Chase Credit Card Boredom and Why I Hardly Pay Attention Anymore

Chase has been very good to me over the years. I vividly remember obtaining my Chase United Mileage Plus card about 20 years ago, my second card in the hobby. I recall Chase announcing the original Hyatt card about 11 years ago and the thrill of then obtaining it. But for the past several years, I’ve solely focused on their Ultimate Rewards-earning cards and cashing out all points at – gasp – 1 cent per point. I’ve recently reached a new stage in my relationship with Chase – apathy. Chase now only holds my attention a few times annually, and my involvement is fleeting. How did it come to this? Below are just a few reasons why my Chase credit card boredom has reached a new high (or low).

A Moldy List of Travel Partners

For years, Chase has leaned on a reliable set of hotel and airline transfer partners. Indeed, many a travel website touted these solid partners. For many of us, we’re now at a point where the only somewhat special partners in the Ultimate Rewards program are Hyatt, United, and Southwest. And for much of that group, this list comes down to one, Hyatt, or maybe none (hello, cashout). Sure, Chase has lost several, and added a few, partners over the years. But we haven’t had an amazing partner added in years. Also, many of us can do fine, or better, with the partners of other bank currencies like Amex or Citi. Absent of great partner redemptions, I happily cash out my Ultimate Rewards, for better (via Pay Yourself Back) or worse (1 cent per point, which I find acceptable).

Mediocre Chase Credit Card Welcome Offers

Every few years, Chase comes out with an eye-catching welcome offer, such as when the Freedom Flex was announced. Indeed, several years prior was the 100k Chase Sapphire Reseve offer. Maybe Chase elevates a co-branded card offer every now and then, too. Woohoo. Over time, I’ve consistently been drawn to the superior offers from the other major (and even mid- and lower-tier) card issuers. I feel like Chase leans on the amazing offer (Flex or Reserve) every once in a while and coasts for a few years in between. Meanwhile, elevated offers abound elsewhere.

Easily Forgotten Pandemic Era Promotions

Chase knocked the ball out of the park with Pay Yourself Back in mid 2020. Indeed, I product changed a Freedom to the Reserve simply to cash out with 50% more value. It was a no-brainer to obtain more for something I was already doing. Loosening up the Reserve travel credit for groceries and a few limited time points earning opportunities have complemented Pay Yourself Back nicely. But Amex has done so much more across their card portfolio. And other banks have matched Chase with more liberal travel credit redemptions and points earning opportunities.

While Pay Yourself Back can be lucrative, it’s largely unchanged and settled in as a long term-feeling benefit (even if it’s not). I’ve already grown accustomed to it – I enjoy it, but I easily turn my focus elsewhere. Perhaps this is because I’d be cashing out at the normal rate, anyway. Regardless, I feel like Chase hasn’t done enough to keep consumers’ attention in recent years.

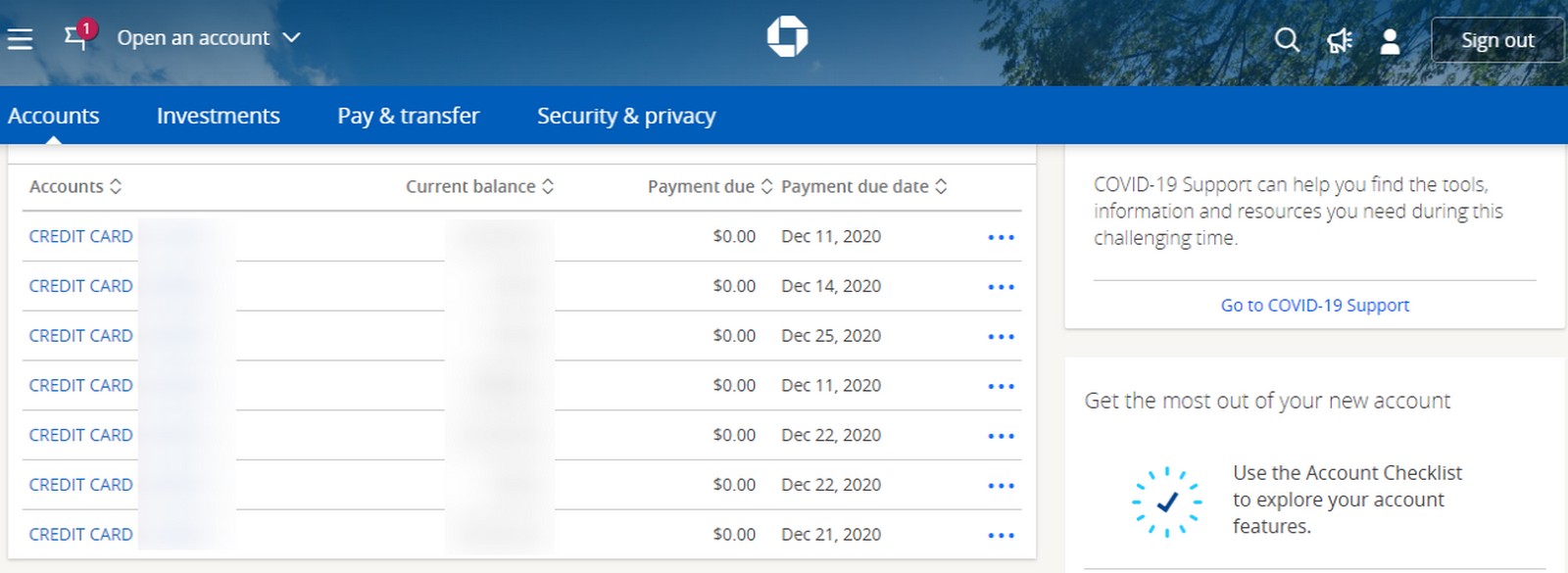

Unsightly Website

I actively avoid the Chase website, because it’s slow, poorly laid out, and clunky compared to many competitors’ offerings. It’s just a mess to me. Conversely, I’m on the Amex site or app daily (at least) to find more good stuff, such as Amex Offers, card upgrade promos, and more. Hell, I even like Citi’s website compared to Chase’s. Quite simply, I have fun on other bank websites; Chase’s site is just full of unnecessary clutter and clicks. And it seems like the site is getting worse over time. I’m so annoyed by the site’s user unfriendliness, I just want to get Chase off my fingertips and mind as soon as possible.

Low Value Chase Offers

Sure, Chase Offers exist, but they are inferior in utility and volume compared to Amex. In my experience, I’ve had about half a dozen Chase Offers available at a given time, and maybe one is with a merchant I actually purchase from. And even then, Amex quite often holds a better offer than Chase! Full disclosure, I just took advantage of a TurboTax offer from Chase, but I can probably count on one hand how many Chase Offers I’ve used in the past few years.

The 5/24 Rule

I’ve written previously about how I quit caring about the 5/24 rule years ago. I understand that my ineligibility for Chase welcome offers may color my overall Chase opinion a bit. But I can’t ignore that this draconian rule can turn people off Chase in part (like me regarding welcome offers) or in whole as a customer. I simply refuse to let Chase singlehandedly control my credit card rewards behavior. I bet I’m not alone here. While Chase has obviously assessed their adoption of the 5/24 rule as good business, I feel that the policy drives many of us away. Perhaps Chase doesn’t care about this. Yes, other banks have credit card application rules, but nothing near Chase’s, in my opinion. Regardless, I feel that other banks, including Amex, do more to keep us as customers than Chase.

Chase Credit Card Boredom – Conclusion

I admit this isn’t a highly analytical article; rather, it’s one based on my personal feelings and experiences. Those perceptions are coloring my reality with Chase. I’ll keep chugging along with mindlessly earning Ultimate Rewards points and cashing out. Barring any future innovation from Chase, though, I won’t waste additional time with them. Maybe they’re fine with that arrangement. But their rather sedentary strategy toward customer engagement is driving me, and maybe others, away. How do you feel about Chase’s actions or inactions lately?

Q2 adds excitement for me esp having both Freedom cards.

Agreed on the website. Navigating to sending a message is not user friendly and plus why on earth haven’t they pulled into the 21st century with chat service instead of only emailing and calling? Amex is so far ahead on their customer service!!

You want really boring, try US Bank or Barclays. They haven’t made any changes to their FlexPerks or Arrivals Plus cards and still only offer their highest rewards on travel redemptions. At least Chase pivoted to allow non travel redemptions on travel credits. And for all the love of MR do people forget that Amex will pass on the excise tax on US program transfers whereas Chase does not?

Agree, other than 5x on Flex and Freedom and doing $15,000 at the beginning of the year with Hyatt, Chase cards stay in the safe. AMEX Gold and Citi Premier, Double Cash and even Rewards + have more use for me.

Chase has been very boring of late. AMEX Gold is my new go to card, especially at the grocery store and restaurants. About 5 years ago I was so happy after receiving my Sapphire Reserve card with 100k welcome points. On my next renewal the Sapphire will likely just be closed. Poor sign up bonuses at this point on most Chase cards. The one thing they did that was very proactive is the Pay Yourself Back program. Used all my CSR points to pay for groceries before I obtained my AMEX Gold.

Sorry, but IMHO, boring for a bank is good. Maybe that’s because I think the opposite is anger and frustration , like BofA. Also, Chase for me, has been the most competent at spotting and responding to credit card hacks. Of loyalty programs, the Chase Hyatt is by far my favorite.

Joe

Joe,

Interesting perspectives – thanks for sharing!

DEAD. TO. ME. When I temporarily lost my job when covid hit, I accepted a 3 month deferment “covid relief” out of panic and they went and lowered my credit limit on every single card to the balance that was on it. My credit score went down by 80 points due to the available credit vs. credit line ratio. NEVER would have deferred payments had I know they’d pull this stunt. On the other hand, 3 other banks raised my credit limits without me even asking which I use as my defaults now anyway. Canceling everything before the hefty Sapphire annual fees come up. Long story short–suckit chase.

David,

Wow, I’m sorry this happened to you, but thanks for sharing your story.

Totally agree with the general gist: UR are now at the bottom of my list when compared with MR and TYP. However, I gotta disagree with the “bad offers” note. 100k on Ink Preferred, and 75k each on Ink Cash and Ink Unlimited make for a really, really nice combo, especially since none of them hit 5/24. If you happen to be below 5/24, 250k UR for a single $95 AF isn’t a bad haul, and if you really wanted to, you could downgrade all to CIC going forward.

JP,

Thanks for reading and your overall comments. I didn’t use the words “bad offers” in the article; I described my views of Chase’s mediocre welcome offers and lack of enough amazing offers over time. And I agree with your downgrade to Chase Ink Cash point – so much so that I’ve already done that with all of my Chase business cards. Big picture, I feel Chase does just enough to keep things interesting for a large group of customers, but they do not innovate enough.

I am locked out by 5/24 so I don’t pay much attention either. I have the CSP since they allowed me to get approved as an exception to 5/24. Got that bonus and still some small earning I send all to SWA. I loved Hyatt but they changed all their beds and I can’t sleep there any more. Amex has been the main source of points lately for sure with fantastic offers and no lifetime language offers. Still getting bonuses from Barclays with rotating Wyndham and AA cards. Would much rather be 9/24 all the time than worry about Chase!

JI100,

Yes, I agree it’s still nice to earn and redeem a steady influx of UR’s while I promptly pay minimal attention to Chase otherwise. To your other point, I’d much rather be 1,458/24 than think about Chase, as well.

Congrats on Barclays still liking you. I don’t expect to receive any new Barclays accounts any time soon.

I’m still all chase and UR. I’m a huge SWA customer with two companion passes currently. I max out everything I can to earn more UR and SWA points. Hyatt is a killer on hotels. Currently at 9 chase cards and eveytime I try and close one they offer me something making it worth my while to keep it. Pandemic bonuses and lack of travel have my UR balance over 700k and possibly hitting 1M by 2022. I’ll be ready to go anywhere when it time to get out there again. Chase just makes it easy vs all the monthly credits and games you have to play with Amex.

Enjoy!

The question is are you the type of customer that Chase is really interested in keeping? Credit card companies make money off people who don’t pay off their cards on time and people who don’t only use the card for the bonus category. They probably lose money on most of us who play the travel game, so why would you expect them to compete with Amex and Citi for the customers who they lose money on.

Touche.

I totally agree with the article. I cannot decide to downgrade my CSR to just Preferred card. The only thing that is not discussed in this article is the upcoming partnership with Air Canada (Aeroplan) this fall, I believe. They will be a transfer partner and at least two cards coming out this fall. With Air Canada taking ownership back of Aeroplan, I think there’ll be value with the Aeroplan program. I already believe the new program already has currently. They just need to work out all the bugs in their system currently.

Oh yeah, one more thing! I am putting almost all of my spending on the AMEX MR pts currently. The current bonus points, offers and credits cannot be beat.

Platini,

Thanks for commenting. I agree Air Canada will be a nice addition to Chase, but will it be enough? Maybe for some, but not others.

Benjy,

It should be enough to get some folks excited, since Aeroplan would be a good replacement for Avianca Lifemiles. I agree the UR at the moment is only good for Hyatt and Singapore Airlines, for First Class Suites redemptions.

Most definitely!

Funny, I feel this way about my AMEX plat. The Best Buy, Home Depot and PP promos only offset the $200 I’m not getting in air redemption. Their travel redemptions suck light years more than Chase, which I don’t find offensive. Outside of xfer to Delta AMEX points just don’t feel as useful to me. Haven’t been in a lounge for 18 months. Uber credit is cute but would I use Uber eats monthly otherwise, nah, I’m team DoorDash. Years of saving MR points just got me 3 nights in a nice boutique hotel in Asheville. Could have booked the same for 25% the points with UR, but I wanted to drain the account. Hell the Hilton cards don’t even come with free annual nights. I’m babbling here but think I’m way done on AMEX. I’ll take Chases boring but worthwhile redemption options instead.

Mike Z,

Thanks for chiming in. I agree that depending on one’s redemption philosophy with each currency, Amex can be less user-friendly than Chase.

Actually, three out of four Amex cards have annual free night certificate options. The Aspire gives one FNC annually, including soon after approval. Additionally, based on spend, one can earn FNC’s with the Surpass ($15k, $60k), Business ($15k, $60k), and Aspire ($60k).

The Chase and Amex merchant offers mostly are all crap. At any given time between Amex and Chase both combined I’ll have like 150 offers and maybe 10 are sort of maybe OK and 1 or 2 good ones at most. Not only that but you have to click and sign up for each one and then jump through all the hoops and hope they work. Boring and too much work.

DaninMCI,

I can totally see that perspective. I have a much higher tolerance for Amex “work” since I most always find “good stuff” for my situation. Chase, not really.

Hard to beat 5x UR to Hyatt and United, man. Except when you can earn 2x or 3x TYP and use Turkish Miles and Smiles.

Ian,

You’ve accomplished your goal of triggering me on multiple levels in just two sentences. 😉

The Reserve Card is losing its appeal to me. 3x Dining? I can get that through Freedom Flex/Unlimited. The $300 travel credit was nice but I used that up in Jan from groceries/ordering out. The Priority Pass was a pain to use with lounges having restrictions/overcrowding prior to COVID. I’m planning to downgrade to Sapphire before I’m up for renewal.

I recently signed up for Amex Platinum with 100K MR offer with 10x at supermarket/gas station. The Uber credits can be used for Uber Eats and the PayPal credit is pretty nice. I generally don’t shop at Saks

but will probably get something reasonable like Kiehl’s products. The only thing I can’t use now is the $200 travel credit.

John,

I hear you! Congrats on the new Platinum card. I agree the Saks and travel credits can be a bit of a nuisance, but I don’t find them overly frustrating to consume. Even without those, the Platinum offer towers over what the CSR is providing many of us, in my opinion.

I’m a fan of small Zwilling J.A. Henckels products at Saks – high quality and the pricing is Saks credit-friendly.

It seems all the major issuers are in a lull right now, reevaluating new product & promos as things turn more “normal.”

I’m more excited about the Hyatt & Marriott loyalty promos. Am making a lot of points thru them directly I would normally be relying on the co-branded cards to accomplish. I’m not flying as much but am still staying in nice hotels.

OMG, everyone! You really need to get vaccinated when you can so that we can all get traveling again. Then all our beloved points and travel bloggers can actually write about points and travel again. You can tell that our favorite writers and travel experts have finally run out of material when one of them is left with only, “I’m bored with my credit cards.” Please get your shots so that Benjy and his family can get on the road and report back to us again! Cheers to all.

Neal,

Whoa – I’m included in a group of “beloved points and travel bloggers”? Rad! Now, I just need to pick up my membership card. 🙂

Chase cards still hold a place for me: the travel credit on the Sapphire Reserve is cash in my pocket and unless you have the Double Cash and a Citi THANKYOU card, you won’t find a card where points can be exchanged for travel programs or cash back at the $0.01 valuation. Beyond that, I can’t help but giggle when people

Bemoan the lack of Chase Offers compared to Amex. Lest anyone forget, Chase still maintains the Ultimate Rewards shopping portal which is solid and doesn’t require minimum purchases like Amex. And because UR points are always a minimum of $0.01 each, those same shopping portal deals are as good as or better than Amex.

Admittedly, they could use a few new partners. The Avios trio is a joke, but Air Canada is coming later this year. Adding another Skyteam, Star Alliance, and Oneworld partner would help round out the program (perhaps re-adding Korean after Delta devalues their program some more, along with Turkish, and Royal Air Maroc or Qantas?)

Bobby J,

I can appreciate all the points you make. I don’t equate the UR shopping portal with Amex Offers in my situation but can definitely see how others may do just as well or better with the former than the latter. As with other topics, we can all have different Chase viewpoints and be correct for our given situation. Thanks for reading and commenting!