A Surprise Winner! The Best Two Card Wallet from Each Major Bank

I recently stepped through some of the five best options for single card wallets from the three major banks – Amex, Chase, and Citi. Actually, it ended up being two banks, highlighting the vast superiority of Amex and Citi products in comparison to Chase. Back in January, we explored the best three card wallets with each major card issuer, as well. Similarly, Chase came in dead last in that comparison. Today, we’re going to look at the best two card wallet options from each of the same banks. Can Chase better compete this time? Let’s see.

A Reset of the Ground Rules

Mark previously checked out a few different sites to get the average spending over the course of a year for a family of four. The following are approximate annual spending figures for an average family that Mark found. Remember, these are only general averages. Ensure to incorporate your own numbers and calculations for your specific credit card spending patterns.

- Groceries – $4,100

- Restaurants – $3,000

- Travel – $4,000

- Gas – $2,500

- Cable/Streaming Services/Etc – $1,400

- Cell Phone – $1,000

- Everyday Spend – $14,000

I then created a spreadsheet with those spending figures and incorporated different card combinations until I figured out what worked best. Again, these numbers are based on normal spending. These figures do not include increased spending, purchasing gift cards in a bonus category for more points, etc.

Unlike the three card wallet article where I focused on bank point currencies, I’ve decided to consider the banks’ co-branded cards in today’s comparison, as well. This leads to a more complex game, but travel hackers with an open mind can substantially benefit. We value a hotel free night certificate (FNC) from card anniversary or big spending at $250 – it’s generally possible to get at least that value out of a FNC across hotel brands. Nonetheless, identify and include your value for a free hotel night based on your situation.

Given that we are focusing on cards consumers should consider holding long term, we aren’t incorporating welcome offers in this comparison. These offers can vary widely based on when one applies, and we are attempting an evergreen comparison today. Of course, ensure to incorporate a welcome offer based on your application timeframe in your decision.

We are using Ryan S’s average valuations for air/hotel currencies as part of the calculations, as well. But how do we value bank points for this exercise?

A Reminder on Bank Point Valuations

In my view, exact point values are highly dependent on the individual, his/her specific travel goals, and the ability to meet those goals based on how points are redeemed. I strongly recommend you determine your own valuations for your specific situation. However, in order to address a wide audience and move forward with this article’s comparison, we must use some sort of valuation. In general, it’s safe to assume that an individual can obtain a valuation of at least one cent per point for all of the major bank currencies via cash out, travel bookings, transfer to partners, or gift cards. Again, Ryan S created a great guide for average valuations of points and miles, and I encourage you to reference this guide as you determine your optimal redemptions.

I’m also not including temporary bonus earning rates or values, such as via Chase’s Pay Yourself Back feature, or quarterly bonus-earning cards with unpredictable participants. Let’s now go through the three issuers to determine the best two card wallet with each.

Amex

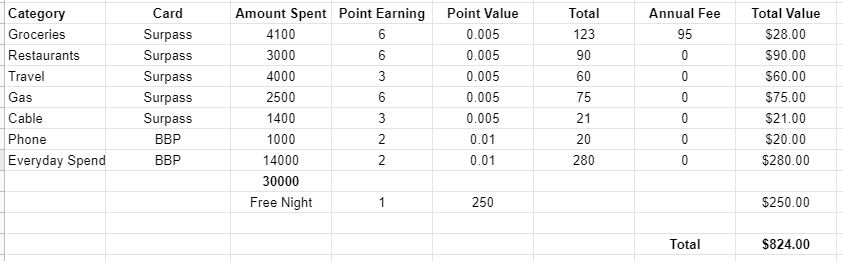

After experimenting with various card combinations, the Hilton Amex Surpass and Blue Business Plus combination came out on top with Amex. The Surpass carries strong 6x Hilton Honors points earning in the broad supermarket, gas, and dining categories. Even better, all spend contributes to the $15k required to obtain an FNC good at the vast majority of Hilton family properties. Based on the categories, some of the spend is only at 3x earning, but the spend also contributes to the $15k free night. And let’s not forget that the Surpass comes with Hilton Honors Gold status, the best mid-tier elite hotel status, in my opinion (hello, free breakfast most everywhere).

The Blue Business Plus earns 2x everywhere on the first $50k in purchases annually, providing plenty of spend capacity for the average individual based on the above categories. It’s a great choice for all spend over $15k. This earn rate from a no fee card is hard, if not impossible, to beat!

Amex Two Card Wallet Total Net Value: $824

Chase

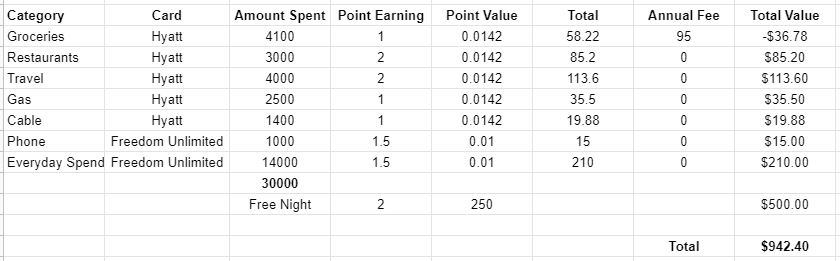

The World of Hyatt and Freedom Unlimited cards quickly rose to the top in my Chase calculations. Similar to the Surpass, World of Hyatt cardholders benefit from their spend earning points and contributing to the FNC requirement (also $15k). Meeting this spend level would mean a second free Hyatt night, considering a cardholder automatically receives one at his/her card anniversary. Remember, all Hyatt FNC’s are limited to categories 1-4. Hyatt card bonus categories aren’t broad on this card. Bonus category highlights are 4x Hyatt and 2x dining and airline purchases. Cardholders also achieve Discoverist status (low-tier) by holding the card.

For all other spend beyond $15k, look at the Freedom Unlimited card and its 1.5x everywhere earning. This everywhere earn rate is solid, if not a leader, in Chase’s no fee card portfolio. (Of course, you can swap the Freedom Unlimited for the Ink Business Unlimited since each earn at the same rate.)

Chase Two Card Wallet Total Net Value: $942.40

Citi

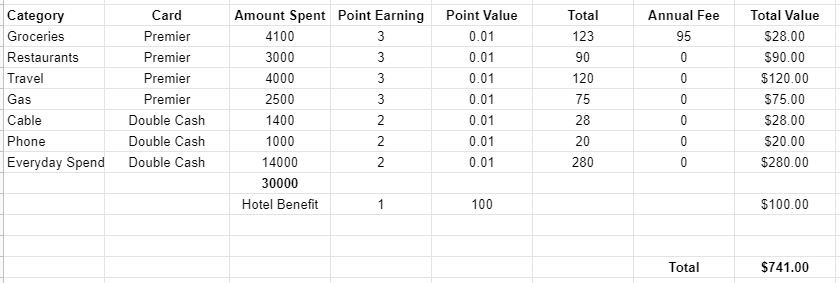

Two cards from Citi’s three card wallet winner rounds out today’s comparison. Not surprisingly, the Citi Premier and Double Cash cards reflected the most favorable two card return. The Citi Premier provides great 3x bonus earning across the four highest specific categories: groceries, dining, travel, and gas. The Citi Double Cash performs great at 2x on all other uncapped purchases. Cardholders can immediately cash out their Double Cash rewards or turn them into ThankYou points. And let’s not forget that the Premier also offers the annual $100 hotel benefit. This new feature isn’t completely user-friendly, but it’s not as painful as I originally thought.

Citi Two Card Wallet Total Net Value: $741

Best Two Card Wallet – Analysis, and a Winner*

Upon running the above combinations and numbers, I immediately noticed that incorporating co-branded cards had a significant impact. The Blue Business Plus provides substantial rewards equal to $300, but the Surpass delivers even more to Hilton enthusiasts ($524 in net rewards). Obtaining the free night certificate based on the $15k spend is the huge contributor here.

And so it goes with Chase. Obtaining $225 in rewards from the Freedom Unlimited is nice, but the $717.40 in rewards from the Hyatt card is even better. The two free night certificates (one from card anniversary, the other from $15k spend) largely carry the load here, as well.

Citi consistently delivers excellent rewards, with their Premier and Double Cash cards totaling $741 of rewards in this exercise. The $100 hotel benefit requires $500 in hotel bookings via the ThankYou portal, which may be a non-starter for many out there. Adjust your values accordingly.

Based on this process, here are a few takeaways:

- Co-branded cards, especially hotel cards that offer free night certificates, can greatly sway numbers in a two card wallet.

- Chase’s permanent bonus categories are far behind those of Amex and Citi, particularly in the supermarkets area. This is just another reason Chase is boring me to death.

- Citi’s relatively limited co-branded card offerings cannot be ignored.

- One’s optimal two card wallet may hinge on his/her preferred family of hotels.

- The two card wallets of Amex and Citi provide solid rewards, and these can also be transferred to travel partners. This leads me to our winner and that asterisk.

The Winner* of the Best Two Card Wallet

To my surprise, Chase came out on top as the winner of the best two card wallet. The World of Hyatt card delivered the win. But Chase has one substantial blemish that Amex and Citi do not. Chase’s two card wallet does not allow cardholders to transfer their rewards to travel partners. Remember, the Freedom Unlimited alone is not an Ultimate Rewards-earning card; it must be paired with a Sapphire Preferred, Reserve, or Ink Business Preferred card for the rewards to become a transferrable currency. There’s no denying the Chase numbers lead, but this inability to transfer to travel partners may be a deal breaker to many out there.

Best Two Card Wallet – Conclusion

This exercise isn’t meant to replace any one person’s specific analysis of his/her situation. But it reflects that playing a slightly more complicated game, particularly using multiple different points currencies, changes the outcome and leads to even bigger rewards. I encourage you to weigh a simple game with good rewards against a busier one with greater rewards. Which do you prefer? It’s a highly personal decision. Indeed, the answer can change for any one person over time! Based on this exercise, which bank’s two card wallet would you pick?

I will stick to my BofA two card combo. With a 50% earning bonus I use the Cash Rewards (3% on Groceries / 4.5% on Travel) and Premium Rewards (2.25% on everything else). I also have the free Citi Costco card for gas (4%). That totals out to $862 but redemptions are easy and automatic each month.

Capped Hyatt free night is not the same as uncapped Hilton free night. With a cap of 15k for Hyatt, these should not be valued at more than $0.015x15k=$225, though $0.015x12k=$180 is probably more realistic. Makes it borderline w/ Amex, but we are talking 10s of $, not 100s.

Contrasting w/ Hilton, excluding a few properties it’s capped at about 95k. This has a peak value of about $0.005x95k=$425.

(yes, all certs can find outsized value in specific scenarios. I can’t recall a Hilton free night I’ve used for less than $400. Meanwhile I haven’t used a Hyatt cert for more than $250. Currently booked for this summer (pre-tax/fee): Hyatt free night (x2@Regency): $190/nt; Hilton free night (x3@Curio): $560/nt)

1.5 is kind of trashy , much better off with a Sapphire so you can get more valuable points and travel protections. Each point is worth 1.25 and you may get more sometimes if you transfer to Hyatt or a partner.