(Rumor) Is Citi Looking To Make Some Cash Back Changes?

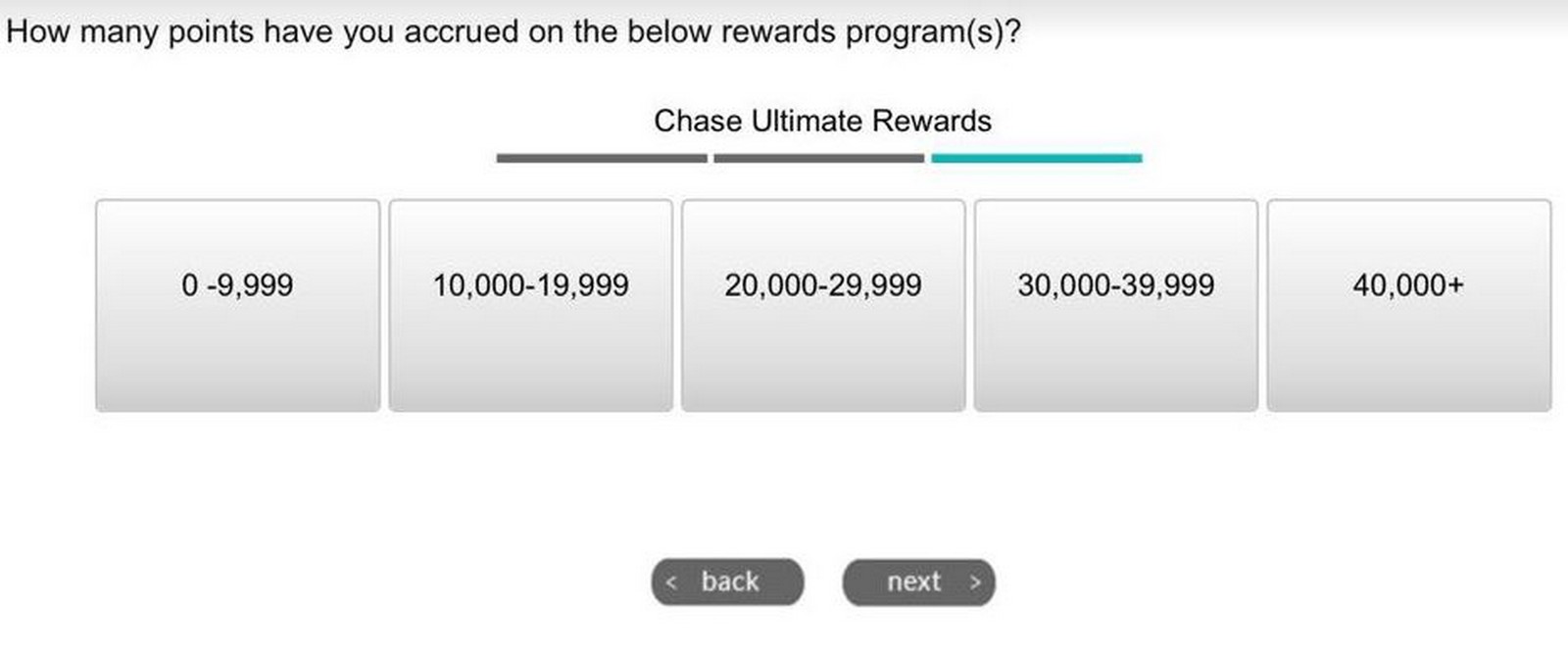

Citi has targeted some members for a pretty interesting survey about cash back cards. They offered an Amazon gift card if you qualified for the survey. You heard that right, you had to actually qualify for this survey…by passing a credit card test. They listed various cards, some real and some made up, and you had to properly say which program it belonged too. They also asked about other programs like Membership Rewards and Ultimate Rewards during the survey.

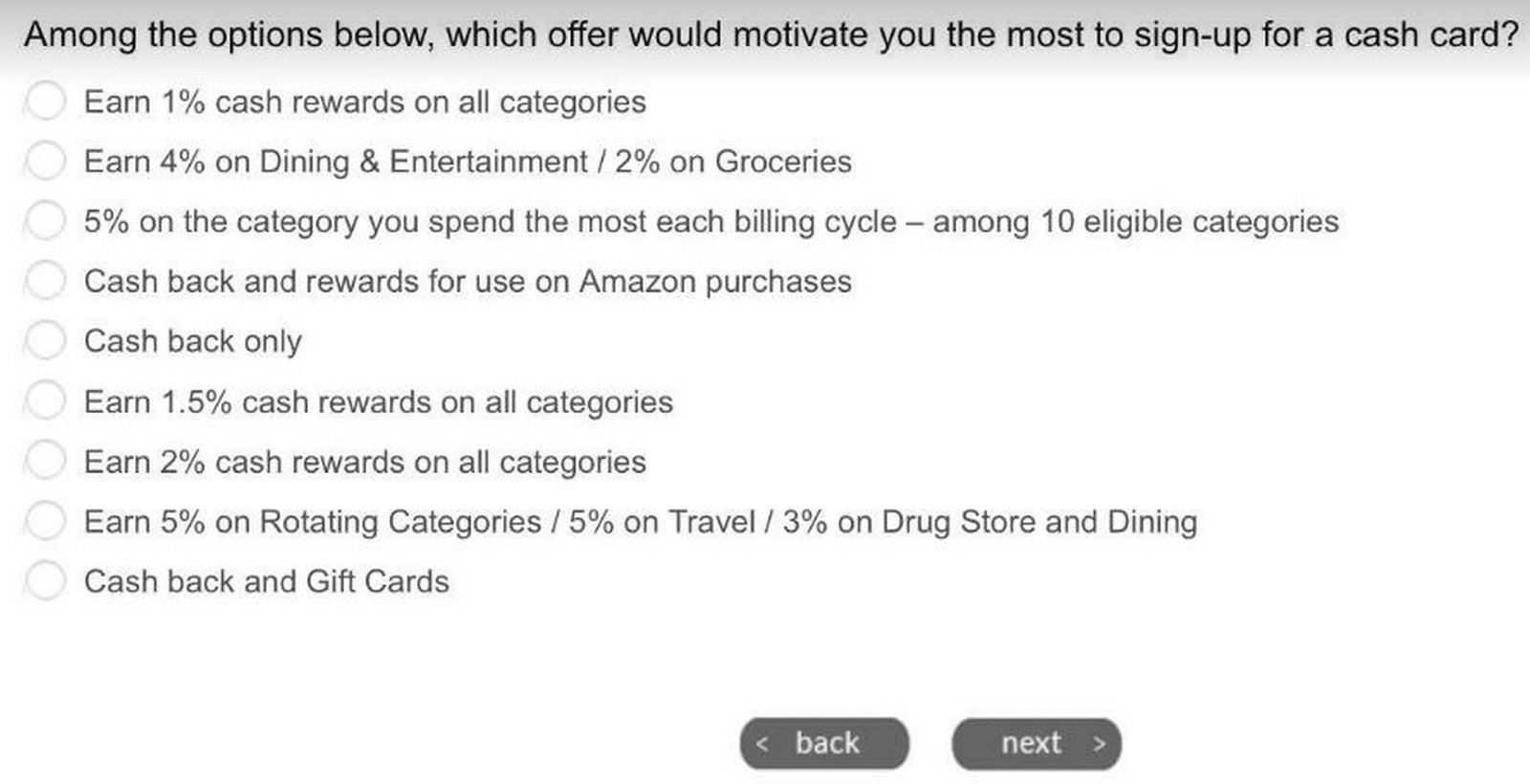

But the most interesting question was about what would the person want out of a cash back card.

As you can see some of the options are comparable to current offers from Amex and Chase. They also asked about the person’s earning stats with Citi’s competitors.

This isn’t anything more than a survey at this point but it is interesting nonetheless. The fact that they quizzed the participants before allowing them to participate, and paid out a gift card for it make me believe it is a more serious survey.

The thing we don’t know is if this is in terms of refreshing some current products or launching a new Citi credit card. One can hope it is a new credit card with a juicy welcome offer. I wouldn’t mind seeing something along the line of the Chase Freedom Flex card but for ThankYou points, even if they are not my favorite points.

One thing is for sure, they realize that the competition has been making some moves and they don’t want to be left in the dust.

Which option do you like best from the survey? Let me know in the comments.

The only competitive advantage that Citi offers is the 2% Cash payment on ALL purchases. If they reduce that, I’ll cancel the card.

Zero percent intro apr!!!

I sure hope they aren’t planning to drop/change their 2% cashback card! That’s the only thing they offer that is uniquely valuable. It’s interesting (and not surprising) that their idea of how to increase their customer base is to continuously cut benefits from the cards they have and introduce new cards that are clones of cards from other more successful banks.

I have enough easy ways to earn TYPs that a new card (shy of a large welcome offer) or a refresh doesn’t move the needle for me.

Bring back travel protection, keep the 25% uplift for the Premier, and let cash out TYPs at 1cpp WITHOUT having to hold the Prestige and then they’ll have my attention. Shy of that, Citi is just “meh”.

Those would be nice changes for sure. Just allowing moving TYP to Citi DC cash back would be an easy fix that they should have done when they opened it up the other way.

Agreed

I don’t understand why a credit card company would require someone to have more than one card to move points. To me, it attracts the enthusiasts versus the average credit card user. I stopped using my Prestige for travel since Citi removed the protection. It was my go-to card. No amount of points is worth taking the risk. It just takes one airline strike or fiasco to realize how valuable credit card travel insurance is.

I agree. And I live in an AA hub and they’re notorious for delayed flights. No way would I book without trip delay…especially in an AA captive city.

I think I kind of like the 5% on the category I use most, though I could be more sure if I knew what the 10 categories to choose from were!

That would be a good one.

This is could be the greatest option, or the greatest disappointment. The categories are key, as is the spending cap.