The Best Three Card Wallet with Each Major Issuer, and a Clear Winner

Mark has previously identified the best three card wallet across card issuers for two reasons: thinning out a wallet and simplifying the hobby. Now, we figured it would be interesting to focus on each of the major card issuers (Amex, Chase, and Citi) separately to determine the best three card wallet with each. Of course, we know many cards exist across a variety of small/large banks and credit unions, some which may have superior earning or redemption rates. Today, we’re heavily weighting the simplicity factor of three cards with one bank (and hopefully avoiding high annual fees). What is the best three card wallet with each major card issuer? Does one clearly come out on top? Let’s see!

Ground Rules

Mark checked out a few different sites to get the average spending over the course of a year for a family of 4. Based on Mark’s previous article, the following are approximate annual spending figures for an average family. Remember, these are only general averages. Ensure to incorporate your own numbers and calculations for your specific credit card spending patterns.

- Groceries – $4,100

- Restaurants – $3,000

- Travel – $4,000

- Gas – $2,500

- Cable/Streaming Services/Etc – $1,400

- Cell Phone – $1,000

- Everyday Spend – $14,000

I then created a spreadsheet with those spending figures and incorporated different card combinations until I figured out what worked best. Again, these numbers are based on normal spending. These figures do not include increased spending, purchasing gift cards in a bonus area for bonus points, etc. Remember, simplicity rules the day in this exercise.

Bank Point Valuations

I’m not a huge fan of broad point valuations. In my view, exact point values are highly dependent on the individual, his/her specific travel goals, and the ability to meet those goals based on how points are redeemed. I strongly recommend you determine your own valuations for your specific situation. However, in order to address a mass audience and move forward with this article’s comparison, we must use some sort of valuation. In general, it’s safe to assume that an individual can obtain a valuation of at least one cent per point for all of the major bank currencies via cash out, travel bookings, transfer to partners, or gift cards. Ryan S created a great guide for average valuations of points and miles, and I encourage you to reference this guide as you determine your optimal redemptions.

Also, the three card wallet combinations are focused on bank point earning cards – no airline or hotel cobranded products are included. The best apples to apples comparisons can be made with each issuer’s flagship currency. Again, remember simplicity! (If you decide to customize your own three card wallet with bank points and hotel points/airline miles cards, do so carefully!)

Again, tweak your valuations based on your own specific redemption situations. To maintain simplicity, I didn’t incorporate the increased values of points with more advanced plays involving high annual fee cards like the Schwab Amex Platinum and Chase Sapphire Reserve. I’m also not including temporary bonus earning rates or values, such as via Chase’s Pay Yourself Back feature, or quarterly bonus-earning cards with unpredictable participants. Let’s now go through the three issuers to determine the best three card wallet with each.

Amex

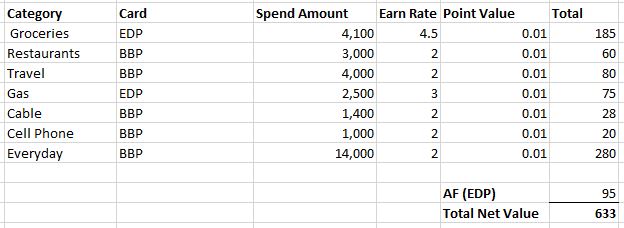

I’ll first reveal the data and subsequently dive in:

You’ll notice there are only two cards listed above: Amex EveryDay Preferred and Blue Business Plus. Why? When taking into account average spending, annual fees, and earn rates, one can maximize value with these two Amex cards. At these average spending levels, EveryDay Preferred cardholders earn a healthy 4.5x and 3x in the major grocery and gas spending categories, respectively (when making at least 30 transactions during a billing cycle). The Blue Business Plus earns 2x everywhere on the first $50k in purchases annually, providing plenty of spend capacity for the average individual based on the above categories. For the average spend categories and amounts, there really is no need to add a third Amex card for additional value!

Amex Three Card Wallet Total Net Value: $633

Chase

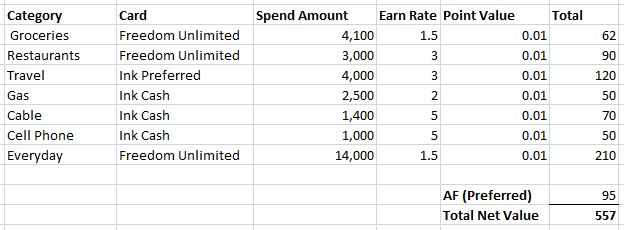

Here’s how Chase measures up:

The Chase Ink Cash card is the big standout here, earning 5x on cable/cell phone services (and office supply stores) on the first $25k spend per cardmember year. The Cash and Freedom Unlimited complement the gas and restaurants categories nicely with 2x and 3x earnings, respectively. All of this is from a no annual fee card! The Ink Preferred provides great 3x value on travel spend, but holders come out only $25 ahead with these numbers after the annual fee. However, the ability to transfer to partners and the extra 25% value for Chase redemptions make the Preferred attractive. Chase largely suffers from the lack of a card with permanent bonus category earning at grocery stores – the Freedom Unlimited (or Ink Unlimited) at 1.5x is the best we can do here. Earning 1.5x on everyday spend is underwhelming.

Chase Three Card Wallet Total Net Value: $557

Citi

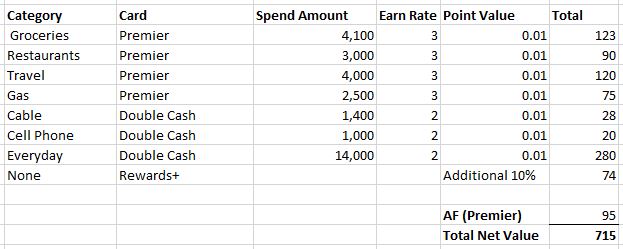

And finally, let’s look at Citi’s numbers:

The Citi Premier provides great 3x bonus earning across the four highest specific categories: groceries, dining, travel, and gas. The Citi Double Cash performs great at 2x on all other uncapped purchases. Cardholders can immediately cash out their Double Cash rewards or turn them into ThankYou Points. The third card rounding out the group is the Citi Rewards+. Why are we including the Rewards+ without incorporating any spend on it? Thanks to the card’s 10% points back feature, holders receive 10% of their redeemed points back annually (up to 100k ThankYou Points redeemed). This card effectively makes all rewards from Premier and Double Cash spend worth 10% more, automatically!

Citi Three Card Wallet Total Net Value: $715

Analysis, and the Best Three Card Wallet

Obtaining $633 from the Amex EveryDay Preferred and Blue Business Plus is strong from two cards, but it does come with the need to have 30 transactions in a billing period on the EDP. In my opinion, this substantially takes away from the “simplicity” many look for with a small wallet.

Surprisingly, the Freedom Unlimited, Ink Preferred, and Chase Ink Cash wallet finishes in last place, and it wasn’t that close. But Chase’s simplicity particularly shines with the ease of cash out and transfers to a wide variety of partners.

From my perspective, the biggest surprise is how much Citi’s three card wallet of the Citi Premier, Citi Double Cash, and Citi Rewards+ outperforms Chase and Amex in this exercise. Citi came out quite a bit ahead ($82) using my conservative cash out valuations. Citi cardholders also benefit from 3x bonus earning across major categories, and 2x everywhere else (via Double Cash). It doesn’t get much simpler than that! However, cashing out at 1 cent per point is not as easy as it is with Chase but still doable.

Based on this exercise, I came away with even more pronounced indicators of what I previously believed:

- Below-average to average spenders benefit from using Membership Rewards-earning cards, albeit not as much as high spenders.

- By focusing on simplicity (2-3 cards with one issuer), one is losing out on greater rewards and values. Playing a bit more complex game leads to better rewards.

- Citi provides the average consumer the best value for a three card wallet of the major issuers, especially if the consumer values Citi’s transfer partners. The Citi three card wallet is the clear winner.

Best Three Card Wallet – Conclusion

This exercise is a simple guide and not meant to replace any one person’s specific analysis of his/her situation. However, it did reveal some interesting general trends, particularly the strengths and weaknesses of each major issuers’ own products. Above all, playing the credit card rewards game simply can still be substantially rewarding. Those who want to take it easy and not get overly caught up in the hobby can still benefit. Also, remember this is also evaluating each point as an equal currency. People will weigh points more or less than others based on their particular uses, partners, and options. Be sure to plug in your own numbers, as well.

Do you enjoy playing the game simply? If so, what other strategies do you use to keep it simple?

Thoughtful analysis, much appreciated.

DjG,

Thanks for reading!

On Chase, you could switch Dining to use Freedom Unlimited since it earns 3x now on dining.

Garettg,

Nice catch! I’ve updated the article.

Thank you Benjy! My only criticism is that the Premier (for those who signed up long ago it runs out in April) will only earn 3x on airfare, hotels and online travel agencies. I would say most people will be able to cover most of their travel budget with those, but it is important to remember you will not receive 3x for stuff like parking, public transportation or ride share services.

HChris,

Thanks for pointing this out! I’ve long-enjoyed 3x earning on parking with the Premier; losing that is a shame.

Yes, very unfortunate. I have already started using my Ink Preferred for those type of travel categories. That way I avoid forgetting to switch before it runs out in April.

HChris,

Nice – it’s always good to be ahead of the game!