Deep Dive into the New Wyndham Rewards Credit Cards

I love exploring hotel credit cards, particularly traversing through those of mid- and lower-tier lodging brands. They definitely aren’t the flashiest card products out there, but one can obtain great value with a bit of homework. Long gone are the days of effectively obtaining 50% off all award stays with the Club Carlson cards. But plenty of excellent opportunities still exist with hotel cards. So, of course, the unveiling of the new Wyndham Rewards credit cards piqued my interest. Let’s dive deep into the new Wyndham Rewards credit cards, who can benefit most from them, and my overall take.

A Caveat

Given the substantial changes in how we travel during the pandemic, including if we travel at all, I don’t recommend pursuing new Wyndham Rewards credit cards without a definite plan for near term redemption. Of course, it’s never a good idea to collect a rewards currency without any idea how you will redeem. But I think this concern is paramount with the Wyndham Rewards credit cards. Why? Wyndham’s stringent points expiration policy as described on their site:

Except as may otherwise be required under applicable law, Wyndham Rewards points expire four (4) years after the checkout date of the stay for which the application points are posted to the Member’s account, unless the points are forfeited or cancelled earlier due to membership inactivity (as more particularly described below), or otherwise in accordance with these Terms and Conditions. All accrued points in a Member’s Wyndham Rewards account may be cancelled or forfeited if the Member has no Account Activity (as defined below) for a period of eighteen (18) consecutive months.

The account activity isn’t a huge deal, as earning points via credit card spend, redemption, or hotel stays is broadly achievable within 18 months. But I think Wyndham’s four year points expiration policy is terrible. They are one of the very few, or perhaps only, hotel programs where points can expire even with activity. Given the pandemic and Wyndham’s overall quirkiness, four years passing without redeeming enough points is a valid danger. This policy also creates a considerable amount of work for an individual to effectively keep track of their “rolling four-year clock” for Wyndham point earning. Keep the above points limitations in mind as you consider the new Wyndham credit cards.

Now, let’s jump in to the new cards!

Wyndham Rewards Earner

The new Wyndham Rewards credit card without a fee is the Earner. Here are the card specifics:

- Welcome Offer: Earn 30K bonus points after spending $1K on purchases in the first 90 days.

- 5 points per dollar spent on Wyndham hotels and gas purchases.

- 2 points per dollar spent on restaurants and grocery purchases.

- 2 points per dollar spent on eligible purchases made at Wyndham Timeshare properties (including maintenance fee and loan payments).

- 1 point per dollar spent everywhere else.

- Earn 7,500 bonus points each anniversary year after spending $15K within the cardmember year.

- Automatically receive Wyndham Rewards Gold status.

- Redeem 10% fewer Wyndham Rewards points for go free awards.

Wyndham Rewards Earner+

Stepping up to the $75 annual fee version, here’s the info on the Earner+:

- Welcome Offer: Earn 45K bonus points after spending $1K on purchases in the first 90 days.

- 6 points per dollar spent on Wyndham hotels and gas purchases.

- 4 points per dollar spent on restaurants and grocery purchases (excluding Target and Walmart).

- 4 points per dollar spent on eligible purchases made at Wyndham Timeshare properties (including maintenance fee and loan payments).

- 1 point per dollar spent everywhere else.

- Receive 7,500 bonus points each anniversary year.

- Automatically receive Wyndham Rewards Platinum membership.

- Redeem 10% fewer Wyndham Rewards points for go free awards.

Wyndham Rewards Earner Business

This is a new business card product for the Wyndham Rewards card lineup. Cardholders can expect the following for a $95 annual fee:

- Welcome Offer: Earn 45K bonus points after spending $1K on purchases in the first 90 days.

- 8 points per dollar spent on Hotels By Wyndham and gas purchases.

- 5 points per dollar spent on marketing, advertising and utilities.

- 1 point per dollar spent everywhere else.

- Receive cell phone protection for the next calendar month when you pay your wireless bill with your card.

- Receive 15K bonus points each anniversary year.

- Automatically receive Wyndham Rewards Diamond membership.

- Redeem 10% fewer Wyndham Rewards points for go free awards.

Who Benefits The Most From Each Card?

Earner

Fans of Wyndham properties who also want to avoid an annual fee will benefit from the Earner card. Those who plan to spend normally on the card at Wyndham/gas stations and grocery stores/restaurants will enjoy the 5x and 2x respective earning with the card. The 7,500 bonus points with $15k cardmember year spend is nice, but perhaps not for one looking to optimize Wyndham earning on spend. Specifically, if a cardholder is putting $15k spend on the card, he or she may do much better with the Earner+ card while easily outweighing the annual fee. While Gold status can’t be totally ignored, those who care about Wyndham status may do better with the Earner+ or Business cards. The Earner card is best for casual Wyndham fans looking to boost their Wyndham balances and earning potential while avoiding an annual fee.

Earner+

The Earner+ card unlocks much more potential in return for the $75 annual fee. Wyndham fans who can more aggressively spend in the Wyndham/gas station and grocery store/restaurant categories will benefit from the elevated 6x and 4x respective earning with the card. The 7,500 bonus points each cardmember year without a spending requirement is solid. The bump to Platinum status enables cardholders access to early check-in, Caesars status match, and Avis/Budget car rental upgrades. The Earner+ is an excellent choice for those able to spend much more on the card in the bonus categories and who have specific plans for redeeming in Vegas or at the higher Wyndham Rewards levels.

Earner Business

Finally, the Earner Business card enables even more rewards with a $95 annual fee. Heavy spenders at Wyndham properties and gas stations earn 8x in those categories. This card also holds unique 5x earning for marketing, advertising, and utilities spending – surely an interesting category with a potentially broad definition. Cardholders automatically receive 15k bonus points every cardmember anniversary – the exact amount for a free night in a mid-tier property. Cell phone protection is repetitive – many of us maintain that benefit on other cards.

This card shines brightest by granting Wyndham’s top-tier Diamond status simply for holding the card. With this status, cardholders are eligible for suite upgrades on every stay, including award stays. Diamond status holders get a welcome amenity each visit and can gift Gold status to a friend or family member, as well. This card is a great choice for those with high spend in the 8x or 5x categories, but it also could be a no-brainer for those solely interested in simply obtaining Diamond status at Wyndham or Caesars.

All Cards

Not to be forgotten, each card unlocks 10% off the 7.5k, 15k, and 30k go free reward night rates. This benefit effectively makes points worth 10% more for cardholders when they redeem at Wyndham properties. FYI, you cannot hold Earner and Earner+ accounts simultaneously, but you can hold both a personal and business Earner card account.

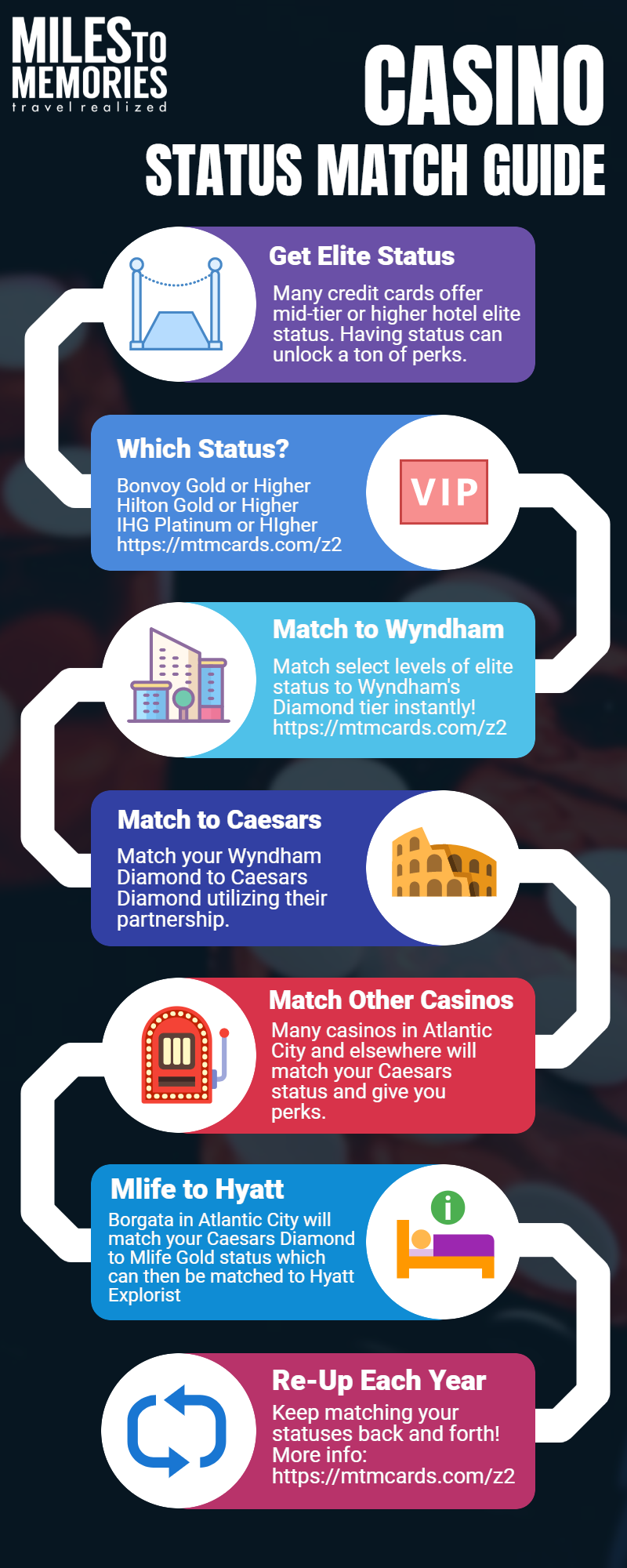

The Caesars Rewards Angle

The new Wyndham Rewards credit cards, particularly the Earner+ and Business cards, are huge wins for Caesars Rewards and Vegas fans. Why? First off, the ability to match your Wyndham Status (Platinum or Diamond) to the respective Caesars Rewards status (also Platinum or Diamond). Mark summed up the high points about Caesars status here. The most noteworthy benefits are the celebration dinner,waived resort/parking fees and free show tickets for Diamond members, in my opinion.

Bigger picture, all Wyndham cards, and the Wyndham Rewards program in general, provide outsized value for Vegas fans. Members can transfer Wyndham Rewards points to their Caesars Rewards account and effectively redeem at 1 cent per point (cpp) for stays and dining at Caesars properties. Normally, point values can vary widely depending on the Wyndham redemption, but rarely do I obtain at least 1 cpp value.

Key Takeaways for Caesars Rewards Redemption

Here are some card takeaways for those who redeem for stays and dining at Caesars properties:

- The no-fee Earner card provides 5% and 2% returns for Wyndham/gas station and grocery/restaurant spend, respectively.

- The Earner+ card provides 6% and 4% returns for Wyndham/gas station and grocery/restaurant spend, respectively.

- The Earner Business card provides 8% and 5% returns for Wyndham/gas station and marketing/advertising/utilities spend, respectively.

I’m not a big gambler, but Caesars rewards points can be used for free play in the casinos at a 0.5 cpp rate. Therefore, those looking to gamble (away) their points should cut the above rates in half.

My Overall Take

In general, I’m a big fan of this Wyndham card refresh. Barclays and Wyndham have offered plenty of options for driving up our points balances and elite status from different angles with these three cards. While they may not be amazing for everyone, they have provided more options for us all. In my book, having more options is always better than the alternative. While this isn’t a groundbreaking statement, it’s definitely true in our hobby.

Beyond welcome offers, the Earner Business card is the standout in the new lineup, in my opinion. A cardholder is effectively buying one night at a mid-tier Wyndham property, top-tier Diamond Wyndham status, and Caesars Diamond status for $95 annually. Many would pay $95 for a one-night stay at a mid-tier Wyndham property alone. And, just a reminder, this is all obtained without any other card spend. The increased spending categories are the cherry on top.

Earner+ cardholders are effectively paying $75 for one night at a lower-tier Wyndham property, Platinum status in Wyndham and Caesars, and increased spending categories. No fee cardholders get access to bonus spending categories, albeit at a lower rate than the Earner+ and Business versions.

Product Change?

I’m a holder of the legacy $69 annual fee Wyndham Rewards Visa card, and I’ve enjoyed 2x everywhere earning and an automatic 15k bonus points on each card anniversary. I like that I have the option to product change to the Earner+ card, but I’ve decided to hold off for now. Given the pandemic, decreased travel, and Wyndham’s points expiration policy, I currently have no need for a ton more Wyndham points. Also, holders of the legacy no-fee Wyndham Rewards Visa have the option to product change to the Earner version.

Not For Everybody

Several other cards earn better in the Wyndham cards’ bonus categories, especially if you don’t plan on redeeming your Wyndham points at Caesars for outsized value. And, let’s not forget, many of the Wyndham brands aren’t exactly, um, aspirational properties. That said, I love me some La Quinta and Days Inn in moderation, and I bet I’m not alone here!

Conclusion

As with all spending and award redemptions, consider your other cards and alternatives to maximize rewards for meeting your specific travel goals. That’s a lot to think about, and we’ve been given even more to consider with these new Wyndham Rewards credit cards. But it’s a great time for many of us to reevaluate while we aren’t traveling as much as usual. Are you planning to go after any of the new Wyndham Rewards credit cards? Why or why not?

I too had the Wyndham Legacy card, and racked up well over 1.5M points via both business and leisure expenses. I was able to spend weeks in the Caribbean at their Viva properties each summer. Then the point redeptions at the Viva’s doubled overnight from 15K to 30K. Shortly thereafter, the Viva’s were removed from the program. Then the pandemic hit, and Wyndham did very little to help their customers with the four year hard expiration of points. My points were slated to expire in October of this year, and they would not extend them for me. It was use them or lose them. Accordingly, I booked a three week National Parks trip where I spent 30K a nigh to stay at Days Inns and Super 8’s. I witnessed hotel managers refusing to wear face masks, and Wyndham Custmer Service unwilling to do anything about it. While I was able to use my remaining points, I called Barclay’s to cancel my card, and will never stay at a Wyndham again. I know that’s a defintive statement, but the way Wyndham handled the pandemic, and enforcement of their safety protocals of their farnchisees was disgraceful. Remember, this is the company that Henry Sliverman ran into teh ground. Once iconic Howard Johnson and Ramada’s, are now low end properties.

CJ,

Wow, thanks for sharing, and sorry that this happened to you! This is definitely a good reference for us all on how certain properties are handling (or mishandling) things and a great example of how Wyndham’s stringent points expiration policy can force less than optimal redemptions.

Benjy, our stays at six different Wyndham’s in August were disgraceful. The very first property in Montana that we stepped into was met with the front desk informing us of all the services that had been doscontinued under the guise of COVID (no breakfast, no housekeeping, etc.) There was signeage throughout the property regarding the county mask mandate–yet not a single employee was wearing one. There were also no hand sanitizer or wipes anywhere to be found. On our day of check-out, I asked for the manager, who also was not wearing a mask.

This was repeated at four other Wyndham’s we stayed at. One of the worse was the Days Inn West Yellowstone, MT. They had a grab and go breakfast, but the young lady handling the breakfasts would bring the brekfast bags out from the kitchen, and then look for a mask to wear. In other words, the kitchen staff was handing food without wearing masks.

It was only a Super 8 in Jackson Hole, WY where the staff wore face coverings for the most part (we did see some housekkepers with their masks under their chin).

Interestingly, we had stayed at a couple of Holiday Inn’s, and it was like night and day compared to the Wyndham’s in terms of safety measures being taken.

What really aggrivated me is that Wyndham Customer service would only refer me to the individual property managers. They would not assume any responsibility or take ownership of the lack of franchisee compliance with safety operating standards. I made numerous calls to Wyndham.

We actually should not have been placed in this situation with Wyndham had they eased up on their four year hard point expiration policy in the midst of a pandemic.

CJ,

Ugh. Your experience is a warning to us all! Thanks again for sharing.

No masks aren’t even a big deal. If you’re staying at a hotel you’re at risk. Do you wear the mask all the time in your room? When sleeping? Doesn’t make a whole lot of sense.