Chase Sapphire Preferred

The Chase Sapphire Preferred is, perhaps, the most talked-about travel rewards credit card out there. Indeed, it’s been a big hit with consumers – across the points and travel community and otherwise – for years. And, not coincidentally, I don’t waste much time considering it anymore – partially, because I’m tired of hearing about it. My wife and I obtained Chase Sapphire Preferred signup bonuses many years ago, only to product-change out of those accounts without returning.

But now, we’re considering a downgrade from the Sapphire Reserve to a Freedom Flex again. I figured it’s worth a brief look at the Preferred to determine if we’re missing anything at this point. I think I know how this will go, but I shouldn’t assume. Let’s see how this works out.

Pay Yourself Back

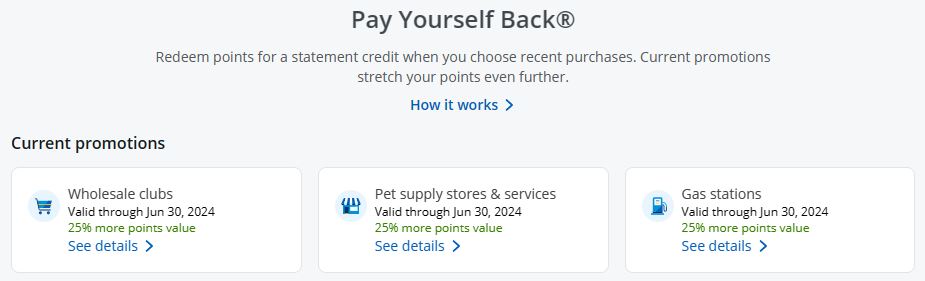

We’ve primarily stuck with the Reserve for its superior Pay Yourself Back benefit. Yes, the Preferred and several other Chase cards offer Pay Yourself Back, also, but not in as useful/valuable categories. Here’s where we’re at currently with that benefit:

Sapphire Preferred: Cardholders can redeem Ultimate Rewards at a 1.25 cent per point value at select charities through 30 Jun 2024.

Sapphire Reserve: Cardholders can redeem Ultimate Rewards at 1.25 cent per point value at wholesale clubs, pet supply stores, gas stations, select charities, and for the annual membership fee through through 30 Jun 2024.

Annual Fee Considerations

Many enjoy simply unlocking Chase’s transfer partners with the Preferred and its $95 annual fee. Others justify paying the Reserve’s $550 annual fee thanks to the $300 annual travel credit, access to the same partners, and additional benefits. I’ve fully valued that easy-to-use travel credit in the past and still do. So, before getting into anything else, it’s a $155 difference between the two cards for us. But what about the other Sapphire Preferred benefits?

Other Chase Sapphire Preferred Benefits

Chase touts several ” partnership benefits” which they value at $150, including a DoorDash Dashpass subscription, and an Instarcart membership including a quarterly $15 credit. Interestingly, they lump in 5x Peloton and Lyft earning with those things. Oh, and there’s a $50 statement credit for a hotel stay booked through Chase travel each anniversary year. This selection of benefits is worthy for some, but not for us. Perhaps the only one we partake in is Dashpass with the Reserve, but not enough where we’d assign it an everyday value.

Our Decision

Should my wife and I product change from the Reserve to the Preferred? The answer’s still a resounding NO. There’s simply not enough for us to get back into the Preferred game. We plan to downgrade our Reserve to a no-fee Freedom Flex, fully knowing we have the freedom (get it?) to product-change to another card which better fits our needs on our preferred (again, see what I did there?) timeframe. And having multiple Freedom cards provides additional flexibility and points, so why not take advantage?

I’ve called Chase boring before, and perhaps they still are. That’s not all bad. We’ll be back for another Reserve in the future to predictably maximize Pay Yourself Back, but we also know we don’t always need one. I can’t recall ever transferring Ultimate Rewards to a travel partner and don’t have a need any time soon. So the Reserve is still our favorite card to rent. Chase provides the Freedom Flex, an excellent 5x earner with no annual fee, in the meantime while we sort everything else out.

Conclusion

We gave up on 5/24 and new Chase signup bonuses several years ago, and we have no plans on turning back. That said, our nuanced decisions with Chase continue as we enjoy earning on a variety of cards – primarily Chase Ink Business Cash, with a dash of Freedom and IHG Premier mixed in.

Meanwhile, the Preferred is the no-brainer card for many points and travel hobbyists to hold. A more-reasonable-by-the-day $95 annual fee unlocks travel partner transfers, solid earning categories, and a few other benefits. That’s enough to keep the Preferred top of mind for many.

Do you currently hold the Chase Sapphire Preferred? Why do you opt for that over other Chase products?

One reason the CSR is a keeper for me is the excellent airline and rental car coverage should there be a problem. With my AMEX Platinum, it’s extra.

When there’s a delay that requires an overnight, I appreciate choosing my hotel rather than relying on the airline’s supply. For example, I paid for my Alaska flight recently with my Alaska Visa. When there was a flight delay due to a mechanical issue, I was put in a Days Inn near Tukwilla. This particular one was worse than any Motel 6 I’ve ever stayed in. Airlines don’t cover “acts of god” so I was lucky to get this, I suppose, from Alaska.

But, with the Amex Platinum you’re earning 5X on airfare and hotels. Or, with the WF Autograph Journey, you’re earning 4X on airfare and 5X on hotels. Assuming you have a premium card because you have a healthy amount of travel spending, the value of the extra points would more than offset the cost of standalone travel insurance. Allianz has annual policies that offer comparable coverage for roughly $300 to $500. Saving the CSR’s net annual fee of $250 would be gravy on top of the value of the extra points.

If you’re still tied to Chase’s travel protections, go with the Ink Preferred (combined with another card for restaurants).