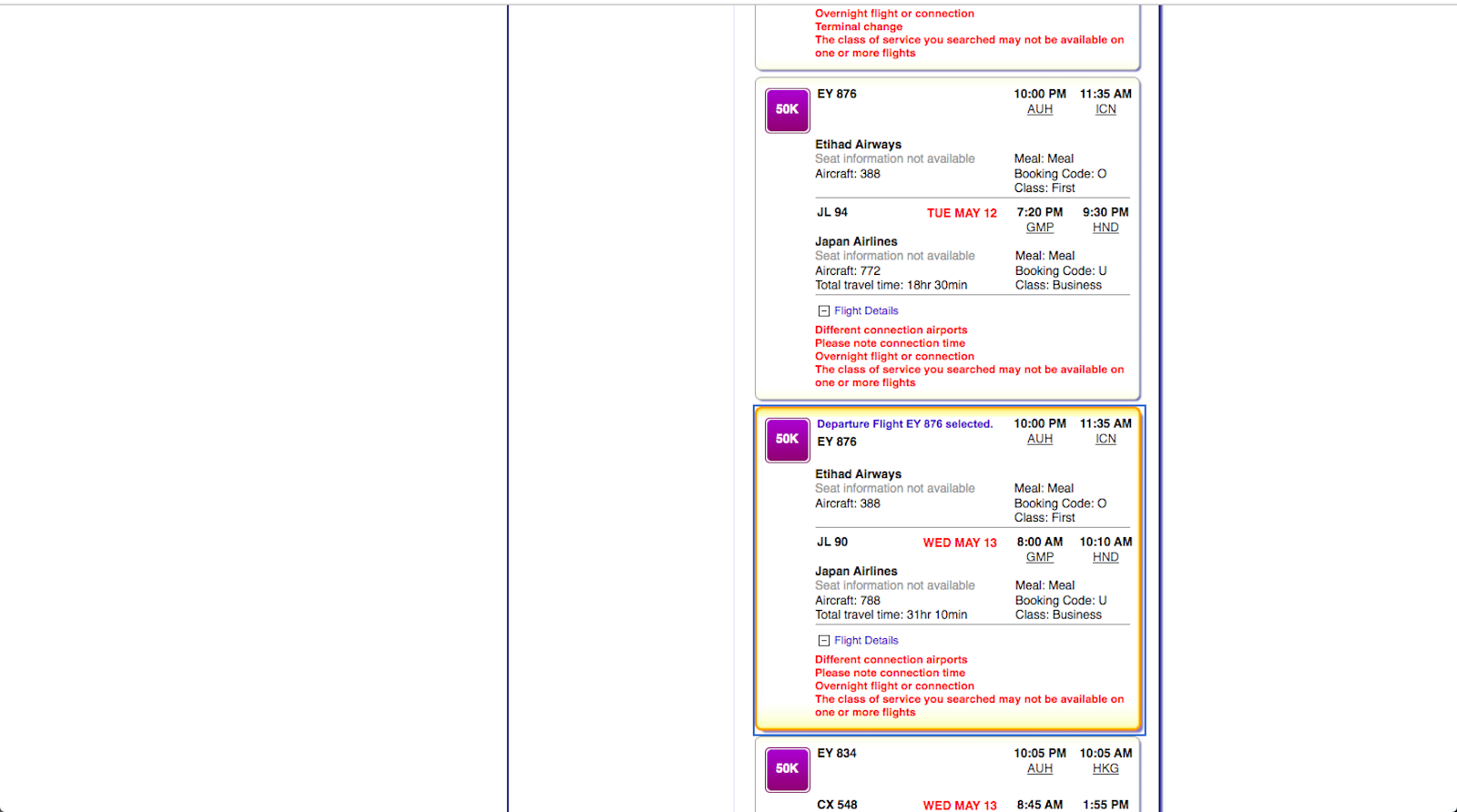

For a measly 50,000 AA miles and $56.20 in taxes, ride 2 amazing products. Depart Abu Dhabi, United Arab Emirates on the famous Etihad First Class Apartments. (Etihad isn’t flying the A380 right now, and they may be retiring them permanently. If so, you’ll still fly first class but on a Boeing 777 which isn’t an apartment) It flies direct to Seoul Incheon ICN airport. But what if you aren’t trying to go to Seoul? You can extend this to Japan without any extra points.

It involves changing airports in Seoul, which might turn some people off. Hear me out. Depart Abu Dhabi and get the full experience with Etihad, including the incredible lounge at AUH. Arrive at ICN at 11:35am. Spend the rest of the day and night in Seoul. At 8am the next morning, depart Seoul GMP (the other airport) for Tokyo on Japan Airlines business class.

This flight will run GMP-HND (Tokyo Haneda) on the JAL Sky Suites III, their newest product. You get 11:35am to 8am in Seoul to explore, then continue to Tokyo without adding any extra points. You’ll check out Etihad first and JAL business class. Win! The Etihad flight is 8:35 long, and the JAL flight is 2:10.

Final Thoughts

If you’re maximizing the Citi Premier Card and its welcome offer of 80,000 ThankYou Points (which you can then transfer to American Airlines), I hope you found some good ideas here. We looked at the perks of the card and the welcome offer. We also looked at ideas for maximizing those 80,000 miles for some great trips.

How would you use 80,000 American Airlines miles? Let us know.

[…] the 80k Citi Premier. This is now THE card to get if you are really after American Airlines miles! What I’d Do With 80k AA Miles: Using The Citi American Airlines Transfer. For some reason, this bank is being very stingy in approvals lately, […]

I’m leaning towards going the statement credit route of $840+. That’s mainly because I already have 335K AA miles (and in excess of million airline miles total). You do have me thinking of uses for those miles though. Thanks.

I thoight Etihad A380s were retired. Did something change?

I know they aren’t flying them and you can’t book them at present. Holding out hope it’s not forever, but fair point. I added a note to point that out.