SoFi Money Beats The Competition – Including Charles Schwab

Update: SoFi Money has had some recent changes made which makes it a good account but it is no longer a great account. The interest rate is now near nothing because of the Federal Reserve continues to lower the rates. But they also recently switched their ATM coverage. Now only Allpoint ATMs are covered for any accounts created after 6/8/20. This puts the program in line with a Capital One 360 account and the Charles Schwab card is once again the best option for travelers. I still think the account is worthwhile to have because of the promos they continue to run but it isn’t the go to for travel that it used to be for anyone looking to sign up now.

A week or two ago I wrote about an offer for SoFi Money because it had one of the easiest $50 bonuses (has increased to $75 3/1/20) you will ever see. They also have a pretty sweet $50 investment bonus too. That was pretty much it. I mean the program looked pretty good but I was happy with my Charles Schwab debit card. Remember that is the card I said that everyone should get.

Well after digging into the program even more and testing it out I need to change my thinking. SoFi Money beats the competition when you put them head to head and it isn’t really all that close. I have been saying that for a week or so now but there are still some doubters so I put it to the test.

SoFi Money Perks

Let’s review the perks of SoFi Money one more time real quickly:

- Earn

1.1% APY(updated 3/3/20) on your account balance. This rate moves as interest rates move. It was up to 2.25% last year but the Fed keeps reducing rates. As of 7/1/2020, accounts with recurring monthly deposits of $500 or more each month, will earn interest at 0.25% APY. All other accounts will earn interest at 0.01% APY. Accounts opened prior to June 9, 2020, will continue to earn interest at 0.25% APY irrespective of deposit activity. - No minimum balance required to unlock the interest rate.

- No account fees.

- ATM fees reimbursed worldwide. As long as there is the ATM is displaying the Visa®, Plus®, or NYCE® logo.

- No foreign transaction fees.

- The cash balance in SoFi Money accounts is swept to one or more program banks where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC Insurance does not immediately apply. Coverage begins when funds arrive at a partner bank. There are currently six banks available to accept these deposits, making customers eligible for up to $1,500,000 of FDIC insurance (six banks, $250,000 per bank).

- There is a ATM withdraw limit of $615 per day but there is no ACH money transfer limit that I know of.

Putting SoFi Money To The Test

The big knock against SoFi Money was that their 1% foreign exchange fee. After digging into their terms deeper it appears they eat this fee just like Charles Schwab does. It had been previously reported that the user incurred this fee. We even had people comment that the withdraw amounts were the same between the two when they tested it.

I decided to hop over to Canada this week and test it out for myself. I made a withdraw for the same amount from two different ATMs with both cards. And wouldn’t you know the amounts were exactly the same for both.

Charles Schwab ATM Report

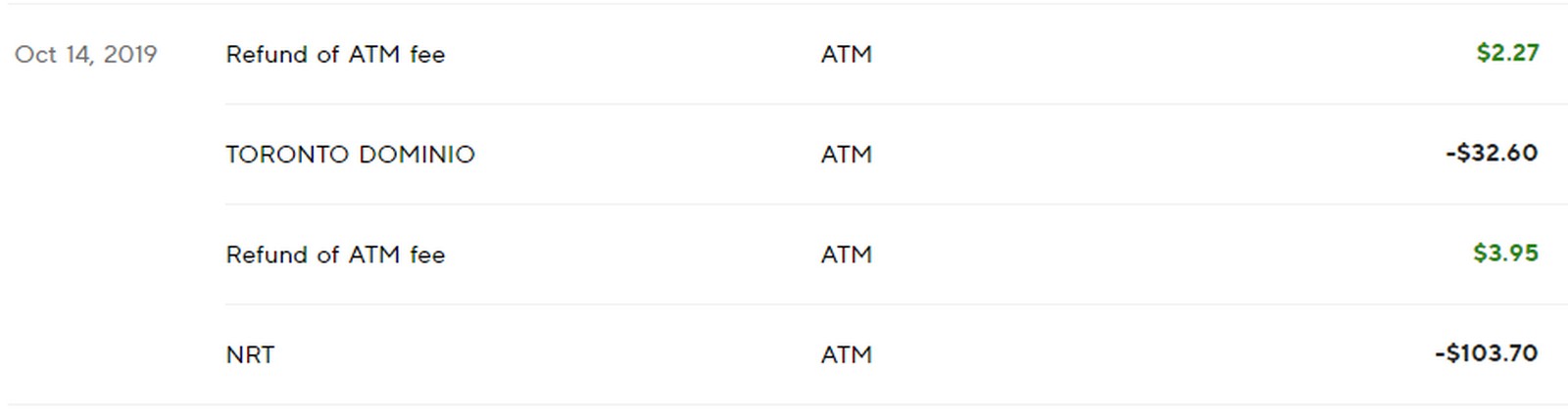

SoFi Money ATM Report

SoFi Money ATM Report

As you can see the amounts were exactly the same. The only difference is that SoFi Money refunds the ATM fees almost immediately. I have to wait till the end of the month for Charles Schwab to refund them.

Ways SoFi Money Beats the Competition

Here are the reasons I think SoFi Money offers the best program for travelers:

- Near instant ATM refunds

- No fees for ATM withdraws domestically or internationally

- Competitive conversion rates that equals the competition

- An APR rate that beats the competition by a wide margin

- No hard pull to signing up for the account like Charles Schwab does

- No minimums or fees of any kind

When Charles Schwab‘s Debit Card Still Makes Sense

There are two reasons that I can think of that people would still benefit from getting the Charles Schwab account. If you are a serious investor their customer service is top notch (not that SoFi’s isn’t good) and they offer more than SoFi can on the investment side. The other reason is if you want access to the Charles Schwab Amex Platinum card and its 60,000 point welcome offer. You have to have a Charles Schwab account to get that version of the Amex Platinum.

Even then I would still get the SoFi Money account and use it as my go to account for travel and most checking activities.

Final Thoughts

I know it is difficult to get past our preconceived notions and to many people Charles Schwab has the best thing out there. But I can assure you that SoFi Money is the better option for all of the reasons I listed above. I encourage you to give it a try, what do you have to lose? I can guarantee that you will lose an easy $50 if you don’t!

I am a little bit confused about what the current situation is with ATM fee reimbursement for people who have had the card before June. You seemed to agree with two points in the comments that were saying something different about all ATMs v Allpoint ATMs only.

BTW, SoFi changed their ATM cards from Visa to MasterCard in early 2020, so the 1% fee (or not) is no longer relevant since that is a Visa imposed fee [Note: I have a Fidelity cash management account and use the associated Visa debit/ATM card as my primary foreign travel card; I have heard conflicting things about whether the fee applies to purchases only or ATM withdrawals too. I have never seen a separate 1% fee when withdrawing cash, and the exchange rates have been pretty close to credit card transactions I made around the same time.]

It is both actually – I had done the update for anyone that finds it on Google in the future but here are their terms. If you have had the card since before June 9th you are still good.

1We’ve partnered with Allpoint to provide you with ATM access at any of the 55,000+ ATMs within the Allpoint network. You will not be charged a fee when using an in-network ATM, however, third party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at our discretion at any time. Accounts opened prior to June 9, 2020 will continue to receive reimbursement for all ATM fees under our prior policy. SoFi Securities ATM policies are subject to change at our discretion at any time.

One thing to note is that accounts created before June 8th still get all domestic and international ATM fees refunded and the 500 a month stipulation does not apply to them

I’ll clarify that – good point.

This is no longer the case. Their site now says reimbursements are for AllPoint network ATMs only.

Thanks – I will update

If there is no 1% fee, why does it say this right on the SOFI website down in the fine print at the bottom?

Please note, though SoFi doesn’t charge foreign transaction fees, there is a foreign exchange fee of 1% charged by Visa that is not waived??

I am guessing the fee is baked in or everyone has it because SoFi matches up to Schwab when I used them both.

Correct me if I’m wrong, but I think the 1% foreign transaction fee applies to purchases, not ATM withdrawals. That is why you didn’t see any difference in the amounts.

Used your link (Jasmine) to open the account. Thank you.

Excellent – thank you Sang!

Hi Mark! You’ve won me over with your SoFi posts 🙂 Could you verify if the $50 referral bonus has expired or not? I read on Doc’s website that it had, but I was really hoping to get it as a new SoFi customer.

I’m also interested in SoFi’s investment account. I have a Drop offer for it too. Would I be able to use both your referral link & the Drop offer?

It looks like it is still active when I click the link. Not sure on the Drop offer. I would just make sure you get that one if you still get the $50 bonus – I appreciate you thinking of us though!

Mark,

Have you gotten a direct deposit into your account yet? If so , how long are the funds being held for before becoming available? My initial funding transfer has was held for almost 4 business days, i’m doing another transfer to test it out before setting up direct deposit I’m hoping the long hold was due to it being the first transfer (but the bonus was held for a few days too)

I haven’t set it up for direct deposit. I have only done transfers in which didn’t seem to be held that long. Let us know how the next one goes.

While I am sure everything in your post is 100% correct Mark, there is no information at all about the actual company itself. I’ve been around the block many times and have witnessed how easy it is for new companies to promise the moon but then have difficulties actually delivering what they promised.

There is no way SOFI can compete against Schwab unless they have the manpower, expertise, and massive funding to do so. SOFI is another wannabe fintech startup. Noting wrong with being another wannabe fintech startup, but I’m not going to use a startup for my financial transactions till they have a significant track record of success.

I went to their website and one of their top 3 executives is their Chief Marketing Officer. She used a photo that looks like it was cropped from a photo with her husband or boyfriend. Not very professional in my opinion. Everyone else has professional photos and look like serious business people. Something like this is trivial, but if they can’t get something this simple right, who knows where else they are dropping the ball.

They are a pretty large personal loan/student loan lender and a half a billion dollar a year company. There are always risks but this isn’t like a first year start up company.

I have used sofi for over 3 years no complaints at all. When you do a phone deposit on a friday it will not clear till tues. So as long as you understand that its all good

Mark, Congrats on your SoFi account. I has a totally and completely different experience. After “jumping through various hoops”in the application process, SoFi “declined ” me via e-mail. SoFI gave three possible vague reasons. I called their toll free number for clarification. Employee Tyler said he had to “check on something.” He puts me on hold, comes back three minutes later and then said he had to transfer me because he was not in the correct department for my type of question (he should have said that at the beginning of the call). I told him I had been on the call long enough, did not want to be “transferred” and hung up. SoFi says it’s not a “bank.” They sure acted like a bank.

That is weird. Mine was super easy also. About a minute to open and fund account.

Yes same here no issues. 60 seconds

I’m surprised to hear that most have been able to sign up in a minute or two no problem. Sorry to hear they failed you.