Maximizing the American Express Delta Platinum Card – Burning 80,000 Delta Skymiles

American Express recently launched new perks and offers on their Delta co-branded cards. Like I did with the new United Business card I wanted to show you how I would go about maximizing the American Express Delta Platinum card. We’ll look at how to earn the miles from the card’s welcome offer, the key perks of the card itself, and then what I would do if those miles were in my account.

These Offers May Have Ended Or Changed

New Delta SkyMiles® Platinum American Express Card Benefits

With new designs and changes of benefits, American Express re-launched all of its Delta SkyMiles credit cards. The re-launch also features increased welcome offers on the cards. Here are the important details of the welcome offer:

- Type of card: personal

- Card issuer: American Express

- Application rules to follow: 1 card every 5 days and 2 cards in 90 days, “once in a lifetime” on welcome offer bonus for that card

- Spending requirements: $3,000 in 90 days

- Welcome offer: 80,000 Delta SkyMiles

- Annual fee: $250 (not waived first year)

- Learn More

New Delta SkyMiles® Platinum American Express Card Benefits

- 3X Miles on Delta flights and Delta Vacations®

- 3X Miles at hotels

- 2X Miles at restaurants and U.S. supermarkets

- Fee credit for Global Entry or TSA Pre-Check application

- 20% rebate as statement credit for purchases of food, beverages, or headsets on Delta flights

- Earn 10,000 Medallion Qualification Miles (MQMs) after spending $25,000 on the card in a year. Can do up to two times.

- Learn More

Other Benefits

- Free first checked bag

- Main Cabin 1 Priority Boarding

- Receive a Domestic Main Cabin round-trip companion certificate each year upon card renewal (just pay taxes)

- $39 reduced rate for visiting Delta Sky Club

- No blackout dates

- Additional cards at no additional cost

- No foreign transaction fees

- Trip Delay Insurance , up to $300 per trip, can reimburse you for expenses during your trip

- Secondary car rental loss and damage insurance

- Baggage insurance plan when flights are paid for with this card

- Purchase protection for 90 days

- Up to 1 year of extended warranty on eligible purchases

- Free ShopRunner membership for free 2-day shipping from online stores

- Learn More

These Offers May Have Ended Or Changed

What I Would Do With 80,000 Delta SkyMiles

So…what would I do with 80,000 Delta SkyMiles? Technically, you’re going to have more than that. After spending $3,000 on the American Express Delta Platinum card, you’re going to have a minimum of 83,000 miles in your account. I’m going to use this number for trip planning. Since Delta is part of the SkyTeam alliance, we’ll be able to use any of those airlines for our flights.

Because Delta moved to dynamic pricing and stopped publishing an award chart after 2015 (meaning the number of miles you need changes based on demand / time of year), we can make some good estimates on what’s “normal”. Let’s take a look at options for economy, business, and first class.

Economy – Japan and South Korea OR Visit Australia

Domestic flights within the U.S. on Delta are hard to beat. 4,500 Delta SkyMiles plus $5.60 in taxes is a deal! You could always plan a big trip but leave a little in your account for these domestic trips. They also have weekly Delta Flash sales. If we’re looking to splurge, I see 2 great options for using 80,000 Delta SkyMiles in economy.

Japan and South Korea

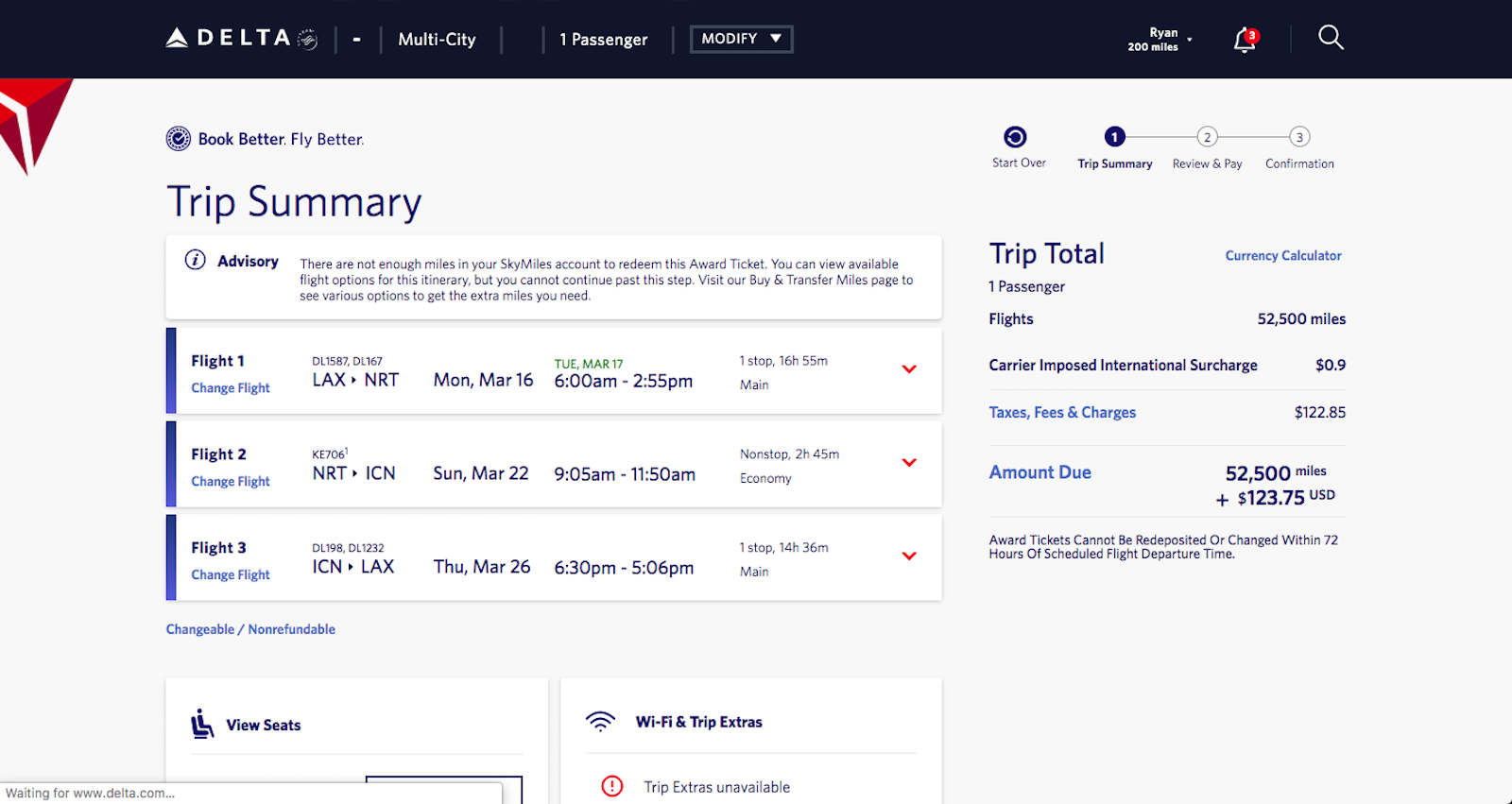

Because I ran across a Delta Flash Sale, this award priced lower than I’d expected. To find the best flexibility on dates, search for each flight as a one-way flight. When you’re ready, build a multi-city itinerary. I can go from Los Angeles to Tokyo, Tokyo to Seoul, and home to Los Angeles from Seoul. In one itinerary, I need 52,500 SkyMiles and will pay $123.75 in taxes.

Round-Trip to Australia

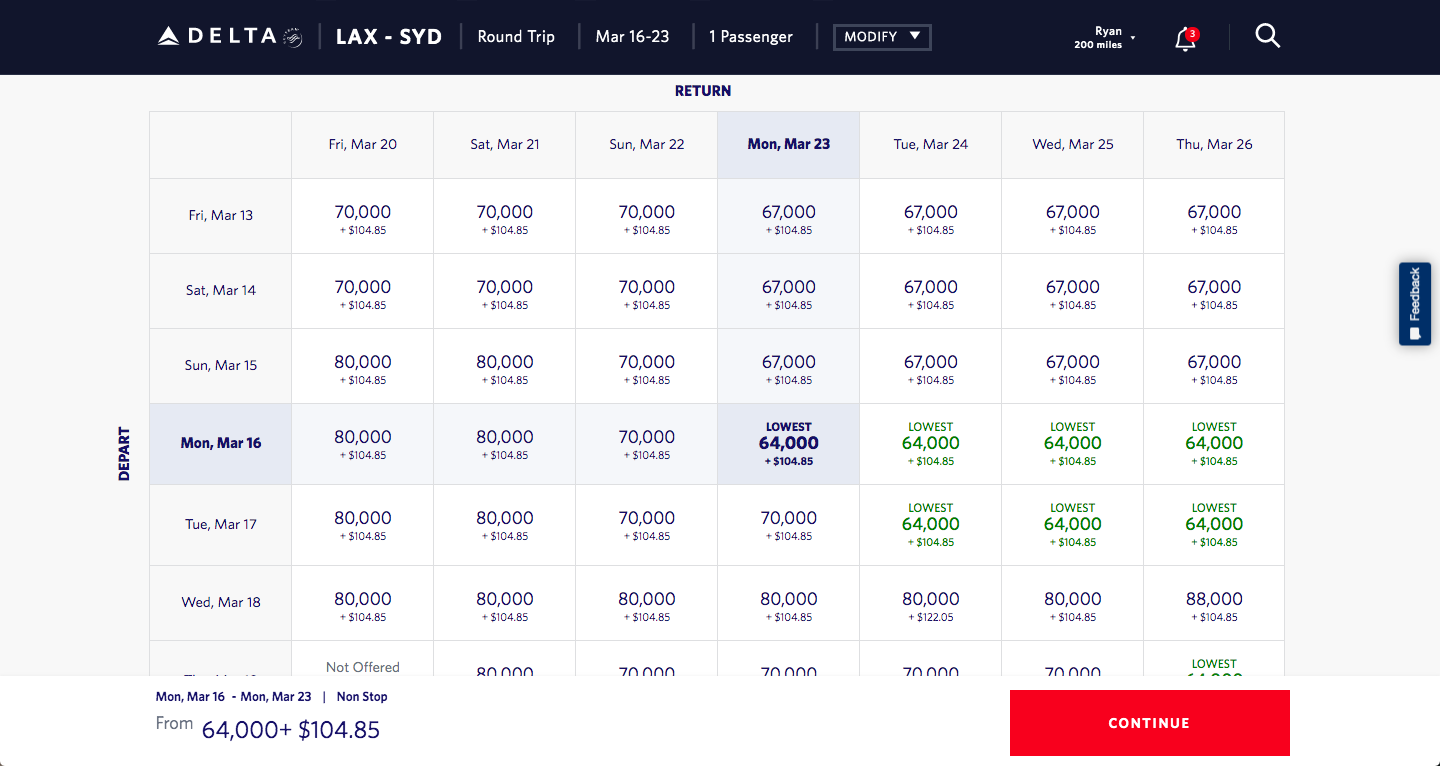

Look at the wide-open availability for a round-trip ticket to Australia. For 64-70,000 SkyMiles, fly to Sydney with Delta or Virgin Australia. Both are direct from LAX. You’ll pay $104.85 in taxes.

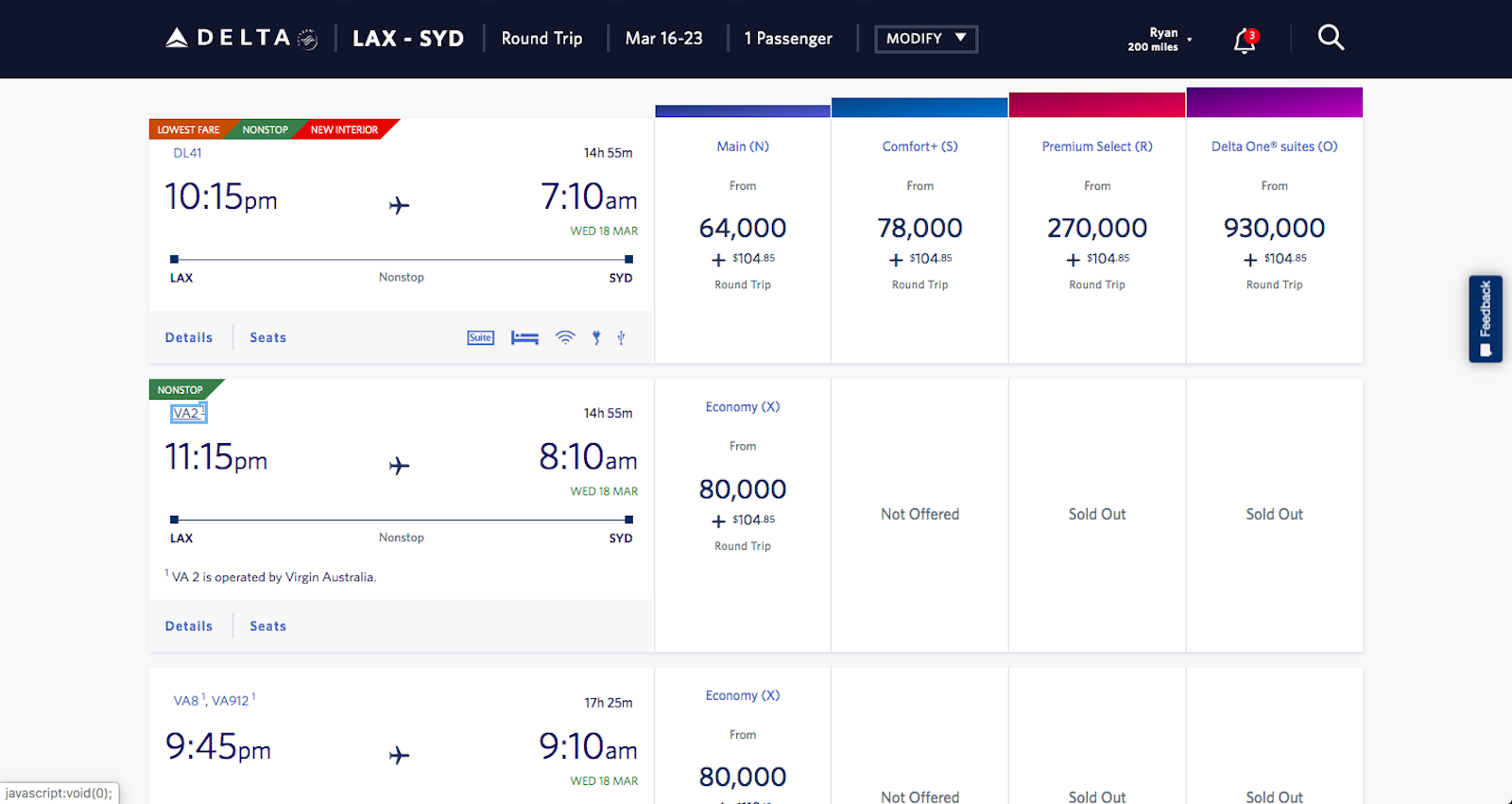

Since this is a long flight, we can get a little more comfortable. That’s a long trip in economy. Find the dates with the flash sales or reduced points. You can find a good deal on Comfort+ seats those days. I can use my 80,000 Delta SkyMiles this way and spend 78k for economy plus seating round-trip to Sydney.

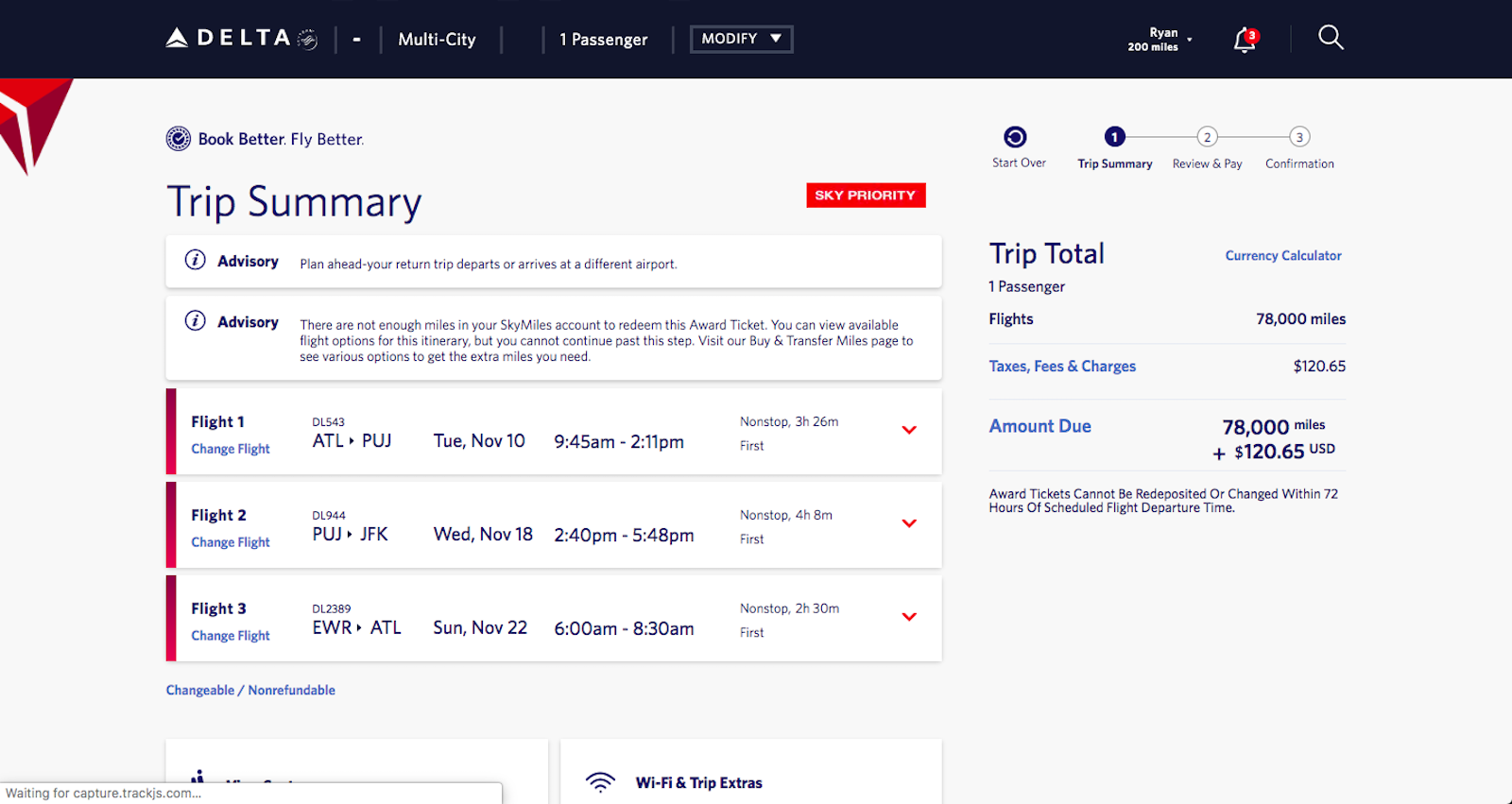

Business Class to the Caribbean PLUS New York City

What if I make 2 vacations in one? From Delta’s base in Atlanta, I could fly business class to the Dominican Republic. After some amazing diving and great beaches, fly to New York City. Spend a few days there before flying home to Atlanta. The best part is that all of these flights are direct. For 78,000 SkyMiles and $120.65 in taxes, this sounds like a great holiday.

First Class Using Korean Air

Delta makes this more difficult than it needs to be. Because Delta itself doesn’t offer true first class on international routes, there’s no way to select it in your search. Their “first class” is domestic business. Their international business is called Delta One.

Delta only shows you first class flights on partners when they can’t find business class seats on that same flight. Again: first class seats show up under a Delta One search if there’s first class availability but not business class availability. That’s incredibly difficult for searching online. Your best bet may be calling, if you don’t want to spend hours banging your head on the desk. I checked multiple dates, multiple carriers, and multiple routes. I came up empty when trying to find these online via Delta even when I know the flights/space exist.

A good option for maximizing your points here is Korean Air first class on shorter, 3-cabin routes between Seoul ICN and either Taipei TPE or Hong Kong HKG airports. If you find a price break, you might even swing a round-trip flight in first class for 80,000 Delta SkyMiles.

Delta also partners with these airlines that allow first class partner award bookings :

- China Eastern

- China Southern

- Korean Air

- Saudia

- Xiamen Air

Note that Air France and Garuda Indonesia offer first class, but you can’t book them with your Delta SkyMiles. Garuda Indonesia only allows first class bookings from its own program. Air France only allows first class bookings using miles/points for its top-tier elites.

Speaking of Taxes

All award tickets will have taxes. That’s a guarantee. While the American Express Delta Platinum card earns 3 miles per $1 on Delta purchases, we can do better. As I recently mentioned, using the best card for your purchase nets more miles. So does using shopping portals and cash back sites. I wouldn’t use a Delta card of any type to pay the taxes for these bookings, to be honest. Unless you were going for Delta status and the 10,000 MQM’s you get for spending $25,000 on the card.

I’d use an American Express Platinum Card as my first option. That would give me 5 Membership Rewards points per $1 when paying the taxes. The 2nd option would be Chase Sapphire Reserve or American Express Gold Card. Either of those will give me 3 points per $1 (Chase Ultimate Rewards or Amex Membership Rewards). Yes, paying with a Delta card also earns 3 points. The difference is the flexibility, which is vastly superior. 3 SkyMiles doesn’t hold the same value to me as 3 UR points or 3 MR points.

Final Thoughts On Maximizing the American Express Delta Platinum Card

If you’re maximizing the American Express Delta Platinum Card and its welcome offer of 80k Delta SkyMiles, I hope you found some good ideas here. We looked at the perks of the card and the welcome offer. We also looked at ideas for maximizing those 80,000 SkyMiles in economy, business, or first class. Here are some other great parting tips.

Maximizing the American Express Delta Platinum Card:

- Remember to check Delta flash sales, which we announce.

- Delta has no “close-in booking fees”, meaning you won’t pay an extra fee for booking an award ticket at the last minute.

- Delta has no lap infant fee on their own flights running domestically. If you’re traveling with a lap infant, booking with Delta is a great way to save money.

Let me know how you use your new SkyMiles. I love hearing about people’s redemptions.

Miles to Memories has partnered with CardRatings for our coverage of credit card products. Miles to Memories and CardRatings may receive a commission from card issuers.

Thanks for the info. If I had the old version of the card, can I still receive the signup bonus with this new version Platinum?

Unfortunately, no. Even though the cards got a makeover, they’re considered the ‘same’ card. If you had the welcome offer/bonus before, you can’t get it now. However, that just means for the same card. If you had platinum but never had gold, you could sign up for the gold card and get the welcome bonus on that one. Or if you had the platinum personal but not the business, you could be eligible for that. Etc.