Amex Business Platinum Tiered Bonus & Analysis

A couple of months ago I was able to get in on that amazing offer on the American Express Business Platinum card. For those who don’t remember, that offer (no longer available) awards 150,000 Membership Rewards after a very hefty $20,000 in spend during the first three months.

Last week I wrote about how I am planning to meet that spend. Through a combination of traditional MS, gift card reselling and merchandise reselling, I managed to spend $12,000 within the first month. A decent start and one that should ensure I meet the $20k spending goal.

The Tiered Bonus

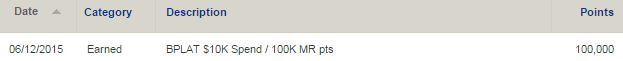

A little secret of that American Express Business Platinum offer was that it was actually tiered. The first part of the offer was, “Spend $10k and receive 100,000 points”. After the first part was met, the second part was, “Spend another $10k ($20k total) and receive an additional 50,000 points (150,000 total)”.

To be honest, I completely forgot about the tiered portion and didn’t expect any points to post until the entire $20k was spent. Then the other day I was surprised to receive an Award Wallet notification that 100,000 Membership Rewards points had just hit my account.

Is It Worth Going For the Extra 50K?

With that nice chunk of points already in my possession, the question becomes is it worth it to spend $10k more (actually $8k for me) to receive the additional 50,000 points. There is certainly an opportunity cost to that additional spend, but in my opinion it is definitely worth it. Here is why:

- I am MSing at a profit

- The points are worth $500-$800

- The same $10k in MS on my Arrival would only net $220

- I recently did an application round and have met all other spending requirements

So as you can see, it definitely makes sense to pursue the additional points in my situation. For many people that may not be the case. For people who pay to MS and who have more limited bandwidth, it may make sense to meet spending requirements on 3 or 4 other cards with that $10,000 in spending.

While that decision ultimately is something everyone must make for themself, I do like that American Express has tiered the bonuses on these cards with large spending requirements. If someone falls short of the $20k, at least they earned 2/3 of the bonus, which in this case is still a decent amount.

Conclusion

It is always nice to see your overall points balance jump up by six figures. Thankfully it makes sense for me to forge on, but it is always a good idea to look at your strategy and goals to make sure you are efficiently using your resources.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Shawn, I’m a new reader. I follow all blogs using my RSS reader – can you make it show RSS displays full article instead of having to click through?

It is an option I am working on.

I strongly urge those without a high spending relationship with Amex to avoid tossing $12k in a single month on any Amex card.

I simply did $5k in MS gift cards in a month and my account was tossed into financial review and ultimately had some serious spending limit reductions.

If you’re new to the game and you don’t an established high spending background take the full three months and try to spread the spending out. You’ll save yourself a lot of headache and potentially avoid a financial review.