I Finally Got The Cathay Pacific Credit Card. Why Was It So Much Work?

After a bunch of head-scratching over their weird process, I finally got the Cathay Pacific credit card. I’m pretty baffled by the process from Synchrony Bank here. At least there’s a happy ending.

Back Story

Back in April, I posted about my laughable experience applying for this card. The Cathay Pacific credit card from Synchrony Bank offers 40,000 AsiaMiles after spending $2,000 within the first 90 days. I applied and received a rejection letter saying I used a “High risk source of application”. After some phone calls, no one at Synchrony could really explain this. A quick Google search says I’m not alone here. The only thing Synchrony could tell me was to wait 30 days and try applying again using a mobile device.

Weird, but OK.

New Application

I submitted a new application from my phone 2 weeks ago. When applying, I made sure location services were on, etc. I didn’t want there to be anything weird-looking, like I’m trying to hide my location, not using a VPN–none of that.

A week later, I got this letter in the mail saying they need me to do identity verification. I called, and they directed me to verify.syf.com

When I went to the website, I got this message that I must use a mobile device. What’s with Synchrony and mobile devices?

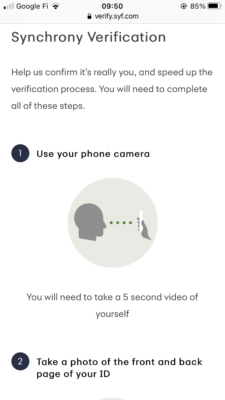

Using my phone, I had to take a video of myself moving my eyes and had a bit to show I’m a real person. Then, take a picture of the front and back of your ID.

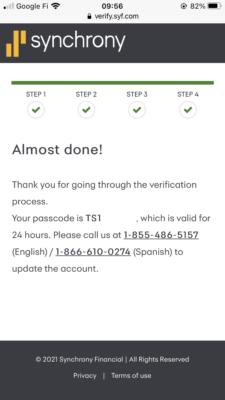

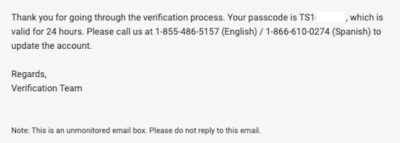

From here, I got a passcode. The website directed me to call and tell them my Cathay Pacific credit card application is complete. Note that this is a different number than on the letter I received in the mail. Weird.

They also sent me the code and instructions via email.

Calling Synchrony Again

After completing the application, I called Synchrony. They asked if I was the one who submitted the Cathay Pacific credit card application, if I was the one who did the verification, etc. I answered “yes” to everything and gave them my code.

After about 30 seconds on hold, the agent told me they approved my application. I only got a credit line of $1,500, but it’s still a win.

Final Thoughts

This is easily the strangest credit card application process I’ve been through. It looks like I’m not alone in this process, but that doesn’t mean it makes sense at all. This is just security theater, in all reality. But a win is a win, right?

$1,500 credit line for a premium international airline like Cathay Pacific. How do they expect you to purchase Cathay Pacific airline tickets with that low a credit line?

That’s a great point! Hadn’t thought about that part.

surprising this bank exists when their is amex and chase. Would even add citi into that.

Synchrony is a fucking joke, end of story.

Thank you for sharing your ordeal. Truly, not sure it is the most efficient use of time and a credit pull. Dealt with Synchrony once applying for the then Virgin America card… Useless customer support, no straight answers. Not being arrogantly indignant, I would not work with that bank again. I was very uncomfortable, like a bad outcome just waiting to happen.

Wow! Not sure the card is valuable long term. I have 125K but most expire n Oct so I’ll book something and be done with it 😉

I think this is the first time I’ve ever read of having to take a video of yourself uploading. LOL!

Ryan had you not passed the next set of instructions would have been take a 15 second video of yourself staffing on one foot while patting your head with one hand and rubbing your stomach with the other.

Oh, and you would need to recite the alphabet while doing so.

Hahahahaha! Synchrony gone be Synchrony! LOL!

I was approved for the Rakuten Visa, but followed Freq. Miler’s approach to cancel some credit bureau reporting and all was approved. They gave me a $7500 credit line. A year after getting the card they increase that to $15,000. What I find odd about Synchrony is that give out credit cards like candy for several department stores like Belk’s, Penny’s.

My Rakuten card application was instantly approved although that was a year or two ago. They certainly have their quirks though. I can’t access my account through the app, only with a regular computer. The app won’t recognize my password. Weird stuff.

Thanks for giving me something to look forward to!

I’d be interested to see if you get the same. Maybe the app just hates me.

Synchrony’s web site is also problematic. Easily 50 percent of log-in attempts fail — “System available at this time due to technical difficulty.” It’s accounting system is flawed — purchases sometimes took weeks to post. One large purchase remained as “pending” for nearly two months. Two months! As it was still pending, I couldn’t pay it. Because I couldn’t pay it, a large chunk of my credit limit was unavailable. The card became impractical. Customer Service simply told me to wait. Closed the account.